Derivatives are the “bad boys” of modern finance: exciting, dangerous, and fundamentally misunderstood. Their supporters defend them as important instruments for measuring, managing, and transferring risk, enhancing both the efficiency and resilience of the financial system. Their critics label them everything from “socially useless” to “financial weapons of mass destruction” to “the crystal meth of finance.” They have been singled out by policymakers as one of the catalysts of the global financial crisis. They have even been condemned by the Pope. Indeed, in the wake of the crisis, it often seems like everyone who is anyone has an opinion about derivatives.

Despite this groundswell in interest, scholars have paid remarkably little attention to the contracts at the heart of derivatives markets. Policymakers, meanwhile, have often been more interested in costly turf wars than understanding precisely what they are regulating. Yet understanding what these contracts say, how they work, and how parties seek to address their inevitable limitations is extremely important: especially given the fundamental differences between these contracts and the conventional equity and debt securities that dominate academic and policy debates in the fields of corporate governance, securities law, and financial regulation. In order to fully understand these differences, we need to split derivatives open, identify their constituent elements, and observe how these elements interact with one another.

The process of splitting derivatives open exposes a far richer and more complex universe of elements than conventional academic and policy debates would otherwise suggest. The first element is some of the world’s most sophisticated state-contingent contracting. These state-contingent terms govern the parties’ payment obligations, the circumstances in which they will be required to post collateral, and the consequences of default. Under normal market conditions—in good times—the execution of these terms relies on input variables that are easily observable: e.g. the price of the underlying asset, the value of posted collateral, and the credit ratings of the counterparties. In good times, the determination and performance of each counterparty’s obligations under a derivative contract may thus appear highly mechanical—almost automatic.

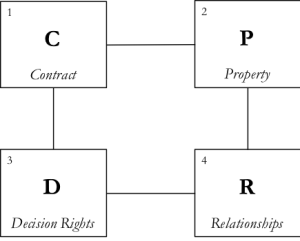

The Elements of a Derivative Contract

How derivatives work in good times is the product of three trends. The first is the standardization of derivative contracts under the auspices of organizations such as the International Swaps and Derivatives Association. The second is an increasing level of automation in connection with the execution, clearing, and settlement of derivative contracts. The third is the shift toward central clearing of standardized derivative contracts, as mandated under the Dodd-Frank Act. Together, these trends have contributed to the appearance that derivative contracts are becoming more commoditized, more transparent, and more liquid—in short, more like publicly-traded shares and bonds.

But appearances can be deceiving. For all their sophistication, the detailed state-contingent terms at the core of derivative contracts are inevitably incomplete. This incompleteness reflects the high front-end costs of writing contracts that identify the entire universe of possible future states of the world and then specify the rights and obligations of the counterparties in each state. It also reflects the significant back-end costs of monitoring and enforcing compliance with these contracts. This incompleteness exposes counterparties to the risk that their contracts will fail to prescribe the best possible outcomes in all states of the world. It also exposes them to the risk of opportunism over the life of the contract. These risks are likely to be most pronounced during periods of fundamental uncertainty—in bad times—when the markets for underlying assets break down, when collateral is scarce and hard to value, and when doubts arise about the creditworthiness of the counterparties. In bad times, the determination of each counterparty’s rights and obligations can thus become highly uncertain and contested—anything but automatic.

Counterparties employ a number of formal mechanisms to address these risks. The first is the allocation of property rights in the form of collateral. The requirement to post collateral can help insure parties against unexpected changes in the price of underlying assets or counterparty creditworthiness. It can also reduce each party’s exposure to opportunism. The second mechanism is the allocation of decision-making rights. This includes the appointment of one party—known as the valuation agent—for the purpose of determining how much collateral counterparties are required to post. In good times, the role of the valuation agent is essentially administrative: observing market prices and other input variables and feeding them into the detailed state-contingent terms embedded within every derivative contract. In bad times, however, the valuation agent is called upon to use its expertise and discretion as a substitute for observable information. The third mechanism is the judicious use of broad contractual standards. Perhaps most importantly, these standards are used to articulate a benchmark for evaluating the reasonableness of the valuation agent’s decisions.

These formal mechanisms for addressing the risks posed by incomplete contracting are subject to several important limits. Collateral is expensive. The valuation of many financial assets is complex and subjective. The enforcement of broad contractual standards is costly and unpredictable. These limitations point to a potentially significant role for more informal mechanisms such reputation and the expectation of future dealings. The threat of reputational sanctions and the loss of future revenue can create incentives for counterparties to engage in cooperative problem-solving under circumstances where the rigid application of state-contingent terms is either impracticable or would lead to suboptimal outcomes. These mechanisms can also help constrain potential opportunism associated with the ex ante allocation of property or decision-making rights. Together with more formal mechanisms, these informal mechanisms can thus provide counterparties with the flexibility to incorporate new information, fill contractual gaps, and facilitate efficient ex post renegotiation. In this way, these informal mechanisms can reinforce the more formal elements of a derivative contract: creating incentives for the use of detailed state-contingent terms and the allocation of property and decision-making rights in good times by providing a safety valve for modifying or relaxing the strict application of these terms in bad times.

The process of unbundling derivatives thus reveals a complex and heterogeneous collection of different elements—a fundamentally hybrid financial instrument. This hybridity enables derivative contracts to morph between what economists Raghuram Rajan and Luigi Zingales have characterized as “arm’s-length” and “relational” financing, depending on the state of the world in which the counterparties find themselves. In good times, derivative contracts trade in deep, liquid, and informationally sensitive markets. In bad times, the very same contracts can be characterized by acute information problems, paralyzing illiquidity, and the resulting dominance of relationships over markets.

Acknowledging the fundamental hybridity of derivative contracts yields a number of important policy insights. First, the braiding of contract, property and decision-making rights and relational mechanisms makes derivatives look far more like commercial loans than publicly-traded shares or bonds. The regulatory treatment of derivatives as “securities” under the Dodd-Frank Act—and the resulting emphasis on market transparency—thus serves to distract regulatory attention from the significant prudential risks posed by the widespread use of derivatives. Second, the flexibility associated with the relational mechanisms embedded within many derivative contracts can play a useful role in promoting both institutional and broader financial stability. This has important implications in terms of the desirability of mandatory central clearing of derivatives under the Dodd-Frank Act, where the elimination of these mechanisms may leave clearinghouses and other counterparties vulnerable to destabilizing contractual rigidity. This same rigidity risks undermining the inherent promise of recent proposals to use distributed ledger technology and smart contracts to execute, clear, and settle derivative contracts. By the same token, the widespread breakdown of these relational mechanisms can be a source of pronounced financial instability. This provides a compelling rationale for authorizing central banks to act as dealers of last resort during periods of fundamental uncertainty.

The failure of scholars and policymakers to fully appreciate the hybrid nature of derivative contracts is also the source of a number of enduring misunderstandings. These misunderstandings are reflected in the widespread and erroneous belief that derivatives are zero sum bets on future price movements, that central clearing of derivatives can eliminate their attendant risks, and that derivatives are fundamentally no different from shares, bonds, or other financial instruments. Lamentably, these beliefs continue to find their way into both policy debates and the pages of leading law reviews. One of the objectives of the article on which this post in based is to correct these misunderstandings, thereby leaving us in a better position to explore the important questions raised by the widespread use of derivative contracts and the changing structure of derivatives markets.

This post comes to us from Professor Dan Awrey at the University of Oxford. It is based on his recent article, “Split Derivatives: Inside the World’s Most Misunderstood Contract,” available here.

Sky Blog

Sky Blog