Evidence of a rise in corporate market power has drawn the attention of U.S. policymakers, prompting antitrust regulators to more closely scrutinize mergers and acquisitions (M&A) that consolidate product markets. Such consolidations are believed to be behind the increased market power, which can lead to higher prices, fewer choices, and lower quality for consumers. To take action against harmful mergers, however, regulators must first be aware of them. In a new paper, we show that thousands of large deals go unreported because the criteria for regulatory review ignore an increasingly important economic asset in the economy: intangible capital.

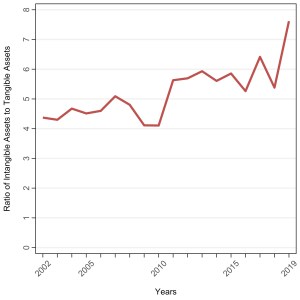

Intangible capital is consistently overlooked because, for mergers and acquisitions exceeding a specific value, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) use the size of the target company’s assets to determine reporting requirements. However, these asset thresholds rely on balance sheet values reported under U.S. Generally Accepted Accounting Principles (GAAP), which exclude nearly all intangible assets, such as intellectual property and customer data. This exclusion occurs even as the FTC and DOJ have recently paid closer attention to sectors rich in intangible assets, like pharmaceuticals and technology. Consistent with such concerns, as illustrated in the figure below, the value of acquired intangible assets is eight times that of tangible assets.

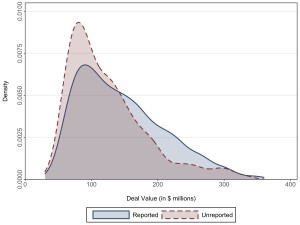

Our paper shows that asset-size thresholds lead to thousands of deals – especially in technology and pharmaceutical sectors – going unreported to the FTC and DOJ, even when their transaction values are nearly identical to those that are reported, as shown in the figure below. If regulators required firms to include intangible capital in the target’s assets, we estimate that the number of reported deals would rise by about 263 annually, with over half of these being horizontal consolidations among competitors.

But do unreported deals reduce competition and thereby harm consumers? If those deals provide anticompetitive advantages, we would expect acquirers to pay a higher premium, and, in fact, we find that they carry a 12 percent higher premium than reported deals. Notably, this premium increase is concentrated in deals that consolidate product markets, where anticompetitive behavior is most likely to arise. Furthermore, if these deals decrease competition, investors may view them favorably for the acquirer and its competitors, even with evidence of higher premiums. Consistent with this, we observe a 5.6 percent increase in the acquirers’ equity values after the deal announcement and a 0.7 percent increase for competitors in unreported deals.

One way unreported deals may benefit shareholders – at the expense of other stakeholders, like consumers – is by enabling acquirers to charge prices well above costs. We find that acquirers in those deals do impose higher markups, which persist for at least two years after the deals close. This effect is especially pronounced in acquisitions involving firms with overlapping product markets and where intangible assets, like established technologies or brands, have an immediate impact on prices.

Our previous findings indicate that acquiring intangible assets enables firms to bypass antitrust scrutiny while gaining anticompetitive advantages. One possible reason for these advantages is that the technologies acquired in unreported deals tend to be of higher quality. To investigate this, we analyzed over 9,000 patents transferred through reported and unreported deals and found that patents acquired in unreported deals are indeed of higher quality, measured by their importance and potential as breakthrough technologies.

Unreported deals may also harm competition through the acquisition of undeveloped products. For instance, acquirers might buy early-stage projects and then discontinue them to prevent future competition – a tactic that Cunningham et al. (2021) have coined “killer acquisitions.” To explore whether bypassing antitrust review allows acquirers to eliminate future competitors, we focus on the pharmaceutical industry, a sector historically monitored by the FTC and DOJ. Analyzing data on drug development, we find that unreported deals are more likely to involve targets and acquirers working on overlapping drug projects, and these projects are 40 percent more likely to be discontinued after acquisition. Notably, this outcome does not seem driven by differences in development capabilities, as acquirers in both reported and unreported deals show similar discontinuation rates outside of these acquired projects.

This pattern of acquiring and discontinuing drug projects also appears to have wider economic impacts. For instance, further analysis shows that entrepreneurs respond to these preemptive acquisitions by launching copycat drug projects in the years following these deals, rather than developing truly novel treatments. This response aligns with the economic incentives associated with higher deal premiums we’ve documented. Additionally, we find that target firms in unreported deals are more often sold by sophisticated investors, such as venture capital firms, who are likely aware of antitrust screening criteria and motivated to sell their firms before they surpass asset-size thresholds.

Overall, our findings indicate that unreported deals are more likely to have anticompetitive effects. Though it’s possible that regulators may not be concerned about deals of this size, our evidence suggests that around 25 percent of all Second Requests – the FTC and DOJ’s highest level of antitrust scrutiny short of litigation – occur in reported deals of comparable size. These deals are rarely blocked, but their size clearly draws regulatory attention, and they go unexamined in other cases purely due to the exclusion of intangible assets because of accounting rules.

This raises a final question: If antitrust regulators are unaware of these deals, why doesn’t private litigation fill the gap in public enforcement? We find some evidence that private enforcement can compensate for limited public oversight only in part because of various legal barriers we discuss in the paper. Since the United States relies on both public and private enforcement, these barriers suggest that many anticompetitive deals are likely to persist, unchecked by either public or private efforts.

This post comes to us from professors John D. Kepler at Stanford Graduate School of Business and Charles McClure and Christopher R. Stewart at the University of Chicago Booth School of Business. It is based on their recent paper, “Competition Enforcement and Accounting for Intangible Capital,” available here.

Sky Blog

Sky Blog