Despite substantial judicial and public scrutiny, non-prosecution agreements (“NPA”) and deferred prosecution agreements (“DPA”) have retained their prominence as vehicles to resolve complicated corporate investigations, particularly for companies operating in regulatory environments. In the first half of this year, NPAs and DPAs remain in common use. We do not expect this trend to change. Thanks in part to a D.C. Circuit opinion affirming the critical independence and discretion that the U.S. Department of Justice (“DOJ”) has in crafting the terms of DPAs, we expect use of such agreements to remain widespread. Finally, tacitly acknowledging the utility of the U.S. DPA/NPA regime, other nations continue to emulate the U.S.-style DPA/NPA practices and adapt them to the nuances of their local justice systems.

This client alert, the sixteenth in our series of biannual updates on NPAs and DPAs, (1) summarizes highlights from the NPAs and DPAs of the first half of 2016; (2) discusses DOJ’s recent decision to find a company in breach of the terms of its DPA; (3) explores the D.C. Circuit’s decision in United States v. Fokker Services B.V., reversing Judge Richard Leon’s rejection of Fokker Services B.V.’s (“Fokker Services”) DPA; (4) addresses new developments in HSBC’s effort to preserve the confidentiality of its compliance monitor reports; and (5) provides an update on the growing movement to develop DPA policies around the world.

NPA and DPA Overview

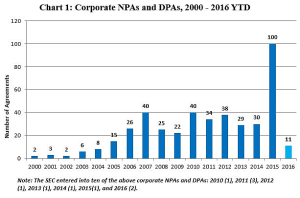

NPAs and DPAs are two kinds of voluntary, pre-trial agreements between a corporation and the government, most commonly DOJ. They are standard methods to resolve investigations into corporate criminal misconduct and are designed to avoid the severe consequences that conviction would have on a company, its shareholders, and its employees. Though NPAs and DPAs differ procedurally–a DPA, unlike an NPA, is formally filed with a court along with charging documents–both usually require an admission of wrongdoing, payment of fines and penalties, cooperation with the government during the pendency of the agreement, and remedial efforts, such as enhancing a compliance program and–on occasion–cooperating with a monitor who reports to the government. Although NPAs and DPAs are used by multiple agencies, since Gibson Dunn began tracking corporate NPAs and DPAs in 2000, we have identified approximately 400 agreements initiated by DOJ, and only ten initiated by the Securities and Exchange Commission (“SEC”).

NPAs and DPAs to Date in 2016

In the first half of 2016, DOJ and the SEC have collectively entered into eleven corporate NPAs and DPAs, of which nine were NPAs and two were DPAs. Atypically, the SEC–which has historically been very judicious in its use of corporate NPAs and DPAs–accounted for two of the eleven agreements, both of which addressed alleged violations of the U.S. Foreign Corrupt Practices Act (“FCPA”). As shown below, the number of corporate NPA and DPA releases has slowed considerably since the end of 2015, when the DOJ Tax Division entered into dozens of NPAs pursuant to its Program for NPAs or “Non-Target Letters” for Swiss Banks. This program, discussed at length in our 2015 Mid-Year and Year-End Updates, drew to a close in January 2016, following seventy-eight settlements with as many Swiss banks, including penalties ranging from $0 to $211 million.[1]

Following the close of the Swiss bank program, corporate NPA and DPA releases have been relatively slower than in prior years. In 2016 to date, we have identified only eleven publicly available corporate NPAs and DPAs, and this figure includes the three last NPAs issued under the Swiss bank program. In comparison, DOJ and the SEC had collectively entered into seventeen agreements by this date in 2014. In 2013, they had entered into sixteen agreements; and in 2012, they had entered into twenty-two. Indeed, the number of NPAs and DPAs entered into year-to-date are at their lowest since 2010, when there were also eleven agreements released by July 6. This data, however, is not necessarily predictive of a slow year: in 2010, the second half of the year more than compensated for the slow start, and 2010 ultimately yielded forty corporate agreements; it is entirely possible that the same may happen in 2016.

Chart 1 below shows all known corporate NPAs and DPAs since 2000.

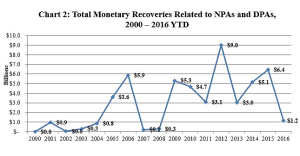

Chart 2 below illustrates the total monetary recoveries related to NPAs and DPAs from 2000 through today. Year-to-date monetary recoveries in 2016 are lower than in years past. Indeed, while recoveries in 2014 and 2015 had both exceeded $3.5 billion by this point in the year, 2016 year-to-date recoveries sit at only $1.2 billion.

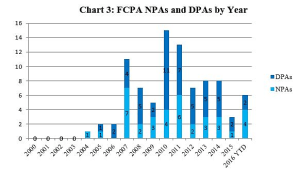

Although it is too early to draw many concrete inferences about the road ahead for corporate NPAs and DPAs, one potential trend is the resurgence of FCPA NPAs and DPAs. As shown in Chart 3 below, while 2010 and 2011 were very active years for FCPA NPAs and DPAs (totaling fifteen and thirteen agreements, respectively), 2012 through 2015 saw a relative decline. From 2012 through 2014, each year saw between seven and eight agreements, and in 2015, there were only three. This year, however, there have already been six FCPA NPAs and DPAs, including two from the SEC–Akamai Technologies and Nortek Inc.–announced by the SEC on the same day.

