In the fall of 2016, UFP, LLC, d/b/a uFundingPortal (UFP), became the subject of FINRA’s first enforcement action against a registered funding portal. During the course of the investigation, UFP shut down its website and withdrew its registration as a funding portal with the Securities and Exchange Commission (SEC). Despite its withdrawal from registration, UFP remained subject to FINRA’s jurisdiction and submitted a Letter of Acceptance, Waiver and Consent (AWC) to settle the alleged rule violations without admitting or denying the findings. FINRA accepted the AWD, finding that UFP violated two Regulation Crowdfunding Rules and three FINRA Funding Portal Rules, and expelled UFP from FINRA membership.

Regulation Crowdfunding Rule 301(a) requires funding portals to have a reasonable basis for believing that companies offering and selling securities on their platform comply with applicable securities laws and rules. However, UFP allowed issuers on its platform even though none of those issuers had filed all the required disclosures with the SEC, which include (i) a description of the business plan, (ii) a description of the ownership and capital structure, (iii) a discussion of the issuer’s financial condition and (iv) material risk factors. Moreover, six of the issuers on the UFP platform did not disclose the names of all directors and officers with the SEC, as required by law. Accordingly, FINRA found UFP had violated Rule 301(a).

Regulation Crowdfunding Rule 301(c)(2) requires a funding portal to deny access to its platform if the funding portal has a reasonable basis to believe that the issuer presents the potential for fraud or raises concerns about investor protection. In addition to the violations of Rule 301(a) discussed above, FINRA also noted that each of the prospective issuers on the UFP platform had impracticable business models and disclosed “oversimplified and overly-optimistic financial forecasts,” and that nearly all of them had no assets or operating history and “coincidentally listed identical amounts for their target funding requests, maximum funding requests, price per share of stock, number of shares to be sold, total number of shares, and…claimed an unrealistic, unwarranted and identical $5 million equity valuation.” Despite all of these “improbable coincidences,” UFP failed to take any steps to deny any of these issuers access to its platform, and FINRA found this inaction to be a violation of Rule 301(c)(2).

Based on the above findings, FINRA also found UFP in violation of FINRA Funding Portal Rule 200(c)(3), which prohibits funding portals from including information on their platforms that contains an untrue statement of a material fact or is otherwise false or misleading, and FINRA Funding Portal Rule 300(a), which requires funding portals to establish and maintain supervisory systems to maintain legal compliance. By virtue of these violations, FINRA also found that UFP violated FINRA Funding Portal Rule 200(a), which requires funding portals to observe high standards of commercial honor and just and equitable principles of trade.

In light of these violations, UFP consented to its expulsion from FINRA membership, effective December 8, 2016.

The result of this enforcement action should serve as a reminder to registered funding portals, issuers, and investors alike of the gatekeeping role played by funding portals in the nascent crowdfunding space. The crowdfunding regulatory regime relies on the ability of funding portal intermediaries to effectively vet issuers and ensure compliance with disclosure requirements to prospective investors.

Analysis of 2016 Offerings

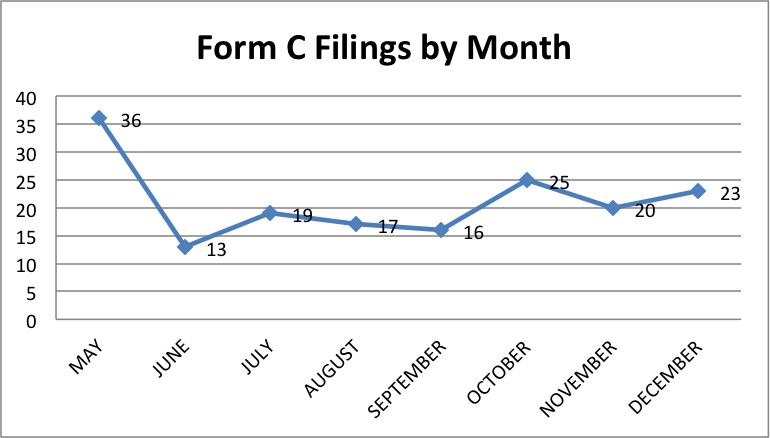

In general. As of December 31, 2016, 169 companies had filed a Form C to offer securities under the Regulation Crowdfunding exemption. As Figure 1 below illustrates, after an early peak in May and slight trough in June, the number of offerings have quickly evened out to an average of 21 per month.

In many instances, the data from the 169 crowdfunding offerings commenced last year is consistent with our analysis of the 50 offerings reviewed in our initial Crowdfunding Report, available here. The median target offering amount was $50,000, as compared with $55,000 for the first 50 offerings. Similarly, nearly all issuers disclosed that they would accept offers in excess of their respective target amounts, including a majority that indicated they would accept investments at or near the $1,000,000 maximum amount. However, the percentage of issuers that elected to cap their offerings at $100,000 or less fell from 36 percent of the first 50 to 23 percent of the year’s 169 offerings. In the aggregate, if all crowdfunded securities offerings filed in 2016 are successful, 169 small companies could raise up to $108.5 million in new capital to fund their businesses.

Offering durations ranged from a mere eight days to 15 months, but the median offering period decreased to 122 days for the full data set from nearly six months in the first 50 offerings.

