On May 17, 2016, the Securities and Exchange Commission issued new Compliance and Disclosure Interpretations (“C&DIs”) on the use of non-GAAP financial measures. With a fiscal reporting period having passed since the SEC issued the C&DIs, we surveyed the impact that the C&DIs had on company disclosure practices and related developments. Our survey sample included 100 earnings releases issued by Fortune 500 companies since May 17 that included a presentation of two or more non-GAAP financial measures and guidance on at least one non-GAAP measure (the “Survey”). Unsurprisingly, given the nature of the C&DIs, a significant majority of the Survey companies modified their non-GAAP disclosures when compared with the disclosures in their prior fiscal period’s earnings releases. Further, the SEC has maintained the initiative by recently issuing over 30 comment letters focused on non-GAAP disclosures.

Background

The SEC issued the C&DIs out of concern that companies have been overly aggressive in their use of non-GAAP financial measures, creating the potential for investor confusion. The C&DIs address the SEC’s concerns on a range of issues regarding the use of non-GAAP measures, including:

| · use of misleading non-GAAP financial measures | · presentation of “free cash flow” |

| · the prominence of non-GAAP financial measures | · income tax effects related to adjustments |

| · non-GAAP revenue recognition | · EBITDA reconciliation |

| · use of non-GAAP per share measures | · presentation of “funds from operations” |

Survey Results

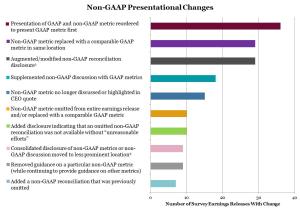

The Survey results demonstrate a high degree of responsiveness by companies in conforming their disclosure to the C&DIs. Of the 100 companies included in the Survey, 79 companies altered the presentation of non-GAAP measures in their earnings releases when compared with the presentation of those same non-GAAP measures in their earnings releases for the fiscal period immediately preceding the issuance of the C&DIs. The most common changes identified by the Survey as seemingly responsive to the C&DIs are categorized below by frequency:

- Including: (i) more detailed reconciliation tables or description of line items; (ii) changed line items in reconciliation; or (iii) revised general disclaimer or revised qualification regarding the use of non-GAAP metrics.

- Combined disclosure into one paragraph together with other non-GAAP metrics or GAAP metrics.

COMMENT LETTERS

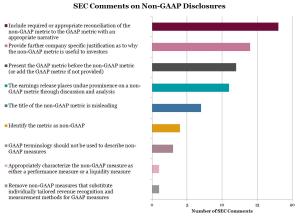

Since the publication of the C&DIs, the SEC has issued over 30 comment letters that contain at least one specific comment on the recipients’ use of non-GAAP financial measures (the “Comment Letters”). In nearly all of the Comment Letters, the SEC directs the recipients to review their non-GAAP disclosures in light of the C&DIs. Further, the SEC’s comments focus on many of the disclosure practices that appear to have been remediated by the Survey companies in response to the C&DIs.

The table below categorizes the most common issues raised in a sample of 32 of the Comment Letters:

FINAL THOUGHTS

While a significant number of companies have altered their disclosure practices in response to the C&DIs, it seems clear that the SEC will continue to focus on the presentation and disclosure of non-GAAP metrics. As such, companies should continue to review their disclosure practices against the C&DIs and specific issues raised in the Comment Letters. In addition, companies should monitor areas on which the SEC chooses to focus in future comment letters targeting perceived deficiencies in non-GAAP related disclosures.

This post comes to us from Debevoise & Plimpton LLP. It is based on the firm’s client update, “Early Returns: Companies Change Non-GAAP Financial Disclosures Following Recently Issued SEC Guidance,” dated September 1, 2016, and available here.

Sky Blog

Sky Blog