This uptick in FCPA resolutions arises in a context of increased focus on FCPA enforcement by both DOJ and the SEC. As discussed in our 2015 Year-End FCPA Update and our 2016 Mid-Year FCPA Update, both DOJ and the SEC recently announced reinvigorated enforcement efforts in the FCPA sphere, and appear to be actively pursuing rapid resolution of open FCPA investigations. Assistant Attorney General Leslie Caldwell, for example, announced a more than 50% expansion of DOJ’s FCPA Unit in November 2015,[2] and the Federal Bureau of Investigation similarly announced the establishment of three new international corruption squads–with exclusive mandates to investigate foreign bribery and kleptocracy crimes–in March 2015.[3]

DOJ also trumpeted a new FCPA Pilot Program in April–addressed in detail in our 2016 Mid-Year FCPA Update–that is intended to motivate voluntary corporate self-disclosure of FCPA violations.[4] For its part, the SEC announced in November 2015 that voluntary self-disclosure would be a threshold requirement to achieving a FCPA NPA or DPA with the SEC.[5] Nortek Inc. and Akamai Technologies were the first two NPAs announced since the SEC’s threshold announcement in November 2015. In announcing the agreements, Andrew Ceresney, Director of the SEC’s Enforcement Division, noted: “When companies self-report and lay all their cards on the table, non-prosecution agreements are an effective way to get the money back and save the government substantial time and resources while crediting extensive cooperation.”[6] While DOJ has not similarly pegged achieving an NPA or DPA to self-disclosure, there can be no doubt that self-disclosure of FCPA violations (or lack thereof) may factor into DOJ’s decision to offer an NPA or DPA as a vehicle for settlement. For additional information regarding developments in FCPA enforcement, please access our 2016 Mid-Year FCPA Update.

DOJ Declares Another DPA Breached

In June of this year, DOJ found that orthopedic device manufacturer Biomet Inc. (“Biomet”) was in breach of the terms of its DPA. This announcement of breach is highly unusual; indeed, this is only the third declaration of breach issued by either DOJ or the SEC since 2000.[7]

In 2012, Biomet negotiated a DPA with DOJ, stemming from allegations of misconduct in Argentina, Brazil, and China, where Biomet allegedly bribed public health care officials to secure lucrative private business contracts.[8] Biomet was levied a $17.28 million fine as part of the DPA, which carried a three-year term with the possibility of a one-year extension if DOJ found, in its sole discretion, that Biomet “knowingly violated” any provision of the DPA.[9] Pursuant to this provision, the government extended Biomet’s DPA for a fourth year in March 2015.[10]

On June 6, 2016, DOJ filed a status report with Judge Reggie Walton of the U.S. District Court for the District of Columbia indicating that Biomet was in breach of its 2012 DPA.[11] DOJ determined that unspecified conduct by Biomet in Brazil and Mexico in 2014, which Biomet had disclosed to DOJ, constituted a breach of the company’s DPA.[12] In finding Biomet in breach of the terms of its DPA, DOJ referred to the conduct in both Brazil and Mexico, and alleged that Biomet failed to implement and maintain a compliance program as required by the DPA.[13] According to the Status Report, Biomet has expressed a commitment to continue cooperating with DOJ in a manner that will still allow it to avoid trial, despite the new allegations of misconduct.[14] The parties are currently negotiating a resolution of the breach allegations.[15] If the parties are unable to reach an agreement, Biomet could face prosecution both for the original charges and the new allegations of misconduct in Brazil and Mexico. DOJ’s determination that Biomet breached its DPA is part of a larger trend of DOJ taking an aggressive approach to post-resolution matters. Assistant Attorney General Leslie Caldwell outlined this approach last year, in connection with certain enforcement actions against several banks:

Make no mistake: the Criminal Division will not hesitate to tear up a DPA or NPA and file criminal charges, where such action is appropriate and proportional to the breach. DPAs and NPAs are powerful tools. They can’t be ignored once they’re signed, and they can’t be followed partially but not completely. We will take action to ensure that banks are held accountable for DPA or NPA violations. And where a bank that violates a DPA or NPA is a repeat offender with a history of misconduct, or where a violating bank fails to cooperate with an investigation or drags its feet, that bank will face criminal consequences for its breach of the agreement.[16]

This position reflects DOJ’s treatment of NPA or DPA breaches, or incomplete performance under NPAs or DPAs, in recent years. In 2014, for example, DOJ extended Standard Chartered Bank’s DPA for an additional three years after finding that the corporation had not fulfilled the requirements of its 2012 agreement and may have committed additional violations of sanctions laws.[17] Certain banks and other companies have also seen DPAs extended by DOJ in recent years.[18] These extensions of time and findings of breach serve as a cautionary tale to companies subject to NPAs and DPAs: while two findings of breach in one year do not a trend make, they do suggest that DOJ may be growing more inclined to terminate rather than renegotiate agreements. Corporations should continue to take particular care to ensure that proper monitoring protocols are in place to ensure compliance with NPAs and DPAs and avoid further misconduct.

