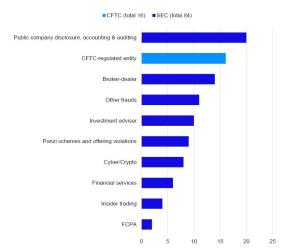

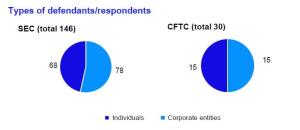

In July and August 2023, the SEC filed 84 actions and the CFTC filed 16, against a combined total of 176 defendants and respondents. (These figures exclude follow-on actions, bars and suspensions.) The actions include public company disclosure and crypto matters, among others.

Actions initiated by the SEC and CFTC in July and August 2023

Number of actions, by matter type

Public company disclosures

Molecular diagnostic company settles misrepresentation claims related to COVID-19 testing products

In the Matter of Co-Diagnostics (A.P. July 5, 2023, settled)

In the Matter of Dwight H. Egan (A.P. July 5, 2023, settled)

In the Matter of Andrew B. Benson (A.P. July 5, 2023, settled)

In the Matter of Reed L. Benson (A.P. July 5, 2023, settled)

The SEC settled claims with a Utah-based molecular diagnostic company, its CEO and its Head of Corporate Communications and Investor Relations (HCCIR) for issuing two allegedly misleading press releases in advance of a securities offering. The SEC also brought claims against the Company’s CEO and former CFO for failing to disclose certain related party transactions.

According to the SEC, shortly before a securities offering, the Company issued two press releases saying that a screening test that it had developed could be used by consumers to detect COVID-19. The SEC alleged that the two press releases, drafted by the CEO and HCCIR, were misleading because, at the time of drafting, the Company was aware that the test could not be sold for clinical diagnostic purposes. The SEC further alleged that, soon after the press releases were published, the Food and Drug Administration (FDA) contacted the Company regarding the accuracy of the language used in the press releases, but the Company did not correct the press releases until approximately two weeks later, after its securities offering. The SEC alleged that the uncorrected press releases were materially misleading because the Company had not secured the appropriate regulatory approval and the statements were made in the early stages of the pandemic, when COVID-19 testing was limited.

Separately, the SEC alleged that the Company failed to disclose certain related party transactions in proxy statements filed between 2019 and 2021. The Company allegedly paid compensation to the son of the CEO and the son of the then-CFO between 2018 and 2020 but did not record or disclose the compensation as related party transactions, as required by Item 404 of Regulation S-K. The SEC further alleged that the Company lacked policies or controls concerning related party transactions, including what constituted a related party transaction or how such transactions should be disclosed by the Company.

To settle the SEC’s various claims, the Company, CEO, CFO and the HCCIR agreed to pay penalties of $250,000, $75,000, $40,000 and $40,000, respectively.

SEC press release │SEC company order | SEC CEO order | SEC HCCIR order | SEC CFO order

SEC gives cooperation credit for self-reporting disclosure failure

In the Matter of View, Inc. (A.P. July 3, 2023, settled) SEC v. Vidul Prakash (N.D. Cal. July 3, 2023, contested)

The SEC brought and settled claims against a California-based window manufacturer for allegedly failing to disclose approximately $28 million in expected warranty-related liabilities.

According to the SEC, the Manufacturer, after discovering a defect in one of its products, provided customers with window replacements for those that had failed due to the defect, pursuant to its 10-year written warranty. In addition, although not obligated to under the warranty, the Manufacturer paid installation and shipping costs for the replacement windows. In subsequent filings with the SEC, the Manufacturer disclosed its discovery of the defect and costs for remediation but did not include the shipping and installation costs it had assumed.

The SEC alleged that, as a result, the Manufacturer’s SEC fillings between December 2020 and May 2021 misstated warranty-related liabilities by nearly $28 million.

In a separate but related action, the SEC brought contested claims against the Manufacturer’s former CFO for alleged failure to ensure that the Company correctly disclosed its warranty-related liabilities, even after the SEC and the Company’s controller raised questions about the adequacy of the Manufacturer’s disclosed warranty liabilities. The SEC’s complaint seeks permanent injunctions, civil penalties and an officer and director bar against the CFO.

