Critics of the shareholder-primacy model assert that it is flawed because it encourages managers to adopt a myopic view of profit generation that forgoes necessary investment and creates externalities borne by society. These critics argue that greater attention should be paid to the interests of non-investor stakeholders and that by investing in initiatives and programs to promote the interests of these groups, the corporation will create long-term value that is larger, more sustainable, and more equitably shared among investors and society. This concept is known as ESG (environmental, social, and governance) investing.

Advocacy for a more stakeholder-centric governance model, however, is based on assumptions about managerial behavior that are relatively untested. For example, little information is available about the degree to which executives currently incorporate or ignore non-investor stakeholder interests in strategic planning and investment decisions. Furthermore, little is known about the views that these executives have about the relative costs and benefits of ESG activities in both the near and long terms.

Are executives really as “penny wise and pound foolish” as critics assume?

Pressure to Incorporate Stakeholder Interests

Pressure has been growing on large, publicly traded U.S. corporations to incorporate stakeholder interests into their long-term strategic planning. This pressure comes from multiple fronts:

- Money flowing into ESG investment funds. In 1995, less than $1 trillion was invested in money managers and institutional investments dedicated to sustainable, responsible, and impact investing in the U.S. By 2018, that number exceeded $12 trillion.

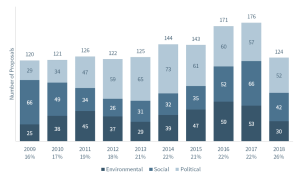

- ESG-related proxy proposals. The number of shareholder-sponsored proxy proposals that require companies to address ESG-related considerations has generally increased over the last decade. Furthermore, the percent of shares voted in favor of these proposals has also increased.

- Institutional investors. Large institutional investors that had previously taken passive stances on ESG-related issues have become more assertive. For example, BlackRock engages in an annual letter writing campaign to encourage portfolio companies to incorporate stakeholder needs into their business planning, Vanguard engages with companies through what it calls “quiet diplomacy” to understand stakeholder issues, and State Street launched a public campaign to pressure companies with all-male boards to increase gender diversity.

- ESG metrics. Data providers use survey data and publicly observable metrics to rate companies along a variety of stakeholder dimensions. This data is sold to institutional investors to inform investment decisions or is used in magazine rankings. Examples of data providers include MSCI, HIP (“Human Impact + Profit”), and TruValue Labs. Examples of published indices include Barron’s 100 Most Sustainable Companies, Bloomberg Gender Equality Index, Ethisphere Institute’s Most Ethical Companies, and Newsweek Top Green.

- Employee activism. Employees of some companies have become more vocal expressing their views to management on environmental or social issues. In the last year, employees at Microsoft protested the company’s involvement in the development of weapons technology for the U.S. military, employees at Amazon wrote a letter urging management to take more aggressive efforts to reduce climate change, and Google employees staged a worldwide walkout over the company’s handling of sexual harassment allegations against a former senior executive.

Executive View of Stakeholder Interests

Despite these pressures, corporate executives need to make rational investment decisions for both the short and long terms. To understand the role that stakeholder interests play in corporate planning, we surveyed over 200 CEOs and CFOs of companies in the S&P 1500 Index.[1] We find that companies do not adopt a shareholder-centric governance model that is as extreme as current critics suggests, that many companies pay significant consideration to stakeholder interests, particularly those of their employee base, and that most do not agree with the prevailing assumption that addressing stakeholder concerns requires an economic tradeoff between the short and long terms.

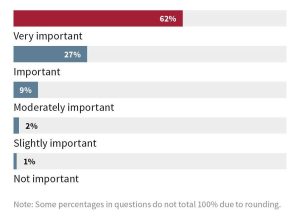

CEOs and CFOs claim that stakeholder interests already play a considerable role in the management of their companies. Eighty-nine percent believe it is important or very important to incorporate the considerations of these groups in their business planning; only 3 percent believe it is slightly or not at all important (Figure 1).

