On July 11, 2018, the US Department of the Treasury (Treasury) and the Internal Revenue Service (the IRS) issued final regulations (the Regulations) continuing efforts aimed at curbing cross-border corporate expatriation transactions — commonly referred to as inversions — and diminishing the tax advantages associated with inversions.

The Regulations generally follow the guidance provided in notices and temporary and proposed regulations promulgated during the 2014-2016 period (the Prior Guidance), with certain clarifications and modifications. Differences between the Regulations and the relevant Prior Guidance are generally technical, and the Regulations do not change fundamental policy decisions reflected in such guidance.[1]

This Client Alert outlines notable changes and considerations raised by the Regulations given the Tax Cuts and Jobs Act (the 2017 Act).[2] Considering these latest updates in the context of how inversion issues can impact the M&A market is important, including in light of how the significant 2017 Act fits into the key decisions surrounding cross-border M&A, selecting a holding company jurisdiction, and designing a global platform for a multinational corporation. The central concepts are:

- The Prior Guidance had a fundamental impact on the M&A market by limiting both:

- The ability to qualify a transaction under the anti-inversion rules (that is, the rules increased the possibility that a foreign holding company would be treated as domestic)

- Post-inversion planning, such as certain cash repatriation and group restructuring techniques

- The rules included in the Prior Guidance remain in full force, with the Regulations issued last week simply clarifying certain provisions (the high points of which are discussed below). Thus, all of the restrictions imposed under the Prior Guidance remain applicable to current transactions, with no indication of regulatory or legislative relief on the horizon. As enacted, those provisions can impact deals that, five years ago, would have been far outside the scope of the anti-inversion rules, thus resulting in a surprise inversion issue for senior management or investment bankers analyzing a potential transaction.

- The 2017 Act was, fundamentally, never intended or designed to make an inversion or corporate expatriation easier. Rather, the 2017 Act aimed to reduce the appeal of such a transaction — and of a foreign holding company structure — by enacting a more competitive US corporate tax regime with a lower corporate tax rate and a partial participation exemption for foreign earnings.

- Finally, the 2017 Act actually made the inversion trap harsher in that engaging in a transaction in which the inversion fraction (discussed below) is 60% or more can now result in:

- A recapture of the 2017 Act transition tax on foreign earnings at a full 35% rate without foreign tax credits (as opposed to a 15.5% rate with such credits)

- An increased base erosion and anti-abuse tax

- The taxation of shareholders on distributions at ordinary income (as opposed to qualified dividend) rates (together, the 2017 Act Inversion Penalties)

- Thus, while under the original statutory provision many transactions were structured so that the inversion fraction was simply below 80%, the 2017 Act Inversion Penalties move the goalposts. Parties will now find it critical to structure their transactions so that the inversion fraction is below 60% in order to avoid the 2017 Act Inversion Penalties. Indeed, one might say that after the 2017 Act, “60 is the new 80.”

Taking into account these factors — and as described in Latham’s January 2018 White Paper on the 2017 Act[3] — dealmakers and their advisors will in most cases continue to opt for a foreign holding company, if such a path is available in a deal, which increases the relevance of these rules and the Regulations as the business community and their advisors look to a post-2017 Act M&A market. In that regard, these rules may only become more important going forward, particularly as the financial benefits associated with debt investments decreases due to the limitation imposed by the 2017 Act on interest deductions under Section 163(j),[4] a limitation which becomes more onerous beginning in 2022. The continued tightening of tax benefits associated with debt financing will likely prompt dealmakers to increase the use of share consideration for target companies, perhaps coupled with a spin-off. As has been abundantly clear over the last several years, whenever a foreign acquirer issues equity in a deal, the US anti-inversion rules require analysis, even in cases in which their application seems far from the original intent of the statute.

