Notwithstanding the ongoing spread of COVID-19 and unprecedented changes in daily life and the economy, the second half of 2020 marched on to the steady drumbeat of securities-related lawsuits we have observed in recent years, including securities class and stockholder derivative actions, insider trading lawsuits, and government enforcement actions. In this 2020 year-end edition of our semi-annual publication, we discuss developments in the securities laws that have occurred against this backdrop.

The year-end update highlights what you most need to know in securities litigation developments and trends for the second half of 2020:

- Federal securities filings decreased by approximately 22% when compared to 2019, even as the average settlement value rose and the median settlement value remained comparable.

- The Supreme Court granted certiorari in Goldman Sachs Group Inc. v. Arkansas Teacher Retirement System, No. 20-222, and is set to review the Second Circuit’s inflation-maintenance theory and consider the use of price-impact evidence to rebut the presumption of reliance at the class certification stage.

- With the Supreme Court set to provide additional guidance on “price impact” theories under Halliburton II, the Seventh Circuit followed the Second Circuit’s path by requiring trial courts to consider evidence of a lack of price impact even where that evidence overlaps with a merits issue, such as materiality, and assigning both the burden of production and the burden of persuasion to defendants.

- The Delaware Supreme Court diminished Section 220’s threshold requirement that a stockholder have a “proper purpose” to inspect a corporation’s books and records, and may soon reduce or eliminate former stockholders’ standing to continue litigating “dual-natured” merger claims post-closing. We also discuss the fraud-on-the-board theory that survived a motion to dismiss in Mindbody.

- We continue to monitor courts’ application of the disseminator theory of liability recognized by the Supreme Court’s 2019 decision in Lorenzo.

- We again survey specific securities-related lawsuits arising in connection with or related to the coronavirus pandemic, including class actions, derivative actions, and government enforcement actions filed by both the Securities and Exchange Commission (the “SEC”) and the Department of Justice.

- We review developments regarding Omnicare’s falsity of opinions standard, as rulings by the Second Circuit and several district courts shed light on the boundaries of liability for false or misleading statements of opinion as well as omissions.

- Finally, we consider notable ERISA litigation activity, including how the Supreme Court’s early 2020 decisions in Sulyma and Jander have been applied by lower courts, as well as a potential circuit split regarding an employer’s fiduciary duties while offering a single-stock fund.

Filing And Settlement Trends

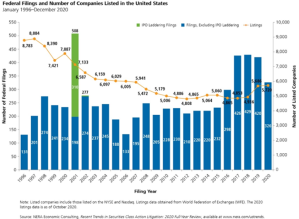

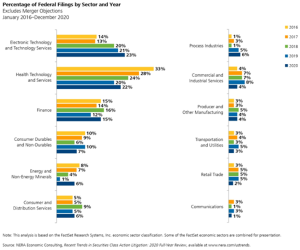

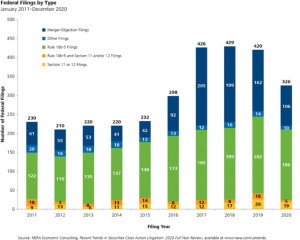

According to data from a newly released NERA Economic Consulting (“NERA”) study, filings and settlements in 2020 reflected the volatility of a tumultuous year, though certain aspects remained consistent with existing trends. For example, a decrease in the number of merger-objection cases filed in 2020 (down to 106 from 162 in 2019) drove a decline in the number of new federal class actions filed in 2020 (down to 326 from 420 in 2019). As in 2019, the most frequently litigated industry sectors continue to be the “Health Technology and Services” and “Electronic Technology and Technology Services” sectors, each rising by 2%.

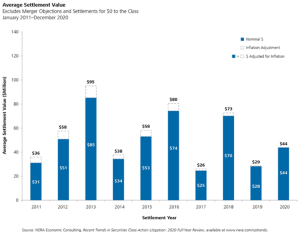

The median settlement value of federal securities cases in 2020—excluding merger-objection cases and cases settling for more than $1 billion or $0 to the class—was largely consistent with prior years (at $13 million, up from $12 million in 2019, and on par with $13 million in 2018). By contrast, average settlement values (excluding merger-objection and zero-dollar settlements) rose in 2020 (at $44 million, up from $29 million in 2019, though down from $73 million in 2018).

Filing Trends

Figure 1 below reflects filing rates for 2020 (all charts courtesy of NERA). 326 cases were filed last year, down considerably from the steady figures we have seen from 2017–2019. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those filed in the Delaware Court of Chancery.

Figure 1:

Mix Of Cases Filed In 2020

Filings By Industry Sector

As shown in Figure 2 below, the distribution of non-merger filings by industry was relatively consistent with 2019, even as the number of filings significantly decreased. The “Electronic Technology and Technology Services” and “Health Technology and Services” sectors continued to account for almost half of all filings, reaching 45% in 2020, with filings in both sectors rising by 2% over 2019. Notably, “Energy and Non-Energy Minerals” filings rose by 5% (at 6%, up from 1% in 2019), while “Commercial and Industrial Services” dropped by 4% (at 4%, down from 8% in 2019).

Figure 2:

Merger Cases

As shown in Figure 3 below, there were 106 merger-objection cases filed in federal court in 2020. This represents a 34.5% year-over-year decrease from 2019, and the lowest number of such filings since 2016, when the Delaware Court of Chancery put an effective end to the practice of disclosure-only settlements in In re Trulia Inc. Stockholder Litigation, 29 A.3d 884 (Del. Ch. 2016), which drove the increase in merger-objection filings between 2015 and 2017.

Figure 3:

Settlement Trends

As reflected in Figure 4 below, the average settlement value rebounded in 2020, reaching $44 million, after declining by more than 50% from $73 million in 2018 to $29 million in 2019, although that decrease can primarily be attributed to the inclusion of a settlement in 2018 that exceeded $1 billion, which skewed the average.

Figure 4:

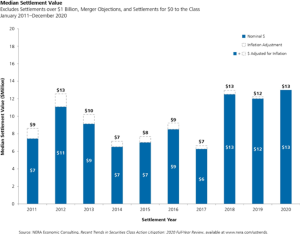

Turning to the median settlement value, and excluding settlements over $1 billion, we see in Figure 5 that the steady pace of 2018 ($13 million) and 2019 ($12 million) continued in 2020 ($13 million).

Figure 5:

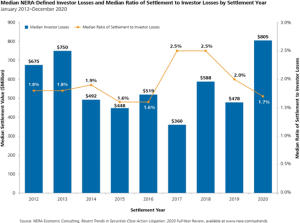

Finally, as shown in Figure 6, even though Median NERA-Defined Investor Losses rose steeply in 2020 to $805 million after a relatively consistent trend during the period 2014 through 2019, the Median Ratio of Settlement to Investor Losses fell for the second year in a row.

Figure 6:

What To Watch For In The Supreme Court

Supreme Court To Weigh In On Use Of Inflation Maintenance Theory

As we previewed in our 2020 Mid-Year Securities Litigation Update, the Supreme Court has granted certiorari in Goldman Sachs Group Inc. v. Arkansas Teacher Retirement System, No. 20-222, a case concerning the use of price-impact evidence to rebut the presumption of reliance at the class certification stage. ___ S. Ct. ___, 2020 WL 7296815 (Mem.) (Dec. 11, 2020). Recall that under Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014) (“Halliburton II”), the Supreme Court preserved the “fraud-on-the-market” presumption that enables courts to presume classwide reliance in Rule 10b-5 cases where plaintiffs satisfy certain prerequisites, but also opened the door to defendants rebutting that presumption at the class certification stage with evidence that the alleged misrepresentation did not impact the issuer’s stock price. Since then, lower courts have split on the viability of the “inflation maintenance” theory in this context. Arkansas Teacher Retirement System offers the Supreme Court the opportunity to resolve this split, squarely presenting the question of whether plaintiffs may use the inflation maintenance theory to demonstrate reliance by alleging that misstatements affected a stock price not by artificially inflating it, but by maintaining preexisting inflation.

