Back to normal doesn’t mean what it used to. Following a year like no other, demand came roaring out the gate in 2021. While the pace of new demand has slowed somewhat in recent months amidst concern of new COVID variants, net new flows into long-term mutual funds and ETFs reached unprecedented territory. The $1.1 trillion gathered over the first 11 months of the year has surpassed all other years on record for the fund industry.

Passive funds led inflows in the year-to-date period at $826.9 billion, but active funds have strongly contributed to demand with net deposits of $252.5 billion even if they remain shy of their 2009 highwater mark ($303.0 billion). As covered in research compiled by ISS Market Intelligence throughout the year, extensive opportunities exist across the fund industry, ranging from new structural developments like fund-to-ETF conversions and semitransparent active funds to burgeoning areas like ESG and cryptocurrencies.

Below are excerpts from across ISS MI’s core research offerings throughout the past year. For more information about ISS Market Intelligence’s research offerings, please contact our client success team.

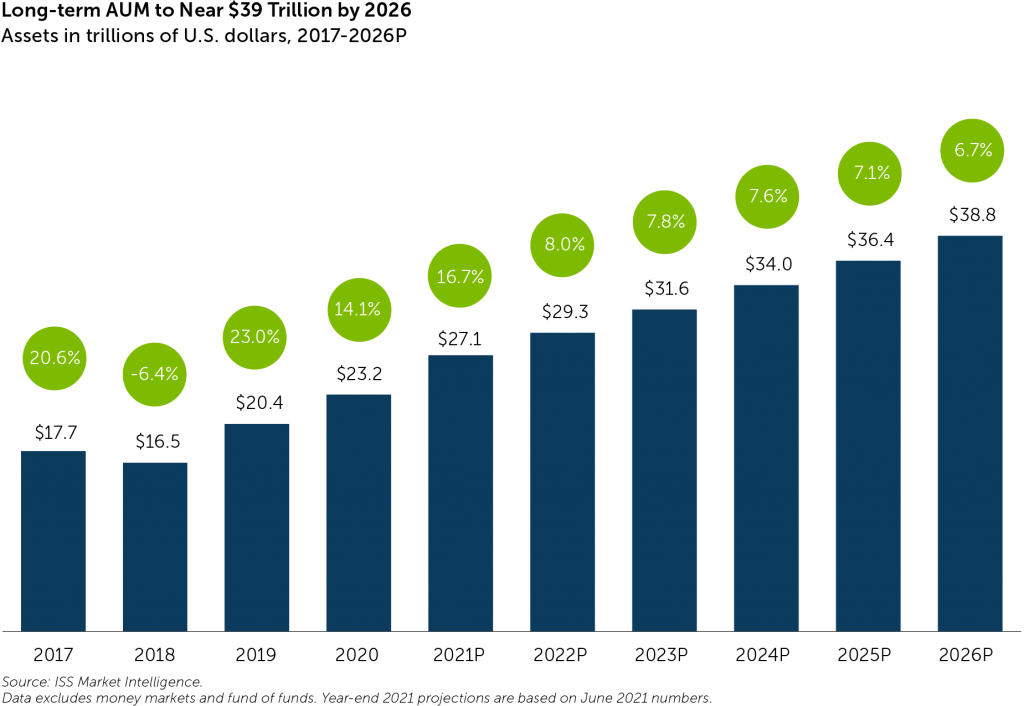

Our Five-Year Outlook: AUM Growth Falls to Earth, ETFs Gain Steam

“2021 caps a half-decade of well above average AUM growth. ISS Market Intelligence’s 2022-2026 outlook for long-term funds, detailed in the forthcoming State of the Market: Future of Retail Products report, anticipates slower growth ahead. Our forecasted 7.4% annual growth falls well short of the estimated 13.1% gain long-term fund AUM will have delivered from 2017-2021. While the future may look disappointing, it is closer to the historical norm than the recent past. Over the past 20 years, the median five-year growth rate for long-term fund AUM was 8.3%. While diminished in percentage terms, future asset growth is nothing to sneeze at in dollar terms: Long-term AUM will climb $11.7 trillion over the next half-decade to nearly $39 trillion.”

Are Mutual Fund to ETF Conversions the Next Big Thing?