Baseline Statutory Provisions

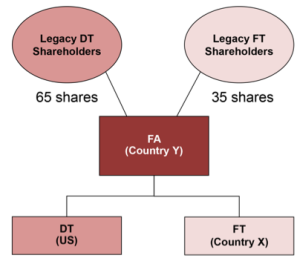

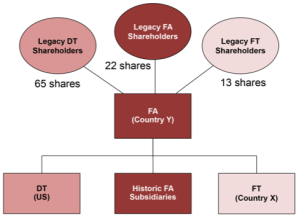

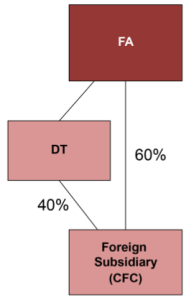

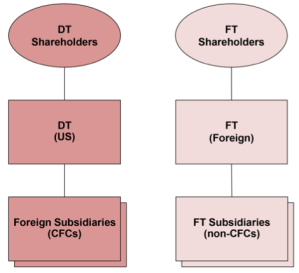

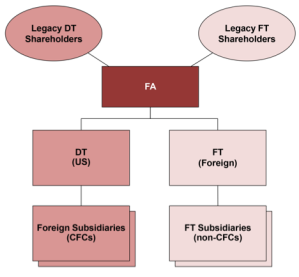

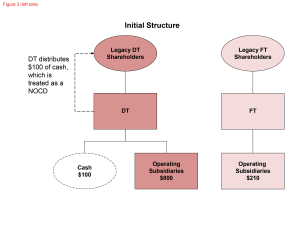

For purposes of the following discussion, assume that a US corporation (DT) and a foreign corporation (FT) seek to combine under a new foreign holding corporation (FA). The first chart in Figure 1 below depicts the structure immediately before the transaction, and the second depicts the structure after the transaction.

| Figure 1: Basic Transaction | |

| Initial Structure | Post-Acquisition Structure |

|

|

Under statutory anti-inversion provisions, a foreign corporation acquiring a US corporation is treated as a US corporation for US tax purposes if, among other requirements, both of the following apply:

- The amount of stock (by vote or value) of the foreign acquiring corporation (FA Stock) owned by former shareholders of the acquired US corporation (Legacy DT Shareholders) following the acquisition by reason of ownership of the acquired US corporation (the inversion fraction) is at least 80%.

- The expanded affiliated group (EAG) of the foreign acquirer does not have substantial business activities in the foreign country in which the acquirer is organized (the relevant foreign country).

If the Legacy DT Shareholders own less than 80%, but at least 60%, of the FA Stock, and the EAG does not have substantial business activities in the relevant foreign country, then certain limitations apply to the entire corporate group on the use of tax attributes, an excise tax may apply to certain executive compensation, and the 2017 Act Inversion Penalties would also apply.

As a general matter, the Prior Guidance was designed to introduce various adjustments to the inversion fraction by increasing the numerator and reducing the denominator in the inversion fraction, as well as to limit post-inversion cash movements and group restructurings through an array of rules.

Changes Made by the Regulations to Prior Guidance

Serial Acquisitions

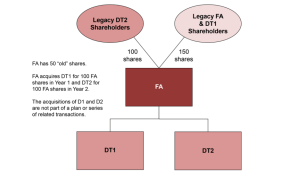

If a foreign corporation issues equity in exchange for a US business, that equity must be tracked for 36 months pursuant to a rule that links such acquisitions for purposes of the inversion rules (the serial acquisition rule). In particular, § 1.7874-8 generally reduces the denominator of the inversion fraction by the amount of FA Stock attributable to domestic entity acquisitions that FA (or its predecessor) completed within the prior 36 months. See Figure 2 below. Note that the serial acquisition rule is distinct from the multiple domestic entity acquisition rule, which is retained in § 1.7874-2(e) and integrates related transactions by providing that FA’s acquisitions of unrelated domestic targets as part of a “plan or series of related transactions” are treated as the acquisition of a single domestic target for purposes of the inversion rules, thus increasing the numerator of the inversion fraction.

In 2016, the US Chamber of Commerce filed suit in the US District Court for the Western District of Texas, asserting that Treasury and the IRS (i) lacked the statutory authority to promulgate the serial acquisition rule, (ii) engaged in arbitrary and capricious rulemaking, and (iii) failed to adhere to the notice and comment requirements of the Administrative Procedure Act (the APA).

The district court held that Treasury and the IRS had the statutory authority to promulgate the rule and did not engage in arbitrary and capricious rulemaking, but that they had failed to adhere to the notice and comment requirements of the APA and thus the serial acquisition rule in the temporary regulations was invalid. Although the case is currently on appeal to the Fifth Circuit, in the preamble to the Regulations, the Treasury highlights the district court’s view that the serial acquisition rule was substantively valid.

The Regulations adopt the serial acquisition rule, reconfirming the prior policy decisions, with three technical clarifications:

- The determination of the FA Stock that is attributable to a prior domestic entity acquisition does not include FA Stock deemed to be received under the NOCD rules discussed below.