By way of background, on April 7, 2020, a divided Second Circuit panel affirmed the trial court’s order certifying a class under the inflation maintenance theory premised on Goldman Sachs’s generic public statements. Arkansas Teacher Retirement System v. Goldman Sachs Group, Inc., 955 F.3d 254, 264–70 (2d Cir. 2020) (“Goldman Sachs II”). The plaintiffs did not make any showing that the challenged statements inflated the stock price, but rather premised their action on a drop in stock price following the announcement of a related regulatory action. Id. at 258–59, 262–63, 271, 273–74; see also id. at 275 (Sullivan, J., dissenting). In doing so, the Second Circuit rejected Goldman Sachs’s argument that the inflation maintenance theory may be applied only to “fraud-induced” inflation and should be narrowed to disallow its application to “general statements.” Id. at 265–70. The court also dismissed Goldman Sachs’s policy arguments that upholding inflation maintenance in these circumstances would “open the floodgates to unmeritorious litigation by allowing courts to certify classes that it believes should lose on the merits,” id. at 269, and that any time allegations of misconduct caused a stock to drop, “plaintiffs could just point to any general statement about the company’s business principles or risk controls and proclaim ‘price maintenance,’” id. (quoting Brief and Special Appendix for Defendants-Appellants at 52–53, Ark. Tchr. Ret. Sys. v. Goldman Sachs Grp., Inc., 955 F.3d 254 (2d Cir. 2020) (No. 18-3667), ECF No. 62).

Following the Second Circuit’s denial of rehearing en banc in June 2020 in Goldman Sachs II, Order, Ark. Tchr. Ret. Sys. v. Goldman Sachs Grp., Inc., No. 18-3667 (2d Cir. June 15, 2020), ECF No. 277, it was expected that the Supreme Court would consider this important issue. On December 11, 2020, after reviewing amicus briefs from the Society for Corporate Governance, former SEC officials and law professors, and financial economists, the Supreme Court granted the defendants’ petition for a writ of certiorari.

The Supreme Court will consider (1) whether the defendant in a securities class action may rebut the presumption of classwide reliance recognized in Basic Inc. v. Levinson, 485 U.S. 224 (1988), by pointing to the generic nature of the alleged misstatements in showing that the statements had no impact on the price of the security, even though that evidence is also relevant to the substantive element of materiality, and (2) whether a defendant seeking to rebut the Basic presumption has only a burden of production or also the ultimate burden of persuasion. Petition for Writ of Certiorari at I, Goldman Sachs (No. 20-222).

If the Supreme Court rejects the Second Circuit’s inflation-maintenance theory, it would protect the foundational importance of price impact to the Basic presumption of reliance, and would enable securities class action defendants to defeat the Basic presumption using any price-impact evidence—direct as well as indirect—even if that evidence overlaps with a later merits inquiry. It would stop plaintiffs from establishing price impact by pointing only to a company’s generic, aspirational statements and a subsequent stock drop in response to some enforcement activity. It would also preclude plaintiffs from showing loss causation by merely alleging that investors purchased stock at inflated prices and later suffered losses. On the other hand, if the Court were to affirm the Second Circuit’s approach, we expect a proliferation of “inflation maintenance” class actions based on a company’s general statements.

Questions Over Constitutional Challenges To Power Or Appointment Of Administrative Adjudicators

Readers will recall the Supreme Court’s landmark decision in Lucia v. SEC, 138 S. Ct. 2044, 2053 (2018), as discussed in our 2018 Mid-Year Securities Enforcement Update, that administrative law judges (“ALJs”) are “Officers” under the Appointments Clause and therefore must be appointed by either the President, the SEC, or a court of law. The Supreme Court’s holding in Lucia continues to generate constitutional questions over the appointment of administrative adjudicators, which could have implications for anyone considering bringing similar challenges against an ALJ of the SEC.

On March 1, 2021, the Supreme Court is set to hear argument in United States v. Arthrex, No. 19-1434 et al., which presents the question whether administrative adjudicators in the Patent and Trademark Office are “principal” or “inferior” Officers of the United States for purposes of the Appointments Clause. These consolidated cases present a question, not resolved by Lucia, as to how to categorize administrative adjudicators in light of their functions, supervision, and (possibly) removal protections. Gibson Dunn represents Smith & Nephew and ArthroCare Corp., the petitioners in No. 19-1452, in arguing (alongside the government) that administrative patent judges (“APJs”) are inferior Officers and were therefore permissibly appointed by the Secretary of Commerce. The Court’s resolution of the categorization issue in the context of APJs could have impacts for administrative adjudicators in other agencies.

On March 3, 2021, the Supreme Court is set to hear argument in Carr v. Saul and Davis v. Saul, a pair of consolidated cases involving whether parties need to present constitutional challenges to the appointment of administrative adjudicators at their administrative hearing in order to preserve the challenge for their later appeal. In both Carr and Davis, the petitioners filed for disability benefits under the Social Security Act, only for their claims to be denied by the Social Security Administration (“SSA”), the administrative tribunal, and the agency’s appeals board. Carr v. Comm’r, 961 F.3d 1267, 1268 (10th Cir. 2020); Davis v. Saul, 963 F.3d 790, 791 (8th Cir. 2020). Petitioners sought review in federal district court, and in light of Lucia, for the first time challenged the constitutionality of the appointment of the SSA ALJs. In Carr, the district court reversed the SSA decisions and remanded for new hearings before constitutionally appointed ALJs, while in Davis, the district court found that the petitioners had waived those challenges by not first bringing them during the administrative proceedings themselves. 961 F.3d at 1270; 963 F.3d at 792–93. On appeal, both the Eighth and Tenth Circuit Courts of Appeals agreed that the challenges had been waived by not being brought directly before the SSA. 961 F.3d at 1276; 963 F.3d at 795. The Court’s decision in these consolidated cases should help clarify the applicability of preservation, waiver, and forfeiture principles to these type of structural challenges.

Delaware Development

Recent Trends In Section 220 Litigation

Since the Delaware Supreme Court’s decision in Corwin v. KKR Financial Holdings LLC, 125 A.3d 304 (Del. 2015), stockholder plaintiffs have increasingly sought company books and records under Section 220 of the Delaware General Corporation Law to aid in drafting complaints that can withstand dismissal. See, e.g., Morrison v. Berry, 191 A.3d 268, 273, 275 (Del. 2018) (reversing dismissal under Corwin by relying on “crucial” documents obtained pursuant to Section 220). This uptick in Section 220 demands is not surprising, as Corwin established a formidable hurdle to plaintiffs hoping to overcome a motion to dismiss, as discussed in our 2017 Mid-Year Securities Litigation Update. Further, Delaware courts have “repeatedly admonished plaintiffs to use the ‘tools at hand’ and to request company books and records under Section 220 to attempt to substantiate their allegations before filing derivative complaints.” California State Teachers’ Ret. Sys. v. Alvarez, 179 A.3d 824, 839 (Del. 2018) (citation omitted).

Delaware Supreme Court Tosses “Proper Purpose” Requirement Except In “Rare” Circumstances

Section 220 permits a stockholder to inspect the company’s books and records for any “proper purpose” reasonably related to the stockholder’s “interest as a stockholder.” 8 Del. C. § 220(b). One well-recognized “proper purpose” that stockholders commonly assert is investigating alleged corporate mismanagement or wrongdoing, but a stockholder’s curiosity alone will not permit such an investigation. Seinfeld v. Verizon Commc’ns, Inc., 909 A.2d 117, 121–22 (Del. 2006). Instead, the stockholder must demonstrate “a credible basis from which the court can infer that mismanagement, waste or wrongdoing may have occurred.” Lavin v. West Corp., 2017 WL 6728702, at *7 (Del. Ch. Dec. 29, 2017) (quoting Seinfeld, 909 A.2d at 118). Although the “credible basis” standard imposes “the lowest possible burden of proof” under Delaware law, see Seinfeld, 909 A.2d at 123, Delaware case law has required stockholders to present some evidence to demonstrate that the alleged wrongdoing could be actionable, see United Techs. Corp. v. Treppel, 109 A.3d 553, 559 & n.31 (Del. 2014), and identify the course of action the stockholder plans to pursue if its demand succeeds, see Sec. First Corp. v. U.S. Die Casting & Dev. Co., 687 A.2d 563, 570 (Del. 1997).

