Sustainability in business and environmental, social, or governance (ESG) factors in finance have entered the mainstream. In 2020, the CEO of Blackrock wrote: “Our investment conviction is that sustainability and climate integrated portfolios can provide better risk-adjusted returns to investors.”

At NYU Stern’s Center for Sustainable Business, we set out to study the state of the research on the topic and surveyed 1,141 primary peer-reviewed papers and 27 meta-reviews (based on ~1,400 underlying studies) published between 2015 and 2020. Recent interest is enormous: The research output over the last five years matches the number of articles published prior to 2015.

Our meta-analysis found robust evidence that better ESG is associated with better financial performance in corporate-focused studies. Investor-focused studies demonstrate that ESG investing, on average, is comparable or preferable to conventional investing. In addition, we also developed six propositions based on the research, such as the finding that ESG disclosures alone are not necessarily associated with better financial or ESG performance.

Our research finds that the question of whether ESG/sustainability is associated with better financial performance continues to generate significant debate. Many still argue the evidence is ambiguous or that ESG is, at best, a distraction from the real business of making money.

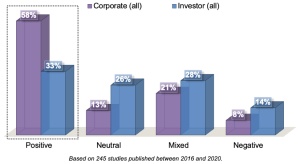

Thus, one of the main objectives in our study was to disentangle a common conflation: Are there differences among studies based on whether they focus on corporate managers or investors? To do so, we classified and reviewed three types of studies: corporate, investor, and thematic (limited to climate change). We screened, coded, and analyzed the resulting sample of 245 primary studies. Descriptively, 58 percent (± 7 percent) of corporate studies interpreted the correlation between ESG and financial performance as positive (see chart below). For investment studies, one in three studies (33 percent ± 8 percent) found a positive performance (typically a risk-adjusted return such as Jensen’s alpha) for sustainable portfolio management strategies compared with conventional investing.

We analyzed 15 existing, quantitative meta-analyses in a second-order meta-analysis (a meta-meta-analysis). They cover more than 1000 studies published between 1976 and 2018. Again, we found evidence consistent with our two general findings: that corporate sustainability results in better financial performance in a majority of studies while investor studies generally find similar returns. One explanation we explore: If a study found a null result (ESG and conventional strategies are indistinguishable), practitioners may deem this successful, but researchers (us in this case) would code it as neutral and not positive. While we do not settle this issue in this paper, we do argue that investor studies often lack clarity around how they assess sustainable investment strategies (conflating negative screen strategies with ESG integration strategies for example, while they have very different risk/return profiles).

In the paper we also developed an ordinal logistic regression model. This model aims to explain how different study characteristics lead to an overall conclusion that is positive, mixed, or negative. For example, we developed proxies for a study’s causal research design, underlying mechanisms (what we call mediating factors), and general features of the study such as accounting- versus market-based measures of financial performance.

We interpreted the result of our research, review, and model as a set of six propositions, replicated here:

- Studies that focused on corporate disclosures versus performance showed lower associations with financial performance.

- Improved financial performance due to ESG becomes more marked over a longer time horizon.

- More research is needed on the mediating factors driving the ESG-CFP relationship, but risk management and innovation stand out.

- ESG integration as a strategy seems to perform better than screening and divesting.

- ESG investing provides asymmetric benefits, i.e. downside protection, especially as during a social or economic crisis.

- Research on mitigating climate change through decarbonization strategies is fairly recent but finds promising evidence for better financial performance.

Finance and management are not static fields, so it is likely that these propositions will evolve. We encourage researchers and practitioners to test them critically. Over time, markets may adapt or climate change strategies may become a common practice instead of a source of competitive advantage. Either way, sustainability investments, from promoting innovation to preventing pandemics, are more relevant than ever.

This post comes to us from Research Fellow Ulrich Atz and Research Associate Professor Tracy Van Holt at the NYU Stern Center for Sustainable Business and Zongyuan (Zoe) Liu, Instructional Assistant Professor at the Bush School of Government & Public Service, Texas A&M University. It is based on their recent article, “Do Corporate Sustainability and Sustainable Finance Generate Better Financial Performance? A Review and Meta-analysis,” available here.

Sky Blog

Sky Blog