My article, Enforcement Against the Biggest Banks, takes a census of the hundreds of enforcement actions by American regulators against the world’s largest banks between the passage of Dodd-Frank in July 2010 and December 31, 2016, near the end of the Obama administration. The effort allows us to characterize the nature of contemporary American bank enforcement.

Enforcement against big banks can be “cumulative” – increasingly, multiple agencies penalize banks for the same misconduct. One regulator might view the misconduct as, say, a violation of public disclosure duties, but another regulator might see it as a problem with the safety and soundness of the bank. This cumulative approach to enforcement is analogous to the behavior of a wolf pack. Enforcement against banks can also be “viral” – action against one for certain misconduct is correlated with action against others for the same kind of misconduct. Finally, for many regulators, particularly the Department of Justice and the Securities and Exchange Commission, such enforcement can be “comprehensive” – one action bundles together a variety of similar sorts of misconduct in a settlement of all the violations of a particular statutory provision across a bank.

We can see the importance of these cumulative, multi-agency enforcement actions by looking at the number of times during the Obama administration that enforcement actions were announced on the same day, a quirky but interesting measure.

We can also consider whether certain types of banks are targeted most frequently. In particular, as I ask in the article, is there discrimination against foreign firms? Is there discrimination in favor of large banks? In the United States, do large banks face more regulatory risk from their direct supervisors or from other regulators?

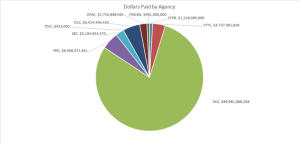

The largest banks, though holding a disproportionate share of the assets of all banks, account for less than 1 percent of enforcement actions. However, the largest banks pay a higher proportion of fines than do community banks. Large foreign banks have been subject to the same number of enforcement actions as large domestic banks – even though domestic banks hold a much larger share of the American market. Significance testing does not suggest that American regulators are disproportionately likely to launch enforcement actions against foreign banks, however. The largest domestic banks have paid the most in penalties as a percentage of their total assets to American regulators. Perhaps most notably, the Department of Justice dwarfs all other regulators when it comes to imposing fines on big banks.

The DOJ has imposed approximately 80 percent of the monetary penalties and settlements paid by big banks in the wake of the passage of Dodd-Frank. DOJ’s 64 enforcement actions resulted in approximately $100 billion worth of penalties imposed on big banks, almost always through settlement. Bank of America paid almost $30 billion to settle cases with the department in the wake of the financial crisis, BNP Paribas paid over $18 billion, and JPMorgan paid almost $15 billion.

We do not know exactly what nonfinancial sanctions the banking regulators have imposed on the largest banks – many of those sanctions, including some of significant size and scope, are not publicly available. We can say, however, that large banks cannot avoid worrying about the regulatory risk from secondary regulators, especially the Department of Justice. Where financial penalties are concerned, DOJ is just about only regulator worth worrying about.

There is no question that the regulatory risks facing big banks have become fragmented, and it is probably the case that our regulatory system should be simplified with a reduction in the number of regulators – at the very least, it is not clear why the three banking regulators and two market regulators have been kept apart. But understanding the nature of the regulatory environment for big banks involves an understanding of enforcement as it is actually practiced. My paper offers that understanding.

This post comes to us from Professor David Zaring at the University of Pennsylvania. It is based on his recent article, “Enforcement Against the Biggest Banks,” available here.

Sky Blog

Sky Blog