Section 404 of the Sarbanes-Oxley Act of 2002 (SOX 404 hereafter) and the associated implementation guidance require firms’ management and independent financial statement auditor to formally document, test, and report publicly in the annual Form 10-K on the effectiveness of internal controls over financial reporting. The costs of complying with this requirement are substantial and include a significant fixed component, making them particularly burdensome for small firms (e.g., Engel et al. 2007; Kamar et al. 2007; SEC 2009; Alexander et al. 2013). As a result, the Securities and Exchange Commission (SEC) delayed the implementation of SOX 404 several times for non-accelerated filers, which are firms with public float of less than $75 million, and the Dodd-Frank Act of 2010 eventually granted these firms a permanent exemption from the auditor attestation requirement.[1]

The costs of complying with SOX 404 create incentives for non-accelerated firms to avoid crossing the bright-line threshold of $75 million in public float and retain their non-accelerated filer status. Because the threshold is tied to the value of firms’ outstanding common equity, such incentives potentially affect the financing choices of smaller firms. That is, when comparing alternative sources of external financing, the regulatory threshold is likely to make additional common equity relatively more costly and additional debt relatively less costly. Thus, for non-accelerated firms looking to access external capital, we expect the scaled requirements for SOX 404 to increase the likelihood of issuing debt and decrease the likelihood of issuing common stock.

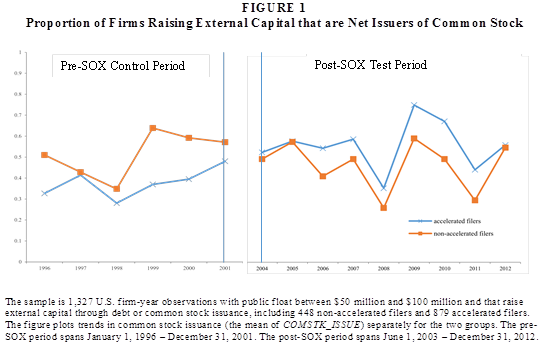

We provide evidence on this question by comparing the sources of finance used by non-accelerated filers that access external financing in the post-SOX era to those of a control sample of accelerated filers. Our empirical tests are then based on a difference-in-differences design where we examine how differences between the financing choices of non-accelerated filers and control firms change from the pre-SOX period to the post-SOX period.

Our results are consistent with SOX 404 exemptions creating incentives for smaller firms to shift their sources of financing toward debt and away from common equity to maintain their non-accelerated filer status. Controlling for other relevant factors, we find that the likelihood of issuing common stock decreases by 19.1 percent in the post-SOX period among non-accelerated filers that access external financing (and thus the likelihood of issuing debt instead of stock increases by 19.1 percent), relative to control firms. This effect is economically significant relative to the unconditional likelihood of issuing common stock, which is 47.0 percent among our sample firms (53.0 percent issue debt). These results are robust to a number of sensitivity tests, including different sample bands around the $75 million threshold, several alternate measures of common stock and debt issuance, and alternate control groups.

We also consider operating leases and preferred stock as additional potential sources of financing that do not affect public float. We find that the likelihoods of using operating leases and preferred stock instead of common stock both increase for non-accelerated filers relative to control firms, by 1.8 and 4.3 percent, respectively. These effects are modest in an absolute sense, but notable relative to the unconditional likelihood of engaging in the two activities (12.0 and 4.4 percent, respectively, in our sample).

This evidence indicates small firms may avoid regulatory thresholds and still continue to pursue profitable investment opportunities by availing themselves of strategic financing choices. Such choices, however, are unlikely to be costless, particularly because smaller firms are already more likely to have high leverage and bankruptcy risk. Our evidence adds to the literature examining economic consequences of SOX and the literature on corporate financing decisions and capital structure more generally.

ENDNOTES:

[1] Public float is the aggregate market value of a company’s outstanding common equity held by non-affiliates. An affiliate is “a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with” the issuer (17 CFR 240.12b-2).

REFERENCE:

Alexander, C., S. Bauguess, G. Bernile, Y. Lee, and J. Marietta-Westberg. 2013. Economic effects of SOX Section 404 compliance: A corporate insider perspective. Journal of Accounting and Economics 56 (2-3): 267-290.

Engel, E., R. Hayes, and X. Wang. 2007. The Sarbanes-Oxley Act and firms’ going-private decisions. Journal of Accounting and Economics 44 (1-2): 116-145.

Kamar, E., P. Karaca-Mandic, and E. Talley. 2007. Sarbanes-Oxley’s effects on small firms: What is the evidence? In In the Name of Entrepreneurship? The Logic and Effects of Special Regulatory Treatment for Small Business, eds. S. Gates and K. Leuschner, 143-168. Santa Monica, CA: RAND.

Securities and Exchange Commission (SEC). 2009. Study of the Sarbanes-Oxley Act of 2002 Section 404 Internal Control over Financial Reporting Requirements. Washington, DC: SEC.

The preceding post comes to us from David Weber, Associate Professor at the University of Connecticut School of Business, and Yanhua Sunny Yang, Assistant Professor at the University of Connecticut School of Business. The post is based on their article, which is entitled “The Debt-Equity Choice When Securities Regulations are Scaled by Equity Values: Evidence from SOX 404” and available here.

Sky Blog

Sky Blog