Equity markets are an important source of capital financing for firms, particularly in the United States. These large, liquid markets channel capital from savers to firms and facilitate corporate investment by distributing risks among many smaller investors. There is concern, however, that along with these benefits, equity financing has significant costs. One of the most prominent criticisms of the public ownership of firms is that investor pressure over short-term stock market performance causes public firms to forgo profitable, long-term investments.

This criticism has prompted such notable corporate leaders as Jamie Dimon of J.P. Morgan Chase and Warren Buffett of Berkshire Hathaway to lead efforts to develop a set of corporate governance principles designed to promote long-term focus and investment. Policymakers on both sides of the Atlantic have also tried to curb short-termism. For example, in France grants long-term investors additional voting rights, and the European Commission is considering following suit. In the United States, the Delaware Supreme Court has endorsed the idea that a firm’s true owners have held shares long term.

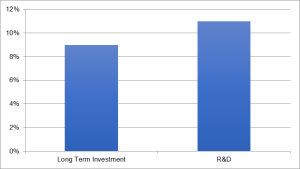

In contrast to conventional wisdom, our new research shows that public firms actually invest more than do private firms—particularly in research and development (R&D). Using a large sample of corporate tax returns for public and private firms from the IRS, we find robust evidence that public firms invest about 9 percentage points more in long-term investments than do private firms, and that this overall investment advantage stems largely from commitments to R&D, where public firms invest 11 percentage points more than do private firms (Figure 1). This is true even after carefully accounting for differences between public and private firms such as firm size, age, and structure. Alternative estimates that compare investment spending relative to tangible assets also show that public firms out invest private firms in general and especially in long-term assets like R&D. Put differently, publicly traded companies in the United States account for only 30 percent of total sales in the sample, but undertake 45 percent of all capital investment and 60 percent of total R&D.

Figure 1: Difference between Public and Private Firms Long Term and R&D Investment as a Fraction of Total Investment

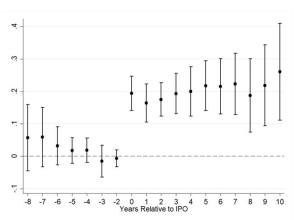

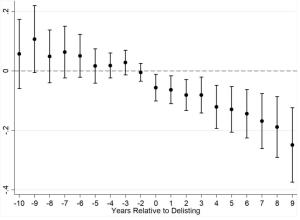

While directly comparing two groups of firms (public and private) is one way to detect differences in investment patterns, a complementary approach is to compare the investment pattern of the same firm when it is private and then public or vice versa. Examining changes in investment patterns following public listing, we find that after their IPO, firms, on average, dedicate an additional 17 percentage points of their investment budgets to R&D relative to the years prior to the IPO (Figure 2). When firms delist, the pattern is the reverse (Figure 3). Following delisting, firms dramatically cut the R&D share of their investment budgets.

Figure 2: R&D Share of Total Investment, by Years Since IPO

Because the majority of R&D spending goes to the wages and salaries of research employees, the results here suggest that public ownership particularly facilitates long-term and highly uncertain uncollateralized investments. It may be that public status does not cause firms to undertake more research; instead, when a firm is poised to expand its R&D program, it could opt to go public in order to access more cost-effective financing for these projects. The strong association between public status and R&D investment repeatedly evidenced by our estimates is consistent with either interpretation, but is inconsistent with the notion that earnings pressure renders public firms so short-sighted that they, on net, forgo long-term investment.

Figure 3: R&D Share of Total Investment, by Years Since Delisting

The knowledge spillovers associated with any given firm’s research spending makes boosting R&D a national concern and as such a host of federal and state policies aim to increase private R&D. The results here suggest that measures by policymakers or industry leaders that make it more difficult for firms to access capital through public markets would counter policies to support innovation and may reduce the R&D spending of U.S. firms.

This post comes to us from Laura Kawano, a research affiliate at the University of Michigan at Ann Arbor; Professor Elena Patel at the University of Utah; and Professor Nirupama Rao at the University of Michigan. It is based on their recent paper, “The Long and the Short of It: Do Public and Private Firms Invest Differently?,” which was co-authored by Naomi Feldman of the Federal Reserve Board; Michael Stevens at the U.S. Department of the Treasury, Office of Tax Analysis; and Jesse Edgerton of JPMorgan, and is available here. The views expressed in the post are those of the authors and do not necessarily reflect the views or policy of J.P. Morgan, the Federal Reserve Board of Governors, or the U.S. Department of Treasury. All access to administrative tax records has been through Treasury staff.

Sky Blog

Sky Blog