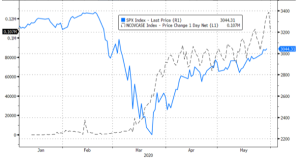

From its February 2020 peak to a March 2020 trough, the S&P 500 index fell 34 percent. This fall was accompanied by extreme volatility, at a level last seen during the global financial crisis. Invariably the selloff was accompanied by media speculation about the onset of another Great Depression. However, the incidence of COVID-19 cases during most of this selloff was not yet at extreme levels, as evidenced by Exhibit 1 below.

Exhibit 1: S&P 500 index and incidence of global COVID-19 case counts, as reported by the Johns Hopkins COVID-19 dashboard. Source: Bloomberg.

So what drove the precipitous market decline? Surely it was in part a rational anticipation of future COVID-19 cases and the associated impact on the economy and on society more generally. An article in the Wall Street Journal on June 12, 2020, for example, details a January 31 meeting where a medical expert from the Wellcome Trust warns investors that the upcoming medical crisis would be surprisingly severe. Yet innumerable headlines from the time of the selloff described market and economic conditions in extreme terms. For example, one from the Washington Post stated on March 9 that “A market crash was coming, even before coronavirus,” in effect attributing the selloff to years of easy monetary policy. Similarly dire headlines appeared in The New York Times, CNN, and other national publications. Investors might be forgiven for not wanting to own stocks during such inauspicious times. Might such headlines have played a large role in the extreme market volatility during February and March?

To investigate this question in a systematic way, I analyze the 72,263 Reuters news articles that mention the terms “coronavirus” or “COVID-19” between January 17 and the end of April 2020. From these articles, I derive 14 measures of news coverage surrounding the coronavirus pandemic. Twelve of these categorize the sentiment of news coverage across specific topics, such as news about credit markets, news about sports, or news about the health impact of the disease. Two look at aggregate news sentiment and the standard deviation of sentiment across all news stories written in each day. I then analyze how these measures of news flow interact with five market indices: the S&P 500 stock market index, the VIX volatility index, an index tracking the performance of high-yield bonds, and two- and 10-year Treasury yields.

During this early phase of the coronavirus crisis, markets and the news media were both highly focused on understanding the near-term progression of the disease. The question was whether any of the five market indices or 14 news measures were able to predict future COVID-19 case counts. I find that all five market indices are highly correlated with cases that occur two to four weeks in the future, thus confirming that markets are forward looking, even, as in this case, during periods of extreme volatility. I also find that several of the news measures anticipated future case counts. For example, news about central banks, credit markets, the corporate and government sectors, and sports are all highly correlated with case incidence up to a month in the future. Other news series, however, are not.

I then study the contemporaneous relationship between markets and news. In the early part of the sample, markets are very sensitive to contemporaneous news. Negative news is strongly related to lower market prices. However, markets are more sensitive to news that proves inaccurate about future cases than to news that proves accurate. News related to markets, health, Europe, and aggregate news sentiment all drive contemporaneous market responses yet prove to be inaccurate about future case incidence. Furthermore, I document that markets react more to news, even inaccurate news, on days of high market volatility. This is volatility for volatility’s sake: markets move a lot not because news is more volatile, but because market volatility is high. I refer to this as hypersensitivity.

To better understand the dynamics of the markets-news relationship, I investigate how day t market action affects day t+1 news, and vice versa. In the early part of the sample, markets and day-ahead news are tightly connected. Lower market prices today prompt negative news the following day[1] across most of my news measures. Tomorrow’s bad news, as I have already shown, then leads to lower markets tomorrow, which in turn causes bad news the day after tomorrow. The markets-news cycle thus amplifies negative shocks. At the same time, day t news predicts day t+1 market price action but very frequently in the direction opposite to the contemporaneous market response. Thus, a piece of news that causes lower markets today often predicts a move tomorrow that either fully or partially reverses the contemporaneous markets-news response. This is evidence of market overreaction to contemporaneous news.

I document that the markets-news relationship undergoes a structural break in the middle of March. The hypersensitivity and overreaction of markets stop and are replaced by a more “normal” markets-news regime that prevails from mid-March to the end of April. In the late subsample, markets are more sensitive to news that proves to be accurate about future disease incidence, and there is much less evidence of either hypersensitivity or overreaction. I speculate that a robust monetary policy response caused the structural break, which suggests an additional channel for how central banks can influence markets: Strong monetary policy response can push the markets-news equilibrium from a stressed to a more normal state.

Aspects of the markets-news relationship during the COVID-19 crisis can be explained by the theoretical analysis in Glasserman, Mamaysky, and Shen (2020), who argue that extreme media scrutiny can push markets into a high-volatility, low-price state, which in turn invites more media scrutiny. In the model, such states are characterized by prices that are extremely sensitive to fundamentals and that have high risk premia. Part of the markets’ response to the global coronavirus pandemic appears to stem from this kind of news-induced extreme sensitivity, apparently an unintended consequence of a highly active news sector.

ENDNOTE

[1] In the statistical sense of Granger causality.

This post comes to us from Professor Harry Mamaysky at Columbia Business School. It is based on his recent paper, “Financial Markets and News about the Coronavirus,” available here.

Sky Blog

Sky Blog