The SEC did not impose civil penalties against the Manufacturer, noting that the Company self-reported the misstatements, undertook prompt remedial measures and cooperated with the SEC’s investigation.

SEC press release │SEC company order | SEC CFO complaint

SEC settles assets recovery and impairment loss disclosure claims

In the Matter of Future FinTech Group Inc. (A.P. July 3, 2023, settled)

The SEC announced settled claims against a fruit juice producer for alleged material misstatements over a three-year period.

According to the SEC, the Company disclosed that certain of its related businesses were experiencing significant adverse changes such as limited to no production and sustained operating losses, which could impact certain of its assets such as production equipment. While the Company disclosed these business conditions, the SEC alleged that the Company failed to adequately perform assets recoverability analyses or sufficiently measure for impairment losses. As a result, the Company’s recorded impairment losses in public filings were allegedly unsupported and materially misstated. The SEC also alleged that the disclosure failures were caused by inadequate internal accounting controls, including an insufficient understanding of GAAP.

The Company agreed to pay a $1.65 million civil penalty to settle the SEC’s claims and to retain an independent compliance consultant to test, assess and review the Company’s internal accounting and financial reporting controls.

SEC settles claims related to pre-IPO SPAC disclosure

In the Matter of Digital World Acquisition Corp. (A.P. July 20, 2023, settled)

The SEC announced a settled action against a special purpose acquisition company (SPAC) for alleged material misrepresentations in its pre-IPO disclosure regarding future plans to acquire a media company.

According to the SEC, the Company’s disclosure stated that neither the Company nor its officers and directors had any substantive discussions, directly or indirectly, with any business combination target before its IPO. According to the SEC, however, an individual who later become the Company’s CEO and Board Chairman allegedly engaged in extensive merger discussions with a potential target company before the Company’s IPO and used these plans to solicit certain pre-IPO investors. The SEC further alleged that the Company failed to disclose that the CEO had a potential conflict of interest based on an agreement the CEO signed with the same potential merger target company.

To settle the action, the Company agreed to pay an $18 million penalty in the event it closes a merger transaction.

SEC brings claims against electric vehicle company, CEO, CFO relating to SPAC transaction

SEC v. Ulrich Kranz et al. (C.D. Cal. August 4, 2023, settled) In the Matter of Canoo, Inc. (A.P. August 4, 2023, settled)

The SEC settled claims with an electric vehicle company, its former CEO and its former CFO for making allegedly inaccurate revenue projections. The SEC also alleged that the Company and the CEO engaged in misconduct related to nearly $1 million in undisclosed executive compensation.

According to the SEC, from August 2020 until March 2021, during which time the Company became publicly listed through a transaction with a SPAC, the Company’s public financial projections contained statements that were materially inaccurate. Specifically, the SEC alleged that the Company projected revenue of $120 million for 2021 and $250 million for 2022, in connection with the provision of engineering services to other companies. However, as alleged in the SEC’s complaint, the CEO and CFO should have known these projections were unreasonable because they had information demonstrating that significant projects on which the Company based revenue projections were unlikely to materialize. In March 2021, after allegedly raising hundreds of millions of dollars from investors, the Company, under the direction of its new CEO, announced that it would “deemphasize” its contract engineering services line and removed its revenue projections from its public filings. The Company’s stock price decreased by approximately 21% the day after this announcement.

Separately, the SEC alleged that in November 2019, the CEO entered into an agreement with two investors to receive up to $1 million in compensation related to his work at the Company, and in October 2020, the CEO received over $900,000 from these two individuals. According to the complaint, the CEO failed to disclose this arrangement compensation, causing the Company to make inaccurate executive compensation disclosures from September 2020 until April 2021.

