In Augenbaum v. Anson Investment Master Fund LP et al., the Southern District of New York recently denied a motion to dismiss in a case seeking short-swing profit disgorgement relating to trades that generated ~$500 million by an alleged investor “group”.[1]

The case is a stark reminder of the importance of carefully avoiding group formation through the appearance of implicit agreements or concerted action.

The alleged facts are complicated and involve a particularly volatile security during an especially turbulent period, the COVID-19 pandemic. Annex I presents a detailed chart of the timeline. Annex II shows the stock price during the relevant period. Annex III presents the SEC’s Q&A regarding the legal standard for determining whether a “group” has been formed.

Section 16

I. The Section 16 regime aims to prevent corporate “insiders” from unfairly using confidential information to profit from trading in the issuer’s securities.

- An investor becomes a Section 16 “insider” if it beneficially owns > 10% of any class of SEC-registered voting equity securities of a U.S. issuer – whether individually or as the result of collective ownership with other members of a group– or has a director representative or is an officer at a U.S. issuer.

- An insider generally must file SEC reports indicating its beneficial ownership (Form 3) and when it transacts (Form 4).

- Absent an exemption, an insider is required to disgorge to the issuer profits (or deemed profits) resulting from “short-swing” trading in the issuer’s equity securities.

- A short-swing trade generally is any purchase and any sale (or vice versa) that are made by an insider within six months of each other.

- Derivative securities are generally reportable and transactions in derivatives may be considered matchable trades that can result in “short-swing” profits.

II. A “beneficial owner” is a person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares voting or investment (including dispositive) power over a security.(This is the same standard as for Schedules 13D and 13G.)

- A person generally is deemed a beneficial owner of a security if the person has the right to acquire beneficial ownership within 60 days, including through a convertible security or similar right.

III. A “group” is formed when two or more persons agree to act together for the purpose of acquiring, holding, voting or disposing of equity securities of an issuer, even in the absence of a written agreement or intent to form a group.Group formation ultimately depends on relevant facts and circumstances and the SEC has issued guidance in the form of a Q&A. The group is deemed to have acquired beneficial ownership of all the securities beneficially owned by its members.

IV. Exchange Act Rule 13d-6 provides a limited exemption from group formation where investors purchase equity securities directly from an issuer in a private placement so long as:

- Each investor is a regulated entity, such as an investment adviser or broker-dealer.

- The purchase is in the ordinary course of each member’s business and not with the purpose nor with the effect of changing or influencing control of the issuer.

- There is no agreement among or between any members of the group to act together with respect to the issuer or its securities except for the purpose of facilitating the specific purchase involved.

- The only actions among or between any members of the group with respect to the issuer or its securities subsequent to the closing date of the non-public offering are those which are necessary to conclude ministerial matters directly related to the completion of the offer or sale of the securities.

V. Very often, market participants cannot meet these stringent conditions, and must proceed carefully with the advice of counsel to the extent that they wish to interact with each other in connection with an issuer’s capital raising activity and avoid “group” status.

- Some courts have taken a flexible approach and found that an “understanding” between parties is enough to find an agreement to act together.The agreement does not have to be in writing and may be proven by circumstantial evidence, which involves a fact-intensive inquiry.

- Courts generally look at multiple factors, such as coordination and communications leading up to the initial decision to make parallel investments.

- In one case, the court granted summary judgment to defendants where the plaintiffs alleged group status based only on the existence of a common PIPE agreement negotiated and executed by a common lawyer.Litzler v. CC Invs., L.D.C., 411 F. Supp. 2d 411, 414–15 (S.D.N.Y. 2006).

- However, where multiple indices of collusion are present, such as identical or very similar trading activities, courts are more likely to allow suits to go forward.

Augenbaum Court’s Reasoning

I. In January 2022, Todd Augenbaum, a shareholder of Genius Brands International (“Genius”), filed a derivative action on behalf of Genius suing several institutional investors alleging that they formed a group when they entered into a joint Securities Purchase Agreement (“SPA”) in order to obtain more than 10% of Genius’s securities.

II. The court found evidence from which a jury could infer agreement, including:

-

- Messages among the placement agent (“PA”) and defendants leading up to the initial transaction and afterwards.These included messages between the PA and defendants about other investors’ intentions.

- An internal placement agent memo noting that it had “received a call from [two of the defendants] asking if the company was willing to sell common stock off its shelf registration statement at $1.50.”

- Defendants working together prior to signing the SPA.

