Over the past two years, Environmental, Social, and Governance (ESG) matters have become an increasingly important issue in the boardroom. This trend is accelerating today as a growing number of investors and stakeholders expect companies to both produce strong stock price returns and demonstrate ESG improvements. Many companies are responding to investor pressures by providing enhanced disclosures on existing ESG practices. In turn, boards are broadening their mandates to add ESG.

To understand how boards are disclosing the scope of their oversight responsibilities, Exequity reviewed the board committee charters[1] of the S&P 100 constituents. Our research reveals the overall scope and distribution of ESG responsibilities, as described by the committee charters of each respective company.

Summary of Results

Across the S&P 100, we found 93 companies with at least one committee with ESG oversight responsibilities (the “ESG Group”). Key findings include:

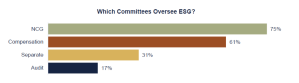

- 75% of nominating and corporate governance (NCG) committees maintain ESG oversight responsibilities, most commonly Environment and Sustainability.

- 61% of compensation committees have ESG responsibilities, typically limited to oversight of Diversity, Equity, and Inclusion (DEI), including pay equity.

- 31% establish oversight over ESG responsibilities to a separate (other) committee.

Expectations for 2022 and Beyond

Exequity expects the trend of compensation and NCG committees leading boards’ ESG efforts to continue in 2022. We note that ESG governance practices are evolving quickly, and as such, Exequity advises reviewing board committee charters for appropriateness. We believe the inclusion of specific ESG areas into committee charters demonstrates the board’s commitment to this topic.

As a practical matter, the expansion of ESG sensitivity and governance highlights the need for coordination across committees and the full board. However, to facilitate a cohesive approach to ESG efforts, over time we expect many companies to establish a separate board committee vested with comprehensive ESG oversight and authority to meet the growing expectations of shareholders and proxy advisors.

Defining ESG Responsibilities

We identified six broad categories of “ESG responsibilities,” described below.

| Focus Area1 | General Description of Responsibilities |

| Environment | Oversight of environmental matters, such as greenhouse gas emissions, energy consumption, and other matters related to the impact of the company’s current operations on the environment. |

| Sustainability | Oversight of the company’s efforts to build a sustainable business model. Greater focus on future operational matters and/or sustainability of current operations. |

| DEI | Oversight of company DEI programs and initiatives, including pay equity. For this purpose, does not include oversight of board diversity. |

| Employee Health and Safety | Oversight of Employee Health and Safety programs and initiatives. |

|

Corporate Social Responsibility |

Oversight of general corporate social responsibility efforts that are not further specified. Includes oversight of charitable donations and relationship with relevant communities. |

| General ESG | Other ESG responsibilities and/or general references to “ESG” responsibilities that are otherwise undefined in the charter. |

|

1 We did not include Human Capital Management (HCM) oversight responsibilities as a separate “ESG” focus area because it encompasses established oversight responsibilities and HCM disclosure is now an SEC requirement. |

|

Defining Committees Responsible for ESG

Like most publicly traded companies, nearly all S&P 100 company boards maintain at least three committees: audit, compensation, and nominating and corporate governance. Most S&P 100 companies also maintain additional committees, with 71 reporting four or more standing committees, such as finance, risk, and/or public policy committees (excluding executive committees and subcommittees).

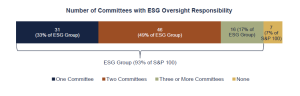

Exequity reviewed the charters of each board committee to determine which include oversight of one of the ESG focus areas described in the table above. We found that 93 companies incorporated ESG oversight into one or more board committee charters and seven did not. Notably, 67% spread ESG oversight over two or more committees. Of the seven cases in which ESG responsibility is not delegated to a specific committee, two companies indicate in their most recent proxy filing that ESG matters are overseen by the full board and five were silent on the board’s involvement.

Prevalence of ESG Oversight Across Committees

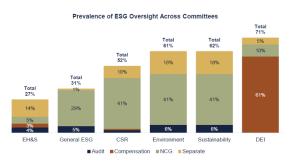

The graphics below display how boards of ESG Group companies distribute oversight responsibilities.

Note: Percentages of individual committees do not sum to the total prevalence due to overlapping responsibilities between committees. For example, five ESG Group companies delegate DEI responsibility to two committees, four to NCG and the compensation committee, and one to a separate committee and the compensation committee.

As the graphics above illustrate, NCG committees most often have responsibility for overseeing ESG, followed by compensation committees. Among all ESG Group companies, 31% delegate ESG responsibilities to a separate committee.

DEI is the single most common area of ESG overseen by board committees, as designated in their charters. Sustainability and Environment focus areas are nearly as prevalent. Among ESG Group companies, 78% include at least one of these measures and 45% include both. Employee Health and Safety is commonly overseen by a separate committee and is more prevalent in industries where safety is of particular concern.