Figure 1

“Generally speaking, how important is it that your company consider the interests of non-shareholder stakeholders (such as employees, local communities, the general public, etc.) as you pursue your business objectives?”

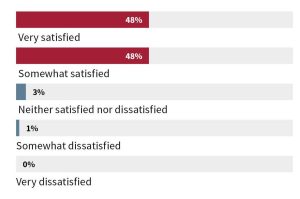

Furthermore, most (77 percent) do not believe that shareholder interests are significantly more important than stakeholder interests. Instead, most assign some level of parity in weighing the interests of these two groups, and almost all (96 percent) are satisfied or somewhat satisfied with the job their company does to meet the interests of their most important stakeholders (Figures 2 and 3).

Figure 2

“In general, how important are stakeholder interests relative to shareholder interests in the long-term management of your company?”

Figure 3

“How satisfied are you with the job your company does to meet the interests of these stakeholders?”

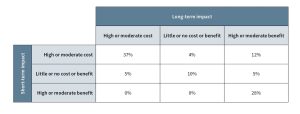

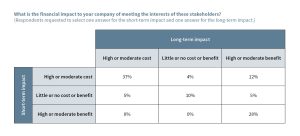

When asked to assess the relative impact of ESG activities today and in the future, only 12 percent believe addressing stakeholder interests requires a short-term cost in order to generate long-term value. This finding directly contradicts the standard narrative that companies do not invest in ESG activities because they are unwilling to incur a temporary hit to profitability. Instead, most respondents believe either that investing in ESG activities is costly in the short run and will continue to be costly in the future (37 percent), or that investing in these activities generates immediate benefits that will continue into the future (28 percent). The remaining respondents (24 percent) believe ESG activities have little cost or benefit in either the short or long term (Figure 4).

Figure 4

“What is the financial impact to your company of meeting the interests of these stakeholders?” Respondents were asked to select one answer for the short-term impact and one answer for the long-term impact.

Given their satisfaction with the work they do to address stakeholder interests and their assessment of the relative costs and benefits of these initiatives, it is perhaps not surprising that CEOs and CFOs view with suspicion institutional investors who advocate that they “do more” for stakeholders. Respondents in our survey, for example, generally agree with the sentiments expressed by BlackRock CEO Larry Fink in his annual letter to portfolio companies, but his words appear to have very little impact on corporate activity. For example, a large majority (82 percent) agree with Mr. Fink that companies have a responsibility to address broad social and economic issues. They also agree with him (69 percent) that companies face pressure to maximize short-term pressure at the expense of long-term growth. However, the vast majority (87 percent) of CEOs and CFOs say his letter does not motivate them or only slightly motivates them to evaluate or implement new ESG initiatives.

This might be because executives believe they are already doing a satisfactory job of incorporating stakeholder concerns into their corporate planning. It might be because they are circumspect of Mr. Fink’s motivation. Or, it could be that ESG investment can only be profitably achieved in a more narrow scope of activities than Mr. Fink recommends. Different respondents expressed each of these sentiments.

Finally, it might be that companies are not responsive to activism by their largest investors because they do not believe their shareholder base as a whole cares about stakeholder interests. Only 43 percent of CEOs and CFOs believe their overall investor base cares about stakeholder interests, while 38 percent believe they do not (Figure 5).

Figure 5

“Do you believe that our largest institutional shareholders really care about the interests of these stakeholders?”

These survey results challenge the existing narrative that companies do not incorporate non-investor stakeholder interests into their long-term planning because they have a myopic view of profit maximization and underappreciate the potential of ESG-related activities. At the same time, they raise new questions about the real costs and benefits of these activities, and the processes by which internal and external constituents measure and monitor ESG performance.

ENDNOTE

[1] Rock Center for Corporate Governance at Stanford University, “2019 Survey on Shareholder versus Stakeholder Interests,” (June 2019), available at: https://www.gsb.stanford.edu/faculty-research/publications/2019-survey-shareholder-versus-stakeholder-interests.

