Not surprisingly, cognitive abilities predict many economic and social outcomes such as salary, job complexity, or success in investment decisions. What is surprising, however, is that almost all auditing research analyzing archival data on audit outcomes has assumed that all auditors are equally good at their work. This assumption is especially surprising because auditing involves a great deal of subjective judgments and decisions. Auditors assess various economic estimates that are subject to uncertainty arising from difficulty to predict the outcome of future events. Auditors moreover design and implement tests to evaluate the likelihood of errors in financial reporting.

In our recent study “Do Smarter Auditors Have More Important Clients? Archival Evidence Based on Unique IQ Data on Swedish Auditors”, we relax the assumption of homogenous auditors and argue that some audit partners within the audit firm are more able than others. We moreover argue that the more capable auditors are perceived as higher-quality auditors by their clients. Larger and more complex client firms are more important for the audit firm, because they generate greater audit fees due to the greater amount of audit work and the higher ‘degree of difficulty’ of their audits. These clients also often purchase more advisory services than their smaller counterparts. They are also willing to pay more for high-quality audit services. Therefore, in competitive audit markets, more able audit partners are likely to be endogenously matched with the most important clients.

Using an archival data set containing the intelligence quotient score (IQ score) of audit partners of Swedish listed firms, we examine whether high IQ audit partners have (1) larger and more complex client firms, (2) higher audit and non-audit fees, and (3) clients receiving better accounting quality, as compared to the low IQ audit partners.

The reason why we chose data from Sweden is that the Swedish Military Forces has collected data on the IQ score of all Swedish male citizens for almost 100 years. Military service is mandatory in Sweden, and all male citizens at around the age of 18 are obliged by law to attend the enlistment test which includes comprehensive psychological tests to assess their cognitive abilities. These tests are based on the methodologies developed in the psychological literature and are conducted by professional psychologists. We use the results from these tests to obtain the IQ score for all male audit partners of the firms in our sample.

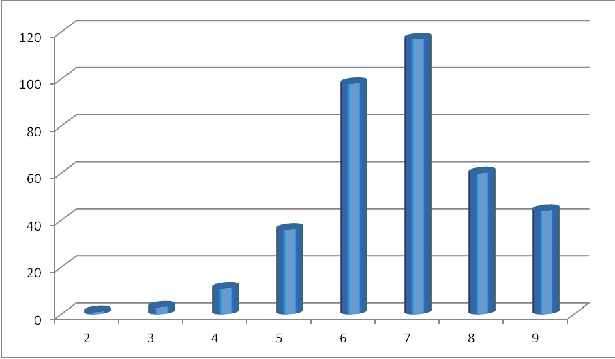

Our results show that IQ really matters in auditing. First, the distribution of audit partners’ IQ shows a substantial variation in IQ among audit partners in our sample (Figure 1). Although most audit partners have relatively high IQ, still some of them have surprisingly low IQ. Our untabulated results show that as many as 14 percent of the audit partners have an IQ score that is equal to or less than the mean value of the whole Swedish population. Also, audit partners’ IQ nicely follows a normal distribution.

Figure 1. Frequency distribution of audit partners’ IQ (N= 367). The sample includes all male audit partners (82 percent of all auditors) auditing all listed Swedish firms during 1999-2007.

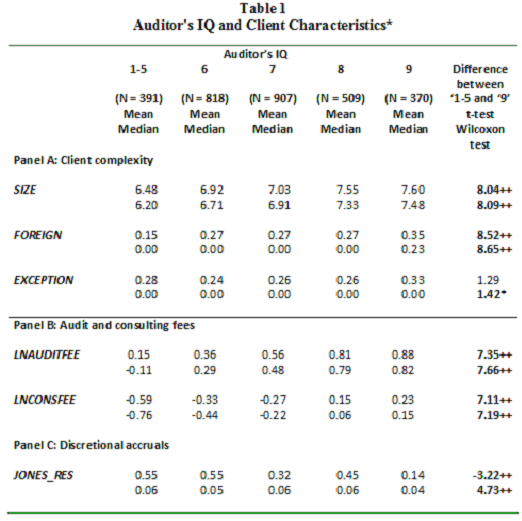

Second, the results reported in panel A of Table 1 show that the clients of high IQ audit partners are greater in size (SIZE) and are more complex, having more extensive foreign operations (FOREIGN), if compared to the firms in audit engagements of low IQ audit partners. We also find some evidence that these firms have more extraordinary income statement items (EXCEPTION), although the result is significant only for median values. Taken together, these results show that high IQ audit partners have more important clients compared to those with lower IQ.

Third, high IQ audit partners charge higher audit and consulting fees. The results reported in panel B of Table 1 show an economically and statistically strong positive association with an audit partner’s IQ and the audit and consulting fees paid by their clients. It may be that high IQ audit partners are more capable in helping client firms in their demanding tasks and/or high IQ audit partners’ may have better skills at negotiating the fees with the client firm. The results suggest that the quality of an auditor’s services is priced in audit markets and high quality providers are able to charge higher fees. Firms are willing to pay more for valuable expertise in e.g. minimizing taxes, improving internal efficiency, and evaluating growth prospects.

Finally, high IQ audit partners provide better audit quality, if compared to their colleagues with lower IQ. The results reported in panel C of Table 1 show that audit quality as measured by discretional accruals (JONES_RES) increases with an auditor’s IQ. Discretional accruals is a commonly used measure of the extent of the earnings management exercised by the client firm.

Notes: 1) The table presents mean and median values of the variables, and the results of testing the differences in means (t-test) and medians (Wilcoxon test) between client firms with the lowest/highest IQ audit partner. 2) The sample includes 1,455 firm-year observations for all Swedish listed companies during 1999-2007. 3) ++, +, * denote significance levels at the 0.01, 0.05, and 0.10 levels respectively.

We conclude our analyses in a multivariate setting. Specifically, we estimate regression models, where audit and consulting fees are the dependent variables, and auditors’ IQ and the variables for client importance are the independent variables. After controlling for factors that previous studies have shown to be related to audit fees, we find evidence that is consistent with those discussed above.

The preceding post comes to us from Juha-Pekka Kallunki, Professor of Financial Accounting at the University of Oulu; Lasse Niemi, Associate Professor of Auditing at Aalto University; and Henrik Nilsson, Acting Professor of Accounting at Stockholm School of Economics. The post is based on their recent article, which is entitled “Do Smarter Auditors Have More Important Clients? Archival Evidence Based on Unique IQ Data on Swedish Auditors” and is available here.

Sky Blog

Sky Blog

Yes, I agree. IQ impact one performance and quality, even tough there is still EQ and SQ. Thank you for the posting, looking forward to another post.