The COVID-19 pandemic and efforts to combat its spread were an unprecedented shock to corporate cash flows and consequent need for external financing. How did corporate leverage respond? More important, what does the impact on leverage mean for financial stability? In the U.S., firms that were most affected by the pandemic, in terms of drop in demand, are likely facing a debt overhang problem and increased risk of default. We document these recent patterns on corporate leverage and financial fragility in our recent paper, which uses a dataset of about 3,000 U.S. public companies.

Controlling for the effects on leverage due to firm characteristics (such as size, profitability, growth prospects, tangible assets, sectoral differences, and firm management) and macroeconomic conditions, we identify the impact of the COVID-19 pandemic on corporate leverage. Specifically, our analysis reveals that leverage, defined as the ratio of net-debt-to-assets, declined by 5.3 percentage points. This is a substantial change since mean leverage pre-COVID is 19.6 percent in our sample.

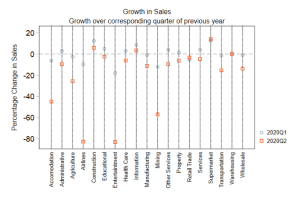

We find that this de-leveraging effect is stronger for firms that were already exposed to pre-COVID financial risks, defined as firms in the upper quartile of rollover risks prior to COVID. Strikingly, firms most severely affected by business risk related to social distancing – identified as firms in the bottom quartile of sales growth in the second quarter of 2020 compared with the second quarter of 2019 – did not reduce leverage compared with those less affected by lockdowns. Figure 1 shows that firms in the accommodation, airline, and entertainment sectors experienced declines in sales of as much as 45, 80, and 82 percent respectively in the second quarter of 2020 relative to the second quarter of 2019.

Figure 1: Sectoral Decomposition of the COVID-19 Impact on Sales Growth.

Source: Compustat and authors’ calculations.

It is possible that the value-maximizing level of leverage for firms, especially those exposed to business risk, may have decreased due to reduced growth prospects or heightened risks from the COVID shock.

This leads us to our second exercise of identifying firms that may have become over-leveraged. We classify a firm as over-leveraged if its actual leverage is higher than its value-maximizing level. We estimate a model of a firm’s value-maximizing level of leverage (from shareholders’ perspective) that considers decline in growth prospects, increase in risks, and changes in market conditions following the COVID shock. Our model predicts optimal corporate leverage declined significantly following COVID. We also find firms that were most severely affected by the drop in demand due to social distancing (i.e., those that did not de-lever based on risks from lockdowns) now have actual leverage ratios that greatly exceed their value-maximizing level of leverage. In other words, we find evidence that these firms are over-levered. This is driven by the fact that the decline in the optimal level of leverage is larger than the actual decline in net leverage.

Over-levered firms have higher default risk, which brings us to our third and final exercise of estimating the impact on probability of default following the pandemic. We zoom in on over-leveraged firms since default probability is likely correlated with over-leveraging. Our analysis relies on a classic model of default probability, introduced by Merton (1974).[1] We compute a popular measure of distress risk, “distance-to-default” (DTD), which tells us how far a company’s asset value is from reaching a point at which it would be expected to declare bankruptcy (so lower DTD values imply higher likelihood of default).

We find significant deterioration in credit risk among firms exposed to business risks from social distancing (i.e. those that did not de-lever compared with those less affected and allowed actual debt to exceed optimal leverage). When we restrict our analysis to large firms, defined as those with an average size of at least $1 billion in total assets in our sample, we observe that deterioration in credit risk is larger for those that were most affected by social distancing. In fact, sorted from highest to lowest DTD, the lowest quartile of this sample of firms has DTD of 1.22 (and lower), implying their asset value is just a little over one-standard deviation away from default. Moreover, firms that already had elevated default probabilities before COVID experienced relatively greater deterioration in default risk.

Overall, our results suggest firms most severely affected by social distancing became over-leveraged. Moreover, these firms experienced the largest deterioration in credit risk, which may continue to linger as renewed concerns of COVID-19 variants and social distancing measures persist.

REFERENCES

[1] Merton, R. C. 1974. On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. Journal of Finance 29:449–70.

This post comes to us from Sharjil M. Haque, a PhD candidate in economics at the University of North Carolina – Chapel Hill, and Richard Varghese, an economist at the International Monetary Fund. It is based on their recent article, “The COVID-19 Impact on Corporate Leverage and Financial Fragility,” available here. The views expressed herein are those of the authors and should not be attributed to the IMF, its executive board, or its management.

Sky Blog

Sky Blog

I am not a man in the related field. I appreciate the study how covid-19 affected US economy as revealed by the critical analysis. A simple comment, whether the analysis could cover the impact/success of vaccination during post Covid duration in USA!

The vaccination is a successful part for curving the Covid-19 havoc by the present admin of USA.

.