A corporate inversion involves the relocation of a corporation’s legal domicile to a lower-tax nation (host country) while retaining its material operations in its higher-tax country of origin (home country). Corporations have been engaging in inversions for over three decades. The first inversion in 1982 occurred when Louisiana-based construction firm McDermott International converted one of its cash-rich Panama-based subsidiaries into the new parent firm, thereby paying much lower income taxes.

Corporate inversions have become headline news again in the US. Last year, US-based pharmaceutical company Pfizer announced a merger with Ireland-based Allergan. Pfizer expected to reduce its effective tax rate substantially by changing its domicile from the US to Ireland thereby avoiding higher taxes in the US. The Joint Committee on Taxation estimates that inversions like this one could erode federal revenues by as much as $34bn over the next decade. This may help to explain why US media and US policy makers portray firms that invert as ‘unpatriotic corporate deserters’.

While US media and politicians have decried corporate inversions as unpatriotic, firm’s management has the task of maximizing shareholder value. For instance, if Pfizer could cut its tax rate from 26% to 15% in 2017, it would save approximately $2.1bn in taxes in 2017 alone. However, on Monday April 4, the deal was abandoned after the US Treasury Department proposed new rules making inversions such as the Pfizer – Allergan deal much harder. As a result, Allergan shares tumbled 21 percent in after-hours trading. These losses in market value highlight that the potential tax savings offered by the deal could have increased shareholder value.

Relatively few studies look at a large number of corporate inversions to understand when an inversion may or may not add value. Our research takes a careful look at the data on corporate inversions to deliver new insights into the world of inversions. We use hand-collected data on more than 600 corporate inversions out of 11 home countries into 45 host countries over the 1996-2013 period.

Are Inversions a US Phenomenon?

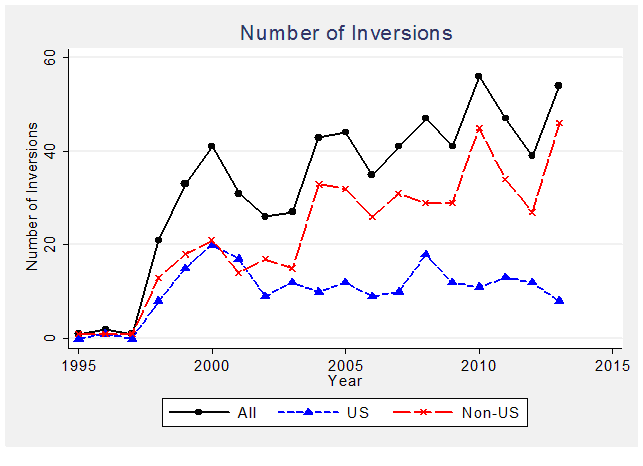

Despite the attention given to corporate inversions in the US, our data shows that corporate inversions are not a US phenomenon. Less than one third of inversions involved US firms. Moreover while inversions have become increasingly popular around the world, the annual number of inversions out of the US has remained constant over the last 15 years (Figure 1).

Taxes Matter!

Consistent with anecdotal evidence, we find robust evidence that the lower the tax rate in the host country vis-à-vis the home country, the more inversions take place between the two countries. To further substantiate this finding, we study inversions around passage of bilateral Double Taxation Treaties (DTTs). DTTs ensure that certain taxes paid in one country can be used to offset taxes due in another country; in short, DTTs reduce firms’ tax bills and make tax-driven inversions more attractive. Not surprisingly, we document a noticeable increase in inversion activity after passage of DTTs.

We find that tax-driven inversions typically increase shareholder value. Firms experience a decline in effective tax rates and an increase in market value after inverting to tax-haven countries or countries with lower corporate tax rates. Economically, a 1 percentage point lower tax rate in the host country (vis-à-vis the home country) is associated with a 0.6% drop in effective tax rates and a 0.4% increase in firm value; inversions into tax havens are accompanied by a 5.4 percentage point decrease in effective tax rates and a 14.4% increase in firm value.

If tax savings increase shareholder value, why are firms not inverting into countries with the lowest corporate rate?

Corporate Governance Is Critical

While tax savings are a reason for a firm to engage in an inversion, inversions may allow managers to expropriate resources from shareholders. This is because inversions into foreign countries make it difficult for shareholders to monitor managers’ activities.

One way for management to signal that expropriation concerns are no justified is to invert into countries with governance standards that are similar to their home country. We find that this is indeed the case. Although the average host country has slightly lower governance standards than the average home country, the majority of inversions occur between home and host countries with similar governance standards.

Digging deeper into the role played by governance in guiding inversion decisions, we examine inversion activity around passage of Tax Information Exchange Agreements (TIEAs). TIEAs are bilateral agreements between two territories – at least one of them a tax haven – allowing for the exchange of information relevant in tax investigations. Such agreements constitute an improvement in governance standards in tax haven countries because they increase the transparency of tax havens. Specifically, TIEAs improve the ability of signatory countries to monitor each other, making it harder to expropriate minority shareholders. Consistent with corporate governance being an important determinant when a firm is choosing a host country to invert into, we find that the number of inversions between two countries increases by 5% after these countries sign a bilateral TIEA.

What Happens If Firms Ignore Corporate Governance?

If a firm inverts into a country with weak governance standards investors will likely be faced with increased monitoring costs and potential expropriation. We show that institutional investors withdraw from firms inverting into weakly governed countries, while inversions into well-governed countries are associated with an increase in institutional ownership.

The Takeaway

We show that corporate inversions have potential to reduce firms’ effective tax rates and to increase firm value. Inversions do not seem to be conducted in a way that allows for expropriation of minority shareholders. Much rather, the evidence we put forward suggests that firms respond to improved governance in potential host countries, suggesting that inversions are in fact corporate actions conducted by well-run firms. In sum, inversion decisions seem to be made in shareholders’ interest.

Why then do corporate inversions attract negative publicity? Though direct avoidance of taxes makes corporate inversions an easy target for criticism, is that criticism justified? Does this mean that the media and policy makers – who have portrayed inversions as unpatriotic acts conducted by poorly run firms – have gotten it entirely wrong? Based on the evidence in the paper, we can speculate that the government in the home country may not be losing as much tax revenue as one might think given that shareholders in the home country would have to pay more taxes due to more highly valued shares and/or larger dividends. Such tension between firms making decisions in shareholders’ interest and governments seeking to correct distributive failures is often overlooked.

The preceding post comes to us from Burcin Col, Assistant Professor of Finance at Pace University, Rose Liao, Assistant Professor of Finance and Economics at Rutgers University, and Stefan Zeume, Assistant Professor of Finance at the University of Michigan, Ross School of Business. The post is based on their article, which is entitled “What Drives Corporate Inversions” and available here.

Sky Blog

Sky Blog