Recently, however, the Delaware Supreme Court held in AmerisourceBergen Corp. v. Lebanon County Employees’ Retirement Fund, “that a stockholder is not required to state the objectives of his investigation” to satisfy Section 220’s “proper purpose” requirement. 2020 WL 7266362, at *6 (Del. Dec. 10, 2020). The Court reasoned that so long as the stockholder states a credible basis to support an inference of mismanagement or wrongdoing, the stockholder need not “specify the ends to which it might use the books and records” should they confirm suspicions of mismanagement or wrongdoing. Id. at *7. The Court also held that, except in “rare” circumstances, a stockholder “need not demonstrate that the alleged mismanagement or wrongdoing is actionable” to obtain company books and records under Section 220. Id. at *13–14.

In light of the developing case law in the Section 220 context, companies should continue to “honor traditional corporate formalities” in acting and maintaining corporate communications and record-keeping regarding its actions. See KT4 Partners LLC v. Palantir Techs. Inc., 203 A.3d 738, 742, 758 (Del. 2019) (ordering directors to produce emails in response to a Section 220 request, where the company “did not honor traditional corporate formalities . . . and had acted through email in connection with the same alleged wrongdoing that [the stockholder] was seeking to investigate”).

Delaware Corporations Not Subject To California Inspection Statute

In another recent decision concerning the inspection rights of stockholders, the Delaware Court of Chancery held that Delaware law precluded a stockholder of a Delaware corporation headquartered in California from seeking books and records under California’s inspection statute, California Corporations Code Section 1601. JUUL Labs, Inc. v. Grove, 238 A.3d 904, 913–18 (Del. Ch. 2020). The court explained that Delaware law governs the internal affairs of Delaware corporations and “[s]tockholder inspection rights are a core matter of internal corporate affairs.” Id. at 915. The court highlighted that the internal affairs doctrine serves “an important public policy . . . to ensure the uniform treatment of directors, officers, and stockholders across jurisdictions,” which the court noted “can only be attained by having the rights and liabilities of those persons with respect to the corporation governed by a single law.” Id. (citation and internal quotation marks omitted). Accordingly, the court held that the stockholder could not seek inspection under Section 1601. Id. at 918. This decision should help Delaware-incorporated companies limit the burden associated with responding to conflicting, burdensome, and invasive books and records demands under the laws of states other than Delaware.

Delaware Supreme Court May Eliminate Standing To Litigate “Dual-Natured” Merger Claims Post-Closing

Despite declining the opportunity to reject precedent that permits stockholders to litigate “dual-natured” merger claims post-closing, the Court of Chancery recently invited the Delaware Supreme Court to do so by certifying its decision in In re TerraForm Power, Inc. Stockholders Litigation, 2020 WL 6375859 (Del. Ch. Oct. 30, 2020), for interlocutory appeal. In TerraForm Power, Inc., plaintiff stockholders asserted breach of fiduciary duty claims against several directors, the CEO, and the majority stockholder of TerraForm Power, Inc., alleging that the controlling stockholder caused TerraForm “to issue [the controlling stockholder] stock for inadequate value, diluting both the financial and voting interest of the minority stockholders.” 2020 WL 6375859, at *1, *2. Defendants moved to dismiss for lack of standing, arguing that such dilution claims are “quintessential derivative claims that belong to the corporation” and could not be asserted by plaintiffs, who had ceased to be stockholders at the time of the motion due to a merger. Id. at *1. But Vice Chancellor Glasscock found that the facts alleged in TerraForm Power, Inc. were “indistinguishable” from those at issue in Gentile v. Rossette, 906 A.2d 91 (Del. 2006). TerraForm Power, Inc., 2020 WL 6375859, at *11. In Gentile, the Delaware Supreme Court held that, where a controlling stockholder dilutes the “economic value and voting power” of a minority stockholder’s shares by “caus[ing] the corporation” to issue itself shares for inadequate compensation, the minority stockholder is not deprived of standing to prosecute such claims after the merger closes because they are in the nature of both direct and derivative claims. Gentile, 906 A.2d at 100. Accordingly, Vice Chancellor Glasscock explained that he was bound by Delaware Supreme Court precedent and, as such, Gentile “mandate[d] that the direct claims pled survive” the motion to dismiss. TerraForm Power, Inc., 2020 WL 6375859, at *16.

In light of the criticism surrounding Gentile, however, Vice Chancellor Glasscock certified an interlocutory appeal of his decision to the Delaware Supreme Court to address whether Gentile remains good law. In re TerraForm Power, Inc. S’holders Litig., 2020 WL 6889189 (Del. Ch. Nov. 24, 2020). We will monitor the progress of this appeal and report on any developments in future editions of our Securities Litigation Update.

Revlon Claim Alleging “Fraud On The Board” Survives Motion To Dismiss

Recent Delaware decisions have potentially important implications for corporate directors’ disclosure obligations. In In re Mindbody, Inc., Stockholders Litigation, 2020 WL 5870084 (Del. Ch. Oct. 2, 2020), plaintiff stockholders alleged that three corporate insiders of Mindbody, Inc. manipulated the company’s sale to Vista Equity Partners for personal financial gain by withholding material information from the Board and tilting the sale process in Vista’s favor. Id. at *1, *20–25. Plaintiff alleged that the company’s founder—who acted as the company’s lead negotiator—“suffered from material conflicts in the sale process that he failed to disclose to the Board,” and that flaws related to a special committee’s mandate and effectiveness suggested that “the Board was the passive victim of a rogue fiduciary.” Id. at *24–25. The Court of Chancery rejected defendants’ attempt to dismiss this “fraud-on-the-board” theory, holding at the motion to dismiss stage where the facts are assumed to be true, that plaintiffs adequately pleaded the paradigmatic Revlon claim involving “a conflicted fiduciary who is insufficiently checked by the board and who tilts the sale process toward his own personal interests in ways inconsistent with maximizing stockholder value.” Id. at *13, *25.

Mindbody is a helpful reminder that “[a] plaintiff can state a Revlon claim by pleading that one conflicted fiduciary failed to provide material information to the board,” Mindbody, Inc., 2020 WL 5870084, at *14, and in such a case “the irrebuttable presumption of the business judgment rule” under Corwin may not apply since “it is not uncommon that a court finds the same information to be material to both directors and stockholders,” id. at *26 (internal quotations omitted).

Development Of Disseminator Liability Theory Upheld In Lorenzo Continues

As we discussed in our 2019 Mid-Year Securities Litigation Update, the Supreme Court held in Lorenzo v. SEC, 139 S. Ct. 1094 (2019), that those who disseminate false or misleading information to the investing public with the intent to defraud can be liable under Section 17(a)(1) of the Securities Act and Exchange Act Rules 10b-5(a) and 10b-5(c), even if the disseminator did not “make” the statements for the purposes of enforcement under Rule 10b-5(b). Notably, Francis V. Lorenzo himself settled with the SEC on October 8, 2020, finally bringing an end to the litigation that commenced seven years ago. While the question of liability had been determined and affirmed by the Supreme Court in 2019, the SEC’s 2020 Order suspended Lorenzo from “association with any broker or dealer” and from “participating in any offering of a penny stock” for a period of twelve months but did not require Lorenzo to pay a monetary penalty. See Francis V. Lorenzo, Securities Act Release No. 10872, Exchange Act Release No. 90110, 2020 WL 5993037, at *3 (Oct. 8, 2020).

In the wake of Lorenzo’s settlement with the SEC, courts continue to grapple with whether and how to apply Lorenzo, which raised the possibility that secondary actors—such as financial advisors and lawyers—could face liability under Rules 10b-5(a) and 10b-5(c) simply for disseminating the alleged misstatement of another upon a showing that the secondary actors knew the statement contained false or misleading information.

For example, a bankruptcy court in the Northern District of Georgia emphasized the wide range of conduct captured by Rule 10b-5 in the wake of Lorenzo and denied summary judgment in an adversary proceeding on that basis. In re King, 2020 WL 6075956, at *18 (Bankr. N.D. Ga. Oct. 14, 2020). Although the bankruptcy court was interpreting Minnesota state securities law, the court analogized it to federal law to conclude that the debtor, King, could be held liable under Section 10(b) and Rule 10b-5 for the representations and omissions cited by investors. Id. Recognizing that a different individual purportedly made many of the allegedly misleading statements, the court reasoned that King nonetheless “could be liable for participating in a scheme to defraud . . . using [the other individual’s] misleading statements” as a disseminator, citing In re Cognizant Technology Solutions Corp. Securities Litigation, 2020 WL 3026564, at *16–19 (D.N.J. June 5, 2020), which we addressed in our 2020 Mid-Year Securities Litigation Update. In re King, 2020 WL 6075956, at *18. Together, the cases confirm that courts are willing to impose liability when individuals “substantially participate or are inextricably involved in the fraud.” Id.