D.C. Circuit Weighs in on Judicial Oversight of DPAs

In several prior updates, we have reported on a growing trend of federal judges substantively evaluating DPAs and, in some instances, rejecting them on their merits. On April 5, 2016, the United States Court of Appeals for the District of Columbia Circuit issued a landmark ruling in United States v. Fokker Services B.V. bucking this trend and signaling that DPAs will remain a flexible tool for federal prosecutors.[19] A three-judge panel of the D.C. Circuit, the first circuit court to ever weigh in on the question of judicial oversight of DPAs, unanimously concluded that the Speedy Trial Act, which requires courts to approve the delay of trial for purposes of a DPA, does not confer judicial authority to review the merits of charging decisions made by the Executive Branch.[20]

The decision is based on an 18-month DPA brokered between Fokker Services, a Dutch aerospace company, and the U.S. Attorney’s Office for the District of Columbia to resolve criminal charges stemming from alleged violations of U.S. sanctions and export control laws.[21] To effectuate a DPA, the Speedy Trial Act, which calls for a trial to begin within 70 days of the filing of an information or indictment, typically must be suspended while the defendant complies with the terms of the DPA and shows good behavior.[22] On February 5, 2015, Judge Richard Leon of the District Court for the District of Columbia rejected the parties’ motion to suspend the Speedy Trial Act, effectively rejecting the DPA.[23] In doing so, Judge Leon faulted the DPA for being overly lenient and for failing to require a corporate monitor.[24]

The D.C. Circuit vacated Judge Leon’s ruling.[25] In a 28-page decision penned by Judge Sri Srinivasan, the court ruled that charging decisions are the sole domain of the Executive Branch and that the Speedy Trial Act does not give “courts substantial power to impose their own charging preferences.”[26] In reaching this conclusion, the D.C. Circuit opined that the court’s authority to question a DPA under the Speedy Trial Act is no greater than other judicial oversight functions in the criminal context.[27] The Court compared Rule 48(a) of the Federal Rules of Criminal Procedure, which requires “leave of court” before a prosecutor can dismiss charges, with the Speedy Trial Act’s requirement of court approval to delay trial for purposes of a DPA.[28] Though Rule 48(a)’s “leave of court” requirement could be read as conferring courts with the authority to reject a motion to dismiss charges for substantive reasons, such as the belief that the defendant should face the charges, the Supreme Court has held that this requirement is designed only to prevent prosecutorial harassment by repeatedly bringing, and then dismissing, charges.[29]

The D.C. Circuit rejected an amicus argument analogizing judicial review of DPAs to the court’s power to reject proposed plea agreements, and advocating for expansive court oversight on that basis.[30] By the D.C. Circuit’s reasoning, courts may not reject plea agreements due to disagreements with a prosecutor’s original charging decisions.[31] Moreover, judicial authority to reject a proposed plea agreement lies in its power over criminal sentencing.[32] A DPA, by contrast, is designed “to avoid criminal conviction and sentence by demonstrating good conduct and compliance with the law.”[33] Though, according to the D.C. Circuit, courts cannot reject DPAs if they perceive the terms to be unduly lenient, the D.C. Circuit seemed to leave open the possibility of rejecting agreements containing “illegal or unethical provisions,” or that aim simply to avoid the Speedy Trial Act.[34]

After Fokker Services paid a total of $21 million in penalties and forfeiture, the government filed an unopposed motion to dismiss on June 9, 2016, arguing that Fokker Services fulfilled the terms of the DPA.[35] Judge Leon granted the motion the next day.[36]

United States v. HSBC

In our 2015 Mid-Year Update, we reported on how former federal Judge John Gleeson, the first to contemplate expanded judicial scrutiny of DPAs, set the stage for Judge Leon’s Fokker Services decision by approving HSBC’s DPA “subject to continued monitoring of its execution and implementation.”[37] Now, HSBC seeks to use the D.C. Circuit’s reversal of Judge Leon’s decision as ammunition to maintain the privacy of an annual monitorship report that Judge Gleeson ordered must be filed with the court.

In response to an order from Judge Gleeson, the U.S. Attorney’s Office for the Eastern District of New York submitted, on June 1, 2015, a lengthy “First Annual Follow-Up Review” report written by HSBC’s appointed compliance monitor.[38] The government, however, filed the report under seal, and a protracted battle has since ensued over the extent to which that report should be unsealed for public viewing. On January 28, 2016, based on a request from a private citizen who filed a consumer complaint against HSBC, Judge Gleeson ordered the unsealing of the report subject to proposed redactions from the government and HSBC.[39]

At the heart of Judge Gleeson’s decision was whether the report constitutes a “judicial document” to which the public would have a constitutional right of access.[40] The reasoning underlying that decision shows how judicial oversight of a DPA can impact much more than the mere approval or disapproval of its terms. By playing a role in overseeing compliance with the DPA, Judge Gleeson reasoned that the monitor’s report became “critical to the execution of [Judge Gleeson’s] duties,”[41] thereby rendering it a “judicial document” subject to public viewing. Judge Gleeson rejected the government’s argument that disclosure would impact the relationship between DOJ and financial institution regulators. The government’s brief noted that the monitor appointed in this instance was also fulfilling obligations imposed by the Federal Reserve, which had indicated to DOJ it may wish to forego using a shared monitor if DOJ were later compelled to disclose the monitor’s report.[42] Judge Gleeson argued that DOJ’s concerns about its relationship with financial institution regulators are outweighed by the court’s role in overseeing the DPA.[43] Judge Gleeson acknowledged the parties’ other concerns stemming from unsealing the report, such as a potential chilling effect on HSBC personnel who cooperated with the monitor or the ability of would-be criminals to exploit weaknesses in HSBC’s anti-money laundering and sanctions compliance programs.[44] To address these concerns, Judge Gleeson ordered the parties to submit proposed redactions.[45] On Judge Gleeson’s last day on the bench before entering private practice, he issued a March 9, 2016 ruling redacting portions of the report but ordered that it remain under seal pending appellate review.[46]

