Shareholder rights plans – or “poison pills” – have been used for close to 40 years to deter hostile takeovers by threatening the dilution of any (hostile) bidder that exceeds the ownership threshold set in such plans. This dilution upon the triggering of a poison pill is effected either by allowing all other shareholders to buy shares at a significant discount (“flip-in feature”) or by the board of directors deciding to give all other shareholders one additional share for each share that they currently own (“exchange feature”).

Many aspects of poison pills received closer scrutiny by courts in the recent years, e.g. the trigger percentage, the permitted purposes of a pill, or features limiting the ability of a future board to redeem a pill (“dead hand”, “slow hand” and “no hand” provisions). Furthermore, proxy advisers, such as ISS and Glass Lewis, view the adoption of poison pills critically and will not recommend the re-election of board members who adopted shareholder rights plans with a duration of more than one year (without shareholder approval). As a result, shareholder rights plans are highly standardized documents that companies – or their legal advisers – have “on the shelf” readily available in order to quickly implement them if and when needed.

An aspect of poison pills that has, however, not gotten as much attention as maybe it should have, is the redemption mechanism. The redemption provision governs the company’s board of directors’ authority to redeem any rights issued under the shareholder rights plan and thereby defuse the poison pill. There are two main structuring alternatives for that mechanism:

- Trip-Wire Feature: If the poison pill implements a “trip wire” concept, the rights granted thereunder are triggered if, and can no longer be redeemed by the board once, the acquirer exceeds the triggering threshold set in the shareholder rights plan.

- Last-Look Feature: If the poison pill implements a “last look” concept, the board of the target company has a “last look” for a certain period after the poison pill has been triggered to decide whether to redeem the rights granted thereunder. If the board redeems the rights, the pill is thereby “defused,” and the bidder can continue buying shares of the target company.

While the difference between these alternatives may sound like it is not that big of a deal, we show in a new paper that it actually is – but that not all law firms seem to appreciate this.

Empirical Evidence on Pill Design and Law Firm Effects

For the purpose of our analysis, we constructed a new data set of 130 poison pills, which is based on the information available in the SEC’s EDGAR database and the following criteria: (i) issuer incorporated in the U.S., (ii) no NOL-pills (as they serve a different purpose), and (iii) pills implemented and/or amended between January 1, 2020, and March 31, 2023.

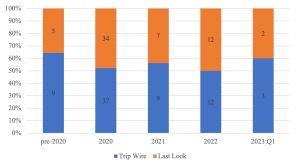

Across this data sample, 70 out of 130 (or 53.8 percent) poison pills followed a trip-wire concept, while 60 (or 46.2 percent) implemented a last-look feature. Figure 1 below shows the distribution of trip-wire versus last-look design by the year the pill was installed. No significant trend may be observed within the sample period.

Figure 1: Trip Wire vs. Last Look Pill Design by Pill Year

Given that virtually all companies rely heavily on outside counsel when implementing a poison pill, we further examined whether there are observable trends regarding trip-wire and last-look features among the different law firms in the data set. However, fewer than half (58 of 130) of the poison pills in the data set identified the outside counsel in the pill documents. Based on our discussions, this is likely caused by the fact that many law firms consider their boilerplate documents, such as poison pills, to be proprietary information. As a result, many of the top-tier law firms will not want to be named in the pill documents to avoid other law firms free riding on their expertise.

In order to nonetheless identify the appointed outside counsel for as many pills in the data set as possible, we examined additional documents such as press releases and other SEC filings. Based on this examination, we were able to determine, with reasonable certainty, the legal adviser with respect to an additional 15 poison pills. This analysis allowed us to draw two important conclusions:

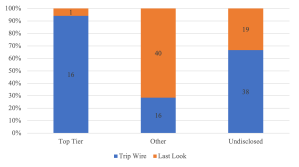

First, most law firms seem to have a clear “house view” on structuring the redemption mechanism. As Figure 2 shows, law firms generally follow either the trip-wire or the last-look concept. Only a few law firms implement both these structuring alternatives in their poison pills.

Figure 2: Preferences of Identifiable Law Firms in the Data Set

The clear preference by law firms for either a trip-wire or a last-look provision is not surprising given the ubiquitous nature of boilerplate documents in corporate law firms. The fact that poison pills typically have to be implemented very quickly may further add to reliance on “off the shelf” documents. However, at the same time, this finding casts doubt on arguments by practitioners that poison pills are carefully designed to reflect the nuances of a particular takeover bid.

Second, we further analyzed whether differences in such preferences can be observed between firms specializing in M&A and other firms without such particular expertise. In order to do so, we divided the data sample according to whether the law firm implementing a pill was included by Chambers as Band 1, 2 or 3 in Corporate/M&A.