In other instances, however, Lorenzo is merely a belt to the suspenders supplied by more traditional theories of liability. For example, in In the Matter of Laurie Bebo & John Buono, an Administrative Law Judge (“ALJ”) considered the liability of a CEO that allegedly misrepresented the state of an assisted living company’s financial affairs in order to conceal that the company was in breach of its lease agreement. Initial Decision Release No. 1401, 2020 WL 4784633, at *1 (ALJ Aug. 13, 2020). According to the SEC, the company then failed to disclose the company’s noncompliance with the lease in periodic reports filed with the SEC in violation of Section 10(b) and Rule 10b-5. Id. Although the ALJ ultimately found that the CEO “made” the relevant statements because she signed and “had responsibility for the content of the [Company’s] periodic reports,” the ALJ also reasoned that whether the CEO specifically made the statements was immaterial for scheme liability under Lorenzo. Id. at *76–77.

In future Securities Litigation Updates, we will continue to monitor closely how the Lorenzo disseminator liability theory is applied and how it is used to buttress other theories of liability.

Survey Of Coronavirus-Related Securities Litigation

When COVID-19 first arrived in the United States, resulting in massive economic dislocation and a stock market drop in March 2020, many predicted a wave of securities litigation would soon follow. The first wave of COVID-19-related securities lawsuits was more of a ripple, however, targeting select industries, such as travel and healthcare, that were most directly impacted by the pandemic. We surveyed these cases in our 2020 Mid-Year Securities Litigation Update.

Despite the steady recovery of the financial markets, the number of COVID-19-related securities litigations has increased. Plaintiffs have continued to sue companies in the travel and healthcare industries and have also widened their net to companies in other industries, including cybersecurity and real estate companies. This second, larger wave of cases has challenged a range of misstatements, including those concerning safety and risk disclosures.

Although it is still too soon to tell how courts will treat COVID-19 in these cases more broadly, we continue to monitor developments in these and other coronavirus-related securities litigation cases. Additional resources regarding company disclosure considerations related to the impact of COVID-19 can be found in the Gibson Dunn Coronavirus (COVID-19) Resource Center.

Securities Class Actions

False Claims Concerning Commitment To Safety

In the Second Circuit, statements concerning a company’s commitment to safety are often considered inactionable because they are “too general to cause a reasonable investor to rely upon them.” In re Vale S.A. Sec. Litig., 2017 WL 1102666, at *22 (S.D.N.Y. Mar. 23, 2017); see also Foley v. Transocean Ltd., 861 F. Supp. 2d 197, 204 n.7 (S.D.N.Y. 2012) (“[W]e note that the statements [regarding commitment to safety and training] would likely be considered expressions of ‘puffery’ that cannot form the basis of a securities fraud claim.”). Such statements may be found actionable, however, when the company operates in a dangerous industry and “it is to be expected that investors will be greatly concerned about [its] safety and training efforts.” Bricklayers & Masons Local Union No. 5 Ohio Pension Fund v. Transocean Ltd., 866 F. Supp. 2d 223, 244 (S.D.N.Y. 2012).

City of Riviera Beach Gen. Emps. Ret. Sys. v. Royal Caribbean Cruises Ltd., No. 20-cv-24111 (S.D. Fla. Oct. 7, 2020): This putative class action against a cruise line company alleges that defendants “failed to disclose material adverse facts about the company’s decrease in bookings outside China, and its inadequate policies and procedures to prevent the spread of COVID-19 on its ships.” Dkt. No. 1 at 3–4. Instead, Royal Caribbean allegedly gave false assurances to “the investing public that its safety protocols were ‘aggressive’ and would ‘ultimately contain the virus.’” Id. at 3. Within days of Royal Caribbean’s suspension of global operations on March 14, 2020, analysts downgraded the company’s stock and lowered their price targets. Id. at 5–6.

Hartel v. GEO Grp., Inc., No. 20-cv-81063 (S.D. Fla. July 7, 2020): A plaintiff stockholder filed a securities class action against GEO Group, a private corrections facilities operator, alleging that the company misled investors about the effectiveness of its COVID-19 response. Dkt. No. 1 at 1–2, 9. The complaint alleges that the company subjected its residents and employees “to significant health risks as the COVID-19 pandemic progressed,” which left the company “vulnerable to significant financial and/or reputational harm.” Dkt. No. 33 at 12. The company’s stock price declined after news of a serious outbreak in one of its facilities was released. Id. at 10.

Failure To Disclose Specific Risks

“Forward-looking statements are protected under the ‘bespeaks caution’ doctrine where they are accompanied by meaningful cautionary language.” In re Am. Int’l Grp., Inc. 2008 Sec. Litig., 741 F. Supp. 2d 511, 531 (S.D.N.Y. 2010). “However, generic risk disclosures are inadequate to shield defendants from liability for failing to disclose known specific risks.” Id.; see also Freudenberg v. E*Trade Fin. Corp., 712 F. Supp. 2d 171, 193 (S.D.N.Y. 2010) (observing generally, in adjudicating a motion to dismiss, that defendants “cannot be immunized for knowingly false statements even if they include some warnings”).

Arbitrage Fund v. Forescout Techs. Inc., No. 20-cv-03819 (N.D. Cal. June 10, 2020): Plaintiffs allege computer and network security company Forescout misled investors when, on February 6, 2020, the company announced a merger with Advent International Corp. without disclosing “the significant and disproportionate impact COVID-19 was having on [Forescout’s] business.” Dkt. No. 1 at 6, 10. Forescout previously disclosed general risks relating to COVID-19 but allegedly omitted that Advent was considering withdrawing from the merger agreement due to COVID-19. Id. at 22. On May 15, 2020, Advent announced it was terminating the merger plans. Id. at 16-17. Forescout’s stock fell nearly 24% in the following days. Id. at 24. This case was later consolidated with Sayce v. Forescout Technologies Inc., No. 20-cv-00076 (N.D. Cal. Jan. 2, 2020). Dkt. No. 55 at 7.

Berg v. Velocity Fin., Inc., No. 20-cv-06780 (C.D. Cal. July 29, 2020): A stockholder of Velocity, a real estate finance company, alleges that at the time of the company’s January 16, 2020 initial public offering, the defendants concealed “the potential impact of the novel coronavirus on Velocity’s business and operations.” Dkt. No. 1 at 2. The “Risk Factors” that Velocity reported were themselves purportedly materially misleading because they “presented as hypothetical[] risks that had already materially harmed the Company.” Dkt. No. 40 at 25. On April 8, 2020, Velocity announced it suspended all loan originations and by May 18, its share price had declined over 80% below the IPO price. Id. at 26–27, 29. As Gibson Dunn recently discussed, on January 25, 2021, the Court granted Velocity’s motion to dismiss, grounding the coronavirus-related portion of its decision on the fact that Velocity could not have anticipated the extent of the pandemic in early January 2020.

Alleged Insider Trading And “Pump and Dump” Schemes Connected To The Government’s Vaccination Efforts

“Under the ‘traditional’ or ‘classical theory’ of insider trading liability, § 10(b) and Rule 10b–5 are violated when a corporate insider trades in the securities of his corporation on the basis of material, nonpublic information.” United States v. O’Hagan, 521 U.S. 642, 651–52 (1997). Relatedly, in a “pump and dump” scheme, an individual promotes company stock to artificially increase the market price and then sells his shares at the inflated price. Emergent Capital Inv. Mgmt., LLC v. Stonepath Grp, Inc., 343 F.3d 189, 197 (2d Cir. 2003). In these cases, a plaintiff can adequately allege loss causation by showing that defendants had “the ability to manipulate stock prices of their ventures and that [] affiliated entities sold substantial quantities of [the stock in the relevant period].” Id. at 197 (internal quotations omitted).