“Mass conversions are unlikely, however. One simple reason is that the mutual fund remains a better mousetrap for many use cases. Mutual funds provide managers with more ways to manage cash flows when the investment strategy focuses on less liquid or capacity constrained asset classes, for instance. Less-frequent disclosure requirements are also an attraction, at least next to fully transparent ETFs.”

For Semi-transparent Active ETFs, Short-term Hurdles Call for a Long-term View

“While STAs have made a respectable start, they are not a silver bullet for active managers. Though they may be more efficient than their mutual fund counterparts, from the perspective of fund firms they do not necessarily create a shortcut for the long process of product development. A multi-year track record is still important. The various STA structures have functioned without any glitches so far, but gatekeepers will still want to see minimum asset sizes to ensure proper liquidity. Financial arrangements with distributors are still evolving. None of these challenges is insurmountable, but for sponsors of STAs, success is likely to be a long-term proposition.”

Following a Successful ETF Launch, What Lies Ahead for Crypto Funds?

“After years of filings of funds that would provide exposure to Bitcoin, ProFunds received approval in 2021 to launch the first open-end mutual fund and ETF investing in Bitcoin futures. Though the mutual fund came to market first, the ETF variant has proved much more popular and ranked among the strongest ETF debuts on record. Retail investors often benefit more from consistent contributions than trying to time the market, but the gulf in assets between the fund and ETF versions demonstrate how important liquidity ultimately is to this asset. The mutual fund held assets of $30 million as of the end of October 2021, while it took two trading days for the ETF to reach $1 billion in assets. The importance of short-term trading appears to have strongly outweighed the appeal of a long-term buy and hold strategy, at least at this initial stage.”

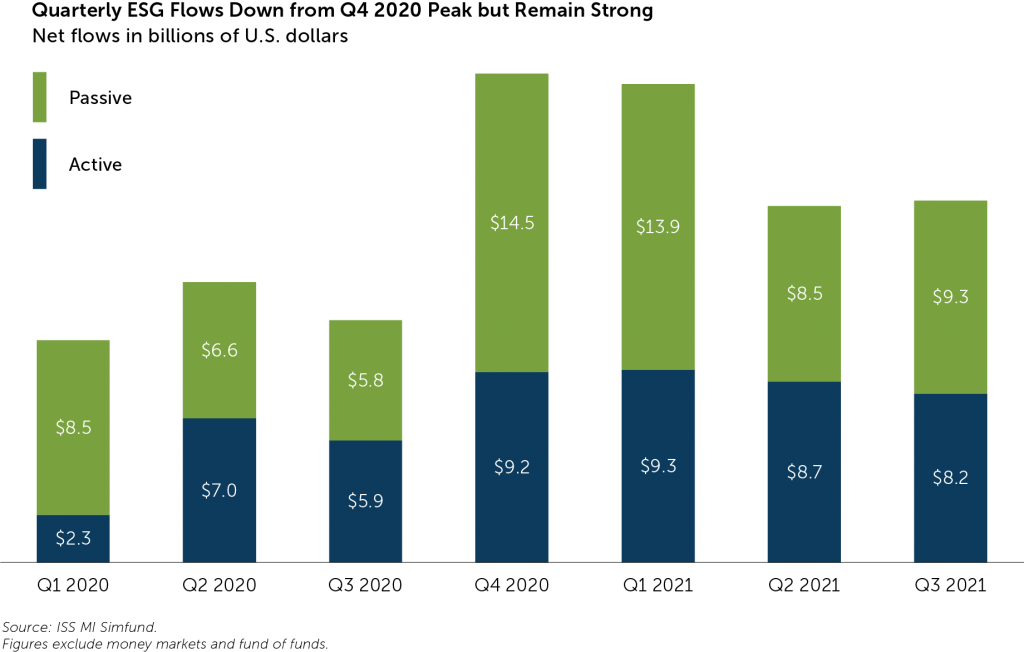

ESG Flows Set to Break 2020 Record as New Products Proliferate

“The ESG fund flows remain on pace to exceed their 2020 record. Third quarter net sales roughly matched the prior quarter’s, reaching $17.6 billion. The year-to-date total—$58.0 billion—is within striking distance of the approximately $60 billion in net flows ESG funds gathered last year. Total long-term ESG assets crossed the $400 billion mark and are up 25% for the year to date, more than double the growth rate for all long-term funds.”