That March 9, 2016 order prompted an immediate motion for interlocutory appeal from HSBC (and another later from the government) taking issue with the fact that it cites a passage from the monitor’s report.[47] The passage is particularly significant because it opines on how HSBC has, despite making significant headway, purportedly moved too slowly to build and maintain an effective anti-money laundering and sanctions compliance program.[48] In an April 12, 2016 letter brief, HSBC cited at length the newly rendered Fokker Services decision arguing that it “rejects the very foundation for the assertion of supervisory authority in this case,” which served as the basis for Judge Gleeson’s order to unseal the monitor’s report.[49] On May 4, 2016, the Honorable Ann M. Donnelly, to whom the case had been reassigned after Judge Gleeson’s retirement, denied the motion on procedural grounds.[50] While her order does not address Fokker Services, Judge Donnelly noted that the case would benefit from appellate review, echoing Judge Gleeson’s prior observation that it presents important issues of first impression.[51] The government and HSBC are scheduled to submit opening briefs before the Second Circuit on July 21, 2016.

As we have discussed in prior updates, and based on our substantial experience both serving as and working with independent monitors, and working with confidential bank supervisory material, Gibson Dunn wholeheartedly agrees with HSBC’s and the government’s view regarding the need for complete confidentiality between the monitor and the company under review. In addition to the chilling effect disclosing a monitorship report would have on the relationship between the monitor and a company’s personnel, it would weaken the protections traditionally accorded bank supervisory information, which have been thought critical to the proper functioning of the bank regulatory process. Disclosure also could provide a roadmap for civil lawsuits or for would-be wrongdoers to circumvent internal controls. We do not believe that Judge Gleeson’s use of redactions was sufficient to address these concerns. As a practical matter, a monitor could not offer employees the kind of confidentiality assurances necessary to facilitate fulsome dialogue because the monitor and the employees providing information to the monitor would not know in advance what information the court would or would not ultimately decide to redact. Additionally, given the length and complexity of monitorship reports, it would be a herculean, if not impossible, task for judges to identify in all cases which information would compromise the bank from a supervisory standpoint or might be beneficial to would-be wrongdoers.

Developments in the DPA Regimes of Foreign Jurisdictions

On the heels of the United Kingdom’s first DPA, discussed in our 2015 Year-End Update, Australia and France are seriously contemplating the use of pre-indictment corporate settlements. Australia, France, and 39 other countries have signed and ratified the Anti-Bribery Convention, a pledge to combat corporate bribery of foreign public officials.[52] The Organization for Economic Cooperation and Development (“OECD”), typically through its Working Group on Bribery, oversees the implementation of the convention by each signatory state.[53] On March 16, 2016, in Paris, France, the OECD held a special Ministerial Meeting (the “OECD Meeting”), attended by high-level government officials from each signatory state, to discuss issues relating to the convention, including whether corporate settlements (such as DPAs) can be used as an incentive for companies to self-report wrongdoing.[54]

In the lead-up to the OECD Meeting, on March 10, 2016, a group of Non-Governmental Organizations–Corruption Watch, Transparency International, UNCAC Coalition, and Global Witness–wrote a joint letter urging the Working Group on Bribery to assess whether DPAs deter corporate crime.[55] Anticipating the “increasing use of corporate settlements,” the group also called for a set of global standards and provided its own set of suggested standards, which would require that, among other things, there be judicial oversight over any out-of-court deals made by prosecutors.[56] The ministers and representatives of the parties to the convention also issued a Ministerial Declaration on the same day as the OECD Meeting, encouraging the Working Group to study corporate settlement good practices.[57]

A set of global standards could be important as countries develop their own DPA regimes. The United States is currently responsible for the vast majority of anti-bribery enforcement actions, all of which in the corporate context are resolved using some form of pre-indictment corporate settlement (whether a DPA, NPA, or plea deal). As discussed in our 2015 Year-End FCPA Update, the United States brought 20 anti-bribery enforcement actions last year. In comparison, according to a report by TRACE International, only four anti-bribery enforcement actions were brought by other countries.[58] There is mounting pressure from the OECD for other countries to step up their anti-bribery enforcement. In a recent interview, Drago Kos, chair of the OECD Working Group on Bribery, stated that “we have a limited number of countries that are really trying hard to improve, which is good. But we still have countries that don’t have much interest or energy in concrete investigation or prosecution of foreign bribery cases.”[59] The United States has used DPAs and NPAs as tools to help resolve foreign bribery investigations and, in the first half of 2016, Australia and France (countries that have been criticized by OECD in the past for lax anti-bribery enforcement) have taken cautious steps towards implementing their own DPA regimes. In the United Kingdom, the U.K. government has also taken further steps to expand the role of DPAs in resolving allegations of corporate crime. The following sections address DPA developments in Australia, France and the United Kingdom, in turn.

Australia

At the OECD Meeting, Australian Minister for Justice Michael Keenan announced the release of a public discussion paper on a possible Australian DPA regime.[60] In the discussion paper, the Australian Attorney-General’s Department (the “Department”) asks the public to comment on how DPAs can incentivize corporate self-reporting and requests opinions on a core set of issues including: (1) which offenses DPAs should be available for; (2) whether DPAs should be available to individuals or limited to companies; (3) the extent of court involvement; (4) whether DPAs should be made public; and (5) consequences of breaching a DPA.[61] The window for submitting comments to the discussion paper closed on May 2, 2016, and the Attorney-General is now “considering responses to the public consultation paper.”[62]

The discussion paper includes an in-depth comparison between the U.S. and U.K. DPA regimes.[63] For example, the United States, unlike the United Kingdom, allows DPAs to be used in connection with the prosecution of individuals.[64] The United States grants prosecutors “broad discretion as to the type of crimes for which DPAs may be entered into” whereas the United Kingdom only allows DPAs for specified offenses that are generally economic in nature.[65] Our 2015 Year-End Update also included an in-depth analysis of several key differences between the U.S. and U.K. DPA regimes.

