In recent decades, economies have become bound together through globalization, a phenomenon that integrates societies and creates business opportunities but also challenges tax policies. The amount of taxes corporations pay is a heatedly debated topic among policy makers, academics, and the media. An article in the Financial Times (Toplensky, 2018), for example, argues that multinational enterprises (MNEs) are paying significantly lower taxes now than they did prior the financial crisis. An important way MNEs reduce their taxes is to move profits from the countries where they’re based to countries where tax rates are lower, a practice commonly referred to as “profit shifting.” Although such strategies are not illegal, they deny host countries tax revenues and put social welfare and equality at risk. The extent of profit shifting, however, remains unclear and has yet to be fully understood.

Parallel to the growing importance of tax planning, CSR has become increasingly popular among businesses around the globe. Driven by corporate strategy or shareholder pressure, companies increasingly participate in socially responsible activities, such as investing in employees and the quality of workplaces, reducing pollution, and improving governance. From an economic perspective, the fundamental reason to engage in CSR is less clear. According to Friedman (1970), firms should only pursue activities that maximize shareholder value. He argues that socially responsible activities do not qualify. Despite a growing body of research on CSR (e.g., Ferrell et al., 2016; Lins et al., 2017), the question of why some firms choose to pursue CSR while others do not remains unanswered and warrants more research efforts. Our results provide a potential explanation.

In our study, we extend prior research (e.g., Hoi et., 2013; Davis et al., 2016) on the link between CSR and tax avoidance and analyze firms’ profit-shifting activities from an international perspective. On the one hand, socially responsible firms are expected to pay their fair share of taxes, thus maximizing stakeholder value. In our context, this would indicate a negative relationship between CSR and profit shifting. On the other hand, according to legitimacy theory, the association between CSR and profit shifting could be positive. This is the case when firms have incentives to invest in CSR. One such incentive may be to gain legitimacy, build “moral capital,” and avoid severe punishment if they act in ethically questionable ways.

To shed more light on this relationship, we use MNEs data from 2009 to 2016, which consist of over 500 parent companies from 20 countries and over 6,000 of their subsidiaries in 63 countries. Our analysis proceeds in two stages. First, we adopt the method proposed by Dharmapala and Riedel (2013) and estimate a measure of profit shifting. Second, we examine the relationship between CSR and profit shifting and find it positive and statistically significant, thus being consistent with the legitimacy-theory view. To further corroborate our findings, we try a number of alternative tests and reach the same conclusion.

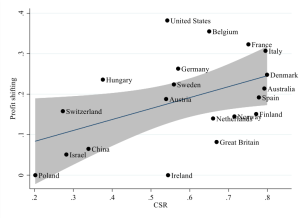

| Figure: Corporate social responsibility and profit shifting |

|

| This graph shows average values of CSR and profit shifting by country for the period 2009-2016.

Source: Authors’ calculations. |

Our next set of tests investigates whether the link between CSR and profit shifting varies across different types of tax systems. Recent debate has focused on the potential drawbacks of the different types of tax systems. Academic research has shown that multinationals under the territorial tax system shift more income than do those under the worldwide tax system (e.g., Scholes et al, 2015; Kohlhase and Pierk, 2016; Markle, 2016). If the positive relationship between CSR and profit shifting holds, one would have expected this relationship to be more pronounced for firms headquartered in countries under the territorial tax system. This is because firms under the territorial tax system are able to repatriate income without the need to pay additional taxes and thus have greater incentives to engage in profit shifting. Indeed, our analysis shows that CSR has a more pronounced effect on profit shifting for firms under a territorial tax system.

Our results suggest that multinational firms with higher CSR scores shift larger amounts of profits to their low-tax foreign subsidiaries, potentially indicating strategic planning in the choice of CSR investments by multinational enterprises. In a fast-paced globalized world, our study provides some empirical justification as to why some MNEs may choose to invest in CSR, and offers potentially useful insights for policy makers and academic researchers.

REFERENCES

Davis, A. K., Guenther, D. A., Krull, L. K., & Williams, B. M. (2016). Do socially responsible firms pay more taxes?. Accounting Review, 91(1), 47-68.

Dharmapala, D., & Riedel, N. (2013). Earnings shocks and tax-motivated income-shifting: Evidence from European multinationals. Journal of Public Economics, 97, 95-107.

Ferrell, A., Liang, H., & Renneboog, L. (2016). Socially responsible firms. Journal of Financial Economics, 122(3), 585-606.

Friedman, M. (1970), The social responsibility of business is to increase its profits, New York Times Magazine, September 13, 1970.

Hoi, C. K., Wu, Q., & Zhang, H. (2013). Is corporate social responsibility (CSR) associated with tax avoidance? Evidence from irresponsible CSR activities. Accounting Review, 88(6), 2025-2059.

Kohlhase, S. and Pierk, J. (2016) Why are U.S.-owned foreign subsidiaries not tax aggressive? WU International Taxation Research Paper Series, 2016-06. WU Vienna University of Economics and Business, Universität Wien, Vienna.

Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. Journal of Finance, 72(4), 1785- 1824.

Markle, K. (2016). A comparison of the tax‐motivated income shifting of multinationals in territorial and worldwide countries. Contemporary Accounting Research, 33(1), 7-43.

Scholes, M., Wolfson, M. A., Erickson, M. M., Hanlon, M. L., Maydew, E. M., Shelvin, 2015. Taxes and Business Strategy, 5th Edition, Prentice Hall.

Toplensky, R. (2018, March 11). Multinationals pay lower taxes than a decade ago. Financial Times, Retrieved from https://www.ft.com/content/2b356956-17fc-11e8-9376-4a6390addb44.

This post comes to us from professors Iftekhar Hasan at Fordham University’s Gabelli School of Business, Panagiotis Karavitis and Pantelis Kazakis at the University of Glasgow’s Adam Smith Business School, and Woon Sau Leung at Cardiff Business School. It is based on their recent paper, “Corporate Social Responsibility and Profit Shifting,” available here.

Sky Blog

Sky Blog