For almost two years, Argentina has been facing a severe economic recession and has not had the ability to access international capital markets. This has been due to several factors, including a general capital flight from emerging markets following the U.S. Federal Reserve’s interest rate hikes throughout 2018, and the country’s persistent fiscal deficits and macroeconomic imbalances. The crisis moreover comes at a time when the risk of a global economic slowdown has sharply increased.

All of this has left Argentina vulnerable to a sovereign debt crisis. The president elect, Alberto Fernandez, has stated that once he takes office the country will attempt to solve its sovereign debt issues quickly and without seeking a haircut for creditors. Fernandez announced he would follow Uruguay’s model, which restructured approximately $5.4 billion in public debt in 2003 by extending the maturities of the outstanding bonds. In IMF jargon, such maturity extension would be called “debt reprofiling” and implies that principal and interest payments are merely postponed rather than reduced. Fernandez has also publicly voiced his confidence that “there will be no difficulties to achieve [a debt reprofiling]” and that “[a reprofiling] will save time and there won’t be discounts.”

To recap, Uruguay extended the maturity date of 18 bonds issued in international markets by five years, while leaving coupon rates and principal payments untouched. The maturity extension resulted in an average discount of 12.2 percent, which was one of the lowest in the history of sovereign debt restructurings. By comparison, Argentina’s 2005 restructuring imposed a 73 percent haircut on sovereign bondholders. Unsurprisingly, commentators have already cast doubt on Fernandez’s announcement that following Uruguay will do the trick for Argentina. As Yeyati notes, there is an inherent trade-off between size and time: “while a quick negotiation may fall short of what is needed to ensure solvency, a slow negotiation may delay a rebound and deepen the economic damage.”

Against this backdrop, here are some of the key legal challenges that Argentina’s leaders will have to confront in a possible (deep) debt restructuring and some possible ways to resolve them.

Argentina’s Current Sovereign Debt Stock – An Overview

According to the latest government statistics, Argentina’s total outstanding debt totals $337 billion, or 80.7 percent of GDP (the amount varies depending on the peso-dollar exchange rate, since a relevant portion of such debt is short-term and denominated in pesos).[1] Of the government’s total financial obligations, 58 percent are denominated in U.S., dollars, 13.8 percent in Argentine pesos, 6.5 percent in euros, and 12.0 percent in other currencies (including the IMF’s Special Drawing Rights).

Argentina has a complex financial indebtedness structure that includes the following:

- Domestic debt,

- International sovereign bonds,

- IMF loans, and

- Credit facilities with multilateral and commercial financial institutions.

Domestic debt

According to the latest statistics by the Argentine Treasury, 23.2 percent of the total debt stock (excluding IMF loans) is denominated in domestic currency. Argentina has, according to Reuters, already delayed the repayment of some of its domestic debt. Domestic-currency debt is typically held by local residents and institutional investors, and, as I describe below, there are fewer legal risks associated with the restructuring of such obligations.

International sovereign bonds

The bulk of Argentina’s international sovereign bonds (debt denominated in foreign currency) was issued in or after 2016, given that Argentina settled much of its foreign-currency bond indebtedness that year. In total, the amount of outstanding international sovereign bonds is approximately $206 billion. Since the Macri administration took office in 2016, Argentina has issued a total of 54 new international sovereign bonds with a total issued amount of $169 billion in three different currencies (U.S. dollar, euro, Japanese yen) and under three different governing laws (New York law, Argentine law, Japanese law).

| Outstanding international sovereign bonds | |||

| Currency | Number of bonds | Total issued amount (in million U.S. dollar) | Governing law |

| Foreign-currency bonds issued by Argentina before 2016 (“Kirchner bonds”)[2] | |||

| U.S. dollar | 14 | 54.250 | New York law |

| Euro | 6 | 32.674 | English law |

| Japanese yen | 5 | 104 | Japanese law |

| Sub-total | 25 | 87.028 | – |

| Foreign-currency bonds issued by Argentina since 2016 (“Macri bonds”) | |||

| U.S. dollar[3] | 44 | 78.697 | New York law |

| U.S. dollar (“Bonar bonds” | 3 | 13.237 | Argentine law |

| Euro | 5 | 27.220 | New York law |

| Japanese yen | 2 | 119 | Japanese law |

| Sub-total | 54 | 119.273 | – |

| Total | 79 | 206.301 | |

Source: Bloomberg

IMF loans

On June 20, 2018, the IMF Executive Board approved a 36-month Stand-By Arrangement (SBA) for Argentina with an amount of $50 billion, which was expanded on October 17 to a total amount of $57 billion. Under an SBA, the IMF provides financial assistance by way of a currency swap that is due within three-and-a-quarter to five years of disbursement against certain macro-financial conditions approved by the IMF executive board and accepted by the borrower country in the Letter of Intent. Argentina’s IMF program is subject to 12 reviews between September 2018 and March 2021, and after each review the fund decides whether to allow disbursement of additional funds under the SBA. The fund completed its fourth review in June 2019, allowing the disbursement of another $4.3 billion, bringing total disbursements since June 2018 to USD44.1 billion, equaling more than three quarters of the amount available under the SBA ($57 billion).