In the discussion paper, the Department presents both the U.S. and U.K. approach to various DPA-related issues but it generally does not adopt either approach on any given issue. However, on the question of judicial involvement, the Department does suggest a process that is akin to how U.S. prosecutors enter into NPAs. Rather than seek court approval of the agreement, the Commonwealth Director of Public Prosecutions would approve the negotiated DPA and “suspend” any indictment it may have filed with the court.[66] This suggestion stems from the federal judicial system limitations under Article III of the Australian Constitution, which effectively states that courts “cannot merely ‘rubber stamp’ administrative processes or penalties that have been ‘agreed’ in advance by the parties.”[67]

The Department’s decision to consider the use of DPAs may be motivated by OECD pressure to strengthen its anti-corruption laws. In 2012, the OECD Working Group on Bribery warned that the government should take significant action to ensure that corporations are not, as a practical matter, avoiding criminal liability.[68] After implementing various OECD recommendations, Australia received a “pass mark” from the Working Group in a 2015 follow‑up report. However, the OECD did identify additional areas where Australia could improve its enforcement, including the development of a “clear framework” for corporate plea bargains and self-reporting.[69]

The timing of the discussion paper also coincides with an inquiry by the Australian Senate Economics Committee, which is specifically considering DPAs and other measures to encourage self-reporting.[70] The Committee was set to publish a report on its findings in July 2016 but the report will likely be delayed due to the dissolution of the Senate on May 9, 2016, which resulted in a recent election for all Australian senators on July 2, 2016.[71]

France

In France, lawmakers are considering on an accelerated timeline a bill regarding transparency, the fight against corruption, and the modernization of economic life (Projet de loi relatif à la transparence, à la lutte contre la corruption et à la modernisation de la vie économique, referred to as the “Sapin II” bill, after Finance Minister Michel Sapin, who presented the legislation). Among other things, the current version of the Sapin II bill would introduce a new settlement mechanism resembling the NPA/DPA process in the United States. Under the proposed mechanism, the public prosecutor can propose to suspend prosecution of a company accused of wrongdoing in exchange for the company: (1) paying a monetary penalty in an amount proportionate to the seriousness of the facts and the profits derived from the offense, capped at 30% of the company’s average annual revenue for the previous three years; and/or (2) implementing a compliance program, at the company’s expense, and under the supervision of the government for a period of up to three years.[72]

Although both serve similar functions, there are various differences between the proposed Sapin II settlement mechanism and the way U.S. prosecutors enter into NPAs/DPAs. Under the Sapin II settlement mechanism, court approval would be required, which is also true of DPAs in the United States; but U.S. prosecutors also have the option of bypassing the courts through use of an NPA.[73] Unlike the U.S. DPA procedure, the current draft of the Sapin II bill also requires a public adversarial hearing before a judge, who may decline to approve the proposed settlement.[74] Interestingly, under Sapin II, companies also have the option of withdrawing from the agreement within 10 days after court approval.[75] In addition, all settlement agreements under Sapin II must be published on the relevant agency’s website, whereas U.S. prosecutors are not required to publish the contents of a DPA/NPA.[76] Finally, a settlement agreement under Sapin II would only be available for legal entities and not for individuals–U.S. prosecutors face no such limitation.[77]

On March 24, 2016, France’s Council of State–the supreme court of the administrative system, which also counsels the French government on the preparation of draft legislative measures–issued an advisory opinion on the draft Sapin II bill, criticizing an earlier version of the proposed settlement mechanism that did not contemplate an adversarial court hearing to approve proposed agreements. The Council observed that such a mechanism would contravene the inquisitorial approach of the French criminal justice system, which aims to determine the facts of a given matter, and would deprive the victim of the ability to help establish how he or she was harmed.[78] The Council also took issue with the fact that, under the draft proposal, no individuals–only corporations–could enter into a settlement agreement, calling it against the good administration of justice to establish divergent procedural pathways.[79] Despite these criticisms, the Council did express support for a settlement mechanism in the specific case of a transnational act of corruption, subject to appropriate safeguards, given the existence of varying settlement practices for corruption cases in different countries.[80]

Ultimately, on March 30, 2016, French lawmakers decided to submit a version of the Sapin II bill to the National Assembly without the settlement mechanism provision.[81] However, the provision was re-inserted into the bill during the parliamentary process, subject to several key amendments, including the requirement of an adversarial judicial hearing before settlements can be approved.[82] On June 15, 2016, the National Assembly voted its approval of the bill.[83] The Senate–France’s other parliamentary chamber–is currently considering the Sapin II bill.[84] On July 5, 2016, the Senate discussed and adopted Article 12 bis of the Sapin II bill, containing the revised settlement mechanism introduced in the National Assembly.[85] Opponents of the settlement provision criticized the imposition of an “Anglo-Saxon” legal mechanism creating a justice system that distinguishes individuals from large corporations.[86] Supporters cited the efficiency and pragmatism of the settlement mechanism, which would help protect the competitiveness of French multinational companies by alleviating some of the collateral consequences associated with prolonged corruption investigations and convictions.[87]

