Although the United States inherited its common law legal system from the United Kingdom, the U.S. securities class actions jurisprudence is well advanced of the development of this area of law in the United Kingdom. With the first major collective action just occurring in 2013 (RBS Rights Issue Litigation), it is easy to understand why the case law surrounding this small but significant area of law has not had as much time to develop as it has in the United States.

The U.K. securities litigation is hitting its stride and the Courts have recently provided some valuable guidance as to how litigation is to be conducted. The number of cases are rising and with that, the jurisprudence on both procedure and substantive issues of law in securities litigation will follow suit.

The main difference between the jurisprudence of the two countries is how each jurisdiction classifies members in class or group actions. There is no true concept of a securities class action in England and Wales in the sense of a representative, opt-out action that other jurisdictions may recognize.[1] In an opt-out jurisdiction, all persons who meet the eligibility requirements are automatically part of the recognized class. Whereas in England (and other countries throughout Europe), the country operates under an opt-in jurisdiction where interested parties must “join” the class by registering themselves as claimants before the actual litigation is commenced. Due to this major jurisdictional difference and other factors, participating in shareholder group actions in the United Kingdom varies vastly from participating in a securities class action in the United States.

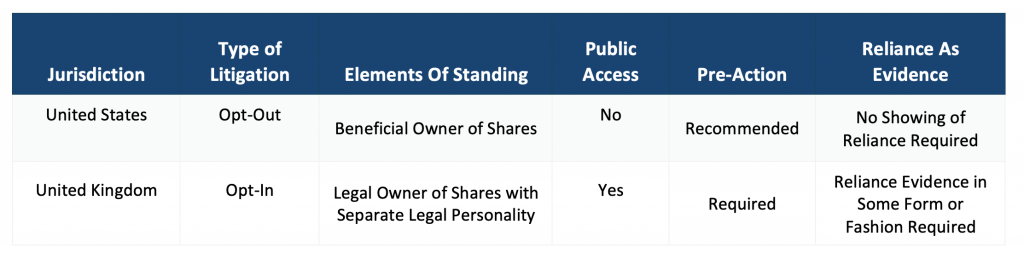

The below chart sets out the key differences at a glance between the United Kingdom and United States:

As stated above, group actions are based on an opt-in procedure. Each individual claimant must consciously take steps to bring a claim to court and individuals will only be bound if they take these affirmative steps.[2] A key element within opt-in jurisdictions is that a sufficient number of claimants will need to be persuaded to bring claims to make the joint group action financially viable for the law firm and funders to pursue.ii

A burdensome consequence of this, in practical terms, is that any law firm deciding to pursue an action will have to identify interested claimants and must also identify who the correct legal entity to list as the claimant is before even bringing the claim. In practice, this translates to much correspondence between the interested claimant and the law firm whereby the law firm has to confirm the proposed claimant is a legal entity with separate legal personality which also owned the shares. Often this entails the law firm to examine the structure of a company and its funds to identify the correct legal entity that owns the shares.

ENDNOTES

[1] Edwards, Harry and Ford, Jon. “The Securities Litigation Review: United Kingdom – England & Wales.” Herbert Smith Freehills LLP, 7 June 2021, https://thelawreviews.co.uk/title/the-securities-litigation-review/united-kingdom-england–wales.

[2] Maples, Jamie; Lund, Hayley; Chaplin, Sarah; and Wedderburn-Day, Zoe. “Class Actions 2021:United Kingdom” Law Business Research Ltd, 2020, https://www.weil.com/~/media/files/pdfs/2021_class-actions_united-kingdom.pdf.

This post comes to us from Institutional Shareholder Services. It is based on the firm’s report, “Securities Class Actions: The Challenges of Litigating in the United Kingdom,” available here.

Sky Blog

Sky Blog