Exhibit: Shareholder-Sponsored Proxy Proposals on Environmental, Social, and Political Related Topics

Note: According to Sullivan & Cromwell, the decline in shareholder-sponsored proxy proposals in 2018 was the result of higher direct engagement between companies and sponsoring shareholders.

Source: FactSet. Calculations by the authors. See also, Sullivan & Cromwell, “2018 Proxy Season Review” (July 2018).

Exhibit 2: ESG Ratings and Indices

| Data Provider | Inputs | Sample Categories | Highly Rated Companies |

| MSCI ESG | 37 key issues

1000+ data points 100+ specialized data sets Company disclosure Media sources |

Climate change

Pollution and waste Human capital Product liability Social opportunities Corporate behavior |

Microsoft

Ecolab Apple 3M Accenture Alphabet |

| HIP | >2 dozen metrics

Multiple data sources |

Health

Wealth Earth Equality Trust |

Advanced Micro Devices

HP Intel Medtronic Biogen |

| TruValue Labs | 26 categories (from SASB)

1M data points, monthly 300,000 ESG signals 115K data sources Media, NGO, watchdogs, journals, Twitter |

Environment

Social capital Human capital Business model Leadership / governance |

Unilever

Nextera Energy Ecolab BorgWarner Mahindra and Mahindra |

| Index Provider | Overview | Methodology | Highly Rated Companies |

| Barron’s 100 Most Sustainable Companies | Analyzes 1,000 largest publicly held companies, measured by market capitalization with headquarters in the U.S. | Based on public data and ESG ratings data: shareholder, employees, customers, planet, and community. | Top 5 companies 2018:

Best Buy Cisco Agilent Technologies HP Texas Instruments |

| Bloomberg Gender

Equality Index |

Distinguishes global companies committed to transparency in gender reporting and advancing women’s equality in the workplace. | Company voluntary disclosure in four areas:

Company statistics Policies Community engagement Products and services. |

Includes the following (2019):

Accenture Cisco JPMorgan Chase Robert Half Visa |

| Ethisphere Institute Most Ethical Companies | Recognizes companies for exemplifying and advancing corporate citizenship, transparency, and the standards of integrity. | Companies self-report data in five categories:

Quality of ethics programs Organizational culture Corporate citizenship Governance Leadership and reputation |

Includes the following (2019):

Colgate Palmolive Ecolab Hasbro Microsoft Visa |

| Newsweek Top Green | Assesses environmental performance of the world’s largest publicly traded companies | Based on public data and ESG ratings data: Transparency

Objectivities Public availability of data Comparability Engagement Stakeholder inclusion |

Top 5 companies 2018:

Cisco Systems Ecolab Hasbro PG&E Corp Seal Air Corp |

Source: Research by the authors.

Exhibit 3: Relative Importance of Stakeholder and Shareholder Interests

Source: Rock Center for Corporate Governance at Stanford University, “2019 Survey on Shareholder versus Stakeholder Interests,” (June 2019).

Exhibit 4: Short- and Long-Term Impact of ESG Activities

Source: Rock Center for Corporate Governance at Stanford University, “2019 Survey on Shareholder versus Stakeholder Interests,” (June 2019).

Exhibit 5: Institutional Investor View of Stakeholder Interests

Source: Rock Center for Corporate Governance at Stanford University, “2019 Survey on Shareholder versus Stakeholder Interests,” (June 2019).

This post comes to us from Professor David Larcker, the James Irvin Miller Professor of Accounting and Senior Faculty at the Rock Center for Corporate Governance at Stanford University, and Brian Tayan, a researcher in the center. It is based on the recent article they wrote with Vinay Trivedi and Owen Wurzbacher, “Stakeholders and Shareholders: Are Executives Really ‘Penny Wise and Pound Foolish’ About ESG?,” available here.

Sky Blog

Sky Blog