- Domestic entity acquisitions occurring as part of certain internal restructurings by a foreign-parented group are not treated as prior domestic entity acquisitions for purposes of the serial acquisition rule.

- The term “predecessor” is defined by cross-reference to the NOCD rules.

Non-Ordinary Course Distributions

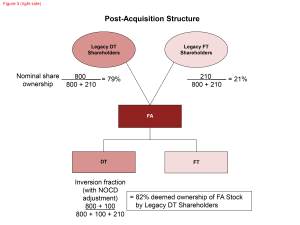

As noted above, the Prior Guidance introduced adjustments that can increase the numerator and decrease the denominator of the inversion fraction. Although a variety of factors and actions taken by the parties to a transaction can give rise to such adjustments, the potential increase of the numerator caused by prior distributions or share buy backs undertaken by DT is one of the issues that dealmakers and their advisors most frequently encounter.

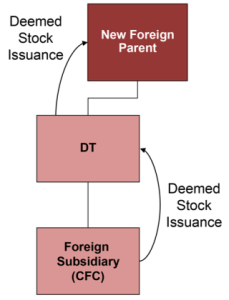

In that regard, § 1.7874-10 retains the rules introduced and refined in the Prior Guidance intended to limit taxpayers’ ability to reduce the size of DT in advance of an inversion transaction (and thereby favorably reduce the inversion fraction) by paying extraordinary dividends, often referred to as “diet” or “skinny-down” dividends. As a result, for purposes of the inversion fraction, any non-ordinary course distributions (NOCDs) by DT during the 36-month (or other applicable) period before the inversion will be disregarded such that the numerator (and, generally, the denominator) will be increased by a number of shares with a fair market value equal to the amount of NOCDs. As is well known in the dealmaking community, these rules go far beyond the purpose-driven rule in the statute and cover routine dividends and share buybacks, along with certain cash consideration provided to the US company shareholders in the deal.

| Figure 3: Non-Ordinary Course Distributions | |

| Initial Structure | Post-Acquisition Structure |

|

|

The Regulations make two clarifications and one modification to the Prior Guidance that may be particularly relevant when analyzing a potential transaction:

- Stock related to NOCDs that is deemed received by Legacy DT Shareholders is included in both the numerator and denominator of the inversion fraction, except to the extent such stock is treated as held by a member of the EAG and subject to the rules applicable thereto.

- The definition of “distribution” for purposes of the NOCD rules has been refined to clarify that (i) a deemed distribution under Section 752(b) will not be taken into account to the extent it does not reduce the partnership’s value and (ii) all Section 355 distributions made by DT will be taken into account, even if made as part of a larger asset reorganization that is otherwise not treated as a distribution.

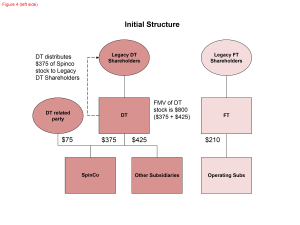

- Observation: The notion that a Section 355 distribution could be taken into account for purposes of the NOCD rules was the subject of significant commentary when first introduced as part of the Prior Guidance.[5] Furthermore, the Regulations’ confirmation that all prior Section 355 distributions within the relevant period will be treated as distributions under the NOCD provisions is one of the most noteworthy aspects of these rules. From a policy standpoint, this treatment serves as one of the most striking examples of how this broad and mechanical rule now captures even certain distributions almost certainly not made with a principal purpose to avoid the anti-inversion rules. In particular, as those dealmakers and advisors who have been involved with such a transaction well know, Section 355 imposes one of the most meaningful “business purpose” requirements of any of the Code provisions. Moreover, the potential practical effect of this rule is significant given the generally material value of the business being spun-off relative to the rest of the group. Such effect may only increase going forward in light of the increased spin-related transactions that can be expected as the market reacts to the interest deduction limitations imposed under the 2017 Act (discussed above).