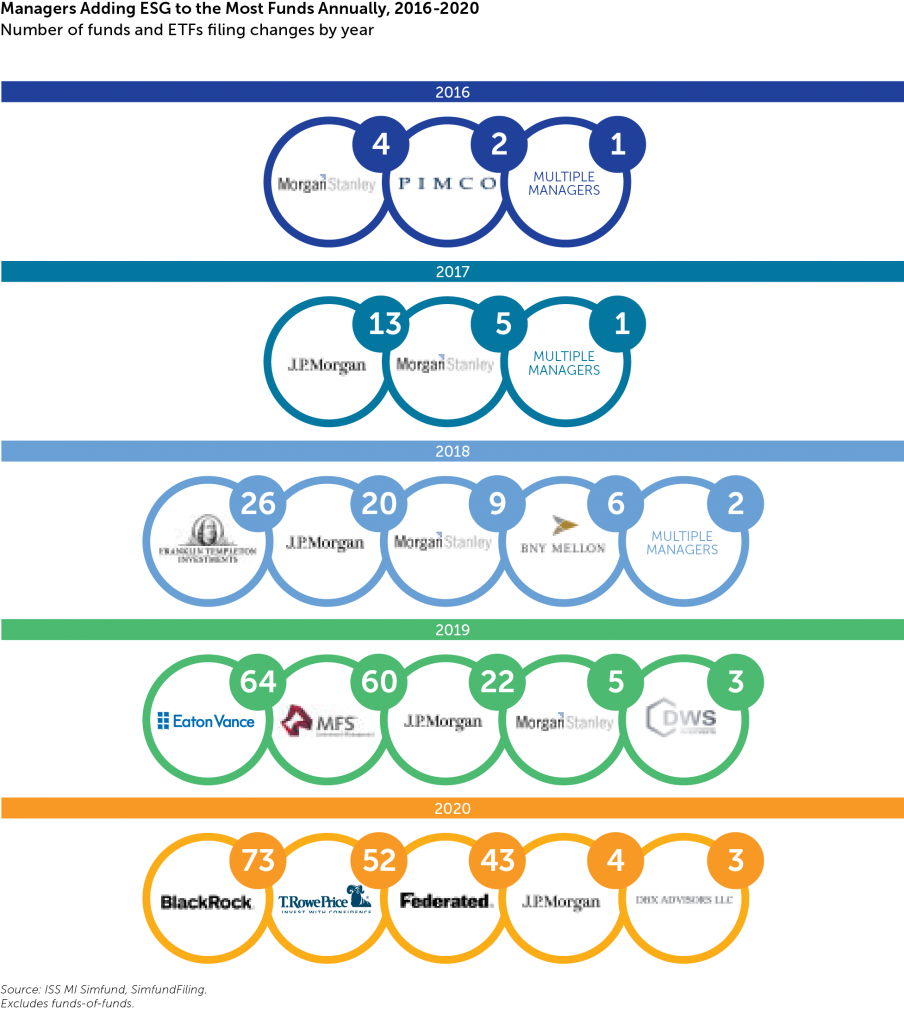

Build New or Renovate? Many Asset Managers Choose Latter in ESG Push

“Few things have taken the asset management industry by storm quite like ESG. Once limited to a few specialist firms and products, investment themes such as sustainability, environmental impact, and social justice have now become mainstream. ESG dominates headlines, and new funds focused on impact investing or reducing carbon intensity are debuting every month.

This active product development pipeline has certainly raised the profile of ESG, but the steady stream of new launches does not fully capture the degree to which sustainable investing has permeated the industry. Data from ISS MI’s SimfundFiling database, which tracks all registrations and prospectus changes for mutual funds and ETFs, shows a sharp increase in managers adding ESG criteria to funds already on the market”

The Future Starts Now: The Evolving Market of DC Plans

“The appeal of pooled employer plans (PEPs) would understandably be strongest among the smallest employers, as such firms are less likely to have the staff or resources necessary to run and offer their own plans. A mere 55% of workers at firms with 99 or fewer employees had access to any retirement benefits compared to 85% of workers at companies with 100 or more employees. Employers opting for a PEP would presumably benefit from a larger pool of assets, possibly allowing them to gain better negotiating power for their investment options. Some providers feel that the greatest opportunity for PEPs lies in competing with existing single employer plans. Given the already stretched and stressed workforces, employers may seek to limit the administrative and legal burdens in running their plans and outsource what they can.”

