The Organisation for Economic Co-operation and Development (OECD) has published a new report on sustainability policies and practices for corporate governance. It includes a new dataset comparing the main trends and features of corporate sustainability at the global level, as well as the comparative analysis of legal and regulatory frameworks in fourteen jurisdictions (Brazil, India, Japan, Mexico, People’s Republic of China, the United States, among others), with a particular focus on the Latin America region. The report also presents the results of OECD surveys conducted with 275 Latin American companies comprising around half of the region’s market capitalisation and 521 asset managers investing USD 1.4 trillion in the region. Our advice: read the report today rather than tomorrow.

It is difficult not to be surprised by the availability of sustainability-related information and the interest shown by market participants. Policy makers have also been especially active in providing guidance and requiring further sustainability-related disclosure by companies in several jurisdictions. However, market practices have been dynamic and important differences remain across jurisdictions.

Sustainability Practices for Corporate Governance

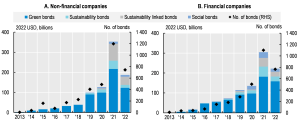

In 2013, the green, social and sustainability (GSS) corporate bond issuance represented USD 3.2 billion globally. In 2021 and 2022 (up to October), the total amounts reached USD 658 billion and USD 410 billion, respectively (half of this total was issued by non-financial companies). While the amount issued in GSS corporate bonds still represents only a fraction of total corporate bonds issuance, GSS bonds can hardly be ignored. Notably, we have seen a recent rising trend in the issuance of sustainability-linked bonds, which provide incentives for an issuer to improve its sustainability performance as a whole rather than only to invest in some green projects.

Global GSS corporate bond issuances

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

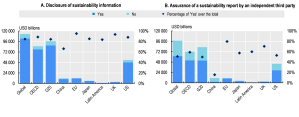

One can fairly complain about “greenwashing” or that some boards of directors may not take sustainability risks seriously enough, but the fact is that many companies already disclose sustainability-related information. Out of the 42 000 listed companies globally, almost 8 000 disclosed a sustainability report or an integrated report that includes sustainability issues in 2021. These companies represent 84% of the global market capitalisation. Probably even more surprising is that a third-party provides assurance to the sustainability-related disclosure of companies representing 51% of market capitalisation (the level of assurance and the coverage of the review are, nevertheless, important issues to follow).

Listed companies’ sustainability disclosure, by market capitalisation

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

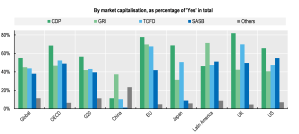

The hardness to compare sustainability-related disclosure between companies is, however, an important challenge. One of the main reasons for this difficulty is that companies have been using different accounting standards and frameworks to disclose sustainability information. Globally, the CDP’s questionnaires are used by 2 891 companies representing 55% of the total market capitalisation, and the GRI Standards are followed by 3 247 companies accounting for 45% of the market capitalisation. TCFD’s recommendations are used by 2 639 companies that total 44% of the market capitalisation, and SASB Standards are followed by 1 572 companies that sum up 38% of market capitalisation. Nevertheless, preferences vary across jurisdictions.

In the United Kingdom and Japan, almost 300 companies (70% of market capitalisation) and 441 (51% of market capitalisation), respectively, followed fully or partially TCFD’s recommendations in 2021. In the United States, 600 companies (55% of market capitalisation) used SASB Standards to disclose sustainability-related information. In many cases, companies use more than one accounting standard to disclose sustainability-related information.

Use of sustainability standards by listed companies in 2021, by market capitalisation

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

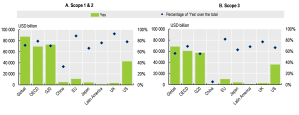

There is a datapoint that calls special attention of companies, investors, and civil society organisations alike: greenhouse gases (GHG) emissions. Globally, 5 240 companies representing 72% of market capitalisation disclosed scope 1 and 2 GHG emissions in 2021. In the United Kingdom and the European Union, on average, 91% of the companies disclosed scope 1 and 2 GHG emissions in the same year. What may be remarkable to some observers is that, despite the reported challenges to reliably account for scope 3 GHG emissions, 3 300 companies (56% of the market capitalisation) disclosed scope 3 GHG emissions globally in 2021.

Disclosure of GHG emissions by listed companies in 2021, by market capitalisation

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

As a consequence of a more or less direct pressure from investors and other stakeholders, several companies have done even more than reporting their previous GHG emissions. Globally, almost two-thirds of the companies by market capitalisation disclose a GHG emission reduction target. In the United Kingdom and the European Union, the share of companies is larger, representing 84% and 81%, respectively. How credible theses reduction targets are and whether they would be enough for our economies to transition to a low carbon economy are still open questions. However, the portion of companies that disclose such targets would have been unimaginable a few years ago.