- Email chains among the placement agent and defendants regarding comments on a proposed term sheet for an investment in the issuer.

- Defendants knowing of each other’s plans prior to purchasing the issuer’s securities.

- The placement agent revealing intended investor identities, and the lead investor’s legal counsel trading comments and drafts with other defendants.

III. In the court’s view, these factors combined to create a genuine issue of fact as to the existence of a group.

IV. Takeaways:

- The decision highlights the importance of avoiding even the appearance of acting as a group.

- The case highlights several potential mitigating factors that investors should be aware of to avoid being viewed as a group including taking independent action, engaging one’s own counsel, and carefully planning how to proceed, both prior to, during and following an investment.

- Investors should consult with counsel before undertaking a transaction that has the potential to result in group liability under the Section 16 regime, especially when participating in coordinated private placements.

Annex I: Alleged Facts

| August 2019 |

· Nominal defendant Genius Brands International (now known as Kartoon Studios) needed financing. · Genius approached a placement agent and investment bank (“the PA”) for help restructuring its debt and securing additional private financing. · The PA and Genius planned for a certain defendant (the “Lead Investor”) to be the lead investor in a PIPE transaction. |

| Jan. 22, 2020 |

· The Lead Investor executed a term sheet with Genius for a $10 million offering of secured convertible notes to be issued by Genius. · The Lead Investor agreed to provide up to $3 million in funding and existing secured note holders would provide at least 200% of the amount of their existing debt. · The Lead Investor retained a law firm to represent it in connection with the planned deal. The law firm did not represent any other clients with respect to that deal, but it does represent other defendants in the suit. · Almost immediately after executing the term sheet, the PA began circulating it to potential investors. · A number of the defendants had all invested in Genius prior to 2019, dating as far back as 2014. |

| Jan. 24, 2020 |

· The PA asked the law firm (copying the Lead Investor) to send drafts of the deal documents to the general counsel and chief compliance officer of one of the defendants. · The law firm attorney responded that, “I’m sure whatever comments [the general counsel] has will just improve the docs for all.” · The law firm also asked a principal and portfolio manager of the Lead Investor about a term in the deal regarding redemption. The principals of the PA were also included on the email. · A principal of the Lead Investor wrote back, “Red[emption] should not be allowed w/o equity conditions being met (registered, liquid etc.) And then given we are getting stock at 15% discount, redemption premium should be 15% up so that we are indifferent between being paid and amortizing out. Those are my thoughts . . . not sure what other folks wi[ll] think. [A principal of the PA], maybe check with [an equity owner of one defendant, and a founder and managing member of another defendant’s general partner]?” |

| Jan. 28, 2020 | · The law firm and Director corresponded about the deal documents again. |

| Feb. 23, 2020 |

· A principal of the Lead Investor contacted the PA and asked if the $10 million funding requirement for the deal had been met. · That principal wrote, “If we’re not going to be at the $10mm perhaps we show it [t]o [the investment manager for one of the defendants]?” · After a principal at the PA responded that the deal was currently “at $7-13mil,” the principal from the Lead Investor emailed back, “[I]f we have a shortage, we show [the investment manager].” |

| Feb. 24, 2020 |

· The principal at the PA emailed a defendant about investing in the Genius deal. · The principal at the PA wrote, “This deal is a Highly structured Self-Amortizing Senior Secured Convertible Note Original Issue discount with ratchets and resets and price protection and most favored nations with 100% warrants with the same protective features as the note. Lead investor is in for $3mil out of $10mil…All other existing note holders are in!!!” · The principal at the PA also attached an investment letter describing the deal in more detail. In the category of “Investors,” the letter stated, “[the Lead Investor], and other institutional and accredited investors acceptable to the Lead Investor (together with the Lead Investor, the ‘Investors’).” |

| Mar. 3, 2020 |

· Genius entered into voting agreements with some of its principal stockholders to ensure that it would be able to obtain shareholder approval for the March 2020 deal. · Under NASDAQ Rule 5635(d), a listed company is required to obtain stockholder approval before it can issue twenty percent or more of its outstanding common stock at a discount, as was the case under the March 2020 deal. · The securities purchase agreements required Genius to hold a stockholder meeting by May 15, 2020, to approve the issuance of shares of common stock upon any conversion of the 2020 convertible notes. · Under the terms of the agreements, following stockholder approval, the conversion price of the notes and the exercise price of the March 2020 warrants would be reduced to $0.21 per share. · Defendants said that none of them (defendants) signed one of these voting agreements with Genius, but the plaintiff claimed that at least one defendant executed one. |

