Global efforts to limit the spread of Covid-19 have prompted the widespread adoption of restrictions on people’s ability to go out and about and, as result, have thrust public mental health issues into the spotlight. Mandatory work-from-home arrangements, for example, have created emotional distress for many homebound employees working alone. The U.S. Census Bureau’s December 2020 Household Pulse Survey found that 42 percent of respondents reported symptoms of anxiety or depression, an 11 percent increase over the previous year’s results. The American Psychological Association found that nearly eight in 10 adults claimed that the pandemic is a significant source of stress, and two in three adults said they experienced more stress just from living through the pandemic. Scientists identify social isolation as the major factor contributing to rising mental health problems during the pandemic. Business leaders also expressed concern about the adverse work-from-home effects on employees, but we know little about how Covid-19 has affected corporate managers’ mental well-being and, as a result, corporate policies.

In a new study, we examine whether isolation from working at home influences managerial sentiment and whether any resulting pessimism affects corporate policies. The psychology literature suggests that emotions can influence individuals’ decision-making and attitudes toward risk and that negative emotions often give rise to pessimism. This line of research also recognizes that social interactions enhance emotional well-being, while social isolation induces loneliness, fear, and anxiety. Therefore, we hypothesize that remote work from home arising from the pandemic can threaten employees’ emotional well-being and increase their pessimism bias. Managers, as individuals, are susceptible to the same cognitive bias. This bias would cause managers to adopt conservative corporate policies and undermine their companies’ performance, especially since working from home limits the workplace interactions that can help correct such biases.

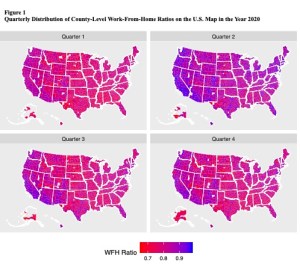

Our study exploits newly available daily foot traffic data from SafeGraph, which has aggregated anonymized location data from millions of mobile devices since the beginning of the pandemic in January 2020, to investigate the work-from-home effect on managers’ pessimism. SafeGraph provides social distancing information that allows us to determine the fraction of time residents stay at home in a particular county. We assume that residents work in the county where they live (i.e., the county location of their company’s headquarters). Hence, a county’s stay-at-home ratio is our proxy for the proportion of time a firm’s employees work from home (hereafter WFHC). Figure 1 depicts the distribution of WFHC on the U.S. map for each quarter of 2020 and illustrates how stay-at-home time varies across states as those states impose, relax, and reinstate social distancing restrictions. We employ managerial sentiment measures constructed by using a textual analysis of companies’ quarterly earnings conference calls to capture managerial pessimism biases during this crisis period.

We begin by checking the validity of our implicit assumption that working from home leads to social isolation. Arguably, the proliferation of video-conferencing tools (e.g., Zoom and Skype) and cloud-based team collaboration technologies (e.g., Google docs and Microsoft Teams) could facilitate virtual communication even under pandemic lockdowns. We, therefore, conduct two validation tests to establish the crucial links between WFHC and individuals’ risk perceptions and workplace communication. The first test shows that working from home intensifies the general public’s risk perception, revealed by Google searches of Covid-19-related topics, including coronavirus, lockdowns, and economic recession. The other test finds a significant increase in Glassdoor’s employee online complaints concerning workplace communication, pointing to lack of social interactions as a potential explanation for isolation-induced managerial pessimism.

Next, we examine the experiences of homebound managers. The baseline results support our main hypothesis that isolation when working from home causes managers to become more pessimistic, as reflected by a significant fall in their sentiment. From an economic perspective, A rise in WFHC from its pre-pandemic to pandemic-mean level leads to a 45 percent drop in managerial sentiment, consistent with numerous health reports that Covid-19 isolation increases stress and anxiety and hence pessimism bias.

Our baseline findings might be open to two alternative explanations. First, working from home might dampen managerial sentiment simply because remote work causes a sudden business disruption, worsens firm performance, and raises uncertainty. The inherent Covid-19-driven information uncertainty gives rise to managerial cognitive bias, and the prospect of poor performance introduces a pessimism bias. To rule out this possibility, we test our central hypothesis on subsamples of firms based on the extent to which a firm is vulnerable to the pandemic. Our results confirm that the adverse work-from-home effect on managerial sentiment is independent of a firm’s operating uncertainty during the pandemic. Second, our main evidence may also be consistent with managerial opportunism when managers intentionally associate their negative news with similar news from other underperforming firms during the pandemic and attribute their poor performance to the health crisis (the opportunism effect). If managers were to manipulate forecasts downward to depress company stock price, one would expect more insider purchases following pessimistic earnings calls. However, if managerial pessimism is a natural, unintended outcome, the depressed feelings due to social disconnection should result in more insider sales and fewer purchases. Our finding is more in line with a psychological interpretation than an opportunism argument.

Finally, we explore the effect of Covid-19-induced isolation on corporate policies through managerial pessimism biases. The notion is that pessimism arising from isolation leads managers to make conservative and risk averse economic choices. Our findings generally support the financial conservatism induced by homebound corporate managers: They make fewer capital expenditures and acquisitions, invest less in R&D, reduce working capital needs, lower leverage, and cut net debt issuance. However, cash holdings are lower during the pandemic. We attribute this to firms’ unprecedented demand for more resources as they spend more to maintain operations and workforces.

Our findings paint a dire picture of potential economic damages arising from adverse mental effects on homebound corporate management. When focusing our analysis strictly on management, we might have underestimated working from home’s mental health costs on non-managerial employees. According to Microsoft’s 2021 Work Trend Index survey of 30,000 people from 31 countries, employees suffer even more from remote working conditions than do company leaders. More than 50 percent of surveyed employees report struggling with work-from-home arrangements, compared with only 39 percent of business leaders. Given the vital role of labor in productivity, our study conveys a cautionary message to policymakers and researchers that the economic damages of Covid-19 social isolation may be far greater than the effects of suboptimal corporate policies.

This post comes to us from professors Lilian Ng at York University’s Schulich School of Business and the European Corporate Governance Institute (ECGI), Jing Yu at the University of Sydney, and Linyang Yu at York University’s Schulich School of Business. It is based on their recent paper, “COVID-19 Isolation, Managerial Sentiment, and Corporate Policies,” available here.

Sky Blog

Sky Blog