- The Regulations require the recast of a Section 355 distribution by DT of a domestic controlled corporation (Spinco), such that Spinco is treated as having made a distribution of DT stock equal to the value of DT stock (net of the value of Spinco stock) at the time of the distribution, if the fair market value of Spinco is greater than 50% of the fair market value of DT. In contrast to the rules under the Prior Guidance, the relative fair market value of Spinco must be determined based on the value of Spinco stock held by both DT and any person that is treated as related to DT for purposes of Section 7874. The addition of related parties to the analysis increases the probability that this recast rule would apply in a manner that causes the inversion fraction to exceed the 60% threshold or the 80% threshold, as applicable.

| Figure 4: Section 355 Recast Rule | |

| Initial Structure | Post-Acquisition Structure |

|

|

Third Country Rule

Regulations § 1.7874-9 renders permanent the “third country rule” which, if applicable, excludes FA Stock issued to former shareholders of FT (Legacy FT Shareholders) by reason of ownership of FT from the denominator of the inversion fraction. See Figure 5. Application of this rule increases the likelihood that the inversion fraction will reach 80% or more (resulting in FA as being treated as a US corporation), particularly if FA is newly formed with little or no historic assets or operations.

Although the rules under the Regulations are generally consistent with those included in the Prior Guidance, the Regulations add two exceptions as well as one modification intended to address potentially abusive situations:

- The third country rule generally will not apply if either of the following applies:

- The EAG has substantial business activities (as discussed further below) in the country in which FA is a tax resident.

- Both FA and FT are created or organized in a foreign country that does not impose corporate income tax and neither FA nor FT is a tax resident of any other foreign country.

- Recognizing that a taxpayer could potentially avoid the third country rule by changing FA’s tax residency following an inversion, the Regulations generally treat a change in tax residency as a transaction. Therefore, if the change in tax residency is done pursuant to a plan or series of transactions including the inversion, the third country rule would apply.

Other Clarifications Included in the Regulations

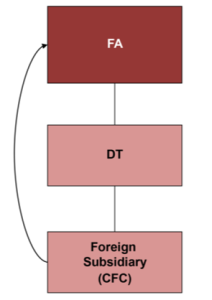

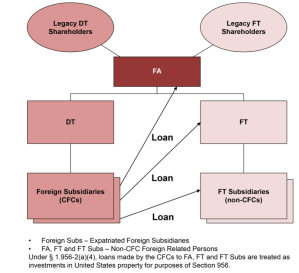

- Post-inversion planning: The Regulations generally incorporate the portions of the Prior Guidance targeting certain post-inversion planning methods, including those intended to enable the FA group to either (i) extract the earnings and profits of pre-inversion controlled foreign corporations (CFCs) through so called “hopscotch loans” and other financing techniques or (ii) otherwise engage in certain so-called “de-controlling transactions” or “out-from-under transactions.” Accordingly:

- The 2017 Act, unexpectedly, retained Section 956 as a general matter, thus resulting in continuing concern over investment in US property triggering a US tax on earnings that might otherwise be distributed tax free under the participation exception. Under § 1.956-2, investments by legacy CFCs of DT (Expatriated Foreign Subsidiaries) in stock or debt of foreign, non-CFC related parties (Non-CFC Foreign Related Persons) generally are treated as investments in US property for purposes of Section 956 (and thus may trigger an income inclusion under Section 951). See Figure 6. Similar rules apply with respect to credit support, such as guarantees and pledges of shares, that an Expatriated Foreign Subsidiary provides with respect to an obligation of a Non-CFC Foreign Related Person. Importantly, for purposes of determining whether an entity is an Expatriated Foreign Subsidiary, the Regulations provide that there is no downward attribution of ownership from a foreign person to a US person. The lack of downward attribution in such case distinguishes this determination from that generally provided in the expanded attribution rules under Section 958 following the 2017 Act.

