The Financial Stability Oversight Council revised its interpretive guidance and analytic framework for FSOC’s authority to designate nonbank financial companies for Federal Reserve supervision and regulation and to otherwise monitor and respond to financial stability risks. These changes reverse key aspects of changes made during the Trump administration to the designation framework and procedures.

Key takeaways

― The Financial Stability Oversight Council (FSOC) revised its interpretive guidance and analytic framework for the designation of nonbank financial companies for Federal Reserve supervision and regulation and for otherwise monitoring and responding to financial stability risks. In particular, FSOC adopted:

▪ (1) Interpretive Guidance on the Authority to Require Supervision and Regulation of Certain Nonbank Financial Companies (the Nonbank Designation Guidance) (available here); and

▪ (2) an Analytic Framework for Financial Stability Risk Identification, Assessment and Response (the Risk Analytic Framework) (available here).

― FSOC has reversed key aspects of the changes made during the Trump administration to the SIFI designation framework and procedures (the 2019 Nonbank Designation Guidance), describing those prior revisions as “inappropriate prerequisites” to the use of its designation authority. In particular, the Nonbank Designation Guidance and Risk Analytic Framework are intended to provide the designation authority for “systemically important financial institutions” (SIFIs) co-equal footing with FSOC’s other authorities going forward.

― The changes eliminate elements of the 2019 Nonbank Designation Guidance that incorporated and addressed certain holdings of the MetLife v. FSOC decision, including the requirement to complete a cost-benefit analysis.

▪ FSOC disagreed with commenters arguing that FSOC is required to conduct a cost-benefit analysis before designating a company under MetLife.

▪ FSOC explained its reasoning as follows: the district court’s opinion is not binding on other district courts; the court’s opinion regarding the necessity of considering a company’s likelihood of financial distress was in part based on FSOC’s previous guidance that the FSOC has now changed; and the district court did not take into consideration that FSOC did not “deem” the cost of designation an appropriate risk-related factor to consider, as required under the Dodd-Frank Act.

― By splitting the procedural and substantive elements of the nonbank designation framework between the Nonbank Designation Guidance and Risk Analytic Framework respectively, FSOC can change the Risk Analytic Framework without public comment, in contrast to the Nonbank Designation Guidance included as an Appendix A to 12 CFR Part 1310.

― FSOC finalized the Nonbank Designation Guidance and Risk Analytic Framework largely as proposed. See here for our client memo on the proposals.

▪ A key change to the Nonbank Designation Guidance clarifies that it is possible for a nonbank financial company under review to mitigate risks to financial stability to avoid designation during FSOC’s review process.

▪ Key changes to the Risk Analytic Framework include: (1) additional detail around the transmission channels and vulnerabilities factors for assessing financial stability risks; (2) an increased emphasis on engagement with state and federal regulators regarding potential risks; and (3) clarification regarding the term “threat to financial stability.”

Key takeaways: FSOC recommendations to address key vulnerabilities

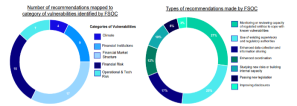

― In response to requests for additional insight into how FSOC identifies and assesses financial stability risks, FSOC pointed out that it regularly provides such insight in its annual report, which details FSOC’s views about various risks to financial stability and recommends steps to address them. Below are the categories of vulnerabilities identified and types of recommendations in the 2022 Annual Report:

Source: FSOC 2022 Annual Report

Key takeaways: Comparison of FSOC’s annual budget and staffing in 2020 versus 2023

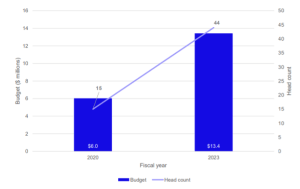

― In considering how FSOC may use its authorities going forward, staffing levels may be instructive. FSOC has increased its budget and staffing capabilities significantly since the end of the Trump administration, as reflected below:

Source: FSOC Fiscal Year 2024 Budget Information; FSOC Fiscal Year 2021 Budget Information

Comparison with the 2019 guidance

| Topic | Comparison of the Nonbank Designation Guidance and Risk Analytic Framework to the 2019 Nonbank Designation Guidance |

|

Prioritization of an activities-based approach |

─ The Nonbank Designation Guidance and Risk Analytic Framework together clarify that FSOC’s nonbank designation authority is not de-prioritized as compared to an activities-based approach.