As illustrated by the graphic on page 3, responsibilities for NCG and separate committees often span two or more areas of ESG. The graphic below depicts the number of ESG focus areas overseen by committees. NCG and separate committees commonly oversee two or more areas of ESG, while audit and compensation more commonly oversee one.

NCG Committee Oversight

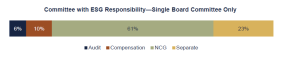

Among ESG Group companies, NCG committees are currently the primary designees for ESG oversight, with 75% delegating some or all responsibility to NCG committees. For companies with only one committee overseeing ESG (33% of the ESG Group), 61% delegate this responsibility to the NCG committee. The graphic below depicts which committee has assumed ESG oversight when only one board committee has this mandate.

For NCG committees, the most common aspects of ESG oversight are Environment, Sustainability, and/or Corporate Social Responsibility. While most companies specify ESG focus areas for board oversight, 31% of ESG Group companies also designate General ESG responsibilities to a committee, and in 93% of these instances NCG is the committee overseeing this focus area.

Separate Committee Oversight

Of the ESG Group companies, 31% maintain a separate committee with ESG responsibilities (other than audit, compensation, or NCG). Like NCG committees, separate committees generally carry a broad mandate, commonly overseeing Environment, Sustainability, Corporate Social Responsibility, and/or Employee Health and Safety.

Of those companies delegating ESG to a separate committee, 45% include Employee Health and Safety as a focus area, and all of these are companies with operations in which operational safety is critically important (e.g., energy and manufacturing). The committees of several of these companies have “environment” and/or “safety” in their names. Of the remaining 55% that delegate ESG to a separate committee, all have oversight of (a) Environment or Sustainability and/or (b) Corporate Social Responsibility. These committees commonly include “public policy” or “responsibility” in their names.

While the formation of separate committees may be a result of historical emphasis on public policy or safety, many of these separate committees are natural fits for an expansion of ESG mandates. In fact, in the 25% of ESG Group cases where the NCG committee does not play a role in ESG oversight, 78% delegate ESG responsibilities to a separate committee.

Compensation Committee Oversight

Compensation committees with ESG responsibility oversee DEI at 100% of ESG Group companies. Compensation committees are the natural fit for oversight of diversity and inclusion efforts within companies as well as pay equity. We note that compensation committees are rarely the sole committee with ESG responsibilities. Of those ESG Group companies with ESG oversight residing with one committee (33% of the ESG Group), only 10% designate the compensation committee alone.

Though we did not specifically include HCM as a separate ESG focus area for this review, we did identify 30 compensation committee charters specifically stating oversight of “Human Capital Management,” as well as others referencing “talent management” or general human resources policies.

Audit Committee Oversight

Audit committees are not commonly involved in ESG oversight, and are also rarely the only committee with ESG responsibilities. In the instances in which they are the only committee involved, the responsibilities tend to relate to ESG risk or the accuracy of metrics published in various public reports, including sustainability reports.

Shared Committee Oversight of a Single Focus Area

As more companies develop their ESG strategies, they are recognizing that ESG is imbued across internal operations and external communications (e.g., sustainability reports and related disclosures). In turn, some boards are assigning oversight responsibilities to multiple committees. Currently, committees at 16% of ESG Group companies share responsibility for a single ESG focus area. In one-half of the cases of this subset (8% of the ESG Group), audit committees share responsibility with NCG committees. Some charters indicate that the audit committee’s role is to oversee the accuracy of sustainability reports or other disclosures. At 6% of ESG Group companies, compensation committees share DEI responsibilities with either NCG or separate committees, and in 2% of ESG Group companies, NCG and separate committees share responsibility.

Committee Names and ESG

There is an emerging trend for companies renaming committees to convey a specific ESG focus by adding “Sustainability.” This extends to NCG committees as well. Currently, 17% of all ESG Group companies include “Sustainability” or “ESG” in the name for at least one of their committees, a figure we expect to grow as companies seek to emphasize their commitments to ESG.

Final Thoughts

Exequity expects board mandates to expand in response to investor interest in ESG, new public reporting on ESG matters, the infusion of ESG into incentive programs, and the continued development of ESG strategies. A thoughtful approach to allocating ESG responsibilities among board committees will be an important step in ensuring appropriate oversight, coordination, and follow-up on these topics of increased internal and external prominence.

ENDNOTE

[1] Board committees defined as the three required committees (audit, compensation, nominating and corporate governance), as well as any separate committees (e.g., “ESG Committee”).

This post comes to us from board and management adviser Exequity. It is based on the firm’s memorandum, “Board Committee Oversight of ESG,” dated March 16, 2022.

Sky Blog

Sky Blog