Subject to court approval, the CEO agreed to a $125,000 civil penalty and a three-year officer and director bar. The CFO consented to a two-year officer and director bar, payment of $7,500 in disgorgement and prejudgment interest and a $50,000 civil penalty. The Company settled in a separate administrative proceeding and agreed to pay a civil penalty of $1,500,000.

SEC press release │SEC complaint | SEC order

Investment adviser agrees to settle disclosure claims for SPAC-related activity

In the Matter of Monroe Capital Management Advisors (A.P. July 20, 2023, settled)

The SEC settled claims against an investment adviser for failure to disclose SPAC-related employee activity. According to the SEC, employees at the Company were involved in the formation and sponsorship of three SPACs and thus were entitled to a portion of the SPAC sponsor compensation. The SEC alleged that this activity created a material conflict of interest between the Company and its advisory clients because the employees had an incentive to cause clients to make investments in the SPACs. According to the SEC, the Company invested $25 million of client funds in certain transactions related to the SPACs but did not obtain informed consent from independent representatives of the private funds in advance of the investments or disclose the conflicts until after the investments were made.

The SEC also alleged that the Company lacked sufficient compliance controls to provide clients with adequate conflict of interest disclosures and failed to file timely Schedule 13G amendments regarding changes to certain of its SPAC-related common stock ownership.

The Company agreed to pay a $1 million civil penalty to resolve the SEC’s claims.

Broker dealer

SEC settles recordkeeping claims with 11 broker-dealer firms for off-channel communications

The SEC announced and settled claims with 11 firms in their capacity as broker-dealers (and one of the entities as a dually-registered investment adviser) for alleged failures by the firms and their employees to maintain and preserve electronic communications. Specifically, according to the orders, employees at the firms communicated through various messaging platforms on their personal devices. According to the SEC, the firms did not maintain or preserve a majority of these “off-channel communications.”

The firms agreed to pay combined penalties of $289 million to resolve the SEC’s claims.

Separately, the CFTC announced settlements with four firms for related conduct, for a combined total of $260 million.

SEC press release | CFTC press release

Financial services

UK Audit Firm settles with SEC over alleged De-SPAC Transaction audit failures

In the Matter of Crowe U.K. LLP et al. (A.P. August 14, 2023, settled)

The SEC settled claims with a UK-based audit firm, its CEO and a senior auditor for the firm’s allegedly deficient audit of a music streaming company. According to the SEC, after the music company went public in 2019 via merger with a special purpose acquisition company (De-SPAC transaction), it was discovered that the Company’s 2018 financial filings contained several incorrect statements, including that the Company earned over $120 million in revenue and had over four million paying subscribers in 2018. The SEC alleged that the Company, in fact, had negligible revenue and subscribers. The SEC alleged that the audit firm failed to exercise an appropriate level of due professional care or professional skepticism over the Company’s financial statement and overlooked several red flags. Specifically, the order alleged that the audit firm failed to confirm the authenticity of the Company’s problematic agreements and confirmation letters, both of which were later revealed to be false. Further, according to the order, the audit firm attested that it had conducted its 2018 audit in accordance with Public Company Accounting Oversight Board (PCAOB) standards when, in fact, the audit team neither had experience nor training in PCAOB standards. Lastly, the SEC alleged that the CEO, as the engagement partner for the Company, failed to appropriately supervise the engagement, maintain adequate documentation or exercise due professional care, and that the senior auditor failed to conduct a sufficient quality review.

To settle the claims, the audit firm, the CEO and the senior auditor agreed to pay $750,000, $25,000 and $10,000, respectively. The audit firm also agreed to be censured, pay disgorgement and prejudgment interest, voluntarily withdraw its PCAOB registration and implement undertakings related to the firm’s acceptance of new clients. The CEO and senior auditor agreed to be suspended from appearing or practicing before the SEC as accountants, with the right to apply for reinstatement after five years and two years, respectively.