Disclosure of GHG emissions reduction targets by listed companies in 2021, by market capitalisation

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

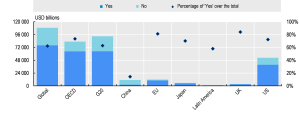

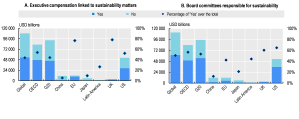

The relevance of environmental and social matters to companies can be noted in other corporate governance practices besides disclosure. For instance, companies representing 44% of market capitalisation worldwide and 54% in OECD economies have adopted an executive variable remuneration policy linked to sustainability factors. Likewise, companies representing around half of the world’s market capitalisation have a board committee responsible for overseeing the management of sustainability matters. In the United States, 65% of the companies by market capitalisation have one such committee, 60% in the United Kingdom, 42% in the European Union, 21% in Japan and 13% in China.

Executive compensation and board committees, by market capitalisation  Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Source: OECD (2023), Sustainability Policies and Practices for Corporate Governance in Latin America, Corporate Governance, OECD Publishing, Paris, https://doi.org/10.1787/76df2285-en; OECD Corporate Sustainability dataset, Refinitiv, Bloomberg.

Sustainability Disclosure Regulatory Frameworks

Probably in response to the market trends highlighted above, regulators in many jurisdictions currently either require or recommend the disclosure of sustainability-related information by listed companies. The nature and scope of their regulatory frameworks, however, vary. Some adopt a recommendation for companies to disclose sustainability information under a “comply or explain” approach (e.g. Brazil and the United Kingdom), meaning that they need to either disclose the information or explain why they do not do so. Others, such as China and India, recommend listed companies to disclose sustainability-related information, but they do not need to explain if they do not make such a disclosure. Other jurisdictions have adopted specific disclosure requirements, such as Chile and the European Union. The OECD Corporate Governance Committee is reviewing the G20/OECD Principles of Corporate Governance, and the management of environmental, social and governance risks is a priority area in the review process (more on the review here).

In relation to the scope of the sustainability matters covered, it may be challenging to compare existing frameworks. For instance, while both Argentina’s and the European Union’s frameworks cover a broad number of sustainability matters, the regulation in the latter is significantly more detailed than in the former. Nevertheless, a clear separation does exist between jurisdictions that have a smaller or greater focus on climate-related matters (e.g. Brazil, Colombia, and the United Kingdom), and others that encompass a greater number of sustainability matters.

A rising trend among sustainability regulatory frameworks is either a requirement or a recommendation for companies to disclose verifiable metrics to allow investors to assess the credibility and progress toward meeting an announced sustainability-related goal or target (e.g. Colombia, the European Union and Mexico). This policy does not mean that companies would need to adopt such goals but, if they do, they will need to provide sufficient information to make directors and key executives accountable.

Sustainability Disclosure Standards and Assurance

An important policy question for jurisdictions developing their sustainability disclosure framework is to either choose an individual accounting standard or allow companies the freedom to report sustainability-related information within the framework that they understand to be the most adequate. Among the jurisdictions that do choose a single sustainability accounting standard for all listed companies, there is also the alternative between adhering to an existing global standard or developing a local one. Some jurisdictions (e.g. China and the European Union) have chosen to develop a local standard, while others (e.g. Colombia, Japan, and the United Kingdom) have adopted the SASB Standards and/or TCFD’s Recommendations.

Accounting standards provide only the framework for companies to report information publicly, but company executives will typically need to decide what pieces of information to effectively disclose. An important reference in such assessment is who would be the primary users of corporate disclosure. Traditionally, accounting standards for financial reports have considered investors and creditors to be the primary users of corporate disclosure, which typically means that only information relevant to their investment and voting decisions would need to be reported. In a sizable number of jurisdictions, investors are considered to be the primary users of sustainability disclosure (e.g. Chile, Japan, the United Kingdom and the United States), while in the European Union and India not only investors but also stakeholders are among the primary users.

The assurance of sustainability disclosure by an independent third party – just like external auditing of financial reports – may enhance investors’ confidence in the information disclosed and the possibility to compare sustainability reports between companies. Only the European Union has established a requirement for the assurance of sustainability information, and the United States in the SEC’s public consultation is considering establishing such a requirement. They only differ in two aspects. First, the level of assurance that would be required: a more limited one in the European Union and, after a phase-in period, a reasonable level in the United States for scope 1 and 2 GHG emissions (reasonable is the level typically expected from external auditing of financial reports). Second, these two jurisdictions vary on whether the assurance service provider would need to be a registered auditor (the case in the European Union) or not (the proposal in the United States).

This post comes to us from the Organisation for Economic Co-operation and Development. It is based on the organisation’s report, “Sustainability Policies and Practices for Corporate Governance in Latin America,” available here, using the following login: [Username: 2022-daf | Password: oecdilibrary2022]. This post does not necessarily represent the official views of the OECD or of its member countries. The opinions and arguments expressed are those of the authors.

Sky Blog

Sky Blog