Tang v. Eastman Kodak Co., No. 20-cv-10462 (D.N.J. Aug. 13, 2020): In this putative class action, a stockholder contends the company violated Sections 10(b) and 20(a) of the ’34 Act by allegedly failing to disclose that its officers were granted stock options immediately prior to the company’s public announcement that it had received a loan to produce drugs for the treatment of COVID-19. Dkt. No. 1 at 2. The price of the company’s stock increased after this announcement, and it then dropped as news of the stock options began to circulate. Id. at 4–5.

Hovhannisyan v. Vaxart, Inc., No. 20-cv-06175 (N.D. Cal. Sept. 1, 2020): A stockholder in Vaxart, a small clinical-stage biotechnology company, filed a putative class action lawsuit against the company, certain current and former senior executives and directors, and its majority stockholder. Dkt. No. 1 at 1. The complaint alleges that the defendants “engaged in a naked ‘pump and dump’ scheme” by making “a series of misleading statements to investors [suggesting the company] was a major player in the U.S. government’s effort to develop a vaccine.” Id. The stock price plummeted once The New York Times reported that the company misled investors about the nature of its vaccination efforts so that its insiders could reap massive gains. Id. at 2–3.

Stockholder Derivative Actions

In a derivative suit, a stockholder seeks to assert a claim belonging to the corporation. “Whenever directors communicate publicly or directly with shareholders about the corporation’s affairs, with or without a request for shareholder action, directors have a fiduciary duty to shareholders to exercise due care, good faith and loyalty.” Malone v. Brincat, 722 A.2d 5, 10 (Del. 1998). “[A] director must make a good faith effort to oversee the company’s operations. Failing to make that good faith effort breaches the duty of loyalty and can expose a director to liability.” Marchand v. Barnhill, 212 A.3d 805, 820 (Del. 2019) (citing In re Caremark Int’l Inc. Deriv. Litig., 698 A.2d 959, 970 (Del. Ch. 1996)).

Disclosure Liability

Fettig v. Kim, No. 20-cv-03316 (E.D. Pa. July 7, 2020): Certain directors and officers of Inovio Pharmaceuticals allegedly breached their fiduciary duties by claiming in February and March 2020 “that Inovio had developed a COVID-19 vaccine in a matter of about three hours,” Dkt. No. 1 at 7 (internal quotations omitted), and “may be in a position to begin human clinical trials in the United States in April 2020,” id. at 10. In response to these announcements, Citron Research posted on Twitter that Inovio’s claims were false and urged the SEC to investigate. Id. at 3. Although Inovio denied Citron’s allegations, it stated that the vaccine was not actually a “vaccine,” but an “early stage prototype,” causing the company’s stock price to plummet. Id.

Wong v. Eberly, No. 20-cv-04269 (E.D.N.Y. Sept. 11, 2020): Plaintiff alleges that directors and officers of Chembio Diagnostics, Inc. made misleading statements about Chembio’s rapid COVID-19 antibody tests, including that they “were 100% accurate after 11 days following the onset of symptoms.” Dkt. No. 1 at 1, 5. On June 16, 2020, the FDA wrote Chembio a letter saying the test was far less effective than the company had represented and revoked its Emergency Use Authorization, effectively barring distribution. Id. at 6–7. After the announcement, the stock price plummeted by over 60%. Id. at 7.

Oversight Liability

Zarins v. Schessel, No. 654833/2020 (Sup. Ct. N.Y. Cty. Sept. 30, 2020): A stockholder in SCWorx Corp., a health care technology company, brought a derivative action against certain company directors, claiming that those directors breached their duties to the company “by making or causing the Company to make false statements that artificially inflated the price of SCWorx securities.” Dkt. No. 1 at 3. Specifically, the complaint alleges that the director defendants caused “SCWorx to announce that it had received a committed purchase order of two million COVID-19 rapid testing kits.” Id. at 11. The company’s stock dropped after an investment research firm referred to the purported deal as “completely bogus” and backed by purported fraudsters and convicted felons. Id. at 14–15.

Insider Trading

As discussed above, insider trading involves a corporate insider trading the company’s securities based on material, nonpublic information. O’Hagan, 521 U.S. at 651. “[A] corporate insider must abstain from trading in the shares of his corporation unless he has first disclosed all material inside information known to him.” Chiarella v. United States, 445 U.S. 222, 227 (1980). “[I]f disclosure is impracticable or prohibited by business considerations or by law, the duty is to abstain from trading.” SEC v. Obus, 693 F.3d 276, 285 (2d Cir. 2012). A similar state-law claim in Delaware is known as a Brophy claim, which permits a corporation to recover from its fiduciaries for harm caused by insider trading. Brophy v. Cities Serv. Co., 70 A.2d 5 (Del. Ch. 1949).

City of Hallandale Beach Police Officers’ and Firefighters’ Personnel Ret. Tr. v. Garcia, No. 2020-0887 (Del. Ch. Oct. 13, 2020): On October 13, 2020, plaintiffs filed suit against the controlling stockholder of a company and other individuals alleging that defendants purchased shares of the company at a price that was too low in light of a decline in the company’s stock price at the outset of the COVID-19 pandemic. Dkt. No. 1 at 2. Plaintiff brought a Brophy claim as well as derivative claims for breach of fiduciary duty, waste, and unjust enrichment. Id. at 42–45.

Jaquith v. Latour, No. 2020-0904 (Del. Ch. Oct. 20, 2020): The plaintiff in this derivative action against the directors and controlling stockholder of Vaxart, a biotechnology company, alleges that the directors breached their fiduciary duties by approving warrant amendments allowing the controlling stockholder to trade on material, nonpublic information relating to Vaxart’s participation in Operation Warp Speed (“OWS”). Dkt. No. 7 at 2–3. Three weeks after the amendments, Vaxart announced that it was selected to be part of OWS. Id. at 5. Shortly after Vaxart’s stock price skyrocketed, the controlling stockholder exercised its warrants and sold its shares for nearly $200 million in profit. Id. at 6.

SEC Cases

SEC v. Schena, No. 20-cv-06717 (N.D. Cal. Sept. 25, 2020): The SEC charged Mark Schena, the President of Arrayit Corporation, a healthcare technology company, for “making false and misleading statements about the status of Arrayit’s delinquent financial reports.” Dkt. No. 1 at 1. At the time, the defendant had allegedly failed to provide Arrayit’s independent auditor with the documents necessary to complete audits of the company’s financial statements. Id. at 4. Schena was also charged with making false and misleading statements that the company had a COVID-19 test and that it was pending emergency FDA approval. Id. at 8. The SEC contends that Arrayit had not applied for emergency approval when these statements were made. Id.

The Cheesecake Factory, Inc., Exchange Act Release No. 90565 (Dec. 4, 2020): As Gibson Dunn recently discussed, this enforcement action came after the company submitted a Form 8-K withdrawing prior financial guidance due to the economic impact of the pandemic. Order at 2. The company had allegedly made misstatements and omissions regarding its ability to operate sustainably in the shift to a business model centered on take-out and delivery. Id. at 3. The Cheesecake Factory settled on a neither-admit-nor-deny basis, and agreed to a $125,000 penalty. Id. at 1, 4.

Criminal Securities Fraud

United States v. Berman, No. 20-cr-278 (D.D.C. Dec. 15, 2020): On December 15, 2020, the CEO of Decision Diagnostics Corp. was indicted by a federal grand jury in connection with an alleged scheme to defraud investors by making false and misleading statements about the development of a new COVID-19 test, which led to millions of dollars in investor losses. Dkt. No. 1 at 4, 15. According to the indictment, the defendant falsely claimed that Decision Diagnostics had developed a 15-second, COVID-19 finger-prick rapid test that was on the verge of FDA approval. Id. at 6–7. At the time, however, the test was allegedly more of a concept than an actual product, and the company lacked the resources to conduct the clinical testing required by the FDA. Id. at 9.

* * *

Although a fair number of COVID-19 suits have been filed, the book is far from closed on these lawsuits or the continued impact COVID-19 will have on the stock market and broader economy. It is still unclear whether optimistic stock market projections regarding the success of vaccinations will bear out, and when companies in the hardest hit industries will be able to return to business as usual. Regardless of the course COVID-19 takes in 2021, we expect plaintiffs to continue filing coronavirus-related securities lawsuits.