SEC alerts claims for failure to file SARs

In the Matter of Archipelago Trading Services, Inc. (A.P. August 29, 2023, settled)

The SEC brought and settled claims against a securities trading services company for failing to file Suspicious Activity Reports (SARs) between August 2012 and September 2020. According to the SEC’s order, the Company operates and provides trading access for other broker-dealers to its over-the-counter (OTC) equity securities platform. The platform, as alleged in the order, plays a significant role in executing trades of microcap and penny stock securities. The SEC alleged that the Company failed to establish an adequate anti-money laundering surveillance program for its transactions until September 2020. As a result, as alleged in the order, the Company failed to surveil transactions executed on the platform for potential red flags regarding suspicious manipulative trading activity.

The Company agreed to a $1.5 million penalty to settle the charges.

Investment adviser

SEC settles claims for misleading advertisements and disclosures

In the Matter of Titan Global Capital Management USA LLC (A.P. August 21, 2023, settled)

The SEC brought and settled claims against a FinTech investment adviser for allegedly using misleading hypothetical performance metrics in its advertisements. The SEC alleged that the Company advertised annualized performance results as high as 2,700 percent. However, according to the SEC, the advertisements failed to note that the hypothetical performance projections assumed that the strategy’s performance in its first three weeks would continue for an entire year. The SEC also alleged that there were multiple compliance failures at the Company that led to misleading disclosures about the custody of clients’ crypto assets, the use of “hedge clauses” in client agreements, the unauthorized use of client signatures and the failure to adopt policies concerning crypto asset trading by employees.

To settle the charges, the Company agreed to pay disgorgement and prejudgment interest of $192,454 and a civil monetary penalty of $850,000.

SEC press release │SEC complaint

Crypto

Trading platform settles suit over alleged unregistered crypto assets

SEC v. Bittrex, Inc. et al. (W.D. Wash. Apr. 17, 2023, settled)

A crypto asset trading platform, its co-founder and former CEO and its foreign affiliate agreed to settle an action brought by the SEC earlier this year. In the complaint filed in April, the SEC alleged that the parties operated as an unregistered securities exchange, broker and clearing agency. According to the SEC, from 2017 to 2022, the platform facilitated the buying and selling of crypto assets, allegedly earning nearly $1.3 billion in revenues from the transactions, while also serving as a broker, exchange and clearing agency. The SEC asserted that the platform was required to register its activities with the agency but failed to do so. The complaint further also alleged that the platform actively sought to evade scrutiny from the SEC, for example by instructing crypto asset issuers to delete from their offering and marketing material “investment-related terms,” including “price predications” and “expectation of profit.”

To settle the charges, the Company and its foreign affiliate agreed to pay, on a joint and several basis, disgorgement of $14.4 million, prejudgment interest of $4 million and a civil penalty of $5.6 million.

SEC press release │SEC complaint

SEC, CFTC bring action for alleged unregistered, fraudulent crypto offerings

SEC v. Celsius Network Limited et al. (S.D.N.Y. July 13, 2023, contested)

The SEC brought claims against a company and its co-founder and former CEO for allegedly raising billions of dollars from investors through unregistered offers and sales of crypto assets, making false and misleading statements to investors and engaging in market manipulation.

According to the complaint, the Company operated a trading platform and offered investors the opportunity to buy crypto assets from the Company or sell crypto assets to the Company in exchange for interest payments. The SEC alleges that the Company’s crypto assets were securities and that its offering should have been registered. According to the SEC, the Company also made misleading statements to induce customers to purchase its crypto assets or invest on the platform, including by promising high earning rates to investors who purchased crypto assets or high interest return rates to investors who sold their crypto assets to the Company. The SEC also alleges that the Company misrepresented its business model and risks to investors by not disclosing that it engaged in certain trading practices, made uncollateralized loans, and often paid more than 80% of its revenue to satisfy interest payment obligations. The SEC further alleges the Company overstated its financial success to investors and potential investors despite internal reports to Company executives warning that the business model was failing, and that the Company engaged in market manipulation because it purchased more of its own crypto assets than it disclosed publicly to inflate the market value of the assets.