|

|

Cost benefit analysis |

─ Designation authority. FSOC is no longer required to analyze whether the expected benefits to financial stability from the entity-based designation justify the expected costs, as had been required under the 2019 Nonbank Designation Guidance. ─ Recommendation authority. FSOC is also no longer required to conduct a cost-benefit analysis in instances where an existing financial regulatory agency is not required to make a cost-benefit analysis, before issuing a recommendation pursuant to Section 120 of the Dodd-Frank Act. |

| Interpretation of “threat to U.S. financial stability” | ─ The Nonbank Designation Guidance removes the definition of “threat to U.S. financial stability” set forth in the 2019 Nonbank Designation Guidance, which interpreted the term to mean a “threat of impairment of financial intermediation or of financial market functioning that would be sufficient to inflict severe damage on the broader economy” (emphasis added). In doing so, the finalized guidance stated that the 2019 definition sets an “inappropriately high threshold” that “contrasts sharply” with the statutory standard set forth in Section 113 of the Dodd-Frank Act. ─ As part of the Risk Analytic Framework and as discussed in the preamble to the Nonbank Designation Guidance, FSOC provides a new interpretation of “threat to financial stability.” Specifically, “events or conditions that could substantially impair the ability of the financial system to support economic activity” would constitute a threat to financial stability.─ This new interpretation of the term clarifies that “designation would not be justified” where a company’s “material financial distress or activities could only cause immaterial impairments of the financial system.” |

| SIFI designation procedures |

The Nonbank Designation Guidance retains certain procedural aspects of the 2019 Nonbank Designation Guidance, but reverses course on others, as summarized below. ▪ Two stage process. The Nonbank Designation Guidance has the same basic structure of a two-stage nonbank financial company designation process as set forth in the 2019 Nonbank Designation Guidance. ▪ No threshold stage. As in the 2019 Nonbank Designation Guidance, the Nonbank Designation Guidance does not reintroduce a threshold stage included in guidance issued in 2012 in which a set of uniform, quantitative metrics were used to identify nonbank financial companies to be subjected to additional review by FSOC. See the Appendix for the quantitative metrics set forth in this 2012 guidance. ▪ Likelihood of financial distress. The Nonbank Designation Guidance no longer requires FSOC to assess the likelihood of a nonbank financial company’s material financial distress as had been required under the 2019 Nonbank Designation Guidance. FSOC stated that in addition to being inconsistent with the statutory standard set forth in Section 113 of the Dodd-Frank Act, FSOC making this assessment “could trigger a run on the company.” § The Nonbank Designation Guidance adds some additional engagement and transparency mechanisms, such as clarifying the period in which FSOC must provide notice (i.e., at least 60 days) to a company under review of the vote to proceed from Stage 1 to Stage 2 of the designation process. ▪ Mitigating risks. Unlike in the proposal, the Nonbank Designation Guidance reintroduces the concept from the 2019 Nonbank Designation Guidance that a nonbank financial company has the ability during the review process to “mitigate any risks to financial stability and thereby potentially avoid becoming subject to [the Council’s designation authority].” In the preamble, FSOC states, however, that it does “not expect to advise companies on actions they may take, delay the designation process in connection with potential actions the company considers taking, or refrain from a proposed or final designation based on actions that a company has proposed but not completed.”

▪ De-designation process. The Nonbank Designation Guidance retains the process from the 2019 Nonbank Designation Guidance for annual reevaluation and potential de-designation of a designated nonbank financial company in the case that an entity or its regulators take steps to mitigate the potential risks identified in FSOC’s written explanation of the basis for its designation. |

Summary of the risk analytic framework

─ Separate procedural and substantive elements. FSOC separates the procedural elements of the designation process (in the Nonbank Designation Guidance) from the substantive analytic considerations (in the Risk Analytic Framework). Separating the procedural and substantive elements allows the FSOC to change the Risk Analytic Framework without public comment, in contrast to the Nonbank Designation Guidance, which is included as Appendix A to 12 CFR Part 1310.

─ Broader applicability of the Risk Analytic Framework. FSOC intends for the Risk Analytic Framework to be used in contexts other than the nonbank company designation process. For example, to “help market participants, stakeholders, and other members of the public better understand how [FSOC] expects to perform certain of its duties” in identifying, assessing and responding to potential risks to financial stability, regardless whether the risk stems from specific activities, nonbank financial companies or otherwise.

─ New definition for “financial stability”. The Risk Analytic Framework interprets the term “financial stability,” as used in the Dodd-Frank Act, as “the financial system being resilient to events or conditions that could impair its ability to support economic activity, such as by intermediating financial transactions, facilitating payments, allocating resources, and managing risks.”

─ New definition for “threat to financial stability”. Unlike the proposal, the Risk Analytic Framework also includes an interpretation of “threat to financial stability.” The term constitutes part of the statutory standard under Section 113 of the Dodd-Frank Act under which FSOC considers a company for designation. The framework defines “threat to financial stability” to mean events or conditions that could “substantially impair the financial system’s ability to support economic activity.”