The Senate is scheduled to conclude its public consideration of the Sapin II bill on July 8, 2016. As in the United States, both of the French legislative chambers (the Senate and National Assembly) must pass the same version of the bill before it is signed into law by the President. The Sapin II bill is being considered on an accelerated basis, requiring only one reading in each chamber, rather than two.[88]

Throughout this process, French lawmakers face the same pressure that Australian lawmakers do, namely the criticism that domestic anti-corruption laws are being under-enforced. In 2014, the OECD Working Group expressed “serious concerns” about France’s “limited efforts” in enforcing its anti-corruption laws.[89]

United Kingdom

We recently addressed the introduction and availability of DPAs in the United Kingdom–along with the U.K.’s inaugural DPA, an agreement between the SFO and Standard Bank Plc–in our 2015 Year-End Update. Since release of the Standard Bank Plc DPA, no additional DPAs have issued from the U.K. In the interim, the debate continues over the extent and nature of cooperation that will be required to secure a DPA.

There has also recently been an initiative to expand the scope of the current DPA program to include cases involving certain alleged financial crimes.[90] As we noted in our 2014 year-End Sanctions Update, the UK’s DPA regime did not extend to cover financial sanctions and export control offenses.

Although passage through the House of Lords is still required, on June 13, 2016, the United Kingdom House of Commons approved the Policing and Crime Bill (the “Bill”).[91] In a factsheet on financial sanctions published in conjunction with an early version of the Bill, Parliament indicated that one of its overarching goals for the Bill with regard to financial sanctions is to “provide the enforcement community with a broader and more flexible array of powers.”[92] To that end, the Bill would extend the maximum criminal sentence for a financial indictment from two to seven years, and would allow the Office of Financial Sanctions Implementation to impose additional monetary penalties or Serious Crime Prevention orders to redress financial sanctions violations.[93] The Bill would also expand the United Kingdom’s recently initiated DPA program. Section 130 of the Bill would amend Schedule 17 of the Crime and Courts Act 2013 to include breach of financial sanctions as an offense eligible for a DPA.[94] Eligible breaches of financial sanctions include conduct ranging from breaching a domestic terrorist asset freeze to export control violations and breaches of financial sanctions.[95] United Kingdom DPAs are by statute only available in England and Wales, and only companies, partnerships and unincorporated associations are eligible. The Policing and Crime Bill is currently pending approval by the House of Lords.

ENDNOTES

[1] DOJ has catalogued all Swiss bank settlements pursuant to the Swiss bank program on its website: https://www.justice.gov/tax/swiss-bank-program.

[2] Department of Justice, Assistant Attorney General Leslie R. Caldwell Delivers Remarks at American Conference Institute’s 32nd Annual International Conference on Foreign Corrupt Practices Act (Nov. 17, 2015), https://www.justice.gov/opa/speech/assistant-attorney-general-leslie-r-caldwell-delivers-remarks-american-conference.

[3] Federal Bureau of Investigation, FBI Establishes International Corruption Squads Targeting Foreign Bribery, Kelptocracy Crimes (Mar. 30, 2015), https://www.fbi.gov/news/stories/2015/march/ fbi-establishes-international-corruption-squads/fbi-establishes-international-corruption-squads.

[4] Department of Justice, Criminal Division Launches New FCPA Pilot Program (Apr. 5, 2016), https://www.justice.gov/opa/blog/criminal-division-launches-new-fcpa-pilot-program.

[5] Andrew Ceresney, Dir., Div. of Enf’t for the Sec. & Exch. Comm’n, ACI’s 32d FCPA Conference Keynote Address (Nov. 17, 2015), http://www.sec.gov/news/speech/ceresney-fcpa-keynote-11-17-15.html.

[6] Securities and Exchange Commission, SEC Announces Two Non-Prosecution Agreements in FCPA Cases (June 7, 2016), https://www.sec.gov/news/pressrelease/2016-109.html.

[7] See our 2015 Mid-Year Update.

[8] See Biomet Inc. DPA Information ¶ 21 (June 18, 2012).

[9] Id. at ¶¶ 2, 5.

[10] Biomet Inc., Current Report (Form 8-K) (March 13, 2015).

[11] See Status Report of Government, U.S. v. Biomet, Inc., 1:12-cr-080 (RBW) (D.D.C. June 6, 2016).

[12] Id. at 2.

[13] See generally id.

[14] Id. at 2.

[15] Id.

[16] Id.

[17] Jaclyn Jaeger, Justice Department Extends Standard Chartered DPA, Compliance Week (December 10, 2014), https://www.complianceweek.com/blogs/enforcement-action/justice-department-extends-standard-chartered-dpa#.V21p-pj2ZJ0.

[18] Jonathan Sack, Deferred Prosecution Agreements – The Going Gets Tougher, Forbes (May 28, 2015), http://www.forbes.com/sites/insider/2015/05/28/deferred-prosecution-agreements-the-going-gets-tougher/#dc846ed305e5.

[19] United States v. Fokker Services B.V., 15-3016 (D.C. Cir. Apr. 5, 2016).

[20] Id. at 738.

[21] Id. at 739.

[22] See id. at 738-39.

[23] United States v. Fokker Servs.B.V., 79 F. Supp. 3d 160, 164-67 (D.D.C. 2015).

[24] Id. at 166-67.

[25] United States v. Fokker Servs. B.V., 818 F.3d 733, 751 (D.C. Cir. 2016).