- Under § 1.7701(l)-4, certain post-inversion transactions that have the effect of either causing an Expatriated Foreign Subsidiary to cease being a CFC or substantially diluting a 958(a) US Shareholder’s (e., a US shareholder that owns directly and indirectly stock of the Expatriated Foreign Subsidiary and that is an expatriated entity) ownership of a CFC will be recharacterized for all purposes of the Code. Consequently, an issuance by the Expatriated Foreign Subsidiary to a Specified Related Person (i.e., a Non-CFC Foreign Related Person, a US partnership with any partner that is a Non-CFC Foreign Related Person or a US trust with any beneficiary that is a Non-CFC Foreign Related Person) for property is treated as (i) the transfer of the property by the Specified Related Person to the 958(a) US Shareholder(s) in exchange for a deemed issuance of stock and (ii) the contribution of the property by the 958(a) US Shareholder(s) to the Expatriated Foreign Subsidiary (through intermediate entities, if appropriate) in exchange for a deemed issuance of stock (see Figure 7). In addition, the transfer of stock by shareholders of the Expatriated Foreign Subsidiary to a Specified Related Person is treated as (1) a deemed issuance of stock by the 958(a) US Shareholder(s) in exchange for property transferred by the Specified Related Person and (2) if the 958(a) US Shareholder(s) are not the transferring shareholders, a contribution of the property by such 958(a) US Shareholder(s) to the transferring shareholders. As described above and contrary to Section 958 following the 2017 Act, there is no downward attribution of stock owned by a foreign person to a US person for purposes of determining Expatriated Foreign Subsidiary status under these rules. Again, the continuing relevancy of these rules is questionable given that earnings can now generally be distributed pursuant to a participation exception.

| Figure 6: Application of § 1.956-2 |

|

- Treatment of FA passive assets: The Regulations generally retain the rule excluding FA Stock attributable to “foreign group nonqualified property” (generally passive assets, such as cash and marketable securities) from the denominator if more than 50% of the “foreign group property” consists of such nonqualified property, but modify the rule such that it only applies when calculating the inversion fraction based on value and not by vote. The change is intended to avoid difficulties associated with allocating the excluded amount amongst classes of stock with different voting power.

- Substantial business activities: As described above, in order for the anti-inversion provisions to apply, FA’s EAG must not have substantial business activities in the relevant foreign country. An EAG will generally be considered to have substantial business activities in the relevant foreign country (e., the country under the laws of which FA was created or organized) only if it meets all three of the following conditions:

- At least 25% of the EAG’s total number of employees are based in the country and at least 25% of its total compensation is incurred with respect to those employees

- At least 25% of the value of all EAG assets are located in the country

- At least 25% of the EAG’s total income during the relevant testing period is derived in the country

In addition, the EAG will only be treated as having substantial business activities in the relevant foreign country if FA is tax resident (i.e., a corporate body liable to tax as a resident) in the relevant foreign country. If the relevant foreign country does not impose a corporate income tax, the tax residency requirement does not apply.

- De minimis rules: Under the Regulations, each of the disqualified stock rule, passive assets rule, and NOCD rule contain a de minimis exception applicable if both:

- The inversion fraction (calculated without regard to the application of the disqualified stock rule, passive assets rule and NOCD rule) is less than 5% (by vote and value)

- Each former owner of the domestic target owns less than 5% (by vote and value) of each member of FA’s EAG

- Coordination rules: The Regulations retain and broaden the provisions coordinating the FA stock exclusion rules (such as the passive assets, serial acquisition, and third country rules) and the EAG rules (which are used to determine which entities are members of FA’s EAG). In addition, the Regulations clarify that NOCD stock deemed received by Legacy DT Shareholders is not taken into account for purposes of the EAG rules.

ENDNOTES

[1] For further discussion of certain portions of prior pronouncements specifically addressed by the Regulations, see Latham’s 2016 Client Alert, Treasury Issues Stringent Inversion Regulations, Proposes Far-Reaching Related-Party Debt Rules.

[2] Public Law No. 115-97 (Dec. 22, 2017). Shortly before final Congressional approval of the Act, the Senate parliamentarian ruled that the previously attached short title, the “Tax Cuts and Jobs Act,” violated procedural rules governing the Senate’s consideration of the legislation. Accordingly, the Act does not bear a short title, although commentators generally have continued to refer to it as the Tax Cuts and Jobs Act.

[3] Latham’s January 2018 White Paper can be found at US Tax Reform: Key Business Impacts, Illustrated With Charts and Transactional Diagrams.

[4] All references to “Section” refer to sections of the Internal Revenue Code of 1986, as amended (the Code), unless otherwise indicated. All references to “§” refer to sections of the Treasury Regulations promulgated under the Code.

[5] See, e.g., New York State Bar Association Tax Section, Report on the Non-Ordinary Course Distribution Rules in Notice 2014-52, Report No. 1324, July 6, 2015.

This post comes to us from Latham & Watkins LLP. It is based on the firm’s memorandum, “Cross-Border M&A: Putting the Recently Finalized US Inversion Regulations into Context Following US Tax Reform,” dated July 27, 2018, and available here.

Sky Blog

Sky Blog