Credit facilities with multilateral and commercial financial institutions

Bloomberg data on multilateral, bilateral, and commercial loans denominated in U.S. dollars seem somewhat less reliable and incomplete than bond data. Putting aside some uncertainties relating to data-quality, the total outstanding amount of U.S. dollar loans, excluding IMF loans, stands at approximately $17.2 billion.

Debt maturities

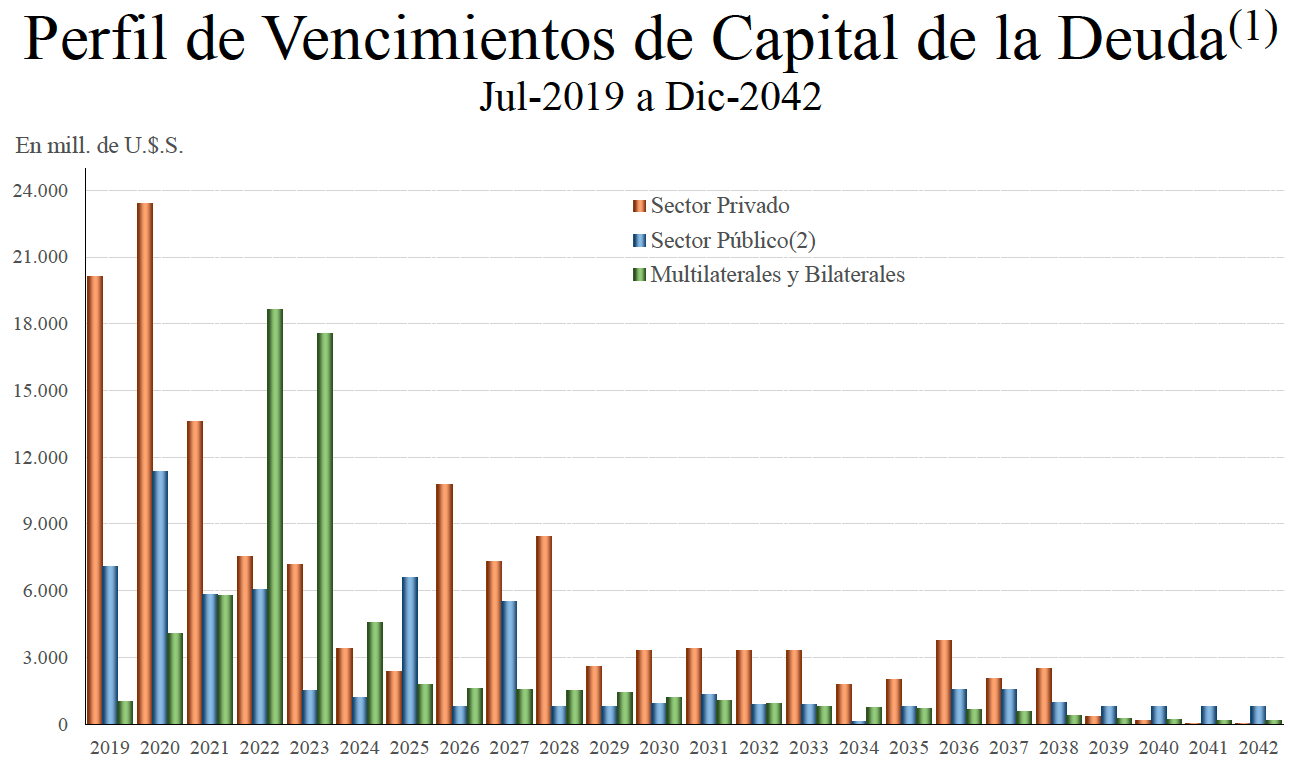

The chart below from the Argentine Treasury shows that Argentina faces relatively high repayment obligations in the near future.

Source: Argentine Treasury

Legal Aspects and “Restructurability” of the Debt Stock

Domestic debt

Argentina has issued a significant amount of bonds governed by local law, many of them with relatively short maturities. The reprofiling or restructuring of local law bonds, can rarely be successfully challenged in court – not least since domestic judges tend to be more sympathetic to the government’s interests. Moreover, Argentine local-law bonds include none of the creditor protection clauses that are typical for sovereign bonds issued on international markets, such as collective action clauses (CACs), negative pledge clauses, cross-default clauses, or pari passu clauses.