Falsity Of Opinions – Omnicare Update

As we discussed in our prior securities litigation updates, lower courts continue to analyze the boundaries of liability for false or misleading statements of opinion set forth in Omnicare, Inc. v. Laborers District Council Construction Industry Pension Fund, 575 U.S. 175 (2015). The Omnicare Court identified two situations in which a speaker can be held liable for a statement of opinion. Id. at 184–86. First, although “a sincere statement of pure opinion is not an ‘untrue statement of material fact,’ regardless [of] whether an investor can ultimately prove the belief wrong,” liability can be found when a speaker does not “actually hold[] the stated belief,” or when the opinion statement contains demonstrably untrue “embedded statements of fact.” Id. Second, even where speakers might sincerely believe their stated opinions, they can be found liable if they omit a fact “about the issuer’s inquiry into or knowledge concerning a statement of opinion” that “conflict[s] with what a reasonable investor would take from the statement itself.” Id. at 189. We expect to see even broader application of Omnicare principles in the coming months as COVID-related securities cases begin reaching judicial decisions.

In July, the Second Circuit shed some light on what qualifies as a plausibly pled omission theory of liability in Abramson v. NewLink Genetics Corp., 965 F.3d 165 (2d Cir. 2020), reh’g en banc denied. The lower court found no liability could attach as a matter of law to the first of the defendants’ statements at issue—that “‘all the major studies’ show survival rates of at most 20 months” for certain cancer patients—because plaintiffs did not “aver that the speaker did not hold the belief.” Id. at 174–76, rev’g Nguyen v. NewLink Genetics Corp., 2019 WL 591556 (S.D.N.Y. Feb. 13, 2019). Noting that Omnicare lessened the importance of a precise distinction between statements of fact and opinion, particularly where the statement was allegedly misleading by omission, the Second Circuit panel, made up of Judges Kearse, Walker, and Livingston, rejected this analysis. Id. at 176. Instead, the panel found that the degree of fact or certainty implied in the defendant’s conclusory statement rendered it misleading because the existence of “major studies” to the contrary should have given the defendant reason to speak in more qualified terms. Id. at 176–77. Applying the same omission theory framework, the panel also reversed the trial court’s dismissal as to the second statement at issue—a mix of opinion and fact: “it is our belief that in our study today we don’t have any reason to believe that median survival for these patients will be more than low 20s,” and that the company’s study “‘is designed’ for the possibility that the control group survival rate is ‘in the low 20s.’” Id. at 178. As before, the panel concluded that the complaint plausibly alleged the statement was misleading by omission due to its categorical nature. Id. As to both statements, the court found the driving factor was whether a fact finder could conclude a reasonable investor, taking these conclusory statements at face value, could be misled to believe no credible study to the contrary existed. Thus, the decision guides issuers to use more qualified terms in their statements rather than conveying absolute certainty to investors, especially if there is reason to believe facts exist cutting the other way.

Otherwise, Omnicare remained a significant pleading barrier in the latter half of 2020, particularly where the opinions concerned general statements about financial performance. In Shreiber v. Synacor, Inc., for example, issued just a few months after Abramson, the Second Circuit affirmed dismissal of class action claims alleging that Synacor’s “upbeat statements about . . . expected future revenues” from a key contract to create a web portal were misleading because they failed to disclose certain material risks in achieving those projections—namely that the counterparty “controlled monetization” of the portal. 2020 WL 6165909, at *1–2 (2d Cir. Oct. 22, 2020). The plaintiffs in Schreiber admitted that the opinions were “honestly held” and supplied no untrue supporting facts, leaving only the question of whether the defendants “omit[ted] information whose omission makes the statement misleading to a reasonable investor.” Id. at *2. The court found no such omission, noting that the defendants disclosed the terms of the relevant contract and effectively cautioned that revenue would only be achievable after the program was fully deployed, so the omissions “fairly align[ed]” with Synacor’s stated expectations to achieve $100 million in revenue after deploying the portal and migrating customers. Id. (quoting Omnicare, 575 U.S. at 189).

Several cases in the Southern District of New York reaffirmed that appropriate cautionary language is significant in protecting issuers from Omnicare liability. For example, in In re Anheuser-Busch InBev SA/NV Securities Litigation, 2020 WL 5819558 (S.D.N.Y. Sept. 29, 2020), the plaintiff alleged that the defendants’ optimistic opinions about expected dividends had omitted material information on factors that could restrict dividend payments. Id. at *6. But because the defendants’ SEC filings had cautioned that they “may be unable to pay dividends” depending on numerous factors, the court ruled that the “alleged misstatements [were] nonactionable statements of opinion.” Id. at *5–*6; cf. In re Ferroglobe PLC Sec. Litig., 2020 WL 6585715, at *8 (S.D.N.Y. Nov. 10, 2020) (statements made during a presentation were not misleading where slides “immediately preced[ing] and follow[ing]” the statements had “acknowledged” the issues claimed to have been omitted). Likewise, in Burr v. Equity Bancshares, Inc., 2020 WL 6063558 (S.D.N.Y. Oct. 14, 2020), the court dismissed claims related to statements about loan loss allowances. Crucially, defendants’ SEC filings had described various factors that affected their allowance determinations. Id. at *6. And defendants expressly noted that their determinations were “ultimately a matter of ‘management’s judgment.’” Id. Given these warnings, as well as the “customs and practices of the relevant industry,” the court determined that a reasonable investor would not have been misled. Id. (quoting Omnicare, 575 U.S. at 189).

Recent district court opinions also illustrate that Omnicare can apply to limit claims even in the absence of classic opinion qualifiers. For example, in West Palm Beach Firefighters’ Pension Fund v. Conagra Brands, Inc., 2020 WL 6118605 (N.D. Ill. Oct. 15, 2020), the district court treated the defendants’ alleged predictions about the “success and effects” of a proposed merger as opinions—to be analyzed under Omnicare—despite the absence of “qualifiers such as ‘I think’ or ‘I believe.’” Id. at *16. The court reasoned that “future predictions” are distinguishable from statements of fact in light of the inherent uncertainty entailed in making predictions. Id. Similarly, in Costanzo v. DXC Technology Co., 2020 WL 4284838 (N.D. Cal. July 27, 2020), a California district court assumed that Omnicare applied to the claims at issue, even though “[t]he challenged statements” lacked “any clear indication” that they were opinions. Id. at *12. Thus, while it remains true that issuers are well advised to properly qualify opinion statements with phrases like “I think” or “I believe,” a failure to do so does not preclude Omnicare treatment when other factors show that the disputed statement was an opinion.

Halliburton II Market Efficiency And “Price Impact” Cases

As discussed above, the most significant development related to litigating price impact during the second half of 2020 was the Supreme Court’s grant of Goldman Sachs’s petition for certiorari. The Supreme Court’s eventual decision in that case will mark the Court’s first guidance on the proper application of its 2014 holding in Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014) (“Halliburton II”). In Halliburton II, the Court affirmed that courts may presume that stockholders classwide relied on alleged misrepresentations—provided the misrepresentations were public and material, the stock traded in an efficient market, and the plaintiffs traded after the alleged misrepresentation but before any correction. See id. at 277–78; Basic Inc. v. Levinson, 485 U.S. 224, 248 & n.27 (1988). In Halliburton II, however, the Court also held a defendant can undermine the presumption—and defeat class certification—by showing that the alleged misrepresentation in fact had no impact on the stock price. See Halliburton II, 573 U.S. at 283.

As we have previously noted, lower courts have had to reconcile the Supreme Court’s explicit ruling in Halliburton II that direct and indirect evidence of price impact must be considered at the class certification stage, see id., with the Supreme Court’s previous decisions holding that plaintiffs need not prove loss causation, see Erica P. John Fund, Inc. v. Halliburton Co., 563 U.S. 804, 813 (2011) (“Halliburton I”), or materiality, see Amgen Inc. v. Conn. Ret. Plans & Tr. Funds, 568 U.S. 455, 470 (2013) (“Amgen”), until the merits stage. Lower courts have also struggled with the issue of what standard of proof defendants must meet to rebut the presumption and what evidence is required to successfully do so.

