In the 100 days since his election, President Trump and members of his cabinet have continued public calls for a rollback of Dodd-Frank and related regulations enacted since the financial crisis, while offering few concrete actions or proposals. Initially, Wall Street (and specifically bank stocks) rallied heavily in anticipation of business-friendly deregulation and tax reform, but bank executives have since tempered their expectations and, at least among the big banks, quieted calls for broad reform.

As we anticipated last November, the Trump Administration largely departed from the anti-bank populism espoused during the campaign and quickly moved on to more traditional Republican goals to (a) spur economic growth by improving the ability of banks to lend more freely and (b) reduce the “excess” regulatory burden on financial institutions and the financial system.[1] However, it remains to be seen how and when this talk will translate into real action. The Administration has been primarily issuing Executive Orders (EOs) and Presidential Memoranda (Memos) which have been more geared toward grabbing headlines than enacting any immediate regulatory change. They have had a particularly limited effect on financial services because EOs and Memos only target executive agencies (e.g., Treasury and Department of Labor) whereas most of the agencies regulating banks are independent of the executive branch.[2] Ultimately, changes to financial regulation will either have to be accomplished by changing the regulators (and therefore the interpretation and enforcement of rules) or changing the rules themselves through legislation.

Even before the battle over repealing and replacing the Affordable Care Act (ACA) revealed the depth of the divisions in the Republican Party, we pointed out that the threat of a Democratic filibuster would make legislative changes to Dodd-Frank difficult to accomplish before 2018 at the earliest (when Republicans have a chance of gaining more Senate seats).[3] Therefore, we continue to believe that changing the referees (i.e., regulators) rather than the rules is the Trump Administration’s best chance for speedy and impactful reforms. One major opportunity for change was recently created by the departure of Federal Reserve (Fed) Governor Daniel Tarullo, formerly the de facto leader of supervision. Although his replacement has not yet been determined, former Governor Tarullo’s exit has already led bank executives to breathe a sigh of relief and express a triumphant cheer.[4]

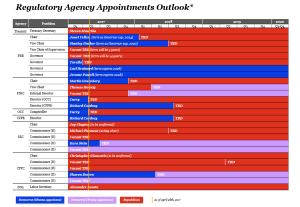

President Trump will have the opportunity to replace the majority of President Obama’s senior financial regulators by the end of this year (See Appendix 1). This transformation at the top of regulatory agencies will enable changes to various pain points – perceived stringent demands of regulators, very narrow or non-transparent interpretations of complex provisions, and punitive enforcement actions. In choosing relatively moderate nominees with industry experience for financial services agency positions thus far, the Trump Administration is sending a signal that there will be changes to financial regulations, but the core framework of Dodd-Frank is here to stay (for now).

With that said, and with the caveat that “unpredictable” continues to be the norm, we have updated our top ten predictions for financial regulation based on the Trump Administration’s first 100 days:

1. Executive Orders will yield few results. Since taking office, the difficult reality of rolling back financial services regulation through legislation has set in and, as a result, the President has turned to EOs and Memos to create the illusion of change (see Appendix 2 for a list of relevant issuances). In doing so, the President has issued more EOs in his first 100 days than any President since Franklin D. Roosevelt. However, the orders lack significance in large part because they are only applicable to executive agencies. In addition to not affecting most of the financial services agencies, the EOs and Memos have limited immediate effects on the industry because most of them require between three and six months of review, and any resulting decisions or actions will take several additional months (at least) to complete.

The most important EO with respect to Dodd-Frank rollback directs Treasury Secretary Steven Mnuchin to conduct a review of all existing financial regulations with the heads of the Financial Stability Oversight Council (FSOC) member agencies,[5] and to issue a report by early June on the extent to which the regulations promote or inhibit seven “core principles.”[6] Although this report will be a clear starting point for possible changes to financial regulations, Treasury cannot by itself repeal any of the regulations issued by other regulators and will need legislation to repeal the statutorily mandated provisions of the Dodd-Frank Act.