| Mar. 10, 2020 |

· Genius entered into lock-up agreements with its principal stockholders. · The lock-up agreements prohibited the stockholders from selling any Genius common stock that they owned at that time for ninety days following the one-year anniversary of the closing date of the securities purchase agreements. No defendant was a party to any lock-up agreement. |

| Mar. 11, 2020 |

· The deal closed, and Genius entered into securities purchase agreements with each defendant. All the agreements were of the same form. · The securities purchase agreements also referenced other agreements, including a voting agreement, a lock-up agreement, and a master netting agreement. · Under the securities purchase agreements, Genius promised to sell and issue a total of $13,750,000 in senior secured convertible notes. These notes were initially convertible into common stock at a price of $1.375 per share. The 2020 convertible notes were issued at an original issue discount of $2,750,000. · Genius also promised to sell and issue to the counterparties warrants to purchase 65,476,190 shares of common stock, exercisable for a period of five years at an initial exercise price of $0.26 per share. · The participating investors funded the $11 million balance with cash payments of $7 million and full-recourse cash-secured promissory notes payable by the investors to Genius in the principal amount of $4 million. |

| Mar. 13, 2020 |

· Genius entered into master netting agreements with every investor in the March 2020 PIPE, including each defendant. · The parties disputed what these agreements provided for, but the plaintiff claimed that they “provided for joint sharing of risks and rewards [among defendants] in the event of [Genius’s] bankruptcy.” |

| Post-Closing | · The price of Genius stock began to rise, so Genius sought to raise more capital through a registered direct offering. |

| Mar. 22, 2020 |

· Genius completed a registered direct offering. Genius entered into a securities purchase agreement with some of its investors in which it agreed to sell 4,000,000 shares of common stock at $0.2568. · Two defendants participated in this deal. |

| May 7, 2020 |

· Genius completed another registered direct offering. Genius agreed to sell 8,000,000 shares of its common stock at $0.35 per share. · Many of the defendants participated in this transaction. |

| May 8, 2020 |

· Genius completed another registered direct offering. Genius agreed to sell 12,000,000 shares of common stock at $0.454 per share. · Almost all the same investors participated. |

| May 15, 2020 | · At Genius’s annual stockholders meeting, Genius stockholders voted to lower the conversion price of the notes involved in the March 2020 deal to $0.21 per share and to lower the exercise price of the warrants involved in the March 2020 deal to the same. |

| May 18, 2020 |

· Genius completed a registered direct offering. Genius agreed to sell 7,500,000 shares of common stock at $1.20 per share. · A number of the defendants participated in the deal. · Each investor signed a “leak-out” agreement with Genius under which each investor could not, for ninety days after the registration statement became effective, sell any common stock obtained through converting the notes or exercising the warrants from the March 2020 deal for a price below $1.65 per share, unless the total amount of shares sold on any trading day by the investor did not exceed a fixed percentage of the daily trading volume. That percentage was based on the investor’s pro rata investment in the March 2020 deal. |

| May 28, 2020 |

· Genius completed another registered direct offering. Genius agreed to sell 20,000,000 shares at $1.50 per share. · Genius agreed to file a registration statement on or before June 5, 2020, to register the shares underlying the March 2020 warrants with the SEC. · A number of the defendants participated in the May 28, 2020 registered direct offering. |

| June 4, 2020 | · Genius filed a registration statement for the resale of 60,100,617 shares of common stock. |

| June 10, 2020 |

· The SEC declared Genius’s June 4 registration statement effective. · The registration statement allowed the sale of 31,100,091 shares of common stock that defendants obtained pursuant to the exercise of their warrants. · The registration statement was followed the next day by a prospectus for the sale of the shares; every defendant subsequently sold Genius shares. |

| June 23, 2020 |

· Each defendant entered into two agreements with Genius: a conversion agreement and a leak-out agreement. · Under the conversion agreements, Genius promised to file a registration statement with the SEC on June 26, 2020 that covered the resale of the shares issued in exchange for defendants’ convertible notes. (It was filed June 26 and declared effective July 6.) · The June leak-out agreements were essentially the same as the May leak-out agreements, except with a trigger price of $2.00 rather than $1.65. The June leak-out agreements were never triggered because the price of Genius’s stock stayed above $2.00 throughout the relevant period. |

| July 8, 2020 |

· Genius filed a prospectus with the SEC for the proposed resale of 59,523,812 shares of common stock issued upon conversion of the notes from the March 2020 deal. · All of the investor defendants were listed as selling stockholders. |

| Mar. – Aug., 2020 | · Alleged sales by the defendants totaling ~$500m. |

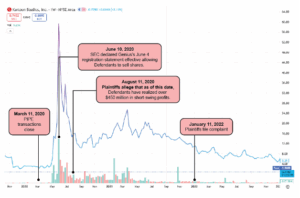

Annex II: Stock Chart[2]