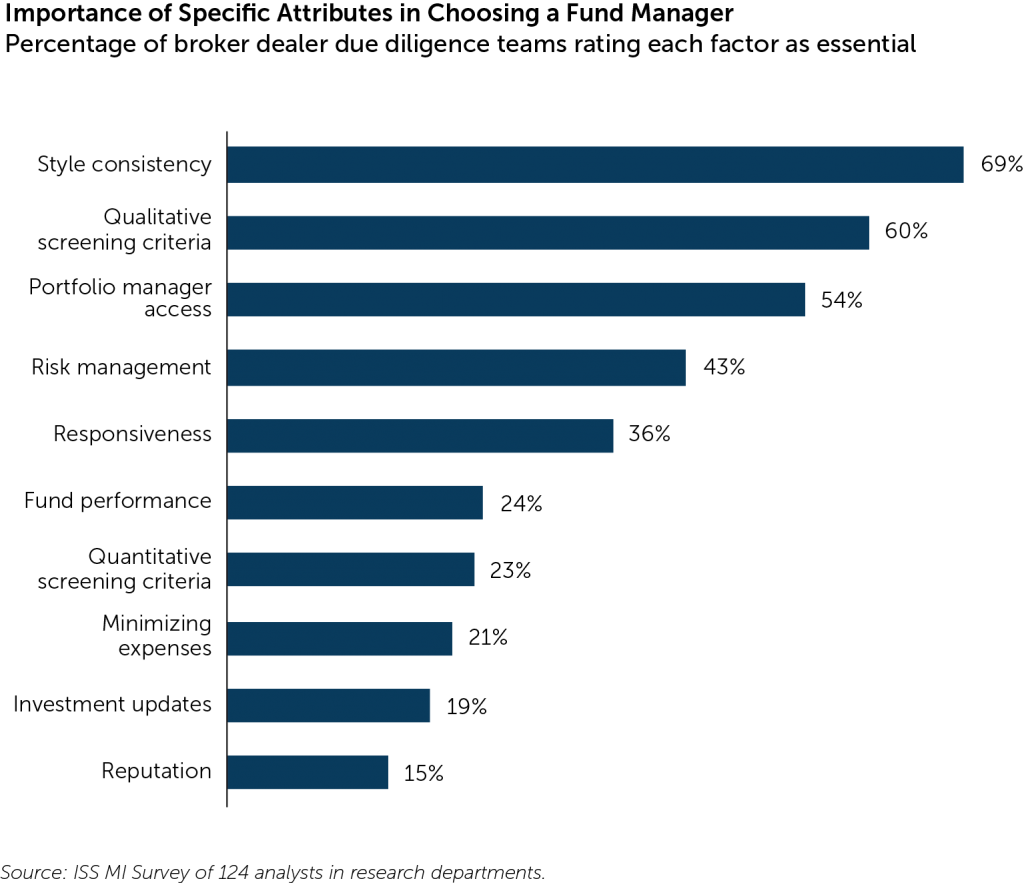

Shelf Space and Distribution Strategy in the Intermediary Market

“In early 2021, ISS MI conducted interviews with over one hundred research analysts at BDs, asking which attributes they consider in selecting managers for their platforms or select lists. Rated as essential by 69% of respondents was style consistency, meaning that the way the fund is managed is consistent with the stated investment process and objectives. Style consistency was also rated as the most essential criterion in placing a fund on a select list and for including it in a model. When advisors already go to such lengths to pick a specific fund among many options, they do not want to be forced to revisit that decision because their initial choice has deviated from its mandate.”

This post comes to us from Institutional Shareholder Services. It is based on the firm’s recent article, “ISS Market Intelligence: Fund Flows Roar Back in 2021,” dated December 21, 2021, and available here.

Sky Blog

Sky Blog