After several years of dramatic growth, ESG investing seems to have entered a period of retrenchment. While it is impossible to predict the future trajectory of ESG, the movement has revealed important structural features of our financial system and the social forces that act on it. As the ESG terrain shifts, it is important to have a clear understanding of these forces. In a new article, we argue that the intense c-suite focus on ESG has been a product of social demand from investors, employes, and customers transmitted to CEOs through various interacting channels.

Within this framework, CEOs bear significant, non-diversifiable personal risks when their firms experienceESG problems. CEOs face the possibility of losing their positions and seeing their career trajectories diminished. Consequently, these risk-averse CEOs may embrace ESG, not only in response to shareholder pressure, but also defensively as a means of self-protection, and such strategies may not be optimal in either a pecuniary or social welfare sense. This CEO-centric ESG agency dilemma has largely been overlooked by both critics and proponents of ESG.

Understanding ESG as a product of social demand is particularly helpful as ESG undergoes a shift. Social pressures can change. What is critical is that CEOs have been – and will remain – at the center of those pressures. While ESG will evolve, or even fade, the confluence of economic and social forces is likely to endure and continue to pressure CEOs.

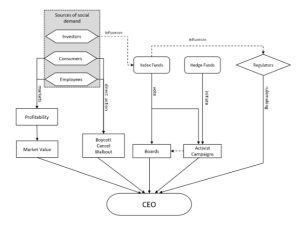

In our article, we identify five channels through which social demand is transmitted to CEOs, leading to investment and perhaps overinvestment in ESG. As social demand shifts, these channels will remain open and continue to affect managers:

First, we discuss a significant body of empirical evidence suggesting that embracing ESG may be necessary to attract and retain talent, attract consumers, and attract investors. This is the most obvious and broadly discussed source of pressure to embrace ESG. Indeed, managers often explicitly make this argument. If this were the only channel of influence, pursuing ESG might simply collapse into maximizing shareholder value, raising no new analytical issues.

Second and more important, we identify a novel set of strong personal incentives for CEOs to promote ESG, separate from firm value. Cancel culture, employee walkouts, boycotts, and other negative ESG incidents not only create risks for firms, but they also threaten the CEO personally. Indeed, recent studies find that negative ESG news, a decline in ESG ratings, or other negative ESG incidents, significantly increase CEOs’ risk of termination. Two other factors, we argue, further magnify CEOs’ incentives to mitigate their personal risk from ESG failures. First, this personal risk is not diversifiable, while shareholders can spread their risk across thousands of investments, managers have only one career. Second, the costs of mitigating this personal risk are not paid out of the CEO’s pocket. While the risk or termination is borne by the CEO personally, the costs of ESG investments are borne by the firm and its shareholders. Risk-averse managers may rationally invest (or overinvest) corporate money in ESG even if doing so has no real impact on firm value and even if such investments are not effective ways to pursue social goals, so long as they accrue personal benefits from reduced personal ESG risk.

Third, we show that the social demand for ESG has created strong, though skewed, incentives for index fund managers to promote ESG. After years without opportunity to differentiate their products and competing only on price, index fund managers are now using ESG activism to win new investors. Index funds have voted against directors over diversity and climate issues. Yet, in seeking to be branded as ESG promoters relative to their competitors, index funds might choose to compete aggressively, potentially (though not necessarily) at the expense of firms’ performance and value.

Fourth, social demand has provided activist hedge funds with incentives to target firms with ESG vulnerabilities. Activist hedge funds, which rely on index funds’ votes to secure seats on corporate boards, understand that framing their activist campaigns around ESG goals will make their campaigns more successful. Most famously, the small, newly founded Engine No.1 successfully elected three directors to the ExxonMobil board with a climate-focused activist campaign. Unsurprisingly, law firm memos now advise managers to search within for ESG weaknesses and fix them to avoid being targeted by activists.

Fifth, the demand for ESG has facilitated ESG regulation, which reinforces the impact of the other channels. First, firms now face pressure to disclose lobbying activities and their alignment or misalignment with ESG policies. Second, high shareholder demand for ESG disclosures, and firms’ responsiveness to this demand, played a key role in the SEC’s Proposed Climate Disclosure Rule by demonstrating a likely-positive regulatory cost-benefit tradeoff.

Figure 1 illustrates how multiple channels converge on the CEO to motivate firm response.

Figure 1: Channels of ESG Pressure on Management

Identifying these channels helps contextualize how firms have dealt with ESG issues. ESG initiatives arise from social pressures that have real implications for firm value, but these pressures are transmitted through channels that have the potential to misalign CEO and shareholder incentives. The net result of these pressures is ambiguous. ESG is neither all smoke and mirrors nor simply another tool developed by management to justify entrenching mechanisms that provide no value to stakeholders.

This framework answers another common criticism of ESG as well. Purportedly ESG-oriented firms sometimes disregard stakeholder interests in M&A transactions. While this has been characterized as evidence that ESG commitments are superficial, we see such shifts as consistent with an incentives story. The sale of the firm is a final period problem in which managers are no longer exposed to the risks of being fired in response to poor ESG performance. As such, they naturally discount ESG commitments, but this does not indicate that those commitments are content-free when the firm is a going concern.

Our analysis has normative implications for the desirability of ESG. Social demand for ESG might cause firms to internalize costs that they have historically imposed on society. This could be efficiency enhancing. But many economists, legal scholars, and policy makers have argued that environmental concerns, employee rights, and other values should be protected by targeted regulations and are beyond the realm of corporate law. Our framework suggests, however, that such benefits should be weighed against the risk that managers will overreact to the fear of public backlash, that index funds may compete in ways that destroy value, or that ESG may not be promoted if the firm is for sale if it possesses significant market power and if the managers are so powerful that they face little risk.

Finally, our analysis has implications for disclosure policy. Currently, securities regulators are responding to ESG by increasing disclosure requirements, and skeptics argue that disclosures related to issues like carbon emissions are about “naming and shaming” bad actors. Yet, when a litany of socially sensitive issues can suddenly become very real problems for a consumer brand or for firms recruiting employees, even the most hard-nosed investors must take notice. Information that would not have been considered material a decade ago may suddenly become material in the new ESG environment. Securities laws should reflect this change.

Finally, as the ESG landscape shifts, our social demand story retains explanatory power. Social pressures are dynamic, and as stakeholder priorities shift, so too may the pressure on CEOs. Importantly, though, the rise of ESG has demonstrated the efficacy of levers of power within the corporate world that are likely more durable than any particular set of social pressures. That index funds can attract assets through their voting policies, that social media and campaigns and employee protest can motivate firm action, and that activist funds can leverage these dynamics to win proxy battles are mechanisms unlikely to be overlooked by stakeholders going forward.

This post comes to us from professors Michal Barzuza and Quinn Curtis at the University of Virginia School of Law and David H. Webber at Boston University School of Law. It is based on their recent article, “The Millennial Corporation: Strong Stakeholders, Weak Managers,” available here.

Sky Blog

Sky Blog