─ Identification of risks. The Risk Analytic Framework sets forth certain categories within which FSOC, in coordination with financial regulators, would monitor financial stability risks, including:

▪ certain financial markets, including markets for debt, loans, short-term funding, equity securities, commodities, digital assets, derivatives and other institutional and consumer financial products and services;

▪ central counterparties and payment, clearing and settlement activities;

▪ financial entities, including banking organizations, broker-dealers, asset managers, investment companies, private funds, insurance companies, mortgage originators and servicers and specialty finance companies;

▪ new or evolving financial products and practices; and

▪ developments affecting the resiliency of the financial system, such as cybersecurity and climate-related financial risks.

While the manner of assessing potential risks is often highly fact specific, the Risk Analytic Framework identifies a list of non-exhaustive vulnerabilities and transmission channels that FSOC believes most commonly contribute to financial stability risks:

▪ Vulnerabilities.

─ FSOC believes that vulnerabilities in the financial system can amplify the impact of a shock, potentially leading to a disruption in the provision of financial services.

─ Although FSOC expects to consider vulnerabilities broadly, it has identified certain vulnerabilities it considers most common: leverage; liquidity risk and maturity mismatch; interconnections; operational risks; complexity or opacity; inadequate risk management; concentration; and destabilizing activities.

─ In each case, the Risk Analytic Framework identifies several types of quantitative metrics that FSOC considers relevant for evaluating vulnerabilities in the financial system, but does not specify the thresholds at which such metrics would signal adverse impacts to financial stability.

▪ Transmission channels.

─ FSOC also expects to consider how the adverse effects of potential risks could be transmitted to financial markets or market participants and what impact the potential risk could have on the financial system.

─ While FSOC believes the transmission of risk could occur through various “channels,” the Risk Analytic Framework identifies several which FSOC considers the four most common: exposures; asset liquidation; critical function or service (“substitutability”); and contagion.

─ In each case, the Risk Analytic Framework identifies several quantitative metrics that FSOC considers relevant for evaluating whether these channels may transmit financial stability risk, but again does not specify the thresholds at which such metrics would signal adverse impacts to financial stability.

─ In addressing risks, the Risk Analytic Framework stresses that FSOC may use “different approaches” or “multiple tools to mitigate” an identified risk, depending on the circumstance once the risk has been identified and assessed in accordance with the framework, and that “the actions [FSOC] takes may depend on the circumstances.”

─ When a potential risk to financial stability is identified, FSOC may consider using any of FSOC’s authorities to respond to risks to U.S. financial stability, including:

▪ Facilitating interagency coordination and information sharing. FSOC has the authority to work with relevant federal and state financial regulatory agencies to seek the implementation of appropriate actions to ensure a potential risk is adequately addressed.

▪ Making recommendations to agencies or Congress to apply new or heightened standards and safeguards for a financial activity or practice as provided for under Section 120 of the Dodd-Frank Act.

▪ Designating a nonbank financial company as subject to Federal Reserve regulation and supervision, in accordance with the procedures set forth in the Nonbank Designation Guidance.

▪ Designating a financial market utility or payment, clearing or settlement activity as systemically important under Title VIII of the Dodd-Frank Act.

Appendix: 2012 threshold criteria to SIFI designation process

─ Absence of threshold criteria. As in the 2019 Nonbank Designation Guidance, the Nonbank Designation Guidance does not include any quantitative metrics to apply during an initial stage to determine which nonbank financial companies should be a focus in subsequent evaluation stages.

─ Threshold Criteria under the 2012 Guidance. The 2012 Nonbank Designation Guidance included a three-stage designation process (rather than a two-stage process as set forth in the 2019 Nonbank Designation Guidance and Nonbank Designation Guidance). During the threshold stage, FSOC determined which nonbank financial companies should be a focus for subsequent evaluations through the application of uniform, quantitative metrics.

▪ To advance beyond the initial stage, a nonbank financial company was required to satisfy the “total consolidated assets size” threshold of ≥ $50 billion and, in addition, one of five factors:

-

- Total Debt Outstanding. ≥ $20 billion of total debt outstanding.

- Credit Default Swaps. ≥ $30 billion in gross notional credit default swaps outstanding for which the financial company is the reference entity.

- Derivatives Liabilities. ≥ $3.5 billion of derivative liabilities.

- Leverage Ratio. Leverage ratio of total consolidated assets to total equity ≥ 15:1.

- Short-Term Debt Ratio. Short-term debt to total consolidated assets (excluding, as above, separate accounts for insurers) of ≥ 10 percent.

This post comes to us from Davis, Polk & Wardwell LLP. It is based on the firm’s memorandum, “FSOC revises its nonbank “systemically important financial institution” designation framework,” dated November 14, 2023, and available here.

Sky Blog

Sky Blog