2. Dodd-Frank will not be repealed. Republican Congressmen have been vocally opposed to Dodd-Frank since its inception, but their current majorities in both chambers will still not allow the major changes they and the President have promised. We expect Republicans to first try to make changes to several Dodd-Frank targets (e.g., the Orderly Liquidation Authority (OLA) and CFPB funding) via the budget reconciliation process (for tax reform and the debt limit) because this only requires a simple majority.[7] Bigger Dodd-Frank repeal efforts will have to wait until Senate Republicans have the opportunity to pick up more seats in the 2018 elections (when Democrats will have to defend 25 of the 33 seats being contested). In addition, other Republican priorities – such as tax reform and healthcare – have significantly pushed back the legislative timeline, and just as Republicans are divided on the path forward for these priorities, they are also not unified on changes to financial regulation (OLA in particular). Despite these obstacles, Representative Jeb Hensarling (R-TX), the House Financial Services Committee Chairman, recently released an updated version of his Dodd-Frank replacement bill – CHOICE Act 2.0. While the bill has little chance of becoming law, it does give us insight into what items Republicans may prioritize for bipartisan consensus or passage through reconciliation.

3. Lack of consensus will slow change. As models for regulatory reform trickle in (including those from former Governor Tarullo, Governor Powell, Rep. Hensarling, and FDIC Vice Chair Hoenig) there is only one clear area of consensus – relief for community banks. The largest banks have continued to moderate the need for significant changes to Dodd-Frank in large part due to their recognition that Dodd-Frank has been successful in reducing systemic risk, which was its primary aim. More interestingly though, the competitiveness of the largest US banks both at home and around the world has never been stronger. The post-crisis regulations, or more accurately the ability of the largest banks to comply with the requirements, have provided them with capital and capabilities that give them a significant competitive advantage over their global peers and smaller US banks. Somewhat ironically, Rep. Hensarling has started to emphasize large banks’ support for Dodd-Frank in selling his updated CHOICE Act. In doing so, he is able to avoid being seen as on the side of politically unpopular large banks while still advocating for dramatic cuts to financial regulations.

As mentioned above, although many acknowledge that Dodd-Frank has been successful in reducing systemic risk in the financial system, most agree that Congress and regulators cast a very wide net in deciding which firms were systemically important. We believe there is sufficient consensus among all at this point to raise the systemically important financial institution (SIFI) threshold from $50 billion to at least $100 billion.

4. Appointments process will delay the impact of new regulators. As we stated in November, the Trump Administration essentially hit the lottery with respect to appointments because of existing vacancies and several key Obama-appointee terms that happen to expire during the new Administration’s first 18 months. However, finding qualified, interested nominees who pass pre-election loyalty scrutiny slows a process that is already laborious under the best of partisan terms. As a result, the Administration’s effort to fill a multitude of financial services agency vacancies continues to move slowly and several key positions, including the Fed Vice Chair of Supervision, remain empty. President Trump has also not indicated a successor to Comptroller of the Currency Thomas Curry, who has remained in his role although his term expired earlier this month. In addition to leadership roles, few agencies have nominees on deck for other senior staff positions, many of which also require Senate confirmation. While some positions that do not need Senate confirmation have started to be filled (e.g., Treasury chief of staff, CFTC general counsel), the large number of vacancies means many key agency functions are on hold. We expect existing agency staff to hold a steady course with a nod towards White House initiatives, but major regulatory reform changes must await leadership in formal roles.

5. Tarullo is gone but may not be forgotten. Former Fed Governor Tarullo left his term early in anticipation of President Trump’s appointment of a new Governor to fill the vacant Vice Chair of Supervision seat. Before his last day, he delivered a farewell address to assert his views on completing and protecting what he considers to be the most important regulatory reforms.[8] Former Governor Tarullo provided a recap of significant Fed supervision innovations during his eight-year tenure and strongly defended reforms such as the annual Comprehensive Capital Analysis and Review (CCAR) stress tests. He was uncompromising in his view that banks’ capital levels need to stay high (or go higher) and reiterated the case that he outlined last fall for introducing the “stress capital buffer” into the Fed’s regulatory capital regime as well as including the Global Systemically Important Banks (G-SIB) surcharge in the post-stress capital minimums.[9] In deal-making fashion, he presented several options for reducing regulatory compliance burdens including an overhaul of the Volcker Rule and removal of the CCAR qualitative objection.[10] Former Governor Tarullo’s viewpoints could remain influential throughout the months it could take to fill current vacancies. We don’t expect significant policy changes in the near term, but in the long run new policy makers may accept only his reforms that scale back regulation.

