In recent years, corporate bond markets have become an increasingly important source of corporate finance, especially for non-financial companies. Given this worldwide trend, it is crucial for policy makers, regulators and market participants to have access to a comprehensive overview of corporate bond market developments and the structural issues accompanying these trends. In the recent OECD working paper entitled “Corporate Bonds, Bondholders and Corporate Governance”, we aim to serve this need by analysing more than 100,000 corporate bonds issued between 2000 and 2013 by companies from 108 different countries[1].

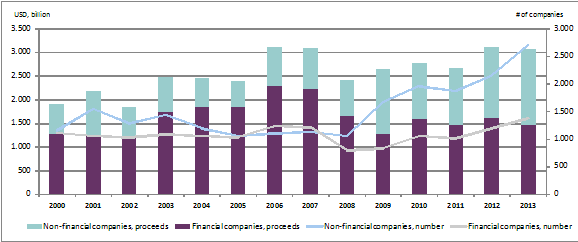

As depicted in Figure 1, the annual amount of money raised through corporate bond issues worldwide steeply increased from USD 1.9 trillion in 2000 to USD 3.1 trillion in 2007. After a major setback with the onset of the financial crisis, the primary corporate bond market quickly recovered and already in 2012 global issuance was back at its pre-crisis level.

A breakdown between financial and non-financial companies reveals that the boost in issuance is driven by non-financial companies. Annual average of total proceeds raised by non-financial companies almost doubled from USD 730 billion in the 2000-2007 period to USD 1,274 billion in the 2008-2013 period. Issues by non-financial companies reached USD 1.6 trillion in 2013, which meant that they for the first time exceeded the annual amount raised by financial companies.

The total number of non-financial companies that tap the corporate bond market in a given year experienced a similar trend and increased from an annual average of 1,250 in the pre-crisis period up to more than 2,500 in 2013. The decrease in bank lending to non-financial companies with the crisis and historically low levels of bond interest rates are the two factors that contributed to this development.

Figure 1. Trends in global primary corporate bond markets – Number of issuers and the total amount of issuance by financial and non-financial companies (2013 USD, billions) Source: Thomson Reuters, OECD calculations.

When we analyse the primary corporate bond market at the breakdown of countries and groups of countries, we see that the developments in the US and European markets are broadly similar to the observations made at the global level and that issuers from these countries are still dominant in the primary market. The strongest increase, however, in corporate bond issues came from emerging market companies. Between 2000 and 2013, the total amount raised through bond issues by companies from emerging markets increased almost 15-fold and reached USD 467 million in 2013. Companies from China, Russian Federation, Brazil, India and Mexico accounted for USD 356 million of the total.

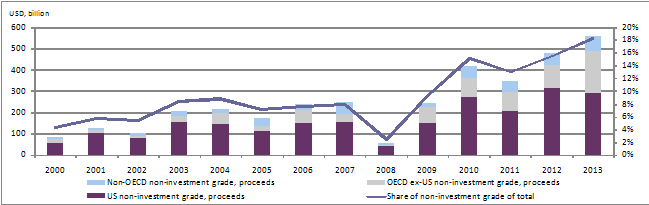

The increase in corporate bond issues has been accompanied by a gradual shift in bond characteristics. The marked increase in the amount of non-investment grade bonds suggests that investors are willing to take more risk in their search for yield amid the current low interest rate environment. From 2000 to 2013, the share of non-investment grade bonds in the total amount of corporate bond proceeds increased from 4% to 18% (Figure 2). The overall increase in the share of fixed-interest bonds and callable bonds are other important indicators that suggest a shift in bond conditions in favour of bond issuers.

Figure 2. The total amount and share of non-investment grade bonds. Source: Thomson Reuters, OECD calculations.

