The 2019 proxy season was marked by an increased willingness among shareholders to hold boards accountable on director elections, say- on-pay, and environmental, social and governance (ESG) shareholder proposals. For example, almost 5 percent of directors received less than 80 percent support for her/ his election, which is the highest proportion since the aftermath of the financial crisis.1 This suggests that investors are beginning to hold boards accountable for failing to improve governance practices and integrate ESG considerations into their overall strategy and oversight responsibilities.

Election of Directors

The most notable example of investors holding boards accountable took place at companies lacking gender diversity at the director level. Looking at boards prior to proxy season, the number of S&P 500 companies with no female board representation was only 1 percent2; whereas nearly 25 percent of Russell 2000 companies still had no gender diversity at the board level prior to this year’s proxy season.3 This disparity between large-cap companies and mid- and small-cap companies was part of the impetus for the Nuveen Responsible Investing team’s “Women on Boards” engagement initiative, which began in 2018.

The campaign targeted approximately 470 mid- and small-cap companies, requesting that each company either add a female director or adopt a formal policy to emphasize diversity in the board’s nomination process. Since the start of the engagement initiative, more than one-third (180) of the companies added a female director to the board by the end of the 2019 proxy season. Nuveen’s engagement and follow-up also led to positive outcomes at an additional 115 companies. These companies committed to emphasize diversity in their nominating policy, initiate enhanced searches for diverse director candidates, and/or interview a female candidate for their next director.

For those remaining companies that did not take any positive steps to improve gender diversity, shareholders, including ourselves, voiced opposition via proxy votes – resulting in at least one director at 20 percent of the companies to receive less than 80 percent support during its 2019 annual meeting.

The emphasis on board diversity resulted in the highest proportion of newly added female directors in 2019 than in any year prior. For the S&P 500, 46 percent of new directorships were filled by women in 2019. The Russell 3000 (ex. S&P 500) saw a similar proportion at 45 percent.4

However, the growth in new female directors risks understating the gender gap that persists in the boardroom today; according to some studies, gender parity may still be more than 40 years away.5 Further, the low rate of board refreshment impedes the opportunity to increase female representation in the boardroom. While over one-third of companies included a new director nominee in 2019,6 almost one- quarter have a median director tenure of more than 15 years.7 Boards should maintain a boardroom culture and composition that empowers directors to challenge the company’s status quo.

Board Quality Case Studies

While board diversity and board refreshment were hot topics in 2019, the overarching focus of responsible investing requires a holistic analysis of board structure, operation and quality. Below are two examples where the Nuveen Responsible Investing team held companies accountable for failing to meet governance best practices.

Gender diversity not enhancing board discussions |

Board leadership sustaining the status quo |

| Overview: A real estate company included in our Women on Boards initiative added a female director in 2019. The appointee was a company insider, the niece of a board member and granddaughter of the company’s founder – who also holds the CEO and Chair positions.

Per our standards of independence, the appointment of an insider tipped the board to have less than a majority of independent directors. |

Overview: A shareholder proposal at an information technology company requested that the company separate the combined CEO and Chair roles. Currently, the company appoints a Lead Director, who is independent according to the exchange standards of independence, as a counterbalance to the combined CEO-Chair.

While the Lead Director can provide a structural counterbalance, part of the company’s annual board review requires each director to have a one-on-one meeting with the CEO/Chair only, rather than the Lead Director. The CEO/Chair then “shares insights” with the Lead Director, the Chair of the Governance Committee, and the full board in terms of board performance. |

| Board Quality Review: The appointment of a director with an inherent penchant to support management can limit diversity of thought in board discussions and further concentrate the authority of insiders, should any contentious issue be put to a vote. | Board Quality Review: Both the Lead Director and Chair of the Governance Committee are long-tenured directors, and the Lead Director also has a family member in an executive role. The company has made greater investments in share buybacks than R&D spending in recent years and has been underperforming its peers.

The CEO-Chair and the highly tenured group of directors have shown a resistance to making investments to keep up with industry changes. Board leadership should be challenging management and pushing for more change. |

| Outcome: We voted against the non-independent nominees up for election at the annual meeting. The nominees received less than 80 percent support – well-below the support received in previous years. | Outcome: We supported the shareholder proposal to require an independent board Chair. The proposal received over 40 percent support.

In 2016, the company had the same proposal on the ballot that received 33 percent support. At that time, Nuveen urged the company to appoint a Lead Director without any affiliation to the company. While this was a positive improvement at the time, such a structural change has proven an insufficient catalyst to change. |

Say-on-Pay

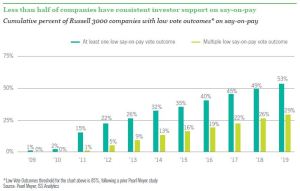

Opposition votes on say-on-pay proposals have also increased – approaching levels only seen following the financial crisis. Nearly 14 percent of say-on-pay proposals received less than 80 percent support. With 2019 marking ten years of say-on-pay voting, over half of the Russell 3000 (53 percent) have had at least one say-on-pay vote outcome with significant opposition and more than one-quarter (29 percent) have had multiple outcomes.8 With that said, in 2019 only 2 percent of say-on-pay proposals received less than majority support.