The policy maker that will take the reins from Governor Tarullo in overseeing the Fed’s supervision and regulation of financial institutions is speculated to be Randal Quarles. Quarles is seen as a moderate pick for Fed Vice Chair of Supervision, and in the past has suggested a measured approach to changing the rules for big banks. However, he has voiced opposition to higher capital standards and therefore may not take former Governor Tarullo’s suggestion to heighten requirements for CCAR. Apart from this crucial appointment, the President will have further opportunity to reshape the Fed as he fills two other current vacancies and replaces Chair Janet Yellen and Vice Chair Stanley Fischer in 2018 if they resign, as is customary, when their chairmanships expire.

6. SEC and CFTC will lag behind banking agencies due to vacancies and funding. Both the SEC and CFTC are down to just one Republican and one Democratic Commissioner after carrying vacancies for much of last year and having their former Chairmen step down in January. Apart from having stretched responsibilities, the current vacancies pose a significant impediment to making major decisions because either of the two Commissioners could skip a vote to deny the Commission a quorum. The SEC is close to having a new Chairman, as Jay Clayton is expected to have his Senate confirmation vote on May 1st, but a third Commissioner will not necessarily allow the SEC to move forward on certain issues.[11] According to SEC ethics rules, Clayton may have to recuse himself for two years from matters that “directly and substantially” affect his former legal clients, which would leave a two-vote split Commission to handle such matters until the other SEC Commissioner vacancies are filled.[12] With respect to the CFTC, President Trump has nominated Acting Chair Christopher Giancarlo to stay on in the role, but he has not yet had a Senate confirmation hearing scheduled. This has not stopped him from espousing his priorities as Chair such as refocusing the agency on digital technologies and fixing swap data reporting, but it remains to be seen how many of these changes can be accomplished.[13] In addition to the difficulties posed by understaffed Commissions, the SEC and CFTC could see their progress slowed by changes to their funding. Both agencies are subject to Congressional appropriations, and we expect Congress to provide them with less funding than in the past, leading to slower rulemakings, exams, and enforcement.[14]

7. The Administration will wait out Cordray. The CFPB has been a constant target for Republican criticism since its inception, but the Administration has not yet indicated a clear direction with respect to CFPB Director Richard Cordray. Although many Republicans want Director Cordray to be fired and replaced before the end of his term in July 2018 (as evidenced in his treatment by House Financial Services Committee Republicans during his most recent semi-annual hearing), President Trump may choose to wait for him to resign voluntarily due to speculation that he will leave early to run for governor of Ohio in 2018. Additionally, the President is likely considering the legal ramifications of firing Cordray. Last year, a federal court ruled the CFPB’s structure unconstitutional because its single director can only be removed “for cause” from his five-year term, but that ruling was vacated when the full court agreed to hear the case on appeal.[15] If the President decides to fire Cordray for cause, the decision would likely be challenged in court. While this political battle continues to play out behind the scenes, Cordray has publicly stated that the CFPB intends to continue enforcing existing rules. We think President Trump has begun to realize that firing Cordray will cause more trouble than it’s worth.

8. The DOL’s fiduciary rule will live on…in spirit. For all the reasons we raised above, potential changes to Dodd-Frank are limited, so killing the fiduciary rule (a regulation issued by an executive agency, over which President Trump has significant control) would be a relatively easy “win” for the Administration. President Trump likely perceives the politics to weigh in favor of repealing the rule given that many industry leaders oppose it and even some regulators have called for the DOL to put the rule on hold until the SEC can establish a similar rule to cover investment advice beyond retirement accounts.[16]

The DOL announced a 60 day delay this month to the rule’s April 10th compliance date.[17] We believe this delay portends an uncertain future for the rule; however, we still expect the “best interest standard” – the rule’s core principle – to largely survive with or without the rule.[18] The industry has already made significant progress toward complying with the rule, and there is a general recognition of the importance of removing perceived conflicts of interest between financial advisers and retirement investors. In fact, several large wealth managers have already been nudging clients and advisors to switch from commission-based to fee-based accounts.