One important implication of this is that a potential restructuring of Argentina’s international sovereign debt would not trigger any rights to accelerate domestic bondholders, and vice versa. Thus, while restructuring local-law bonds may raise delicate domestic political and economic trade-offs, the legal risks associated with such measures appear controllable.

International sovereign bonds

Governing law

The majority of Argentina’s outstanding international sovereign bonds are governed by New York law. Yet, as Table 1 above shows, a significant amount of euro-denominated debt issued before 2016 is governed by English law. While legal risks must be considered against the backdrop of both New York and English law, litigation is likely to be concentrated in New York courts, given that they are generally viewed to be creditor-friendly.

Collective Action Clauses (CAC)

Considering that both maturity extensions as well as haircuts on principal or coupon repayments require contractual changes, Argentina will need to hold a bondholder vote under the respective collective action clause (CAC) procedures laid down in Argentina’s various bond prospectuses. CACs allow a country to call a bondholder meeting and let a supermajority decide on a debt restructuring proposal by the country. I subsequently discuss three key issues that are likely to arise in the context of a CAC-based restructuring: (i) different CAC models, (ii) pooling options, (iii) the uniformly-applicable requirement.

First, one complication, as identified by Bloomberg, Gulati and Weidemeier, and Anna Gelpern, relates to the fact that Argentina has some legacy bonds outstanding that were issued in the debt exchanges in 2005 and 2010, respectively.[4] These legacy bonds have been referred to as “Kirchner bonds” (the name of the former Argentine President Cristina Fernández de Kirchner). The CACs in the Kirchner bonds have different voting thresholds than the bonds issued after 2016 (“Macri bonds”). While Kirchner bonds require affirmative votes of 85 percent of bondholders across all series as well as 66⅔ percent in each individual series, Macri bonds allow for a single-limb modification that requires only one affirmative vote by 75 percent of bondholders across all series. Bloomberg reports that holdout investors are targeting Kirchner bonds because it would be harder for the government to surpass the thresholds set out therein. This has led to a price differential between the two types of bonds. If Argentina were to aim at a wholesale debt restructuring, it ought to consider the different voting thresholds in Macri and Kirchner bonds by employing all available tools to garner sufficient majorities in all Kirchner bond series.

Source: Bloomberg

Second, as recommended by the new ICMA Model CAC, the Macri bond prospectus allows Argentina to “designate which series of debt securities will be included for approval in the aggregate of modifications affecting two or more debt securities.” This provision is also referred to as a “pooling clause,” as it essentially enables the issuer to sub-aggregate certain series of bonds into various voting pools in which at least two different series must be pooled together. By putting apples in one basket (e.g. bonds with 3-4-year maturities) and pears in another (e.g. bonds with 25-30-year maturities), a larger crowd of investors may be willing to vote in favor of the debt restructuring. Voting takes place exclusively within the pools, and, besides the requirement to disclose the design of the various pools, there are no legal limits for the issuer as to the pools’ structure. The success of pooling is predicated on the bondholders’ approval – when it comes to pooling, the biggest obstacle will thus not be legal but transactional.

Third, the CACs in Argentina’s debt stock stipulate that restructuring offers made by Argentina to bondholders needs to be uniformly applicable to holders of debt securities affected by the modification. The “uniformly applicable” requirement applies in the context of a single-limb vote across all series, and – as stated in the Macri bond prospectus – if Kirchner bonds are modified together with Macri bonds. Gelpern and Gulati and Weidemeier have offered apt and insightful explanations of how the uniformly applicable requirement may affect the design and success of an Argentine debt restructuring. Generally speaking, the uniform applicability concept does not require equal Net Present Value (NPV) reductions but rather that investors be offered (i) the same new instruments or (ii) new instruments from an identical menu of voting options. Ultimately, calibrating the uniformly applicable requirement in a litigation-proof fashion will be the crux any Argentine debt workout operation.

Pari passu clauses

The pari passu clause in Argentina’s old New York law bonds played a central role in what the Financial Times considered the “sovereign debt trial of the century.” In 2012, New York courts held that pari passu meant that all creditors, regardless of whether they participated in a restructuring or held out, needed to be paid in equal steps. That allowed holdouts to demand the full-face value of their bonds. All Macri bonds feature the new ICMA pari passu clauses, which expressly reject the interpretation that the New York courts entertained. To be sure, the pari passu clauses in the Kirchner bonds are remarkably similar to the clause[5] that holdouts successfully leveraged against Argentina in New York courts in the NML v. Argentina case.

