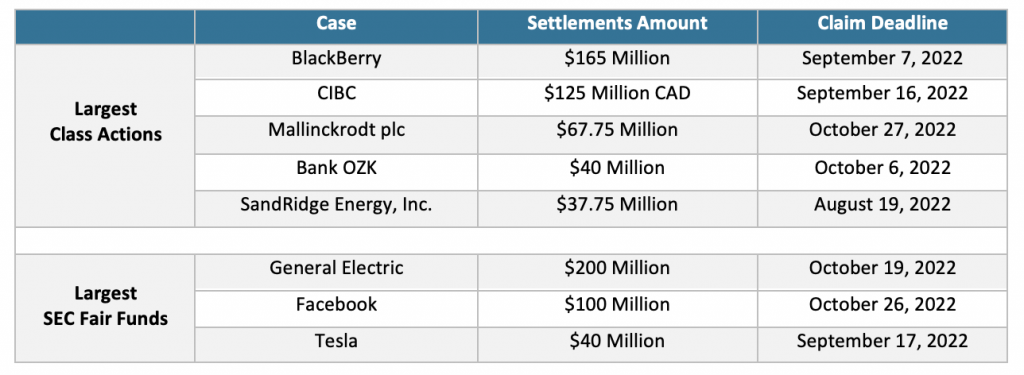

The 39 settlements range from a high of $200 million (General Electric Company) to a low of $250,000 (ABTCOIN LLC). 32 of the 39 settlements occurred in U.S. Federal Court, three with the U.S. Securities and Exchange Commission, two in U.S. State courts, and two in Canadian courts. Not surprisingly, the highest quantity of cases – 12 of the 39 (or 31%) – took place in the United States District Court for the Southern District of New York.

The 39 cases averaged 3.94 years from the initial filed complaint through to the official settlement date. The longest case – at an astonishing 13.5 years – was the CIBC settlement at CAD $125 million. The shortest case – at only 15 months – was with Aterian Inc., which settled for a nominal amount of $1.3 million.

These 39 settlements include 35 traditional class actions, as well as one antitrust action, and three meaningful SEC Fair Funds. Note: Section 308(a) of the Sarbanes-Oxley Act of 2002 empowers the U.S. Securities and Exchange Commission with the ability to create a “Fair Fund” – a provision that allows the distribution of a company’s wrongful profits (disgorgements), penalties, and fines back to defrauded investors. In short, the creation of a “Fair Fund” benefits investors who lost money due to illegal or unethical activities from companies (or individuals) that violate securities regulations.

A closer look at a few of the more noteworthy settlements:

A closer look at a few of the more noteworthy settlements:

- Mr. Musk to step down as Tesla’s Chairman and be replaced by an independent Chairman

- Tesla to appoint two new independent directors to its board

- Tesla to establish a new committee of independent directors and establish controls to oversee Mr. Musk’s communications

Sky Blog

Sky Blog