The December market dip highlighted the limitation in focusing pay-for-performance reviews on point- in-time outcomes. The stock market was in a very different state at fiscal year-end when compensation awards were finalized versus when 2019 voting decisions took place. Despite the market volatility and downturn in stock prices at the fiscal year end, CEO pay continued on its upward trajectory. The median pay for S&P 500 CEOs was $12.4 million, a 5.3 percent increase, while the median pay for Russell 3000 (ex-S&P 1500) CEOs was $2.8 million, a 11.1 percent increase.9

Compensation Case Studies

Compensation design is one of the most effective tools boards can use to promote alignment between management’s focus and shareholder interests. The majority of companies have adopted a structure for performance-based awards; however, there is little consistency in the metrics or targets for such awards. In response to the continued increase in pay, Nuveen’s Responsible Investing team currently works closely with portfolio managers to understand how performance metrics relate to a company’s value- drivers. Over the long-term, pay based on rigorous targets for value-creating metrics should align with performance — both rewarding executives for success and holding them accountable for shortcomings.

Below are two examples where the Responsible Investing team’s case-by-case review of the compensation plan design overrode our initial, quantitative-based pay-for-performance analysis.

Retention award aligned with long-term value

|

Compensation structure not aligned with shareholder interests |

| Overview: An information technology company granted its CEO a retention award with a fair market value of almost three-times the CEO’s annual total compensation, which triggered a pay-for-performance misalignment despite above- average performance over the past three years. | Overview: A recent IPO information technology company had its first say-on-pay vote.

The company has performed at the top of its peer group since its IPO date, with pay rising from the bottom to the upper quartile – more than two-times the median of its peers in 2019. Given the company’s performance, any standardized pay- for-performance screen would suggest there is pay and performance alignment. |

| Compensation review: The structure of the retention award was entirely performance-based and the associated stock price targets were rigorous. Unlike some of its industry peers, this company’s stock price reflected “quality” of earnings rather than growth projections. Therefore, achievement of the awards would align with significant and sustainable value- creation for shareholders.

The award would be vested over a five-year period, which was appropriate for the purpose of retention. As the company had recently expanded its business, the award also incentivized the CEO to focus on the long-term growth of new business rather than making short-term decisions. |

Compensation review: The compensation structure focused entirely on growth, which is important but provides no incentive for management to consider shareholder returns.

The short-term incentive award used revenue as its sole factor and lacked a threshold, target and maximum framework. Instead, the award paid out a proportion of total revenue at various revenue brackets, accounting for over 20 percent of total compensation and without a cap on total payments. The long-term incentive award had no performance metrics attached to it. Therefore, the plan offered no guidance on the drivers of value-creation and limited the ability to understand the board’s perception of management’s performance. |

| Outcome: We supported the say-on-pay proposal, which received 55 percent support. The stock price has improved almost 40 percent year-to- date and more than 60 percent since the compensation committee’s decision to grant the retention award. | Outcome: We voted against the say-on-pay proposal. The proposal received 96 percent support. While the company’s most recent quarterly filing showed a revenue increase of almost 30 percent year-over-year, its net income increase was 11 percent and earnings were up only $0.01 per share. |

Shareholder Proposals

For the third consecutive year, environmental and social proposals (E&S) voted on during the 2019 proxy season outnumbered governance proposals – with 454 E&S proposals compared to 367 governance proposals.10 For 2019, almost half (48 percent) of E&S proposals received more than 30 percent support.11 Furthermore, 10 proposals received majority

support on issues of: diversity (3); human rights (1); opioids (2); and political spending (4). However, no environmental proposal received majority support in 2019.

Alongside increased investor attention to these issues, companies are also recognizing the necessity for environmental and social disclosure, as nearly half of the submitted shareholder proposals (48 percent) were withdrawn after engagement between the proponent and the company.12 Proposals focused on sustainability reporting and climate change (43) were the most common to be withdrawn, followed by diversity proposals (25) and political spending proposals (13).

However, an agreement to provide additional disclosure does not always translate to the effective integration of environmental and social issues into the board’s decision-making process. Engagement is a necessary tool to hold the company accountable for its stated policies and goals, providing an opportunity to discuss key performance indicators and understand how the board and management oversee ESG performance. Investors with a robust engagement practice can require companies to discuss environmental and social risks on an annual basis, regardless of whether a shareholder proposal has been presented for vote at the annual meeting.