In Argentina’s favor is that, in October 2019, the Second Circuit effectively overturned its previous pari passu decision and stated that a sovereign only violated the pari passu clause if it acted in a “uniquely recalcitrant” manner. It will not violate this clause if it simply pays some creditors and not others (selective default). Thus, as Buchheit and Gulati have explained, the government will be sufficiently protected from pari passu litigation if it abstains from using legislation to deter holdout behavior, such as the infamous “Lock Law” that explicitly subordinated payments to holdouts.

Cross-default clauses

Cross-default clauses enable a certain percentage of bondholders, 25 percent in the case of Argentina, to accelerate the maturity of a debt security if an event of default in any of the other outstanding bond series is triggered. Specifically, according to the prospectuses of both Macri and Kirchner bonds, cross-default may only be called if Argentina defaults on its “Performing Public External Indebtedness”. Thus, any debt restructuring operations that do not involve international sovereign bonds are irrelevant in the context of cross-default clauses.

Official-sector debt

IMF loans

In its function as an official-sector creditor and lender-of-last-resort to sovereigns, the IMF enjoys de-facto preferred creditor status (PCS). Thus, while the IMF’s Articles of Agreement make no reference to the fund’s PCS, states have accepted the IMF’s de-facto priority for decades. Indeed, rather than a legal challenge, reneging on IMF debt is likely to trigger vigorous political reactions from the IMF’s members and may thus severely erode the international community’s willingness to provide further financial assistance to the country in distress.

One interesting aspect in this context is that neither the IMF’s stand-by agreement (SBA) nor the international sovereign bonds include cross-default provisions. Thus, if Argentina were to default on its international sovereign bonds, the IMF could not accelerate its repayments – rather its Lending-Into-Arrears Policy would come into play. By the same token, if Argentina were to default on its IMF loans, it would not allow private creditors to accelerate future interest and coupon payments.

International financial institutions (IFIs)

The World Bank and the International Finance Corporation, as multilateral lenders, also enjoy de-facto PCS. To the best of our knowledge, there are also no cross-default clauses in the loan agreements signed with IFIs. As mentioned in the context of IMF loans, if Argentina were to delay its payments to IFIs, it would not automatically allow private bondholders to declare an event of default and accelerate their claims.

Conclusion

The new Argentine administration finds itself between a rock and a hard place. Argentina owes money to different types of creditors, including more than $200 billion to international creditors and roughly $45 billion to the IMF. Given that the latter enjoys a de facto preferred creditor status, any debt restructuring is likely to include international sovereign bonds. Debt workouts involving instruments governed by the laws of foreign jurisdictions and adjudicated by foreign courts are, inherently, more challenging for the government than local-law debt. Foreign courts are, in the vast majority of cases, more reluctant to prioritize a foreign sovereign’s interests over bondholders’ property rights.

Modern sovereign bond restructurings rest on the basic premise of bondholder democracy. In other words, as long as a sufficient majority of creditors accepts a restructuring offer, most legal obstacles can be overcome. To be sure, the entrance of specialized distressed-debt managers into the market suggests that some investors will gamble for a better deal or try to leverage their contractual rights in a holdout. elevated.

Argentina may nonetheless be in a legally superior position to the one it was in during its last debt crisis. Not only have CACs become more resilient to nasty holdout tactics, U.S. courts have, at least partially, reversed the unconventional rulings that brought Argentina to its knees in 2014.

ENDNOTES

[1] In my analysis of Argentina’s indebtedness levels as well as its debt structure, I rely primarily on Bloomberg data [and publicly available data provided by the Argentine government]. While I cannot guarantee the completeness of the dataset available on Bloomberg, it is certainly the most reliable and comprehensive source available. For the determination of the governing law, I draw on the publicly available information of the Luxembourg Stock Exchange.

[2] Most of these bonds were issued as part of the 2005 or the 2010 debt exchanges. The data excludes bonds on which Argentina has defaulted.

[3] This includes short-term Treasury bills.

[4] See above Table 1 for an overview of the outstanding international sovereign debt.

[5] The clause in the Kirchner bonds stipulates the following: “The debt securities will be direct, unconditional, unsecured and unsubordinated obligations of Argentina and will rank pari passu and without preference among themselves. Argentina’s payment obligations under the debt securities will rank at least equally with all its other present and future unsecured and unsubordinated External Indebtedness.”

This post comes to us from Dr. Sebastian Grund, an LLM student and research assistant at Harvard Law School and a former legal adviser to the European Central Bank. A longer version of the post is available here.

Sky Blog

Sky Blog