Before the Supreme Court’s grant of certiorari in the Goldman Sachs case, the Seventh Circuit issued In re Allstate Corp. Securities Litigation, 966 F.3d 595 (7th Cir. 2020), an opinion that both acknowledged the need for and provided guidance on reconciling the three key Supreme Court decisions regarding the presumption of reliance noted above. The Seventh Circuit followed the Second Circuit’s lead in requiring trial courts to consider evidence of a lack of price impact even where that evidence overlaps with a merits issue, such as materiality. Allstate, 966 F.3d at 600–01, 608–09. It also followed the Second Circuit on assigning both the burden of production and the burden of persuasion to defendants. Id. at 610–11 (citing Waggoner v. Barclays PLC, 875 F.3d 79, 96–104 (2d Cir. 2017)). The Seventh Circuit vacated the trial court’s ruling certifying a class and held that the district court’s refusal to engage with defendant’s evidence of a lack of price impact was error. Id. at 609. Thus, the court remanded for further consideration of defendant’s evidence, id., including evidence regarding any price increase when the challenged statements were made and whether the stock price drops when the alleged fraud is revealed, see id. at 613.

Despite the emerging consensus among circuit courts that price impact evidence must be considered at the class certification stage even where it overlaps with merits issues, several district court decisions in the second half of 2020 declined to consider arguments regarding whether alleged corrective disclosures actually corrected the challenged statements. See, e.g., Plymouth Cty. Ret. Sys. v. Patterson Cos., 2020 WL 5757695, at *13 (D. Minn. Sept. 28, 2020) (declining to consider defendants’ arguments that changes in stock price on alleged corrective disclosure dates were not attributable to the challenged statements, because loss causation is a merits issue); In re CenturyLink Sales Practices & Sec. Litig., 2020 WL 5517483, at *13 (D. Minn. Sept. 14, 2020) (same). Both Plymouth County Retirement System and In re CenturyLink cited the Second Circuit’s 2020 decision in Goldman Sachs II, now under review by the Supreme Court, for the proposition that “[d]efendants must show ‘that the entire price decline on the corrective-disclosure dates was due to something other than its alleged misstatements,’” see, e.g., Plymouth Cty., 2020 WL 5757695, at *13 (quoting Ark. Teacher Ret. Sys. v. Goldman Sachs Grp., Inc., 955 F.3d 254, 270 (2d Cir. 2020)), but refused to consider whether the corrective disclosures actually contradicted the challenged statements, see, e.g., id. (citing Amgen, 568 U.S. at 475).

We will continue to monitor developments in the Goldman Sachs matter and cases considering Halliburton II.

ERISA Litigation

Where employer stock is offered as an investment option in employee retirement plans, securities litigation is often accompanied by claims under the Employee Retirement Income Security Act of 1974 (“ERISA”). 2020 saw noteworthy ERISA litigation activity, including the Supreme Court’s Sulyma decision clarifying the statute of limitations for fiduciary breach claims. Lower courts have also been active in the wake of the Court’s January decision in Retirement Plans Committee of IBM v. Jander, 140 S. Ct. 592 (2020), in addition to analyzing the requirements for fiduciary breach claims, the requirement of administrative exhaustion as a defense to fiduciary claims, and the enforceability of arbitration agreements.

Sulyma And Subsequent Lower Court Developments

As we discussed in our 2020 Mid-Year Securities Litigation Update, in February the Supreme Court unanimously held in Intel Corporation Investment Policy Committee v. Sulyma, 140 S. Ct. 768 (2020), that for purposes of ERISA’s limitations period in fiduciary breach cases, a fiduciary’s disclosure of plan information alone does not create “actual knowledge” subjecting such claims to the statute’s shorter three-year period, 29 U.S.C. § 1113(2), absent proof that a beneficiary actually read such disclosures. The Court left open questions, however, concerning how to prove “actual knowledge” based on circumstantial evidence or “willful blindness.” See Sulyma, 140 S. Ct. at 779.

Only a small number of lower courts have applied this decision so far. In Guenther v. Lockheed Martin Corp., 972 F.3d 1043 (9th Cir. 2020), the Ninth Circuit affirmed dismissal of a complaint as time-barred by the three-year limitations period triggered by actual knowledge as addressed in Sulyma. The court found that the plaintiff had actual knowledge based both on his testimony that he received and read relevant plan disclosures, and on “[c]ircumstantial evidence” such as actions that reflected his understanding of their contents. Id. at 1055. By contrast, a few district courts have declined to dismiss complaints as time-barred under the standard articulated in Sulyma. In Pizarro v. Home Depot, Inc., No. 18-cv-1566, 2020 WL 6939810 (N.D. Ga. Sept. 21, 2020), the court held that a plaintiff’s admission of past “generic concerns” about the fees that ultimately gave rise to her claim was “not evidence that she had actual knowledge of the underlying fiduciary conduct at issue”: “[s]he might have thought she was paying too much for the services she received, but her personal beliefs in no way demonstrate knowledge of the details, specifically that the fees charged were allegedly above the market price . . . , and particularly that fees might have even been inflated due to the alleged kickback scheme.” Id. at *28. Another court similarly declined to dismiss on timeliness grounds in Bouvy v. Analog Devices, Inc., No. 19-cv-881, 2020 WL 3448385 (S.D. Cal. June 24, 2020). Defendants argued that the plaintiff had knowledge from receipt of plan disclosures, but “fail[ed] to provide evidence indicating Plaintiff had actual knowledge or was willfully blind.” Id. at *5. In sum, the precise contours of “actual knowledge” and “willful blindness” after Sulyma will continue to be worked out in lower court litigation.

Additionally, at least one court has read Sulyma to shed light on another question, not directly presented in that case: “whether a Plan may set its own limitations period for statutory ERISA claims” that supersedes the statutory period. Falberg v. Goldman Sachs Grp., Inc., No. 19-cv-9910, 2020 WL 7695711, at *2 (S.D.N.Y. Dec. 28, 2020). In Falberg, the district court held that the answer is “no” for a case that would otherwise be controlled by the three-year period in 29 U.S.C. § 1113(2), in part because of the Supreme Court’s statement in Sulyma that “[29 U.S.C.] § 1132(a)(2) claims ‘must be filed within one of three time periods’ pursuant to § 1113.’” Id. at *3 (quoting Sulyma, 140 S. Ct. at 774) (emphasis added by trial court). The court accordingly denied defendants’ motion to dismiss and declined to issue a certificate of appealability on this issue. See id. at *4.

ESOP Fiduciary Claims After Jander

Regular readers will recall the discussion in our 2019 Year-End Securities Litigation Update and 2020 Mid-Year Securities Litigation Update of the circuitous path taken by the case of Retirement Plans Committee of IBM v. Jander, 140 S. Ct. 592 (2020) (per curiam), in which the Supreme Court ultimately punted on the question whether the “more harm than good” pleading standard from Fifth Third Bancorp v. Dudenhoeffer, 573 U.S. 409, 430 (2014), can be satisfied by generalized allegations that the harm resulting from the inevitable disclosure of an alleged fraud generally increases over time. Rather than deciding that question, the Court remanded the case in January to allow the Second Circuit to address two unresolved issues raised by the parties: (1) whether ERISA ever imposes a duty on a fiduciary for an employee stock option plan (ESOP) to act on inside information; and (2) whether ERISA requires disclosures that are not otherwise required by the securities laws. Jander, 140 S. Ct. at 595. Justice Kagan (joined by Justice Ginsburg) and Justice Gorsuch filed dueling concurrences addressing those questions and disputing whether they were properly presented.

On remand, the Second Circuit in June 2020 reinstated the judgment entered pursuant to its original opinion—an uncommon win for plaintiffs in this area. Jander v. Ret. Plans Comm. of IBM, 962 F.3d 85 (2d Cir. 2020) (per curiam). The court agreed with Justice Kagan’s suggestion that the additional arguments raised by defendants and the government in supplemental briefing “either were previously considered by this Court or were not properly raised,” and therefore were forfeited. Id. at 86.

Since then, the Second Circuit’s decision has become even more of an “outlier,” as “the overwhelming majority of circuit courts to consider an imprudence claim based on inside information post-Dudenhoeffer [have] rejected the argument that public disclosure of negative information is a plausible alternative.” Burke v. Boeing Co., No. 19-cv-2203, 2020 WL 6681338, at *5 (N.D. Ill. Nov. 12, 2020). In a pair of cases decided in July, the Eighth Circuit rejected the Second Circuit’s reasoning on this question in Allen v. Wells Fargo & Co., 967 F.3d 767, 774 (8th Cir. 2020), and instead followed the reasoning of “nearly every other circuit court to confront this type of argument” by concluding that “this chain of reasoning is uncertain and a reasonably prudent fiduciary . . . could still believe disclosure was the more dangerous of the two routes.” Dormani v. Target Corp., 970 F.3d 910, 915 (8th Cir. 2020). The plaintiffs in one of these cases, Allen v. Wells Fargo & Co., have filed a petition for certiorari asking the Supreme Court to weigh in on this deepening circuit split, which last year’s remand in Jander left unresolved.