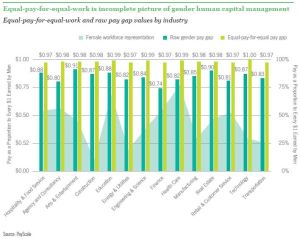

Spotlight on Gender Equity

On an equal-pay-for-equal-work basis, a majority of companies report a minimal gender gap or no gap at all. However, this methodology fails to address underrepresentation of women in senior positions, which limits the pipeline of women for executive or board roles. To help address this shortcoming in gender pay data, Arjuna Capital launched a shareholder campaign for 2019 that requests companies disclose the median, or raw, gender pay gap for its global workforce13.

Of the 12 proposals filed, one was withdrawn after the company provided the requested disclosure, and the other 11 went to a vote. The company that disclosed its raw gender pay gap reported a gap of 29 percent, compared to only 1 percent on an equal-pay-for- equal-work basis. For the remaining companies where the proposal went to a vote, three of the proposals received more than 30% support, and one additional proposal received more than 30% support excluding insider ownership. There were three other gender pay proposals filed by other proponents, two of which also received over 30% support. Overall, average support was approximately 25 percent for gender pay proposals during the 2019 proxy season.

Human Capital Management Case Studies

Along with the disclosure of the raw pay gap information, the Arjuna proposal also requested disclosure of “policy, reputational, competitive, and operational risks, and risks related to recruiting and retaining female talent.” These human capital management issues have been a focal point for the Nuveen Responsible Investing team. Below are examples of how Nuveen analyzed the gender-related human capital disclosures of companies targeted by the proposal.

Recruitment, retention and tracking successful human capital policies |

The need for continued engagement on gender accountability metrics |

| Overview: An information technology company disclosed a target for gender representation and a timeline for achievement. The company also disclosed both hiring and attrition rates for female employees, as well as year-over-year data on the representation of female employees among different seniority levels and technical roles.

Specifically, the company highlighted four root causes of the gender pay gap and noted the policies put in place to address each. The company also provided metrics on the success of those policies, such as an HR program that led to an improved retention rate for female employees. |

Overview: A financial company acknowledged to shareholders that “we have more women than men in entry-level positions and not enough women in senior ranks.” The company also disclosed that a record number of women were promoted to senior positions in 2019, and there was a consistent, upward trend in gender promotion.

The company adopted some innovative programs to support women in the workforce and disclosed many positive anecdotes from participants. However, the company provided no current metrics or future targets for gender representation across levels, nor did it disclose any success metrics for its gender-related human capital programs. |

| Human capital management review: The company had robust and quantitative disclosure of gender representation in its workforce, and recruitment and retention of female employees.

The company has committed to improve gender pay issues through new programs and resources, including supporting education programs designed to grow the future pool of female employees industry-wide. |

Human capital management review: The company demonstrated a general commitment to gender diversity in the workforce, but additional quantitative disclosure was needed to understand the human capital risks.

At the request of the company, the Nuveen Responsible Investing Team provided examples of disclosure from peer companies, frameworks created by consultants on human capital policies and reporting, and academic research on the related effects on gender representation in the workforce. |

| Outcome: We voted with management on the proposal, which received 30 percent support.

The company’s gap in female representation in technical roles and leadership has narrowed 3 percentage points over the past three years. |

Outcome: We voted for the shareholder proposal, which received 31 percent support and the company agreed to continued dialogue with our RI team to improve its disclosure. |

Where We Go From Here

As investors are increasingly holding companies accountable on ESG issues, the marketplace is beginning to scrutinize investors’ voting record and its congruity with their public positions on ESG issues as well. For example, counting the number of engagements is no longer sufficient proof of stewardship; instead, the marketplace is looking to elevate cases where engagement led to positive investment outcomes.

ENDNOTES

1 Source: ISS Early Review of 2019 Proxy Season

2 Post proxy season, for the S&P 500, the all-male board is now a thing of the past, with the last company in the index without a female director having appointed one in July – https://www.wsj.com/articles/the-last-all-male-board-on-the-s-p-500-is-no-longer-11564003203

3 Source: Conference Board Corporate Board Practices

4 Source: ISS US Board Diversity Trends 2019

5 Source: US Government Accountability Office Testimony before the House of Representatives Committee on Financial Services regarding Strategies to Increase Representation of Women and Minorities

6 Source: ISS US Board Diversity Trends 2019

7 Source: Conference Board Corporate Board Practices

8 Source: Pearl Meyer Ten Years of Say on Pay

9 Source: ISS Executive Compensation Proxy Season Update May 3, 2019 Newsletter

10 Source: ISS Early Review of 2019 Proxy Season

11 Source: ISS Early Review of 2019 Proxy Season

12 Source: ISS Early Review of 2019 Proxy Season

13 Arjuna modeled its disclosure request after the mandatory disclosures on gender pay equity required in the UK.

This post comes to us from Nuveen. It is based on the firm’s memorandum, “2019 Proxy Season Review — Shareholder votes signal rising demand for stronger board oversight of ESG issues.”

Sky Blog

Sky Blog