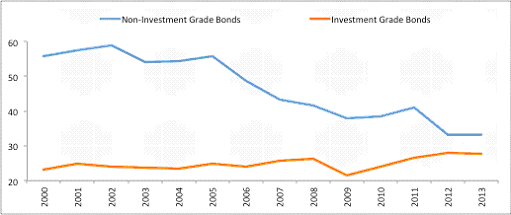

In a separate issue-level analysis, we investigate how bond covenants have evolved since the beginning of the century. Based on a sample covering approximately 13,000 US bonds issued between 2000 and 2013, we find that bondholders over time have come to accept less stringent covenants in a number of key areas, including dividend restrictions. To see the overall trend in covenant quality over the years, we create a covenant protection index. As presented in Figure 3, for investment grade bonds the index moves in a narrow band between 21 and 28% over the observation period. However, for non-investment grade bonds the index shows a significant decline. After reaching a peak of 59% in 2002, the index almost monotonically declines to 33% in 2013. Taken together, these findings suggest that bond investors in their search for yield in a low interest environment have traded governance rights and protections for higher expected returns.

Figure 3. Covenant protection index for non-investment and investment grade bonds in the US. Source: Mergent, OECD calculations

A crucial factor in the availability of bonds as a source of corporate finance is the functioning of the secondary bond market. In contrast to the way trades are handled in the secondary equity market, the vast majority of corporate bond trades are executed over the counter and the share of electronic trading remains limited. According to a 2012 survey conducted by Greenwich Associates, electronic trading in US investment grade corporate bonds is 14%. The same figure is 29% in Europe[2]. One reason why the traditional voice- or message-based system is still dominant in the corporate bond market is the relatively low volume of trading in this market. The bulk of the trading takes place during the first few days of bond issuance and within approximately two months of the issue trading activity drops significantly to eventually reach a long-term annual average turnover of around 25%. Likewise, when we analyse US data, we find that the 50 most-traded bonds in 2012 traded an average of 90 times a day. One reason for this illiquidity is the suitability of corporate bonds for passive investing and long-term liability matching purposes due to their repayment structure with a par value that is paid back at maturity and regular payments up to maturity. Another possible reason is a decreased willingness of dealer banks to make the market as the recent regulations have made it more costly to hold corporate bond inventories.

As corporate bonds increase their role in corporate finance, it is important to understand how and to what extent bondholders engage in corporate governance. Bondholders, like shareholders, have the possibility to both exit and voice. As mentioned above, the illiquidity in the secondary market may make it difficult for bondholders to exit when they are not satisfied with firm performance. On the other hand, bondholders typically use their voice only at specific events: when the bond contract is formed and in the case of default. As suggested by Figure 3, buyers of non-investment grade bonds have, over the years, become more accommodating in the contract formation phase.

From a corporate governance perspective, another important question is how bondholders react when the issuer breaches a covenant or defaults. A recent trend, which appeared in mid-2000s, involves aggressive interpretation of bond covenants by hedge funds. Hedge funds engage specialists to identify actual or potential covenant breaches, file a default notice immediately upon a violation and use the threat of acceleration to negotiate a consent payment or more favourable bond terms. This kind of bondholder engagement, aiming at windfall gains, is a departure from the traditional attitude of large institutional bondholders who usually limit their engagement to governing the risk and participating in restructurings and recovery of losses. With respect to corporate bonds, bondholders and corporate governance engagement, it remains to be seen if larger and more mature bond markets will develop a middle ground between total passivity and aggressive activism. In an era of non-bank financial intermediation, the formation of such a community of informed and motivated financiers may be of particular importance for supporting the critical segment of medium-sized growth companies.

ENDNOTES

[1]Çelik, S., G. Demirtaş and M. Isaksson (2015), “Corporate Bonds, Bondholders and Corporate Governance”, OECD Corporate Governance Working Papers, No. 16, OECD Publishing. http://dx.doi.org/10.1787/5js69lj4hvnw-en.

[2] McKinsey & Company and Greenwich Associates (2013), “Corporate Bond E-Trading: Same Game, New Playing Field”.

The preceding post comes to us from Gül Demirtaş, a research assistant at the finance department of Sabanci University and a researcher at Boğaziçi University’s Center for Corporate Governance, and Serdar Çelik and Mats Isaksson who are both at the Corporate Affairs Division of the OECD Directorate for Financial and Enterprise Affairs. The post is based on their recent article, which is entitled “Corporate Bonds, Bondholders and Corporate Governance” and available here.

Sky Blog

Sky Blog