Figure 3: Trip Wire vs. Last Look Pill Design by Law Firm M&A Expertise

As evidenced by Figure 3, this analysis shows a pronounced law firm effect: 94 percent of poison pills installed by top-tier M&A firms have a trip-wire provision, while only 29 percent of pills put in by other law firms do. When the law firm is unknown, a trip-wire feature is used in 67 percent of pills. For the reason mentioned above (law firms with a lot of expertise prefer not to be named in poison pill documents to protect their proprietary information), we believe that top-tier firms are over-represented in the sample of pills where the law firm is unknown (and top-tier firms are far more likely to put in trip-wire pills).

Discussion of Findings

At the highest level, the findings of our analysis indicate that the choice between a trip-wire and last-look concept is motivated less by the specific circumstances of the takeover that the poison pill is intended to protect against, but rather caused by whether the law firm advising the company includes a trip-wire or a last-look provision in their poison pill documents. Furthermore, the split between top-tier M&A firms and other law firms shows that top-tier M&A firms are far more likely to have a trip-wire “house view,” while most other firms have a last-look house view.

From a doctrinal perspective – and by contrast to views held by some practitioners –, the fiduciary duties of a target company’s board do not require a “last look”. This is supported by the Delaware Supreme Court’s seminal opinion in Moran v. Household International: First and foremost, the pill blessed by the Moran court contained a trip-wire feature. Second, the Moran court specifically addressed the circumstance of a board being presented with a request to redeem a poison pill to allow the tender offer to succeed without triggering it.

Furthermore, the preference for a trip-wire structure of the redemption mechanism of a poison pill is supported by negotiation theory. The key point for this analysis is the fact that a poison pill is, as mentioned, designed to deter hostile takeover bids by representing a threat of dilution. As Schelling (1958) explains, “[t]he distinctive character of a threat is that one asserts that he will do, in a contingency, what he would manifestly prefer not to do if the contingency occurred” in order to alter the perception of the threatener’s own incentives by the threatened party. Furthermore, Schelling further holds that “[i]n case a threat is made and fails to deter, there is a second stage prior to fulfillment in which both parties have an interest in undoing the commitment. The purpose of the threat is gone, its deterrence value is zero, and only the commitment exists to motivate fulfillment.”

Simply put, the company installing a poison pill wants to be perceived as willing to dilute any bidder that acquires shares in excess of the threshold set in the shareholder rights agreement. However, if a bidder triggers a poison pill nonetheless, the company is likely to have multiple reasons for not wanting to follow through with the dilution. First, and as we show in our paper, only one-third of U.S. public companies have a sufficient number of authorized shares to effectuate a full exercise of a flip-in feature. Second, the triggering of a poison pill and the exercise of the flip-in feature result in the company receiving billions of dollars in cash on the balance sheet, which generally is way more than a company is reasonably able to use to finance its business. Third, if a bidder were to present an attractive offer contingent upon a redemption of a poison pill with a last-look feature, the board would have to comply with the fiduciary duties it owes to all shareholders and consider these alternatives. If the board were to conclude that the offer is in the interest of all shareholders, it would have to negotiate with the bidder on the terms of a merger – however, not from a position of strength but rather a position of weakness due to (i) its failure to follow through with its threat to dilute the bidder, and (ii) the clock of – typically – 10 business days ticking until the board must decide on the redemption of a pill with a last-look feature.

All these points that may disincentivize a company’s board to follow through with the threatened dilution can be avoided under the trip-wire structure: In the case of a poison pill with a trip-wire feature, the responsibility for whether or not the dilution will be effected rests solely with the bidder’s decision (not) to trigger the poison pill. As the target company’s board has no possibility to “pull back” if and when the pill is triggered, it can effectively commit to the threatened dilution, thereby increasing the potency of such threat and thus enhancing its leverage and bargaining power.

Finally, the points listed above could have likely all played a role in the Twitter/Musk case, if Musk had decided to “bust through” Twitter’s poison pill. Recall that the Twitter pill was implemented as an immediate reaction to Elon Musk’s takeover bid. Despite this fact, the redemption mechanism of the Twitter pill included a last-look feature (which gave the board an option to reconsider and thus weakened its hand). Further, Twitter did not have a sufficient amount of authorized shares to source the flip-in feature with common shares, and even if it did, this would have resulted in $136 billion of cash on Twitter’s balance sheet. Based on these factors and as further outlined in our paper, our analysis came to the conclusion that in consideration of all factors and a willingness by Musk to take some risks, the decision tree would have pointed in favor of Musk triggering the Twitter pill and negotiating with the Twitter board from a position of strength.

This post comes to us from Olivier Baum, a visiting lawyer at the law firm of Sullivan & Cromwell, and Guhan Subramanian, the Joseph Flom Professor of Law and Business at Harvard Law School and Douglas Weaver Professor of Business Law at Harvard Business School. It is based on their new article, “Redemption Mechanisms in Poison Pills: Evidence on Pill Design and Law Firm Effects,” available here.

Sky Blog

Sky Blog