In October 2023, the FDIC proposed enforceable guidelines on corporate governance and risk management that would apply to all state non-member banks with $10 billion or more in assets.

Key Facts:

- The comment period closed on February 9, 2024

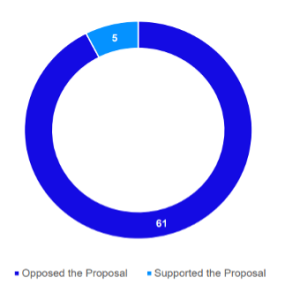

- 66 comment letters were posted as of February 29, 2024

- Of the 66 comment letters, 61 of them – over 92% – opposed the Proposal in its entirety or raised substantial concerns

-

- Criticism came from small and large banks alike, as well as government officials, state banking supervisors, trade organizations, advocacy groups and academics

- Only 5 comment letters – less than 8% of submissions – supported the Proposal

-

- Support came from academics and advocacy groups

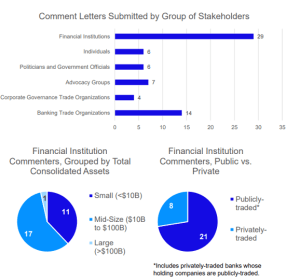

Opposition to proposal came from broad range of stakeholders

A broad range of stakeholders opposed the proposal, including:

─ Conference of State Bank Supervisors

─ Council of Institutional Investors

─ National Association of Corporate Directors

─ North Carolina Commissioner of Banks, Katherine Bosken

─ North Dakota Governor Doug Burgum

─ Society for Corporate Governance

─ U.S. Chamber of Commerce

A broad range of banks expressed concerns

─ Mid-size banks, who would be subject to the Proposal, and small banks alike commented

─ Both publicly-traded and privately-traded banks were well represented

Concerns about new fiduciary duties

Many commenters raised concerns about the Proposal’s requirement that boards consider the interests of all stakeholders, including “shareholders, depositors, creditors, customers, regulators, and the public,” which could conflict with state fiduciary duties.

“The proposed guidelines ignore, and create avoidable conflicts with, state law, the foundational source of corporate governance models, standards, and requirements.” Conference of State Bank Supervisors at page 2

“The Guidelines impose ambiguous standards in conflict with state law and are arbitrary and capricious.” North Carolina Office of the Commission of Banks at pages 1-2

“Corporate governance and fiduciary duty expectations are set in state law, and for a federal agency to impose these types of rules on businesses is clearly an infringement on state sovereignty.” Governor Doug Burgum at page 2

Concerns about independent director requirement

Many commenters raised concerns about the Proposal’s requirement that boards should contain a majority of outside and independent directors.

“Executives and other leadership talent is very difficult to find, recruit, and maintain. The new [independent director] requirement places even more of a burden on IBC to potentially consider placing an unqualified member on the board to simply . . . satisfy an arbitrary requirement.” A small Southwest bank

“Requiring a majority of directors be outside and independent while limiting permissibility of some common boards exceeds OCC and Federal Reserve guidelines and requirements. These requirements would be detrimental to family-owned and closely held covered banks. Should a family-owned private bank give up control to non-shareholder independent directors?” A small Midwest bank

Concerns about $10B asset threshold

Many commenters argued that the Proposal’s $10B asset threshold should be raised.

“[T]he Proposed Guidelines would apply evenly to all covered institutions regardless of their inherent risk profiles, which is especially problematic when combined with the lower $10 billion asset threshold. We strongly urge the FDIC to raise the asset threshold to a level that at least equals the $50 billion threshold set by the OCC.” A mid-size Southeast bank

“One would need only to review recent bank failures to recognize that the FDIC has no actuariallybased justification to vary from the “well understood” $50 billion asset threshold . . . Of the 376 bank failures since 2009, only one bank had assets between $10 billion and $50 billion.” A mid-size Southwest bank

“Even now, banking institutions dread reaching the $10 billion threshold due to numerous CFPB rules and guidelines that trigger at that threshold. To also now add these Guidelines will only cause that dread to grow and will likely increase the number of small and midsized banks reaching that threshold to seek mergers with larger banks.” A small Southwest bank

Further areas of concern

Commenters identified a host of additional concerns, including that the Proposal:

─ Is poorly calibrated to recent bank failures

─ Contains a misguided diversity requirement

─ Includes confusing provisions about “dominant policymakers”

─ Conflates the roles of board and management

─ Does not provide an adequate transition period

─ Will result in increased costs

─ Is not aligned with existing Fed and OCC standards

─ Is vague

─ Is overly prescriptive

“[H]owever well-intentioned, as written, this proposed standard that a board consider existing and potential directors’ race, ethnicity, gender, and age is wholly inappropriate and likely subject to legal challenge. Furthermore, given most, if not all, jurisdictions require that a chartered institution’s board be comprised of a majority of directors resident in their jurisdiction, the proposed standard would create significant regulatory uncertainty in the most geographically remote jurisdictions and other, largely rural jurisdictions that may be less racially and ethnically diverse than the country is as a whole.”

American Bankers Association at page 8

Arguments from supporters

The Proposal’s few supporters argued that it would reduce conflicts of interest through the independent director requirement and that the proposed guidelines are more detailed and enforceable than their OCC and Fed counterparts.

“My [recent law review article] revealed that the vast majority of large-bank directors simultaneously serve as board members of their parent holding companies. These dual directorships create a conflict of interest: when a bank’s directors serve on the board of the bank’s holding company, the directors have an incentive to allow the holding company to exploit the bank and take advantage of the bank’s federal safety net. Adopting the unaffiliated director guideline would help alleviate this conflict of interest and thereby enhance the safety and soundness of the banking system.” Professor Jeremy Kress at pages 1-2

“Along with being more detailed than either the Fed or OCC’s direction related to corporate governance, the Proposal and its guidelines differ from the other Agencies’ guidance because it is enforceable, pursuant to Section 39 of the FDI Act . . . We believe that the lack of enforceability in the Fed’s and OCC’s guidance on Boards of Directors is a critical weakness, and the enforceability aspect of the FDIC Proposal is vitally important.” Better Markets at pages 7-8

Takeaways

Opposition to the Proposal was overwhelming and came from a broad range of stakeholders

─ The FDIC likely anticipated opposition from affected mid-size banks, small banks, and banking trade groups

─ The FDIC likely did not anticipate opposition from corporate governance trade groups, government officials, and state bank supervisors

─ It is possible that this broad-based backlash could cause the FDIC to reconsider aspects of the Proposal

Commenters identified many significant areas of concern that the FDIC will need to consider

─ Under the APA, the FDIC must consider and respond to these comments as it decides whether and how to finalize the proposed rulemaking

─ Failure to respond to the concerns raised could lead a reviewing court to set aside any final FDIC rule as arbitrary and capricious

This post comes to us from Davis, Polk & Wardwell LLP. It is based on the firm’s memorandum, “FDIC corporate governance proposal: Comment letter analysis,” dated March 13, 2024, and available here.

Sky Blog

Sky Blog