The market for cryptoassets is burgeoning, as distributed ledger technology transforms capital and financial markets. With the extraordinary growth in the crypto-markets comes the need for regulation to promote efficiency, capital formation, and innovation while protecting investors. With the need for regulation comes enforcement.

In a new article, Crypto-Enforcement Around the World, we elaborate on these issues and report on the results of an international enforcement survey conducted by our Blockchain and Fintech Research Program. Our analysis also builds on the results of the research by one of the co-authors, Prof. Guseva, in her article, The SEC, Cryptoassets, and Game Theory.

We researched some 23 financial market jurisdictions, only 14 of which had either commenced enforcement actions or issued official warnings. We completed the survey this summer and are currently working on the next steps – the most immediate of which will be assessing the impact of enforcement on markets and innovation.

We find that the United States Securities and Exchange Commission (“SEC” or “Commission”) brings more enforcement actions against digital-asset issuers, broker-dealers, exchanges, and other crypto-market participants than do regulators in most other major jurisdictions combined. SEC enforcement also entails more serious penalties. In addition to the review of the international data, we provide detailed comparisons of the United States Commodity Futures Trading Commission (“CFTC”) and SEC actions. Whereas SEC enforcement has been relatively stable, the CFTC cases have been trending upwards. By contrast, enforcement in foreign jurisdictions seems to be subsiding.

We looked into multiple case classifications and highlight here only a few key findings. Figure 1 shows that most enforcement actions across the world, including light-touch warnings, clustered around 2018 and have subsided since. 2018 was a very active year for regulators. The only rising trend line in 2020 denotes CFTC enforcement. This may be because SEC enforcement in 2017-2019 was already strong. If SEC enforcement is the baseline, the CFTC, which is the smaller agency of the two, is catching up.

Figure 1 – Total Actions

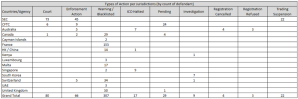

Table 1 demonstrates that, except the United States and only a few other countries, most jurisdictions have pursued a lenient enforcement approach in crypto despite the media attention and press releases stating their intentions to harshly pursue any violations of law. The cases in the United States predominantly involved administrative and court proceedings.

Table 1.1 – Type of Action per Jurisdiction (By Defendants/Respondents)*

* This Table provides data on multi-defendant actions.

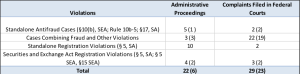

Table 2 shows the Commission’s “venues of choice.” The SEC initiated more crypto-related cases in federal district courts than in administrative actions. Overall, complicated and more salient cases involving the antifraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934 were more often brought in court, which is in line with the findings of previous scholarship.[1]

An important distinctive feature of crypto-enforcement is that the SEC often brings cases not only against entities operating in the cryptoasset markets but also against the individuals behind these firms, including directors, officers, and founders. The figures in parentheses in Table 2 indicate the number of insiders charged in administrative and court cases.

Table 2 – SEC Cases: Federal Courts and Administrative Proceedings*

* “SA” stands for the Securities Act of 1933; “SEA” stands for the Securities Exchange Act of 1934.

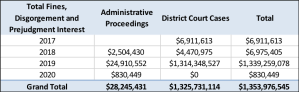

The penalties and disgorgement sought by the SEC were considerable, with the higher amounts received in the cases filed in federal district courts.

Table 3 – Penalties and Disgorgement in SEC Cases

These sums are skewed because of the $1,224,000,000 disgorgement and the $18,500,000 civil penalty against Telegram.[2] However, even without that case, the total civil penalties and disgorgement of ill-gotten gains obtained in court were almost three times higher than those in administrative proceedings.

We cannot rule out the possibility that the SEC and the CFTC have become active enforcers because of the sheer size of the United States financial markets. Yet, this explanation is incomplete. For instance, Singapore had a sizeable share of initial coin offerings (“ICOs”), which were a focus of SEC enforcement efforts in 2017-2019. However, Singapore does not seem to have a similarly intensive enforcement program. We would like to avoid drawing unnecessarily far-reaching conclusions. Instead, our findings suggest that crypto-markets represent an important case study that merits further research.