9. FSOC will become a catalyst for deregulation. It’s becoming increasingly apparent that the FSOC will use its statutory requirement as a means for coordinating its member agencies to streamline existing regulations. Treasury Secretary Mnuchin (who is also the FSOC Chair) has already stated that one area to be targeted for streamlining is the Volcker Rule’s limits on proprietary trading.[19] Many believe the rule to be overly intrusive on banks’ businesses and others have questioned its adverse impact on market liquidity as well as its wide net that accidentally captures certain asset managers.[20]

In addition, we expect the FSOC’s process for designating nonbanks as systemically important to yield very different results going forward.[21] The President has already directed Secretary Mnuchin to put a 180 day hold on new designations in order to review FSOC’s designation process (see Appendix 2), and we do not expect any new designations from this Administration even after the review is complete. We do, however, expect to see de-designations for the remaining two systemically important nonbanks – the FSOC needs a two-thirds majority (or seven votes) in order to de-designate nonbanks, a threshold that could be passed by the beginning of 2018.

10. Midterms will put the brakes on further action. Going forward, the 2018 midterm electoral roadmap is heavily tilted in Republicans’ favor. This could result in a Republican supermajority in the Senate and lead to bolder Dodd-Frank repeal efforts (assuming that Republicans maintain control of the House of Representatives). However, in the short-run, rolling back Dodd-Frank will become increasingly difficult as re-election efforts become the focus of sitting Congressmen and financial services regulatory reform efforts get pushed to the back burner. Midterm elections may seem far off now, but Congressional campaigns effectively begin in November of this year. As that timeline approaches, some moderate Republicans up for re-election will begin to pull further away from backing Dodd-Frank changes in order to distance themselves from being on the side of big banks.[22]

Appendix 1 – Regulatory Agency Appointments Outlook*

We continue to believe that the greatest change will come from regulator appointments.

*This is a projection of possible results; actual results may differ.

*This is a projection of possible results; actual results may differ.

| Key assumptions |

| All agency leads filled with Republicans; all open seats filled upon expiry of prior term; current occupants depart when term expires; Fed Chair and Vice Chair resign at end of chairmanships. |

Appendix 2 – Financial Services EOs and Memos

| 1. Regulatory freeze Memo (1/20/17)

Agencies must freeze any proposed or pending regulations until Trump-appointed agency leaders can review them. |

| 2. Regulatory reduction EO (1/30/17)

Agencies must eliminate two existing regulations for every new one, and the total cost of new regulations must be no greater than zero in FY 2017. |

| 3. Principles for regulating the US financial system EO (2/3/17)

By May 2017, Treasury must consult heads of the FSOC member agencies and issue a report that determines whether financial services requirements “Inhibit” or “Promote” the seven Core Principles for US financial a. Empower independent financial decisions b. Prevent taxpayer-funded bailouts c. Foster economic growth through rigorous impact analysis d. Enable American companies to compete with foreign firms e. Advance American interests in international meetings f. Efficient, effective, tailored regulation g. Publicly accountable and rationalized regulation |

| 4. Fiduciary duty rule review Memo (2/3/17)

The DOL must review the Fiduciary Duty Rule to determine whether it has an adverse impact on the industry or investors, and modify it accordingly. The DOL has since proposed a rule to delay the rule’s first compliance date from April 10th to June 9th. |

| 5. Regulatory reform enforcement EO (2/24/17)

Each agency must appoint a Regulatory Reform Officer (RRO) and establish an agency-specific Regulatory Reform Task Force. The RRO and Task Force must review existing regulations and recommend repeal, replacement, or modification. |

| 6. FSOC Memo (4/21/17)

The Secretary of the Treasury must review the process that FSOC uses to designate nonbank SIFIs and consider several factors including transparency, due process, and cost. The review must be completed within 180 days, during which time there is a moratorium on the Secretary voting for new nonbank SIFI designations. |

| 7. Orderly Liquidation Authority Memo (4/21/17)

The Secretary of the Treasury must review the Orderly Liquidation Authority (OLA) with a focus on adverse impact, cost, and incentives for risk taking. The review must be completed within 180 days, during which time there is a moratorium on the Secretary using OLA. |

ENDNOTES

- See PwC’s First take, Donald Trump’s victory: Ten key points (November 2016).

- The independent agencies are the Federal Reserve (Fed), Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and Consumer Financial Protection Bureau (CFPB).

- Democrats will have to defend 25 of the 33 seats being contested, including five that Trump carried by double digits and five that he won by narrower margins.

