The value and relevance of environmental, social, and governance (ESG) is an important question because of the increasing popularity of using ESG factors to evaluate investments in companies.

In August 2019, for example, the Business Roundtable, which includes nearly 200 major-company CEOs, released a statement that a corporation’s concerns should go beyond shareholder value and include sustainability and other societal benefits. By 2019, the total assets under management (AUM) of signatories to the United Nations Principles for Responsible Investment have grown from just a few hundred-billion dollars to more than $90 trillion – almost three times the market capitalization of companies in the United States.

But research to date on how ESG relates to financial returns has been inconclusive and even contradictory.

My co-author, Kyle Welch, and I performed a study comparing corporate ESG, employee satisfaction, and financial returns. Employee satisfaction has also been linked to positive financial impact but has rarely been studied with ESG.

We found that while ESG alone showed no impact on returns, and employee satisfaction had a small positive effect, the combination of these factors yielded the largest impact on firms’ share value and financial performance.

In a previous study, my co-authors and I showed a link between ESG and share value when firms invest in ESG initiatives that align with their core business (i.e., sector level materiality).

To build on this finding, we examine the intersection of ESG and employee satisfaction, a well-supported predictor of positive stock returns. In particular, we explore whether ESG efforts instill a deeper sense of purpose in employees, boosting productivity and, ultimately, returns.

We collected MSCI data on ESG ratings (related to 10 areas including climate change, human capital, and governance) and Glassdoor data for employee satisfaction for 8,884 firms-years between 2011-2018. We then compared an investment-portfolio comprising companies with high ratings on both ESG and satisfaction to other portfolio compositions on one-year-ahead stock performance and other measures including sales and profits.

What we found sheds much-needed light on the connections among ESG, employee satisfaction, and financial value.

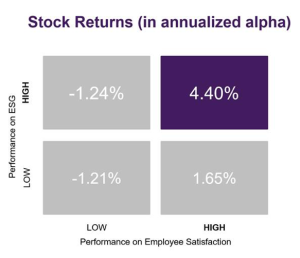

First, we showed that neither ESG practices nor employee satisfaction is sufficient to maximize value. In fact, we found that using ESG alone as an investment signal resulted in no meaningful improvement in returns. Using employee satisfaction alone yielded 2.4 percent higher returns.

But the combination of ESG and employee satisfaction had a large effect.

The portfolio of stocks with top ratings in both ESG practices and employee satisfaction generated 4.40 percent alpha per year, outperforming the portfolio with the lowest ratings in both categories that generated alpha of -1.21 percent by 5.61 percent per year. In essence, we found that implementing meaningful ESG and promoting employee engagement and satisfaction together improve financial returns of every type (see below).

We also find that high-ESG/high-satisfaction companies enjoyed not only higher stock returns but also enhanced operating performance (sales and net income growth) compared with others.

We also note that the correlation between ESG Score (or even Social Score by itself) and employee satisfaction is close to zero. People often confused the “S” of ESG with employee satisfaction. However, in our dataset, Social Score and employee satisfaction are capturing very different things.

Practical Implications

Our findings show that corporations need employee buy-in to make their ESG initiatives work, and strong ESG efforts can yield more engaged, satisfied employees if people feel their employer’s values align well with their own. That satisfaction, in turn, could enhance productivity, ultimately boosting returns.

In line with this logic, it’s important to pay special attention to the “S” in ESG: social, or the people part. Indeed, most of the return effect we found was generated by firms’ socially-focused investments. Companies that strive to treat employees, customers, and other stakeholders well – through focus on diversity, inclusion, and equal treatment of others – are more likely to reap the rewards of their ESG initiatives.

This post comes to us from professors Kyle Welch at George Washington University and Aaron S. Yoon at Northwestern University. It is based on their paper, “Corporate Sustainability and Stock Returns: Evidence from Employee Satisfaction,” available here.

Sky Blog

Sky Blog