The approval of Ethereum Spot Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) in May 2024 marked a significant step forward for cryptocurrency in mainstream finance (Krause, 2024). This decision followed the precedent set by Bitcoin Spot ETFs and has opened new avenues for institutional and retail investment in Ethereum. However, the SEC’s decision to prohibit staking within these ETFs has sparked a debate. Staking, a core component of Ethereum’s Proof of Stake (PoS) mechanism, involves locking up Ether (ETH) to secure the network and validate transactions in return for rewards (Wendl et al., 2023). In a new paper, I examine whether Ether staking should be permitted by the issuers of the Ethereum Spot ETFs by exploring its mechanics, economics, and the regulatory landscape.

Proof of Stake is a consensus mechanism that relies on validators who are selected based on the number of tokens they stake as collateral. This method is more energy-efficient and scalable than Proof of Work (PoW). In September 2022, Ethereum transitioned from PoW to PoS through an upgrade known as “The Merge.” Validators deposit a minimum of 32 ETH into a smart contract to become eligible to validate transactions and earn rewards. This process ensures network security and stability but comes with risks such as penalties (slashing) for validators who fail to comply with network rules or attempt fraudulent activities (Riposo and Gupta, 2024).

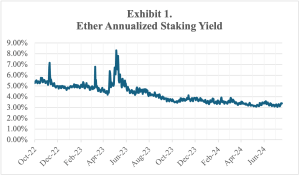

Staking rewards, consisting of newly minted ETH and transaction fees, form the economic backbone of PoS. These rewards give validators an incentive to maintain network security and integrity. Staking can yield returns ranging from 3 percent to 8 percent annually, depending on network conditions. The lock-up period for staked Ether, while ensuring network stability, limits liquidity for investors. Additionally, the value of Ether is subject to market volatility, which affects the overall returns from staking.

Exhibit 1 shows the annualized staking yield of Ether since September 2022. The average staking yield was 4.34 percent over the period, which showed a downward trend in staking yield. The data was obtained from the Compass Staking Yield Reference Index – Ethereum (STYETH), which measures the annualized daily yield obtained when staking on the Ethereum blockchain.

Incorporating staking into Ethereum Spot ETFs could have profound economic implications. By allowing investors to participate in staking rewards through ETFs, demand for Ethereum could potentially increase, driving up its price. However, the extent of this impact would depend on factors such as the size of the ETF market, investor appetite for staking, and overall market conditions.

Moreover, the decision to permit staking within ETFs could influence the supply of ETH available for trading. As more ETH is locked up in staking, the circulating supply could decrease, potentially pushing up prices. Conversely, a significant influx of institutional capital into Ethereum through ETFs could lead to increased liquidity and price stability.

Validator profitability could also be affected. With the potential for a substantial increase in staked ETH, competition among validators might intensify, leading to lower staking rewards. On the other hand, if ETFs attract new investors to Ethereum, the overall network value could rise, potentially offsetting the impact of increased competition.

A critical concern is the potential security risks associated with concentrating large amounts of ETH within ETFs. While pooling ETH for staking can enhance network security by increasing the overall stake, it also creates a single point of failure. A compromise of an ETF’s custody could result in a significant loss of ETH, potentially destabilizing the Ethereum network. Additionally, the concentration of voting power within a few ETFs could raise concerns about governance and centralization risks.

To mitigate these risks and balance the potential benefits, hybrid approaches could be considered. For example, ETFs could be allowed to participate in staking but with restrictions on the amount of ETH that can be staked by a single ETF. Alternatively, ETFs could be required to distribute staking rewards to investors periodically, reducing the concentration of ETH within the fund.

The SEC’s cautious stance on staking stems from its interpretation of the Howey Test, which determines what constitutes a security (Gonzalez, 2022). According to the SEC, staking involves an investment of money in a common enterprise with an expectation of profits derived from the efforts of others. This classification subjects staking to stringent regulatory requirements. SEC Chair Gary Gensler has likened staking rewards to yields from lending or interest-bearing securities, emphasizing the need for regulatory oversight to protect investors.

Incorporating staking into Ethereum Spot ETFs offers several potential benefits for investors, such as enhanced returns through staking rewards. It can also drive increased adoption of Ethereum by providing a regulated vehicle for earning these rewards. Furthermore, staking within ETFs would bolster Ethereum’s network security by pooling significant amounts of ETH for validation purposes. This would reduce the likelihood of attacks and foster greater trust in the network.

The primary obstacle to allowing staking within Ethereum ETFs is the complex regulatory landscape. The SEC’s classification of staking as a security imposes stringent compliance requirements. Moreover, staking involves risks such as slashing penalties and lock-up periods, which limit liquidity and can deter investors. There is also the potential for market manipulation if ETF sponsors control substantial amounts of staked Ether. Allowing staking in Ethereum ETFs could set a precedent for other cryptocurrencies, leading to increased regulatory challenges.

To incorporate staking into Ethereum ETFs, a comprehensive regulatory framework is essential. This framework should balance innovation with investor protection, possibly involving inter-agency cooperation between the SEC and other regulatory bodies. Safeguards such as transparency standards, robust security protocols, and liquidity provisions should be implemented to mitigate risks. Legislative changes might also be necessary to create a conducive environment for staking within ETFs.

While integrating staking into Ethereum Spot ETFs presents potential benefits, the associated regulatory and legal challenges, inherent risks, and broader implications for the cryptocurrency market must be carefully considered. A balanced approach that prioritizes investor protection and regulatory clarity is crucial for ensuring the stability and integrity of both the financial markets and the cryptocurrency ecosystem.

REFERENCES

Gonzalez, N. E. (2022). Does cryptocurrency staking fall under SEC jurisdiction?. Fordham J. Corp. & Fin. L., 27, 521.

Krause, David, Unlocking Ethereum’s Potential: The Rise of Spot ETFs in Cryptocurrency Investment (June 06, 2024). http://dx.doi.org/10.2139/ssrn.4856380.

Riposo, J., and Gupta, M. (2024). A crypto yield model for staking return. FinTech, 3(1), 116-134.

Wendl, M., Doan, M. H., and Sassen, R. (2023). The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. Journal of Environmental Management, 326, 116530.

This post comes to us from David Krause, emeritus associate professor of finance at Marquette University. It is based on his recent paper, “Should Ethereum ETFs Include Staking? A Look at the Benefits and Risks,” available here.

Sky Blog

Sky Blog