Options backdating? Who would be so arrogant to be still backdating their options? It has been exactly ten years since the Wall Street Journal’s exposé on “lucky CEOs.”[1] The intriguing question though is whether the executives could resist temptation for ten years. We decided to find out. We find that despite all the reforms enacted in response to the backdating scandal of 2006, manipulation of stock options as a form of incentive compensation is once again alive and well.

Let’s digress and explain the background first. Backdating an option refers to the practice of fraudulently picking a date in the past when the stock price was lower than today as the grant date of the option. The lower the stock price, the lower the exercise price, and thus the more valuable are the option, since on the true grant date the option is already in the money. Other games involve spring-loading and bullet-dodging. Spring-loading refers to the practice of delaying the release of good news until after the option grant date. The subsequent rise in stock price when the good news is announced immediately increases the value of the option. Bullet-dodging refers to the practice of accelerating the release of bad news so that stock price declines before the option grant date. The decline in stock price ensures that the option grant is not hurt by the bad news.

Section 10(b) of the Securities Act of 1934 makes it illegal for anyone to “use or employ, in connection with the purchase or sale of any security . . .any manipulative or deceptive device . . .”[2] The fiduciary duty of loyalty in corporate law jurisprudence requires corporate officers and directors to act in the best interest of the corporation over their own self-interests.[3] Manipulation of the date of option grants and especially information flow to serve the self-interest of increasing executive compensation seems to run afoul of both areas of law. Yet, securities law violations require evidence of intent to deceive.[4] And executives are given wide-latitude in making business decisions, rarely second guessed by the courts in the corporate law jurisdiction, pursuant to the business judgment rule. It is quite likely that in hindsight, if questioned about the timing of stock options or the timing of information release, some executives may be able to construct plausible business reasons for their decisions. Unless plaintiffs, whether the Department of Justice, the SEC, or shareholders through derivative actions can refute an evidence suggesting a rational basis for the options or information timing at issue, they may not succeed in an attempt to seek redress from these behaviors.

Our evidence shows that where compensation includes grants of stock options, some executives continue to employ a variety of manipulative devices to decrease the exercise price of the options, thereby increasing their compensation.[5] Not only does it appear that executives are changing the date of their option grant to a date that provides a more favorable (lower) strike price even after the option is granted, but also spring-loading and bullet-dodging.

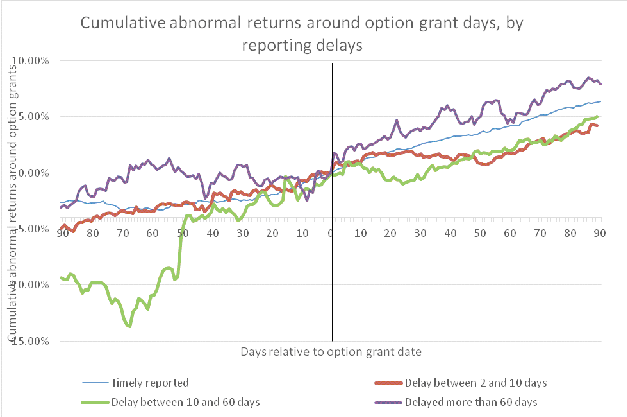

Take a look at the graph below. Day zero is the officially reported option grant date. Day 90 refers to 90 business days after the reported option grant date. As the graph shows, stock prices still do not appear to move randomly around option grants. Instead, stock prices rise after option grants between 5%-8%.[6] Also stock price rise the most (about 8%) after late-reported grants. This evidence is consistent with continuing games to benefit the executives around option grants.

Our data set contains over one million option grants during 2008-2014. As shown above, the data provides evidence of manipulation by executives for surreptitious personal gain on a broad scale. Although each individual manipulation may have a small marginal impact on compensation, our evidence demonstrates that executives were able to increase their compensation through these timing games by about 6% in the 2008-2014 period.

To address this issue and disincentivize this behavior, we propose a modest regulatory reform which should put an end to executive option dating and timing games once and for all. We propose that the SEC adopt a new rule requiring that all executive compensation in the form of option grants be prorated on a daily basis. In other words, any executive compensation in the form of stock options should be spread over the course of an entire year. For example, if an executive is to receive 365 options during the year, one option would be granted on each day of the year. Any backdating, spring-loading, bullet-dodging or any other game that benefits awarding one option on one particular date will necessarily hurt the other options, thereby offsetting the effects of manipulation. Under our proposal, executives would no longer significantly benefit from the timing games documented in our study. A regulation along the lines of our proposal should go a long way toward eradicating this illicit, self-serving behavior, supporting the intent of federal securities laws and state fiduciary duty obligations.

ENDNOTES

[1] For academic studies on backdating prior to Wall Street Journal story, see Erik Lie, On the Timing of CEO Stock Option Awards, 51 Mgmt. Sci. 802-12 (2005); M. P. Narayanan & H. Nejat Seyhun, Do Managers Influence Their Pay? Evidence from Stock Price Reversals Around Executive Option Grants (Ross Sch. of Bus., Working Paper No. 927, Jan. 2005), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=649804 (finding that executive options are backdated); M. P. Narayanan & H. Nejat Seyhun, Effect of Sarbanes-Oxley Act on the Influencing of Executive Compensation ( Nov. 2005), available at http://ssrn.com/abstract=852964 (again finding that options are backdated and that SOX mandatory grant date reporting decreases, but does not eliminate opportunism); Randall A. Heron & Erik Lie, Does Backdating Explain the Stock Price Pattern Around Executive Stock Option Grants?, 83 J. Fin. Econ. 271 (2007); and M.P. Narayanan & Nejat Seyhun, The Dating Game: Do Managers Designate Option Grant Dates to Increase Their Compensation? 21 Rev. Fin. Stud. 975-1007 (2008).

[2] 15 U.S.C. §78j (2000).

[3] In re Walt Disney S’Holder Derivative Litig., 907 A.2d 693, 755 (Del. Ch. 2005).

[4] Ernst & Enrst v. Hochfelder, 425 U.S. 185 (1976).

[5] For additional details, see S. Burcu Avci, Cindy A. Schipani, and H. Nejat Seyhun. Ending Executive Manipulations of Incentive Compensation, 42 Journal of Corporation Law (forthcoming).

[6] These returns are adjusted for the market movements.

The preceding post comes to us from S. Burcu Avci, visiting scholar at the University of Michigan, Cindy A. Schipani, Merwin H. Waterman Collegiate Professor of Business Administration and Professor of Business Law, and H. Nejat Seyhun, Jerome B. & Eilene M. York Professor of Business Administration and Professor of Finance, University of Michigan. The post is based on their paper, which is entitled “Ending Executive Manipulations of Incentive Compensation”, is forthcoming in the Journal of Corporation Law, and is available here.

Sky Blog

Sky Blog