The U.S. banking industry has exhibited increasing vulnerability to economic cycles since the easing of post-depression era measures designed to insulate banking from economic instability. Between 1934 and 2017 there were 2,758 commercial and savings bank failures.[1] Nearly 80 percent of all post-depression bank failures occurred after the deregulatory period started in 1980. The histories of the 1980s, early 1990s, and 2007 – 2009 U.S. banking crises are similar. The crises followed similar patterns in which a period of economic growth included increased risk-taking by banks, manifested through asset-based lending to volatile markets, energy and real estate in particular. When loan-collateral markets softened and the economy weakened, loan delinquencies increased and loan loss rates rose, leading to bank insolvency.

The post-1980s frequency of the bank-failure cycle suggests that there are other root causes of banking crises than business cycles. A growing portion of the academic literature suggests banks are not all innocent victims of business cycles; rather, some failed banks engaged in what Akerlof and Romer (1993) describe as a “bankruptcy for profit” strategy. Akerlof and Romer (1993) develop a theoretical model to explain the 1980s and 1990s U.S. Savings and Loan (S&L) crisis and show that owner-managers of poorly capitalized S&Ls could extract greater personal wealth from the thrift though fraudulent activity than through profit maximization. The literature on fraud in the banking and thrift industries also finds that internal fraud is cyclical, increasing during economic boom periods and detected during subsequent economic recessions.

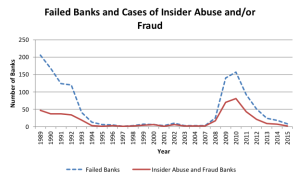

No study we are aware of has attempted to quantify the level of insider abuse and internal fraud during the 1980s, 1990s, and 2007 – 2009 U.S. banking crises. Based on supervisory data on the incidence of insider abuse and fraud at FDIC-insured banks, we find that insider abuse and internal fraud, often by senior bank officers, were present among 37 percent of the 1,237 U.S. commercial and mutual savings banks that failed between 1989 and 2015. Importantly, we also find that insider abuse and internal fraud exhibit cyclicality during the 2007 – 2009 financial crisis, with the number of failures involving fraud increasing during the peak of banking crisis and decreasing thereafter (figure 1).

Figure 1.

These results suggest that bank regulators should consider the possibility that banking crises are not entirely accidental but rather are, at least partially, driven by purposeful behavior.

Understanding the scope of insider abuse and internal fraud is a first step in addressing this source of economic instability. Next, bank regulators need to understand the drivers of internal bank fraud in order to detect and prevent it.

Our research is concerned primarily with fraud detection rather than prevention. We analyze the characteristics of failed banks where insider abuse and internal fraud were present with the goal of developing fraud detection models. We obtained information on the incidence of insider abuse and internal fraud among failed banks from failing bank cases prepared for the FDIC Board of Directors, restitution orders (fines) supervisors assessed for bank employee fraud, and bond claims the FDIC made to recover fraud-related losses on failed banks.

We next develop a framework that provides a rationale for the fraud indicators used in our models. Specifically, we model the typical fraudulent bank as characterized in the literature on financial fraud. An important characteristic of fraudulent banks is concentration of bank ownership, often in a single individual who is dominant in decision-making within the organization. The dominant bank officer is in a position of trust and has access to bank systems and internal controls that allow the individual to use the bank to carry out the fraud and to mask the fraud through misstatements of accounting records and, ultimately, misstatement of bank financial statements. The schemes used to carry out the fraud typically involve activities where the bank can report “paper” profits when actual cash flows do not exist. A common area for fraud has been loans for the acquisition, development, and construction of real estate, where the development project might take three to five years before completion. Given the delay in project completion, the bank is able to mask the lack of profitability of the project through 100 percent financing, balloon payment loans, and interest reserves that make the loan appear to be profitable despite the lack of any supporting cash flow or real market value for the developed property. The result of these types of schemes is that fraudulent banks will be able to report higher earnings than actually exist, over-value assets, under-report losses, and over-state equity capitalization. These types of frauds often require rapid bank loan growth to support the Ponzi scheme needed to generate necessary cash flow. This framework informed our selection of fraud indicators. We tested this framework using regression analysis of the determinants of fraudulent behavior among failed banks between 1989 and 2015 and find evidence that banks with insider abuse and fraud present did report higher income and asset values, lower losses, and higher net worth than did non-fraudulent failed banks.

The most common approaches used by fraud detection models require one to have data on where fraud has been observed so that fraud indicators can be labeled as either coming from fraudulent individuals or firms or not—i.e., supervised fraud models. In supervised fraud modeling one can use various statistical and mathematical techniques to find patterns in the data on fraud indicators, which can subsequently be used to develop rule sets that estimate fraud suspicion scores that indicate the probability the bank has insider fraud present.

We use logistic regression and artificial neural networks to model fraud risk. Logistic regression is a technique for modeling situations that can be characterized by binary variables. In our case we are simply marking all observations on banks’ fraud indicators as coming from either a known fraudulent bank (1) or a non-fraud bank (0). Logistic regression is based on statistical theory and assumes the fraud indicators are distributed independently of one another and are uncorrelated with one another. These assumptions allow us to find the appropriate weights for fraud indicators that maximize the likelihood of correctly identifying fraudulent banks in the “training” dataset. The model (weights) can then be applied to new data on fraud indicators to predict the likelihood of fraud, where fraud has not yet been revealed. Neural networks are not based on statistical theory. Rather, neural networks break up the problem of fraud detection, or its equivalent of classifying banks using fraud indicators, into several steps that can be processed in parallel or sequentially. This allows neural networks to develop multiple rules to classify data as coming from fraudulent banks or not, as compared with the single rule logistic regressions find. Neural networks, as the name suggests, are designed to process data in the same manner as do our brains.

A second category of fraud prediction models does not require knowing where fraud has occurred a priori for model development but rather uses previously established, expected patterns in data that can be used to detect truthful or naturally occurring numbers from non-naturally occurring numbers, as occurs when banks purposefully misstate financial records—i.e., unsupervised models. Specifically, we use a recently developed second-order Benford digit test to identify those banks whose financial statements suggest purposeful misstatement. The unsupervised methods we use to detect financial misstatements are used by accountants to detect fraud and are explained in greater detail in our paper.

Our results suggest that material insider abuse or fraud at banks is detectable using Benford digit analysis of bank financial data for a period one to four years prior to failure. Unfortunately, we are unable to develop an accurate neural network model for fraud prediction. Finally, regression analysis of the determinants of failure among banks with insider abuse or fraud compared with other types of failed banks are in general agreement with the literature on fraud in banking, which finds banks with insider abuse and fraud present will overstate income and asset values, under-report losses, and consequently overstate capitalization.

Early detection of bank fraud could reduce fraud-losses to banks and in some cases might prevent fraud-related insolvencies. Whether insider abuse and internal fraud detection programs can help prevent bank fraud likely depends on the depth and scope of the programs and degree to which bankers are aware of such programs.

ENDNOTE

[1] Source: FDIC Historical Statistics on Banking, available at https://www5.fdic.gov/hsob/selectrpt.asp?entrytyp=30&header=1&tab=bankfailures

This post comes to us from John P. O’Keefe and Chiwon A. Yom, senior economists at the Federal Deposit Insurance Corporation. It is based on their recent paper, “Offsite Detection of Insider Abuse and Bank Fraud among U.S. Failed Banks 1989 – 2015,” available here. The analysis, conclusions, and opinions set forth in the post are those of the authors alone and do not necessarily reflect the views of the FDIC.

Sky Blog

Sky Blog