Our data raise theoretical questions on regulation via enforcement, its effect on financial innovation, and regulatory competition. For one, the United States does not have a regulatory framework designed for crypto-markets, which effectively creates a pure regulation via enforcement environment. Regulation by enforcement, rather than substantive rulemaking in accordance with the Administrative Procedures Act, assumes that the pre-crypto rules are appropriate for complex technological innovations and that it is unnecessary to engage in a notice of rulemaking, comments, and a cost/benefit analysis to determine their suitability – or the need for a different regulatory regime.

Moreover, to the extent that the Commission pursues actions not only against domestic companies but also foreign issuers that raise only part of their capital from United States investors, its actions affect global crypto-markets and raise regulatory competition concerns. National enforcers, such as the SEC and the CFTC, could refer cases to their foreign counterparts. Both the SEC and the CFTC, for instance, rely on international soft law and the expanding framework of Memoranda of Understanding (“MOUs”), the Multilateral MOU among securities regulators, the International Organization of Securities Commissions (“IOSCO”), and various cooperative arrangements. This, however, does not seem to be the case in crypto.

Our findings confirm the previous comparative research that suggests – at least with respect to the SEC – that the U.S. has one of the most active securities and financial law enforcement agencies in the world. It has long been acknowledged that “intensity of enforcement [in securities regulation] may be the factor that best distinguishes the United States from other market centers.”[3]

On the one hand, it is important to acknowledge that investors need to be protected from infinitely ingenious financial entrepreneurs, including crypto-firms. On the other hand, regulation of emerging, technologically innovative capital markets through enforcement risks stifling innovation and driving capital and investors to other jurisdictions, particularly if the methods employed were developed for significantly different investment products at a much earlier time.

A pertinent example of these reactions is the recent restrictions imposed on U.S. investors’ access to a major global exchange. The potential pitfalls of the SEC’s regulation-by-enforcement of cryptoassets are also illustrated by recent cases such as SEC v. Telegram Group, Inc.[4] Following the decision, Telegram discontinued its promising innovative project, citing the preliminary injunction entered by the court and complaining about the extensive extraterritorial application of U.S. law to foreign parties.

SEC enforcement may lead to a positive outcome, such as taming fraud and channeling an unruly fast-evolving market towards a more orderly infrastructure. The counter-arguments to this approach range from the procedural requirements of administrative law and dictating policies through enforcement to the possible obsolescence of the enforced rules, which leads to wasteful compliance. Our data call for more research on the effect of regulation and enforcement on the global cryptoasset markets.

ENDNOTES

[1] For an analysis of SEC enforcement patterns, see, e.g., Stephen J. Choi & A.C. Pritchard, The SEC’s Shift to Administrative Proceedings: An Empirical Assessment, 34 Yale J. on Reg. 1 (2017).

[2] Press Release, U.S. Sec. & Exch. Comm’n, Telegram to Return $1.2 Billion to Investors and Pay $18.5 Million Penalty to Settle SEC Charges, 2020-146 (June 26, 2020), https://www.sec.gov/news/press-release/2020-146.

[3] John C. Coffee, Jr., Law and the Market: The Impact of Enforcement, 156 U. Pa. L. Rev. 229 (2007).

[4] SEC v. Telegram Grp. Inc., No. 19-cv-9439 (PKC), 2020 U.S. Dist. LEXIS 53846 (S.D.N.Y. 2020).

This post comes to us from professors Douglas S. Eakeley and Yuliya Guseva at Rutgers Law School. It is based on their recent article, “Crypto-Enforcement Around the World,” available here, and on Professor Guseva’s article, “The SEC, Cryptoassets, and Game Theory.”

Sky Blog

Sky Blog