[26] United States v. Fokker Services B.V., 15-3016, Slip Op. at 14.

[27] Id. at 743-44.

[28] Id. at 742.

[29] United States v. Fokker Services B.V., 15-3016, Slip Op. at 11.

[30] Id. at 745-46.

[31] Id. at 745.

[32] Id.

[33] United States v. Fokker Services B.V., 15-3016, Slip Op. at 21.

[34] United States v. Fokker Services B.V., 15-3016, Slip Op. at 21.

[35] Government’s Unopposed Motion to Dismiss with Prejudice the Criminal Information at 4, United States v. Fokker Servs. B.V., 14-CR-121 (D.D.C. Jun. 9, 2016).

[36] Order to Dismiss Per Fed. R. Crim. P. 48(a), United States v. Fokker Servs. B.V., 14-CR-121 (D.D.C. Jun. 10, 2016).

[37] United States v. HSBC Bank, No. 12-cr-763 (E.D.N.Y. April 1, 2015).

[38] Monitor’s First Annual Follow-Up Report (Parts I and II), United States v. HSBC Bank, No. 12-cr-763 (E.D. N.Y. Jun. 1, 2015).

[39] Slip Op at 13-14 (Doc. No. 52).

[40] Slip Op at 3-4 (ECF 52).

[41] Slip Op at 6 (ECF 52).

[42] Gov’t Brief at 12 (ECF 35).

[43] Slip Op at 12 (ECF 52).

[44] Slip Op at 11-13 (ECF 52).

[45] Id. at 14.

[46] Slip Op. at 3 (ECF 70).

[47] Defendant HSBC’s Motion to Certify Order for Interlocutory Appeal, at 3, United States v. HSBC Bank, No. 12-cr-763 (E.D. N.Y. Mar. 9, 2016).

[48] Slip Op. at 3 (ECF 70).

[49] Brief at 2 (ECF 80).

[50] Slip Op at 4-6 (EFC 81).

[51] Slip Op at 5 (EFC 81).

[52] The full list of countries that have signed and ratified the convention can be found on the OECD’s website. See OECD, OECD Convention on Combatting Bribery of Foreign Public Officials in International Business Transactions: Ratification Status as of 21 May 2014, available at http://www.oecd.org/daf/anti-bribery/WGBRatificationStatus.pdf (last visited June 22, 2016).

[53] The Convention established an “open-ended, peer-driven monitoring mechanism” which is carried out by the “OECD Working Group on Bribery.” See OECD, OECD Convention on Combatting Bribery of Foreign Public Officials in International Business Transactions: Implementation & Enforcement, available at http://www.oecd.org/corruption/oecdantibriberyconvention.htm (last visited June 22, 2016).

[54] OECD Anti-Bribery Ministerial Meeting Programme, The OECD Anti-Bribery Convention and its role in the global fight against corruption: Towards A New Era of Enforcement, 8 (Mar. 16, 2016), available at https://www.oecd.org/daf/anti-bribery/Anti-Bribery-Ministerial-2016-agenda.pdf.

[55] Corruption Watch, Letter to Secretary General Angel Gurria, Global Standards for Corporate Settlements in Foreign Bribery Cases (Mar. 10, 2016), available at http://www.cw-uk.org/wp-content/uploads/2016/03/OECD-Ministerial-letter-final.pdf.

[56] Id.

[57] See OECD Anti-Bribery Ministerial Meeting, Ministerial Declaration, 4 (Mar. 16, 2016), available at http://www.oecd.org/corruption/anti-bribery/OECD-Anti-Bribery-Ministerial-Declaration-2016.pdf.

[58] See Stephen Dockery, Wall St. J., The Morning Risk Report: U.S. Anti-Bribery Enforcement Overtakes Globe (Mar. 9, 2016), http://blogs.wsj.com/riskandcompliance/2016/03/09/the-morning-risk-report-u-s-anti-bribery-enforcement-overtakes-globe/; TRACE International, PR Newswire, TRACE International’s 2015 Global Enforcement Report: U.S. Enforcement Actions See Noticeable Increase in 2015 (Mar. 9, 2016), available at http://www.prnewswire.com/news-releases/trace-internationals-2015-global-enforcement-report-us-enforcement-actions-see-noticeable-increase-in-2015-300233095.html.

[59] See Samuel Rubenfeld, Wall St. J., OECD Anti-Bribery Head Slams Laggard Countries (Dec. 16, 2015), http://blogs.wsj.com/riskandcompliance/2015/12/16/oecd-anti-bribery-head-slams-laggard-countries/.

[60] Press Release, Australian Government, Office of the Minister for Justice, Exploring new enforcement options for serious corporate crime (Mar. 17, 2016), https://www.ministerjustice.gov.au/ Mediareleases/Pages/2016/FirstQuarter/Exploring-new-enforcement-options-for-serious-corporate-crime.aspx/.

[61] Australia Attorney-General’s Department, Deferred prosecution agreements – public consultation, https://www.ag.gov.au/consultations/Pages/Deferred-prosecution-agreements-public-consultation.aspx (last visited June 22, 2016)

[62] Id.

[63] Public Consultation Paper, Australia Attorney-General’s Department, Improving enforcement options for serious corporate crime: Consideration of a Deferred Prosecution Agreements scheme in Australia (Mar. 2016), available at https://www.ag.gov.au/Consultations/Documents/Deferred-prosecution-agreements/Deferred-Prosecution-Agreements-Discussion-Paper.pdf.

