The corporate governance literature has shown a strong link between good governance practices and firm value. The mechanisms, however, that determine the choice of effective corporate governance and board arrangements in a changing global market are not well studied. In our new working paper “Governance Transfer Through Directors’ Foreign Board Experiences,” we examine one such potential mechanism—whether firms learn about corporate governance and board practices from their directors’ foreign board experiences.

Directors with international board experiences have access to a much larger and more diverse set of governance practices than directors who only sit on domestic firms’ boards. For example, U.S.-based directors can gain experiences in Germany with larger boards that include worker representatives. We document that director experiences transfer across countries. The findings of our research are consistent with a global market for governance that is facilitated by cross-border director appointments. Our results also support the notion that governance initiatives and regulations in one market (e.g., the Sarbanes-Oxley Act and the Dodd-Frank reform in the U.S.) will affect firms in other markets through director connections—a potentially important result for policy makers.

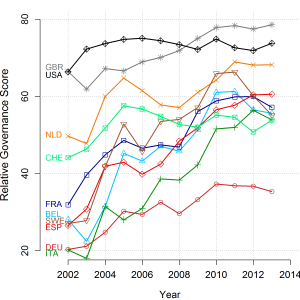

Figure 1 shows that corporate governance has been converging over time and across nations. In our paper, we study whether governance knowledge travels through overlapping corporate boards. Consistent with this notion, Aggarwal, Erel, Ferreira, and Matos (2009) find that institutional investors promote the governance practices of their home countries when investing abroad.

Figure 1: Corporate Governance across Time and Countries

On the other side, it may also be possible that directors’ governance experiences do not travel well across countries. Governance practices that work in one economic and legal environment might not be optimal in a different setting. For example, Doige, Karolyi, and Stulz (2007) find that country characteristics are a bigger factor than firm attributes in explaining the variation in observed firm-level governance arrangements. International governance research has also shown that weak legal environments and entrenched boards plague governance internationally (La Porta, Lopez-de-Silanes, Shleifer, and Vishny, 1998). Hence, while international board appointments are common in the modern corporate world, they may not promote the transfer of governance across countries.

In our study, we find strong firm-level evidence that directors’ foreign governance experiences (measured in the previous year) are positively related to firms’ current governance arrangements.[1] Our results are similar when we study overall firm governance scores as well as sub-scores focusing on board functions, board structure, and compensation policy. In separate tests, we also find that the board knowledge transfer extends to important board characteristics such as board size, board independence, separation of the CEO and chairman, and the number of female directors. The economic magnitude of the implied knowledge transfer is sizeable. For example, if the size of the foreign boards on which the directors served increased by four directors, the board size of the domestic firm would increase by 3 percent in the following year. This is equivalent to an annual change of one director in one out of four firms.

The knowledge transfer increases with the number of directors with foreign board exposure. When at least 25 percent of directors have foreign board experiences, the transfer of foreign governance and board practices is as strong as the one from directors with domestic board experiences only. This suggests that the propagation through directors’ foreign experiences is as important as learning from domestic experiences.[2] Finally, we provide evidence that the governance transfer predominantly occurs in non-U.S. and non-U.K. firms, suggesting that governance flows from well-developed governance markets to less-developed markets through internationally connected boards.

REFERENCES

Aggarwal, Reena, Isil Erel, Miguel Ferreira, and Pedro Matos, 2011, Does Governance Travel Around the World? Evidence from Institutional Investors, Journal of Financial Economics 100 (1), 154-181.

Bouwman, Christa, 2011, Corporate Governance Propagation through Overlapping Directors, Review of Financial Studies 24 (7), 2358-2394.

Doidge, Craig, Andrew Karolyi, and Rene Stulz, 2007, Why Do Countries Matter so Much for Corporate Governance? Journal of Financial Economics (86), 1-39.

La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny, 1998, Law and Finance, Journal of Political Economy (106), 1113-1155.

ENDNOTES

[1] We use board-level data from BoardEx and firm-level governance data from Thomson Reuters. In our tests, we control for observable firm characteristics, institutional ownership, board attributes, and country, year, and, industry fixed effects. We perform numerous robustness tests, including exploiting an exogenous shock, placebo assignments of directors, and firm fixed effects regressions.

[2] Bouwman (2011) shows that governance practices propagate across firms through overlapping boards for a sample of US firms—that is, directors with outside board appointments in the U.S. transfer their knowledge to their “own” firm. We study if this transfer happens between boards in different countries.

This post comes to us from Professor Peter Iliev at Pennsylvania State University’s Smeal College of Business and Professor Lukas Roth at the University of Alberta’s Alberta School of Business. It is based on their recent article, “Governance Transfer Through Directors’ Foreign Board Experiences,” available here.

Sky Blog

Sky Blog