The SEC seeks an injunction against the Company, which filed for bankruptcy in 2022. The Company is cooperating with the SEC and consented to the requested relief. With respect to the former CEO, the SEC is seeking monetary relief in the form of civil penalties, disgorgement of profits, prejudgment interest, an officer and director bar and an injunction prohibiting him from future purchases, offer or sales of crypto assets.

In a parallel action, the CFTC also announced contested claims against the CEO and a consent order with the Company. The U.S. Attorney’s Office for the Southern District of New York also brought claims against the CEO and entered a non-prosecution agreement with the Company.

SEC press release │SEC complaint | CFTC press release

Company agrees to disgorge certain proceeds from alleged unregistered crypto offering

In the Matter of Quantstamp, Inc. (A.P. July 21, 2023, settled)

The SEC settled unregistered initial coin offering claims with a California-based company.

According to the SEC, the Company offered and sold crypto assets to use the proceeds to develop and market an automated smart contract security auditing platform. The SEC alleged that the crypto assets constituted securities and that the Company should have registered the offering. The order also alleged that the Company incorrectly assumed eligibility for a private placement registration exemption by filing a Form D when it did not meet the requirements of Rule 506(c)(2)(ii). The Company allegedly raised over $28 million through the offering.

The Company agreed to pay disgorgement of $1.9 million, prejudgment interest of $494,314 and a civil penalty of $1 million.

SEC settles action for unregistered NFT offering

In the Matter of Impact Theory, LLC (A.P. August 28, 2023, settled)

The SEC brought and settled claims against a media and entrainment company for conducting an unregistered offering of crypto asset securities in the form of non-fungible tokens (“NFTs”). According to the SEC, the Company offered and sold various NFTs that it called “Founder’s Keys.” In advance of the NFT offering, the Company hosted several live speaking events on various platforms, including the Company’s websites, social media channels, YouTube and Discord. The SEC alleged that, during these events, the Company encouraged prospective buyers to view the Founder’s Keys as an investment in the business and allegedly told buyers that the future value of the NFTs would be significantly greater than the purchase price. The Company allegedly raised approximately $29.9 million worth of ether.

To settle the charges, the Company agreed to pay $5,120,718.27 in disgorgement, $483,195.90 in prejudgment interest and a civil monetary penalty of $500,000.

Foreign Corrupt Practices Act

SEC settles FCPA claims related to Colombian highway infrastructure project

In the Matter of Grupo Aval Acciones y Valores S.A. et al. (A.P. August 10, 2023, settled)

The SEC brought and settled claims against a Colombian finance holding company and its merchant bank subsidiary for alleged failure to maintain accurate books and records and adequate internal controls related to a foreign bribery scheme. The SEC also settled an anti-bribery claim against the merchant bank subsidiary.

According to the SEC, the merchant bank subsidiary—through one of its own subsidiaries—held a minority interest in a joint venture engaged in a large highway infrastructure project in Colombia. The SEC alleged that the merchant bank subsidiary, through the actions of its former president, along with a joint venture partner, paid bribes to Colombian government officials through the joint venture in exchange for approval of an extension to the highway infrastructure contract. Based on the above, the SEC also alleged that the merchant bank caused a violation of its parent’s books and records and circumvented its internal controls.

To settle the charges, the companies agreed to pay disgorgement of $32,139,731 and prejudgment interest of $8,129,558. The merchant bank also agreed to enter into a deferred prosecution agreement with the DOJ. The SEC’s order highlights the companies’ prompt remedial efforts and cooperation.

SEC settles claims related to overseas leisure trips

In the Matter of 3M Company (A.P. August 25, 2023, settled)

The SEC brought and settled claims against a global manufacturing company for allegedly failing to maintain accurate books and records and adequate internal controls related to a foreign bribery scheme. Specifically, the SEC alleged that employees at the Company’s wholly-owned subsidiary based in China arranged for Chinese government officials to travel overseas and participate in guided tours, shopping visits and other leisure activities. According to the SEC, the purpose of these trips was to induce the government officials to purchase the Company’s products. The employees allegedly used overseas conferences, educational events and healthcare facility visits as a pretext for these trips. The subsidiary employees purportedly created two sets of travel itineraries. In total, the subsidiary allegedly paid nearly $1 million to fund at least 24 trips for Chinese government officials.

