When assessing the legality of actions by boards of directors, corporate officers, and shareholders, judges use five standards of review: the business judgment rule, Unocal, Revlon, the entire fairness standard, and, to some degree, Blasius.[1]

These standards are often viewed as being on a scale from most deferential (the business judgment rule) to least deferential (the entire fairness standard), with Unocal and Revlon sitting in the middle and Blasius confusingly hovering around them. Yet this view is neither accurate nor useful for practitioners and corporate managers. In a new article, I show that the corporate standards of review are best understood as differing in kind rather than degree.

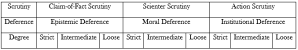

The article first argues that the standards involve scrutiny based on claims of fact, scienter, or action, and the corresponding type of deference: epistemic, moral, or institutional, respectively. Second, the article demonstrates that these pairings of scrutiny and kinds of deference are often bundled together as either independent or auxiliary standards of review, and that corporate law developed the use of scrutiny modifiers – doctrines that allow directors, officers, and shareholders to effectively pre-select their standards of review if they comply with the required processes.

The Scrutiny-Deference Matrix

All substantive standards of review can be understood as depicting both the object of scrutiny and, separately, the type of deference judges want to exercise, if any. For instance, in reviewing a board’s decision to issue stock dividends, a court will have to scrutinize the board’s determinations of facts (such as the value assigned to the stock and the impact it will have on future earnings), its scienter or motivation (such as whether the board was acting to serve directors’ interest in keeping their jobs or to benefit the firm), and its actions (such as whether the board adequately deliberated, conducted market research, or consulted analysts). Independently, the court will have to determine whether it should exercise epistemic deference (deferring to the board’s factual determinations on account of their managerial and financial expertise), moral deference (deferring to the board’s stated motivations behind their corporate plan), or institutional deference (the degree to which the court is not, and the board is, the right institution to determine the correct actions and procedures for administrating equity or managing liability). Each of these types of scrutiny and deference can be dialed up and down and can together be represented as follows:

Bundling Scrutiny and Deference

It can be useful to refer to a collection of scrutiny-deference pairings together, or as “bundles of doctrine.” Standards of review are prime examples of such bundles, and they operate as follows: First, standards of review are either independent or auxiliary. Independent standards of review are themselves dispositive of a case. For instance, a finding of liability under the business judgment rule will itself end the analysis of whether a fiduciary duty has been breached. Auxiliary standards of review do not themselves resolve the case but help point a judge towards another standard of review. The Unocal standard of review often works in this manner. Surviving Unocal review points to a review under the business judgment rule and failing Unocal review calls for further review under the entire fairness standard. Close followers of corporate law will note that while Unocal sometimes works in this auxiliary manner, other times the courts treat it as an independent standard. This discrepancy reveals an important feature: The difference between independent and auxiliary standards of review is a matter of degree.

Second, the courts have adopted bundles of doctrine that can be referred to as “scrutiny modifiers.” Scrutiny modifiers allow litigants to select their standard of review. For instance, the MFW and Corwin doctrines allow shareholders and managers, respectively, to avoid the entire fairness standard of review and select review under the business judgment rule if they follow the prescribed steps for independent and disinterested prior approvals of the relevant transactions.

Pulling It All Together

Armed with the scrutiny-deference matrix and the distinction between independent and auxiliary standards of review and among scrutiny modifiers, we can understand corporate law’s quintet of judicial reviews as follows:

- The business judgment rule. This is the default standard. It is an independent standard of review that scrutinizes claims-of-fact, scienter, and actions with maximum epistemic, moral, and institutional deference. But the business judgment rule is also a scrutiny modifier – it prescribes that maximum deference can apply if decisions are reasonably informed, made in good faith, and not tainted by a conflict of interest.

- The entire fairness standard. This standard examines whether a corporate transaction amounted to a fair price and fair dealing. In practice, this translates into claim-of-fact and action scrutiny coupled with low levels of epistemic and institutional deference. A court will examine a board’s claims as to value and process without much deference to either. This standard will usually be used independently but not always. Since it involves maximum moral deference, courts will sometimes supplement entire fairness with a scienter-focused standard.

- Unocal. This standard of review is designed to address hostile takeovers and defensive measures. Since it attempts to achieve proportionality between the need to check corporate managers and enable managers to deter certain acquirers, this standard often operates as an auxiliary standard that help judges determine which other standard (business judgment or entire fairness) would be most appropriate in that particular corporate battle.

- Revlon. Revlon is an independent standard of review that operates when a sale of the company, or a similar firm-altering event, is inevitable. It mostly scrutinizes claims-of-fact as to the value received from the sale of the company. Judges will exercise very low epistemic deference as to whether the directors were able to extract the “best value.” As far as fact claims about price are concerned, Revlon is stricter than entire fairness (which looks at whether the price was fair). That said, Revlon is less strict than entire fairness when it comes to action scrutiny and institutional deference, as Revlon does not have the same fair dealings

- Blasius. Recent decisions cast doubt on whether Blasius still exists. It will likely continue as a mere variation of the Unocal standard, but it remains to be seen how the standard will play out. One of its uses is clear: Judges invoke it when they want to scrutinize the scienter of the corporate managers and reduce moral deference. The idea is to examine whether directors’ business decisions were motivated by the desire to entrench themselves or by the desire to benefit the firm, and the standard is invoked even if the board’s actions passed muster under entire fairness review.

ENDNOTE

[1] This post refers to corporate standards of review applicable in Delaware, but all the claims herein will also apply in other U.S. jurisdictions, with appropriate adjustments.

This post comes to us from Professor Tomer Stein at the University of Tennessee College of Law. It is based on his recent paper, “A Theory of Substantive Standards of Review: The Case of Corporate Law,” available here.

Sky Blog

Sky Blog