Executive compensation elicits strong opinions from shareholders, practitioners, and the public alike. Ideally, compensation packages should be designed to attract, retain, and motivate executives to perform in accordance with the objectives of their companies’ shareholders. This idea is consistent with the optimal contracting view of pay that high remuneration reflects compensation of effort, risk, or returns to ability (Murphy and Zabojnik, 2004). However, critics of executive compensation often claim that corporate pay packages have grown increasingly complex and are not sufficiently tied to long-term performance. According to this view, the level and complexity in the structure of CEO pay is primarily explained by the greater rent extraction of powerful CEOs (Bebchuk and Fried, 2004). Despite the vast empirical evidence on this subject, whether high pay packages are deserved remains a controversial subject.

In our study, we attempt to inform this debate by studying the implications of top management compensation on firms conducting Initial Public Offerings (IPOs). An IPO is often the first time that a private company focuses on developing a formal compensation plan. Nevertheless, the extent to which governance considerations that are common among established public companies play a role at newly-public firms is unclear (Filatotchev and Allcock, 2013). This is particularly important not only because IPOs have relatively less mature governance structures but also because a vibrant IPO market is crucial for the development of capital markets and the economy (Doidge et al., 2013; Bhattacharya et al., 2015).

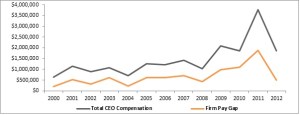

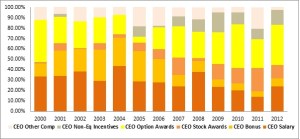

Our research is based on a hand-collected data-set that includes the compensation distribution of the whole management team prior to the offering. As a consequence, this approach considers the implications of both absolute CEO pay and relative CEO pay, i.e., the pay disparity between the CEO and other senior executives. Accordingly, we begin our empirical analysis by highlighting some important descriptive evidence. Figure 1 reveals that executive compensation exhibits an increasing trend (apart from 2012, which is probably due to the passage of the JOBS Act, aiming to minimize the regulatory burden of smaller firms that plan to go public). It also shows a persistent pay disparity between the CEO and the other executives. Furthermore, Figure 2 reveals a significant dependence on long-term forms of compensation (such as stock and option awards). Do these patterns represent managerial entrenchment? Or, do they reflect an equilibrium outcome arising from an efficient labor market?

| Figure 1: Time Trend of Compensation and Pay Gap |

|

| Figure 2: CEO Compensation Structure By Year |

|

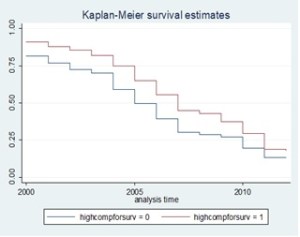

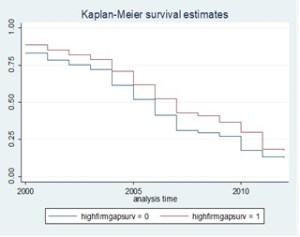

Since IPO issuers are entrepreneurs aiming for growth opportunities, they are usually concerned with maintaining their ability to attract financing from the equity market rather than focusing solely on traditional performance indicators (Klepper, 2002; Chadwick et al., 2016). In this regard, we address the above questions by studying how managerial pay affects the decision to delist. Figures 3 and 4 illustrate that newly-listed firms with either highly compensated CEOs or large pay gaps have consistently lower failure risk. Multivariate tests reinforce this finding as they show that one interquartile change in the distribution of managerial pay translates to an increase in survival time by at least 10 months. Importantly, these results are largely driven by the variable component of executive pay, supporting the contention that the objective function of IPO issuers is largely characterized by survival considerations, as they seem to set compensation incentives with a risky but long-term view in mind.

| Figure 3: Survival Estimates of IPO Firms with a Highly (blue) or a Poorly Compensated CEO (red) | Figure 4: Survival Estimates of IPO Firms with Large (blue) or Small (red) Pay Disparities |

|

|

While the incidence of delisting occurs after the design of compensation contracts, it is nevertheless a voluntary decision, thereby biasing our inferences. To alleviate some of these concerns, we add to our survival regressions a series of CEO and firm characteristics that are assumed to be reasonably stable around the IPO. We also perform an instrumental variable (IV) approach that exploits the fact that firms set compensation policies based on practices of industry peer groups as well as a matching estimator.