As of December 31, 2016, 33 jurisdictions of incorporation were represented among the issuers, but Delaware entities accounted for nearly half (81) of all filers, with California (21) and Texas (10) entities a distant second and third, respectively. In comparison to the first 50 issuers, the median issuer age increased by approximately seven months to 546 days old, still well within the startup stage.

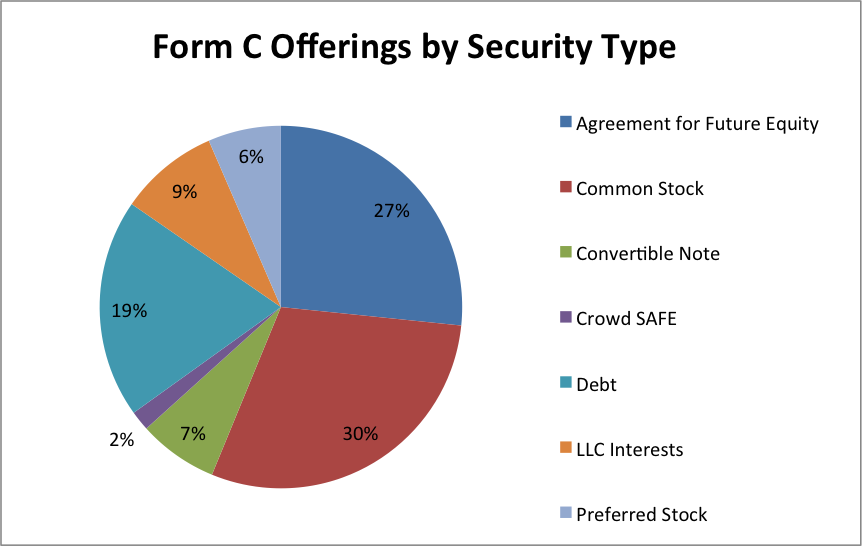

With respect to the type of securities offered, as Figure 2 illustrates, common stock and Simple Agreements for Future Equity (SAFEs) continue to be the most commonly offered securities, accounting for 57 percent of the year’s offerings. Debt securities remained the third most commonly offered securities, but increased their share from 14 percent in the first 50 offerings to 19 percent of all offerings during the year.

Lastly, the number of registered funding portals now stands at 21; however, the Wefunder portal continues to hold a majority of the market share, with 70 of the year’s 169 offerings hosted on its platform. The StartEngine portal maintained the number two spot, hosting 29 offerings in 2016.

Emerging Trends

- Social Enterprises and Alcohol Producers Continue Strong Representation. As we noted in our previous Crowdfunding Report, social enterprises and craft breweries, distilleries and licensed establishments were disproportionately represented among the first 50 issuers. This trend continued through the remainder of 2016. Approximately 16 percent of all issuers are either registered benefit corporations (g., Beta Bionics, Inc., a Massachusetts benefit corporation), certified B Corps (e.g., Hawaiian Ola Brewing Corporation), or operate within traditional corporate forms with strong social and/or environmental missions (e.g., Atmocean, Inc., a Delaware corporation that uses wave energy to power desalination without grid electricity). Similarly, a total of 16 issuers are alcohol producers or sellers, representing nearly 10 percent of all issuers.

- Compliance Rate for Form C-U Filings Remains Low. Regulation Crowdfunding Rule 203(a)(3)(iii) requires all issuers to file a Form C: Progress Update (Form C-U) to disclose the total amount of securities sold in an offering no later than five business days after the offering deadline. As of December 31, 2016, 90 offerings had reached their deadline, but by January 9, 2017, only 39 issuers had filed a Form C-U. Moreover, of those 39 filings, only 14 were filed within the five business day time period, representing a 15 percent compliance rate. In light of the recent FINRA enforcement action, issuers should be vigilant of post-offering deadline reporting requirements, including the Form C-U progress update and the Form C-AR annual report.

- Issuers Conducting Multiple Offerings. Eight issuers have conducted two offerings under the Regulation Crowdfunding exemption, in some cases using different portals and offering a different type of securities from one offering to the next. It is not clear whether this is “comparison shopping” by issuers to determine the utility of certain funding portals versus other, or whether some early adopters have elected to withdraw prior offerings and “rebooted” with a new offering. However, there is nothing in the JOBS Act or the Regulation Crowdfunding Rules that would prohibit an issuer from conducting multiple crowdfunding offerings in the same 12-month period, so long as the issuer does not accept, in the aggregate, more than the $1,000,000 limit.

- Crowdfunding Legislation. The Fix Crowdfunding Act (R.4855), was introduced in the House on March 23, 2016, before the Regulation Crowdfunding Rules took effect, but was not passed by the House (by a vote of 394 to 4) until July 5, 2016. The Senate’s version of the bill, the Crowdfunding Enhancement Act (S.3453), was introduced on September 28, 2016, and was nearly identical to the House bill. The bill would have amended the Securities Act to remove the current prohibition on crowdfunding by special purpose vehicles. The bill was still in committee when the last Congress adjourned. We expect that one or more similar measures will be introduced in the new session.

This post comes to us from Drinker Biddle & Reath LLP. It is based on the firm’s publication, “Crowdfunding Report—FINRA’s First Enforcement Action and Updated Data Analysis,” dated January 30, 2017, and available here. The report’s dataset on crowdfunding offerings is available here.

Sky Blog

Sky Blog