Two weeks ago, there was big news for “event contracts,” which provide for fixed payouts upon the occurrence of specified events and are sometimes referred to as “prediction” products. Kalshi – an exchange that has popularized event contracts on everything from sober economic outcomes to tawdry milestones in pop-culture – prevailed over the Commodity Futures Trading Commission (CFTC) in federal district court. At stake in the lawsuit is whether Kalshi may host contracts that settle on the basis of which political party controls the Senate or the House on specific dates. Judge Jia Cobb held that the CFTC lacked statutory authority to prohibit the contracts because they were “gambling” rather than “gaming” and because they did not “involve” activity illegal under state law. The statutory construction can be debated, and the CFTC has appealed the decision to the D.C. Circuit and obtained a stay on appeal. For a few hours, between Judge Cobb’s opinion taking effect and the D.C. Circuit issuing a stay, Kalshi hosted trading in the congressional election contracts.

Depending on how long the D.C. Circuit takes to consider the case, this November may be the first time Americans can bet on elections.[1] Many at the CFTC dread this eventuality. That is because if an exchange that the CFTC regulates (e.g., Kalshi) supports trading in a contract, the CFTC becomes responsible for policing manipulation, fraud, and other misconduct related to how the contract settles. In the context of contracts that settle on the basis of elections, the CFTC would become responsible for policing election integrity. Not only does the CFTC lack expertise in this area, but the job is politically fraught, as it is imaginable that candidates will not agree that a particular electoral contest was waged honorably. The people involved have a high degree of leverage over the operations of the CFTC through appointments, control over purse strings, hearings, and all the other carrots and sticks effectuating “democracy” in the context of independent agencies. Hence folks that favor a technocratic character to the CFTC and its low political profile are hoping that Kalshi loses, definitively.

The case, however, raises a broader question related to event contracts: Are these contracts within the CFTC’s jurisdiction? The CFTC administers the Commodity Exchange Act (CEA), which has historically enunciated two goals: advancing hedging and pricing in cash markets.[2] Cash markets, which are also referred to as “spot” markets, are the markets for whatever underlies a derivative. For example, the cash market related to futures, options, or swaps on wheat would be the physical wheat market. As Congress envisioned the CEA, the act was not intended to govern derivatives for the sake of derivatives but only to advance cash market activity. Indeed, it would be doubtful that anyone in Congress now or at the time of relevant enactments saw Wall Street as an end in itself as opposed to a means for Main Street.

Event contracts are an unusual kind of derivative. They are typically structured as binary options that settle on the basis of whether some event occurs or not. For example, an exchange like Kalshi may sell a bundle of two contracts for $10 (with a small transaction fee). The first contract pays out $10 if the House is subject to Democrats’ control on January 1, 2026, and the second contract pays out $10 if the House is subject to Republicans’ control on that date. Assuming one party or the other controls the House, the combined payout on the two contracts is $10. However, the price of the individual contracts in the bundle will fluctuate between $0 and $10 (with the other moving reciprocally) as expectations regarding control of the House shift in response to polls and other events.

Exchanges like Kalshi not only sell bundles of contracts exhaustively covering potential future states of the world, but also enable secondary market trading in the components. As a result, the prices of component contracts come to reflect market expectations concerning the likelihood of events. This is why the products are known as prediction contracts (and the markets that support them, are sometimes referred to as prediction markets). For example, if the congressional control contracts described above are trading around $5 each, then the market has little sense of which party will control the House. But if the contracts are trading at around $9 for the one that pays out $10 in the event of Republican control (and around $1 for the one that pays out $10 in the event of Democrat control), then the market believes that Republicans have an approximately 90 percent chance of taking the House.

Because there is no related cash market, event contracts do not assist with pricing in cash markets. This is in contrast to futures on grain and other commodities, where cash market transactions are priced based on prices prevailing in futures markets (e.g., a farmer will not negotiate the price of her wheat, instead asking for a premium above what futures on wheat trade at). To the extent event contracts provide any statutorily recognized benefits to the real economy, it is in their contribution to risk management, i.e., hedging.

