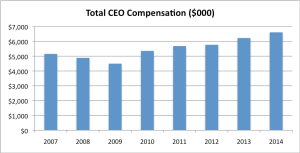

Since the financial crisis, much of the business media have focused on the level of CEO compensation and how much it increases from the prior year, often calling out the CEOs with the highest pay. These articles in the New York Times and Fortune are good examples. Concerns about pay levels provided at least some of the impetus for the adoption of mandatory but non-binding say-on-pay voting in the United States, beginning at 2011 annual meetings for large public companies. These say-on-pay votes allow investors to express their opinions about a company’s executive compensation. Prior research supports the idea that firms limit pay increases after a significant percentage of shareholders object to executive compensation, but say-on-pay has not had a clear effect on pay levels (See figure 1).

Figure 1: Average Total Compensation for S&P 1500 CEOs

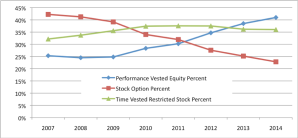

There is reason to believe that investor concerns about pay and related matters extend beyond pay levels and pay increases to issues including the sensitivity of pay to performance and other forms of compensation such as golden parachutes. These conjectures are supported by surveys of institutional investors that confirm that pay for performance sensitivity and the specific metrics used to determine compensation are important to investors(See here, for example). Additionally, ISS and other proxy advisers that make recommendations for say-on-pay votes publish guidelines on their process for developing recommendations that include extensive evaluation of the proportion of compensation that is sensitive to performance and how increases in compensation relate to firm performance. Aggregate trends also provide some support for the possibility that say-on-pay voting influences compensation structure. For example, there is an upward trend in the use of performance-vested equity that coincides with the start of say-on-pay voting (See figure 2).

Figure 2: Distribution of Types of Equity for S&P 1500 CEOs (as a percent of total equity grant)*

*Only includes CEOs granted some equity

In my paper, Say-on-Pay Voting and CEO Compensation Structure, I evaluate how the specific types of compensation affect say-on-pay voting outcomes and in turn how such outcomes influence subsequent changes in CEO compensation at S&P 1500 firms. I find that controlling for the level and changes in total CEO compensation and firm performance, voting dissent (i.e. the percentage of votes cast “against” a say-on-pay proposal) decreases as the proportion of compensation sensitive to performance increases. Specifically, I find that voting dissent decreases when a higher percentage of compensation is in formulaic cash bonuses (i.e. non-equity incentives) and equity rather than salary or other forms of compensation. As for the type of equity compensation, voters tend to favor stock options or performance-vested equity (i.e. grants of stocks were the number of shares that the executive ultimately receives depends on some measure of firm performance after the grant date) more than time-vested restricted stock. Collectively, these results confirm that voting results are consistent with investors’ stated preferences for compensation that is more sensitive to firm performance.

I then turn to how compensation changes in response to the say-on-pay vote in the prior year. I consider how the level of voting dissent in that year influences changes in CEO compensation. Firms that experienced higher levels of voting dissent in the prior year are likely to feel greater pressure to change compensation. If the changes are designed to align with investor preference, I expect firms with greater voting dissent to increase of compensation that is more sensitive to performance. I do not, however, find results consistent with these expectations. On average, I find that as the degree of prior year voting dissent increases, the percentage of compensation consisting of salary increases and the percentage of compensation consisting of formulaic cash bonuses remains unchanged, and the percentage of compensation consisting of equity decreases. These results suggest that voting dissent does not cause firms to shift to the more performance sensitive forms of compensation that investors prefer.

I find that say-on-pay votes do prompt a shift in type of equity compensation. As prior year voting dissent increases, firms increase their use of performance-vested equity and decrease their use of stock options. A 20 percent increase in prior year voting dissent is associated with between a 3.9 percent increase in performance-vested equity and a 2.3 percent decrease in the use of stock options in the next year’s CEO compensation package. I find no change in the use of time-vested restricted stock. Again, these results are not consistent with investor preferences, because voters equally favored performance-vested equity and stock options. Further, the effect of shifting equity from stock options to performance-vested stock grants on the performance sensitivity of compensation is ambiguous and likely depends on factors specific to firms and awards, such as the difficulty of measuring performance. If firms wanted to clearly increase performance sensitivity of equity, they would substitute time-vested restricted stock with either stock options or performance-vested stock grants.

Collectively, the results about how voting dissent affects subsequent compensation are somewhat puzzling, because they do not seem to align with investor preferences. There are several explanations for the results. First, firms may concentrate on controlling pay levels in response to negative say-on-pay votes. If pay level is the main concern, it may be difficult to simultaneously increase the performance sensitivity and thus the risk of pay and still provide sufficient incentives to retain and motivate executives.

Second, with a shift from stock options to performance-vested equity, firms may be attempting to address more specific investor concerns regarding compensation rather than overall performance sensitivity. For example, Equilar reports that in 2016, among 500 of the largest companies, 52.4 percent of long-term incentives including performance-vested equity awards granted to executives included relative Total Shareholder Return (TSR) as a metric. While a CEO receiving stock options may earn a substantial payout purely due to strong industry or firm performance, an award with a metric such as relative TSR ensures that the CEO only earns a high payout if he outperforms his peers. Performance-based equity awards with other metrics (e.g. revenues, ROC, EPS) may address other specific company goals as opposed to stock options, whose payout is purely a function of stock price.

Finally, firms may feel compelled to appear responsive to say-on-pay votes, even though they do not want to make substantial changes to compensation. Proxy statements, even from firms that received extremely high levels of approval in prior say-on-pay votes, often provide significant explanations of how pay has changed because of say-on-pay votes and other shareholder engagement. Thus, firms may make compensation look different without actually changing the risk or incentives to any great extent. A firm could, for example, design performance-vested equity so that the expected payouts from such an award would not differ substantially from the stock option grant that it replaced.

My results demonstrate that investors don’t just consider that amount of pay when casting say-on-pay votes. They also demonstrate a preference for compensation that is sensitive to performance. I do not, however, find that companies increase the proportion of CEO compensation that is sensitive to performance in response to poor say-on-pay voting outcomes. Instead, I find that companies tend to decrease the use of stock options and increase the use of performance-vested equity, a somewhat puzzling change given its ambiguous effect on performance sensitivity.

This post comes to us from Professor Andrea Pawliczek at the University of Missouri at Columbia. It is based on her recent article, “Say-on-Pay Voting and CEO Compensation Structure,” available here.

Sky Blog

Sky Blog