Exhaustion Defenses Against Fiduciary Claims

Decisions in 2020 indicate that the circuits remain split on whether plaintiffs must exhaust administrative remedies before filing claims invoking ERISA-imposed fiduciary duties. Almost all circuits have held that plaintiffs must generally exhaust administrative remedies “before filing suit” for benefits due pursuant to a plan “under [ERISA] § 502(a)(1)(B), [29 U.S.C. § 1132(a)(1)(B)].” LaRue v. DeWolff, Boberg & Assocs., Inc., 552 U.S. 248, 258–59 (2008) (Roberts, C.J., concurring in part and concurring in the judgment). But only two courts of appeals—the Seventh and Eleventh Circuits—have extended that requirement to claims alleging a breach of fiduciary duties imposed by ERISA itself, in addition to claims for benefits due under the terms of a plan. See Lanfear v. Home Depot, Inc., 536 F.3d 1217, 1223–24 (11th Cir. 2008); Lindemann v. Mobil Oil Corp., 79 F.3d 647, 649 (7th Cir. 1996). District courts in those circuits therefore continue to dismiss cases for failure to exhaust that would proceed unhindered in other jurisdictions. See, e.g., Fleming v. Rollins, Inc., No. 19-cv-05732, 2020 WL 7693147, at *5 (N.D. Ga. Nov. 23, 2020).

This circuit split has now persisted for over thirty years. See Mason v. Cont’l Grp., Inc., 474 U.S. 1087, 1087 (1986) (White, J., dissenting from denial of certiorari) (urging that “the Court should grant certiorari in this case in order to resolve the uncertainty over the existence of an exhaustion requirement in cases of this kind”). Until the Supreme Court weighs in, this division is likely to persist for the foreseeable future.

Single Stock Fund Fiduciary Claims

In the past year, a circuit split has developed on the question of whether an employer can satisfy its fiduciary duties while offering a single-stock fund. ERISA requires the fiduciary of a pension plan to act prudently in managing the plan’s assets and to diversify the investments of the plan so as to minimize the risk of large losses. 29 U.S.C. § 1104(a)(1)(B), (C). Recent litigation has challenged whether single-stock funds are per se imprudent because they are not diversified, or whether single-stock funds may be offered so long as a diversified portfolio can be attained at the plan level.

In May of last year, the Fifth Circuit affirmed the dismissal of a putative fiduciary breach class action in Schweitzer v. Investment Committee of Philips 66 Savings Plan, 960 F.3d 190 (5th Cir. 2020). The court first addressed the statutory definition of a qualifying employer security, which is exempt from the otherwise applicable fiduciary duties of diversification. Id. at 105; see 29 U.S.C. § 1107(d)(1) (defining an employer security as one “issued by an employer of employees covered by the plan, or by an affiliate of such employer”). The court rejected the defendants’ argument that the single-stock funds at issue (investing in ConocoPhillips stock) were qualifying employer securities because an intervening spinoff had changed the employer into a new entity (Phillips 66) for statutory purposes. 960 F.3d at 195. Nevertheless, the court held that the defendants satisfied their fiduciary duties to diversify and act prudently because they provided plan participants with an array of other investment options that “enable[d] participants to create diversified portfolios.” Id. at 196–98. The court rejected plaintiffs’ claim that “a single-stock fund is imprudent per se.” Id. at 198.

A few months after Schweitzer, the Fourth Circuit reached the opposite conclusion and reversed the district court’s dismissal of a putative class action claiming that the defendant company breached its fiduciary duty with a single-stock fund. Stegemann v. Gannett Co., 970 F.3d 465 (4th Cir. 2020). Rejecting the argument that “diversification must be judged at the plan level rather than at the fund level,” the Fourth Circuit held that “each available fund on a menu must be prudently diversified.” Id. at 476–77 (emphasis added). The dissent argued that “the majority merge[d] the duties of diversification and prudence,” and, in effect, made it impossible for an employer to “ever prudently offer a single-stock, non-employer fund.” Id. at 484, 488 (Niemeyer, J., dissenting). No other court has adopted the Fourth Circuit’s standard. Defendants filed a petition for a writ of certiorari and, on January 4, 2021, the Supreme Court called for a response from the plaintiff, indicating that the Court might be interested in hearing the case.

Arbitrability Of ERISA §502(a)(2) Claims

Whether ERISA plan participants can be required to arbitrate fiduciary duty-related disputes has continued to be litigated in the past year. Because ERISA § 502(a)(2) “claims belong to a plan—not an individual,” the “relevant question is whether the Plan agreed to arbitrate the § 502(a)(2) claims,” not the individual employee. Dorman v. Charles Schwab Corp., 780 F. App’x 510, 513 (9th Cir. 2019) (citing Munro v. Univ. of S. Cal., 896 F.3d 1088, 1092 (9th Cir. 2018)) (emphasis added). Accordingly, in Dorman, the Ninth Circuit held that because “the Plan did consent in the Plan document to arbitrate all ERISA claims,” the mandatory arbitration agreement was enforceable. Id. at 514; see also Dorman v. Charles Schwab Corp., 934 F.3d 1107 (9th Cir. 2019) (published opinion issued the same day holding that ERISA claims may be arbitrable, and overruling Amaro v. Continental Can Co., 724 F.2d 747 (9th Cir. 1984)).

If the plan does not expressly agree to arbitration in the plan document, however, then an arbitration agreement may be unlikely to be enforced for a § 502(a)(2) claim, regardless of whether the individual employee signed an arbitration agreement related to his or her own employment. For example, in Ramos v. Natures Image, Inc., No. 19-cv-7094, 2020 WL 2404902 (C.D. Cal. Feb. 19, 2020), the district court partially denied a motion to compel arbitration on an ERISA claim for breach of fiduciary duty, even though the individual employee plaintiffs had signed arbitration agreements. The key distinction for the Ramos court was whether the plan is a party to the arbitration agreement. Id. at *7. And because the employee’s arbitration agreement in Ramos concerned only the employment relationship and did not bind the plan to arbitration, the court held that the agreement did “not cover claims for breach of fiduciary duty under ERISA”. Id.; but see Woellecke v. Ford Motor Co., No. 19-CV-12430, 2020 WL 6557981, at *3–4 (E.D. Mich. Nov. 9, 2020) (holding that because “the parties agreed to arbitrate [both] the merits of any arbitrable disputes” and any arbitrability disputes, “the matter must be resolved by the arbitrator . . . to decide whether disputes are subject to their agreement”). For this reason, the court also rejected the argument that, when the plan was not bound by the arbitration agreement, there was a distinction between a plaintiff bringing a class action on behalf of the plan and a plaintiff bringing an individual action. Ramos, 2020 WL 2404902 at *7.

Finally, even if the plan expressly agrees in the plan document to arbitrate § 502(a)(2) ERISA claims, the arbitration agreement still may not be enforced, as other courts have called Dorman into question more directly. In Smith v. Greatbanc Trust Co., the District Court for the Northern District of Illinois rejected Dorman’s holding, even though the plan agreed to arbitrate. 2020 WL 4926560, at *3–4 (N.D. Ill. Aug. 21, 2020). The court reasoned that failure to notify the former employee, who remained a participant in the plan, about changes to the plan was inconsistent with ERISA’s notice requirements, and that, to the extent the arbitration agreement served as a “waiver of a party’s right to pursue statutory remedies,” the agreement was unenforceable. Id. at *4 (quoting Am. Express Co. v. Italian Colors Restaurant, 570 U.S. 228, 235–36 (2013)). The case is now pending appeal, but if the Seventh Circuit affirms the district court in Smith, it could create a split with the Ninth Circuit.

This post comes to us from Gibson, Dunn & Crutcher LLP. It is based on the firm’s recent memorandum, “2020 Year-End Securities Litigation Update,” dated February 16, 2021, and available here.

Sky Blog

Sky Blog