The binary option structure, however, is ill suited to serve hedging purposes. To see this, consider a binary option contract on something simpler than an election, perhaps an option that settles on the basis of whether the S&P 500 index reaches some value. If and only if the value is reached, then the option pays out $10. The payout terms do not consider if the threshold is reached by a smidge or greatly exceeded. The CFTC has previously authorized binary options on equity indices as well as economic variables such as CPI and unemployment. Do these products advance risk management goals? To address this question, a comparison of binary option payouts to payouts under a traditional derivatives instrument is instructive.

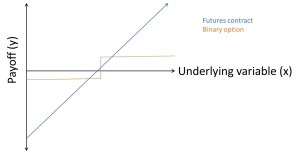

Figure 1: Futures v. Binary Options Payouts

Figure 1 shows that unlike a futures contract or other traditional derivative, a binary option position does not gain or lose value as the value of the underlier changes. As a result, the instrument is a very weak way of managing risk. In the example of a binary option on the S&P500 that pays $10 if the index falls below a threshold, the instrument is largely useless for insuring against losses on an S&P500 portfolio because it does not distinguish between levels of losses.[3]

Binary options have been attractive to retail traders because they are fully collateralized from the outset. As a result, traders do not have to post margin as the value of the position changes – the initial price of the bundle represents the maximum amount payable under its components, so traders do not need to post additional collateral to secure the amount that may be payable at settlement. Operationally and psychologically, retail traders are averse to supporting daily margin calls as they would have to do if they purchased a traditional futures settling on an index like the S&P500. But in choosing a structure that does not expose them to ongoing margin calls, traders also give up the ability to differentiate between levels of losses.[4] This property makes binary options far more effective for speculation than for hedging.

For this reason, I believe that the hedging utility of event contracts tends to be de minimis. As a result, they do not advance the purposes for which the CEA was enacted. Contracts that exchanges list pursuant to the CEA get the benefit of preemption from state law, including state gambling law. Going forward, the CFTC should use its authority to require delisting of most event contracts. This would transfer jurisdiction from the CFTC to the states. In doing so, it would resolve thorny questions posed by congressional control contracts as well as free CFTC resources to oversee traditional sectors of the derivatives market. While elections are particularly thorny, it is doubtful the CFTC should be policing Rotten Tomatoes ratings, the Emmys, or a myriad of other matters on which event contracts settle. Simply put, these are instruments that predominantly attract retail gambling rather than genuinely advance Main Street goals.[5]

ENDNOTES

[1] The Iowa Electronic Market has hosted trading in event contracts on U.S. elections since 1988. However, this and other university sponsored projects are substantially limited in their scope and operate outside of CFTC regulation. See Robert Forsythe, Forrest Nelson, George R. Neumann & Jack Wright, Anatomy of an Experimental Political Stock Market, 82 Amer. Econ. Rev. 1142 (Dec. 1992).

[2] This is evident in the language of CEA Section 3 as it has evolved since adoption in 1922. Section 3 was developed at a time of limited Commerce Clause powers and limits the transactions subject to the CEA as those serving the interstate-commerce related purposes described in that section. The CFTC’s authority to interpret the CEA extends to interpreting Section 3 as a limitation on its jurisdiction.

[3] One may think that combinations of options at different strikes can be used, but in practice, the gaps between strike prices and the transaction costs (e.g., premia) are too great for this to be practicable.

[4] Arguably, an outcome as to which party controls a chamber of Congress is more binary, with traders being indifferent between a party controlling a chamber by a slim margin or a huge majority. However, in the context of congressional elections, there is a question as to how anyone can predictably link a party’s predominance in a chamber to an estimate of monetary consequences such as losses. Can Exxon reliably estimate how much it stands to gain from Republicans controlling the House or the Senate? Personally, I don’t think so.

[5] Will Prediction Markets Live Up to the Hype?, The Economist (Feb. 19, 2022) (“Kalshi specifically looks for events ripped from headlines, says Luana Lopes Lara, one of its co-founders.”).

This post comes to us from Ilya Beylin, a professor at Seton Hall Law School. If you have professional interests in event contracts and wish to discuss this post, Prof. Beylin would be glad to hear from you.

This post comes to us from Professor Ilya Beylin at Seton Hall Law School. It is based on his recent article, “Why State Law Rather Than Federal Derivatives Regulation Should Govern Prediction Products,” forthcoming in the University of Chicago Business Law Review and available here. If you have professional interests in event contracts and wish to discuss this post, Prof. Beylin would be glad to hear from you.

Sky Blog

Sky Blog