To settle the charges, the Company agreed to pay disgorgement and prejudgment interest of $4,581,618 and a civil monetary penalty of $2 million.

FINRA constitutionality challenged

In 2022, the Financial Industry Regulatory Authority (FINRA) attempted to expel a broker-dealer in Salt Lake City and ordered the Company to pay $2.3 million in restitution. The Company challenged the constitutionality of FINRA’s disciplinary hearings, arguing that FINRA’s hearing officers are not properly appointed by the executive branch. Earlier this year, the U.S. Court of Appeals for the D.C. Circuit issued a preliminary injunction against FINRA enjoining FINRA from expelling the Company. FINRA filed a motion to lift the injunction, which the court denied on August 22, 2023. In response, FINRA stated that it “looks forward” to defending the constitutionality of its enforcement authority in court.

Other SEC, CFTC actions and announcements

Federal district court orders international law firm to comply with SEC subpoena

SEC v. Covington & Burling LLP (D.D.C. July 24, 2023)

A Washington D.C. district court directed an international law firm to comply with a subpoena related to the SEC’s investigation into a cyberattack threat that gained unauthorized access to the firm’s computer network, but the court significantly scaled back the scope of the required response.

In January 2023, the SEC filed an application to the district court seeking an order to compel the law firm to comply with the investigative subpoena and provide the names of the 300 clients whose files may have been viewed, copied, modified or exfiltrated during the attack. The SEC said that the information provided by the firm would help it investigate potential trading or disclosure violations. In July, the district court granted the SEC’s application in part, finding that the SEC’s request for all affected client names was too broad. Instead, the court ordered the law firm to provide the names of the seven clients as to whom it had not been able to rule out whether material nonpublic information was accessed during the cyberattack.

SEC Commissioners Peirce, Uyeda oppose SEC’s amicus brief filing

On July 5, 2023, the SEC joined the Solicitor General’s amicus brief in support of the petitioner in Murray v. UBS Sec., LLC, a case that asks the Supreme Court to decide whether a whistleblower bringing an anti- retaliation claim under the Sarbanes-Oxley Act of 2002 is required to prove that their employer acted with retaliatory intent. In response, SEC Commissioners Hester Peirce and Mark Uyeda released a statement opposing the Commission’s decision to join the amicus brief.

The Commissioners wrote that the Murray case presents a difficult legal question and that the SEC, under the Commission’s Canons of Ethics, must approach such questions with “a full understanding of the matter” through careful research and analysis. According to their statement, the Commissioners were not given adequate time to consider whether to join the Solicitor General’s amicus brief because, at the same time, the Commission was also considering two new rulemaking initiatives.

Commissioners Peirce and Uyeda note that the simultaneous consideration of numerous complex items, particularly rulemaking initiatives, has become commonplace at the SEC and suggested that the Commission must begin prioritization to facilitate a robust deliberative process.

Commissioners Peirce and Uyeda statement | Amicus brief

SEC awards whistleblowers combined awards of over $131 million

The SEC announced awards to whistleblowers whose information and assistance led to successful SEC enforcement actions. The first whistleblower award was for more than $9 million, the second award was for $104 million to seven whistleblowers and the third award was for $18 million.

SEC press release 1 | SEC press release 2 | SEC press release 3 | SEC order 1 | SEC order 2 | SEC order 3

SEC announces interim acting co-directors of the Division of Examinations

The SEC announced that Natasha Vij Greiner and Keith E. Cassidy were named interim Acting Co-Directors of the Division of Examinations, while Division Director Richard Best is on extended leave.

This post comes to us from Davis, Polk & Wardwell LLP. It is based on the firm’s memorandum, “SEC & CFTC Enforcement Update,” dated July and August 2023 and available here.

Sky Blog

Sky Blog