- See PwC’s First take, Ten key points from Governor Tarullo’s farewell speech (April 2017).

- The FSOC member agencies are the Fed, CFTC, FDIC, OCC, SEC, CFPB, Federal Housing Finance Agency, and National Credit Union Administration.

- The core principles are: (1) empower Americans to make independent financial decisions and informed choices in the marketplace, save for retirement, and build individual wealth; (2) prevent taxpayer-funded bailouts; (3) foster economic growth and vibrant financial markets through more rigorous regulatory impact analysis that addresses systemic risk and market failures, such as moral hazard and information asymmetry; (4) enable American companies to be competitive with foreign firms in domestic and foreign markets; (5) advance American interests in international financial regulatory negotiations and meetings; (6) make regulation efficient, effective, and appropriately tailored; and (7) restore public accountability within Federal financial regulatory agencies and rationalize the Federal financial regulatory framework.

- Budget reconciliation is a legislative process that can be approved by the Senate through a simple majority after less than 20 hours of debate. However, not all Dodd-Frank targets can make it into a reconciliation bill – provisions must be “germane” to government spending, revenues, or the debt limit.

- See note 4.

- See PwC’s First take, Governor Tarullo’s speech on stress testing and the Fed’s NPR (October 2016).

- Shortly before releasing its February CCAR instructions, the Fed finalized its proposed updates to the capital plan rule, removing the risk of plan objections on qualitative grounds for large and noncomplex firms. The Fed defined large and noncomplex firms as those with (a) balance sheets with smaller than $250 billion, (b) nonbank assets less than $75 billion, and (c) not US G-SIBs.

- The other two Commissioners on the SEC are Republican Michael Piwowar and Democrat Kara Stein.

- Clayton is a former partner of one of the leading law firms for large banks and investment firms. Several of his clients have been investigated by the SEC for possible securities law violations.

- See PwC’s First take, CFTC’s amendment to swap data reporting (July 2016).

- The Fed, OCC, FDIC, and CFPB are outside of Congress’s appropriations process, so they will be largely immune from funding cuts.

- Oral arguments for the case are scheduled to be heard on May 24th.

- The SEC has been slow to even draft such a rule, despite the stated support of both former Chair Mary Jo White and Acting Chair Michael Piwowar, and we do not expect meaningful progress from the SEC this year.

- On April 4th, the Department of Labor (DOL) published a final rule to delay the fiduciary rule’s start date by 60 days from April 10th until June 9th and delaying implementation of certain associated compliance procedures and disclosures is until January 2018. The delay followed a February Memo from the President ordering a review of the fiduciary rule which must (a) determine whether the rule “may adversely affect the ability of Americans to gain access to retirement information and financial advice,” and (b) update its economic and legal analysis when considering specific impacts of the rule. After finishing the review, the DOL has the option to allow the rule to proceed as is, further delay the compliance date, propose a withdrawal of the rule, or propose amendments to the rule.

- See PwC’s Regulatory brief, DOL fiduciary rule: Beyond the headlines (February 2017).

- See PwC’s Regulatory brief, Volcker Shrugged (December 2013).

- Other Volcker reform sentiments have recently come from former Fed Governor Tarullo, Fed Governor Jerome Powell, and Federal Reserve Bank of New York President William Dudley.

- Of the four nonbanks originally designated as systemically important by the FSOC, only AIG and Prudential remain because Metlife’s designation was rescinded by a district court earlier this year and GE Capital was de-designated after it spun off

several operations. - These senators include Dean Heller (R-NV) and Jeff Flake (R-AZ).

This post comes to us from PwC. It is based on the firm’s memorandum, “First take — Ten key points from Trump’s first 100 days,” dated April 28, 2017, and available here.

Additional information

For additional information about PwC’s Financial Services Regulatory Practice and how we can help you, please contact:

| Dan Ryan

Financial Services Advisory Leader 646 471 8488

|

Mike Alix

Financial Services Advisory Risk Leader 646 471 3724 michael.alix@pwc.com

|

| Adam Gilbert

Financial Services Advisory Regulatory Leader 646 471 5806 adam.gilbert@pwc.com |

Roberto Rodriguez

Financial Services Advisory Manager 646 471 2604 roberto.j.rodriguez@pwc.com |

Sky Blog

Sky Blog