Similarly, we examine how the link between managerial pay and IPO failure varies in ways that are predictable by the efficient contracting camp. A sample partitioning approach indicates that the effectiveness of CEO remuneration packages is pronounced in samples of firms with low agency conflicts (i.e., with founder, specialists, or relatively young CEOs, and strong governance mechanisms), whereas the influence of CEO pay gap is strengthened among firms with higher likelihood of promotion (i.e., when the CEO is an outsider, generalist, and close to retirement).

One might argue that the lower incidence of failure among firms with either absolute or relatively higher managerial pay does not necessarily benefit shareholders, since managers may prefer to minimize the occurrence of extreme downside outcomes, possibly, at the expense of positive events. This could be the case, for example, if managers pursue an aggressive cost-cutting strategy or forgo risky but value enhancing projects. We evaluate these conjectures and initially find that, while firms with high managerial pay experience lower post-IPO uncertainty, they exhibit superior operating performance. Our findings do not reveal any association between managerial pay and conservative investment strategies. As a consequence, it seems that, in our sample, high-powered incentives enable IPO issuers to obtain funds from the capital markets for longer periods without undermining the shareholders’ interests.

Our study contributes to both the literature and the ongoing debate on the efficacy of executive pay schemes. First, our findings that IPO compensation packages are more in line with optimal contracting rather that managerial power speak to the controversy over the effectiveness of executive pay arrangements. Second, to the best of our knowledge, this study is the first to establish a link between executive pay incentives (i.e., CEO compensation and CEO pay gap) and the long-term prospects of newly-public firms. In this respect, it adds a new dimension to the nascent literature concerned with the influence of governance factors on the decisions of IPO issuers to delist. Finally, we provide a more complete picture of how the internal incentive structures of young ventures and entrepreneurial firms can serve as an effective governance tool.

REFERENCES

Bebchuk, L. and J. Fried. “Pay without Performance: Overview of the Issues.” Journal of Applied Corporate Finance, 17 (2004), 8-23.

Bhattacharya, U.; A. Borisov; and X. Yu. “Firm Mortality and Natal Financial Care.” Journal of Financial and Quantitative Analysis, 50 (2015), 61-88.

Chadwick, C.; Guthrie, J.; and X. Xing. “The HR Executive Effect on Firm Performance and Survival.” Strategic Management Journal, 37 (2016), 2346-2361.

Doidge, D.; A. Karolyi; and R. Stulz. “The U.S. Left Behind? Financial Globalization and the Rise of IPOs Outside the U.S..” Journal of Financial Economics, 110 (2013), 546-573.

Filatotchev, I. and D. Allcock. “Corporate Governance in IPOs.” Oxford: Oxford University Press (2013).

Klepper, S. “Firm Survival and the Evolution of Oligopoly.” RAND Journal of Economics, 33 (2002), 37-61.

Murphy, K. and J. Zabojnik. “CEO Pay and Appointments: A Market-Based Explanation for Recent Trends.” American Economic Review, 94 (2004), 192-196.

This post comes to us from professors Dimitrios Gounopoulos at the University of Bath, School of Management, Georgios Loukopoulos at the University of Bath, School of Management, and Panagiotis Loukopoulos at the University of Strathclyde, Strathclyde Business School. It is based on their recent paper, “Managerial Incentives and Firm Survival: Rent Extraction or Optimal Contracting,” available here.

Sky Blog

Sky Blog