[64] Id. at 13.

[65] Id. at 13.

[66] Id. at 16.

[67] Id. at 16 (citing Barbaro v The Queen [2014] HCA 2 (in a criminal context); and Commonwealth of Australia v Director, Fair Work Building Industry Inspectorate; CFMEU v Director, Fair Work Building Industry Inspectorate [2015] HCA 46 (in a civil context)).

[68] See Press Release, OECD seriously concerned by lack of foreign bribery convictions, but encouraged by recent efforts by the Australian Federal Police (Oct. 25, 2012), http://www.oecd.org/newsroom/oecdseriouslyconcernedbylackofforeignbriberyconvictionsbutencouragedbyrecenteffortsbytheaustralianfederalpolice.htm; see also OECD Working Group on Bribery, Phase 3 Report on Implementing the OECD Anti-Bribery Convention in Australia (Oct. 12, 2012), http://www.oecd.org/daf/anti-bribery/Australiaphase3reportEN.pdf.

[69] See OECD Working Group on Bribery, Phase 3 Report on Implementing the OECD Anti-Bribery Convention in Australia (Apr. 2015), at 5, 17, available at http://www.oecd.org/daf/anti-bribery/Australiaphase3reportEN.pdf; see also Marianna Papadakis, Financial Review, OECD gives Australia ‘pass mark’ for anti-bribery measures (Apr. 13, 2015), http://www.afr.com/news/oecd-gives-australia-pass-mark-for-antibribery-measures-20150413-1mjyc5.

[70] Public Consultation Paper, Australian Attorney-General’s Department, Improving enforcement options for serious corporate crime: Consideration of a Deferred Prosecution Agreements scheme in Australia, 3 (March 2016), available at https://www.ag.gov.au/Consultations/Documents/Deferred-prosecution-agreements/Deferred-Prosecution-Agreements-Discussion-Paper.pdf.

[71] Parliament of Australia, Parliamentary Business, Foreign Bribery, http://www.aph.gov.au/ Parliamentary_Business/Committees/Senate/Economics/Foreign_Bribery.

[72] See National Assembly, Bill on Transparency, the Fight against Corruption and Modernizing the Economy, Text Adopted No. 755, Article 12 bis (June 14, 2016), available at http://www.assemblee-nationale.fr/14/ta/ta0755.asp .

[73] Id.

[74] Id.

[75] Id.

[76] Id.

[77] Id.

[78] Council of State, Advisory Opinion No. 391.262, Bill on Transparency, the Fight against Corruption and Modernizing the Economy (Mar. 24, 2016), available at http://www.conseil-etat.fr/Decisions-Avis-Publications/Avis/Selection-des-avis-faisant-l-objet-d-une-communication-particuliere/Projet-de-loi-relatif-a-la-transparence-a-la-lutte-contre-la-corruption-et-a-la-modernisation-de-la-vie-economique.

[79] Id.

[80] Id.

[81] National Assembly, Bill No. 3623 on Transparency, the Fight against Corruption and Modernizing the Economy (Mar. 30, 2016), available at http://www.assemblee-nationale.fr/14/projets/pl3623.asp.

[82] See Report Nos. 3785 and 3786 of the Commission of Constitutional Law, Legislation and General Administration on Bill No. 3623, available at, http://www.assemblee-nationale.fr/14/rapports/r3785-tI.asp.

[83] National Assembly, Bill No. 3623 on Transparency, the Fight against Corruption and Modernizing the Economy, Text Adopted No. 755 (June 14, 2016), available at http://www.assemblee-nationale.fr/14/ta/ta0755.asp.

[84] See Senate, Legislative Dossier, Bill No. 691 on Transparency, the Fight against Corruption and Modernizing the Economy, http://www.senat.fr/dossier-legislatif/pjl15-691.html.

[85] See Senate, Legislative Dossier, Bill No. 691 on Transparency, the Fight against Corruption and Modernizing the Economy, http://www.senat.fr/dossier-legislatif/pjl15-691.html; Sénat, Résultat du scrutin no. 419 – séance du 5 juillet 2016, http://www.senat.fr/scrutin-public/2015/scr2015-419.html.

[86] See Senate, Official Summary Record (July 5, 2016), http://www.senat.fr/cra/ s20160705/s20160705_3.html#par_468.

[87] See Senate, Official Summary Record (July 5, 2016), http://www.senat.fr/cra/s20160705/ s20160705_3.html#par_468.

[88] See Senate, Legislative Dossier, Bill No. 691 on Transparency, the Fight against Corruption and Modernizing the Economy, http://www.senat.fr/dossier-legislatif/pjl15-691.html.

[89] OECD Working Group on Bribery, Statement of the OECD Working Group on Bribery on France’s implementation of the Anti-Bribery Convention (Oct. 23, 2014), http://www.oecd.org/newsroom/ statement-of-the-oecd-working-group-on-bribery-on-france-s-implementation-of-the-anti-bribery-convention.htm.

[90] Policing and Crime Bill, 2016, H.L. Bill [55] (Gr. Brit.).

[91] 611 Parl. Deb., H.C. (6th ser.) (2016) 1599.

[92] Policing and Crime Bill Factsheet: Financial Sanctions, available here.

[93] Policing and Crime Bill, 2016, H.L. Bill [55] (Gr. Brit.).

[94] Id.

[95] Id.

This post comes to us from Gibson, Dunn & Crutcher LLP. It is based on their memorandum, which was published on July, 6 2016 and is available here.

Sky Blog

Sky Blog