Annex III: SEC’s Q&A Regarding Group Formation

Question: Is a group formed when two or more shareholders communicate with each other regarding an issuer or itssecurities (including discussions that relate to improvement of the long-term performance of the issuer, changes in issuer practices, submissions or solicitations in support of a non-binding shareholder proposal, a joint engagementstrategy (that is not control-related), or a “vote no” campaign against individual directors in uncontested elections)without taking any other actions?

Response: No. In our view, a discussion whether held in private, such as a meeting between two parties, or in a public forum, such as a conference that involves an independent and free exchange of ideas and views among shareholders, alone and without more, would not be sufficient to satisfy the “act as a . . . group” standard in sections 13(d)(3) and 13(g)(3). Sections 13(d)(3) and 13(g)(3) were intended to prevent circumvention of the disclosures required by Schedules 13D and 13G, not to complicate shareholders’ ability to independently and freely express their views andideas to one another. The policy objectives ordinarily served by Schedule 13D or Schedule 13G filings would not be advanced by requiring disclosure that reports this or similar types of shareholder communications. Thus, an exchange of views and any other type of dialogue in oral or written form not involving an intent to engage in concerted actions or other agreement with respect to the acquisition, holding, or disposition of securities, standing alone, would not constitute an “act” undertaken for the purpose of “holding” securities of the issuer under section 13(d)(3) or 13(g)(3).

Question: Is a group formed when two or more shareholders engage in discussions with an issuer’s management, without taking any other actions?

Response: No. For the same reasons described above, we do not believe that two or more shareholders “act as a . . . group” for the purpose of “holding” a covered class within the meaning of those terms as they appear in section 13(d)(3) or 13(g)(3) if they simply engage in a similar exchange of ideas and views, alone and without more, with an issuer’s management.

Question: Is a group formed when shareholders jointly make recommendations to an issuer regarding the structure andcomposition of the issuer’s board of directors where (1) no discussion of individual directors or board expansion occurs and (2) no commitments are made, or agreements or understandings are reached, among the shareholders regarding the potential withholding of their votes to approve, or voting against, management’s director candidates if the issuer does not take steps to implement the shareholders’ recommended actions?

Response: No. Where recommendations are made in the context of a discussion that does not involve an attempt toconvince the board to take specific actions through a change in the existing board membership or bind the board to take action, we do not believe that the shareholders “act as a . . . group” for the purpose of “holding” securities of thecovered class within the meaning of those terms as they appear in sections 13(d)(3) or 13(g)(3). Rather, we view this engagement as the type of independent and free exchange of ideas between shareholders and issuers’ management that does not implicate the policy concerns addressed by section 13(d) or section 13(g).

Question: Is a group formed if shareholders jointly submit a non-binding shareholder proposal to an issuer pursuant to Exchange Act Rule 14a-8 for presentation at a meeting of shareholders?

Response: No. The Rule 14a-8 shareholder proposal submission process is simply another means through which shareholders can express their views to an issuer’s management and board and other shareholders. For purposes of group formation, we do not believe shareholders engaging in a free and independent exchange of thoughts about apotential shareholder proposal, jointly submitting, or jointly presenting, a non-binding proposal to an issuer in accordance with Rule 14a-8 (or other means) should be treated differently from, for example, shareholders jointly meeting with an issuer’s management without other indicia of group formation. Accordingly, where the proposal is non-binding, we do not believe that the shareholders “act as a . . . group” for the purpose of “holding” securities of thecovered class within the meaning of those terms as they appear in section 13(d)(3) or 13(g)(3). Assuming that the joint conduct has been limited to the creation, submission, and/or presentation of a non-binding proposal,[3] those statutory provisions would not result in the shareholders being treated as a group, and the shareholders’ beneficial ownership would not be aggregated for purposes of determining whether the five percent threshold under section 13(d)(1) or 13(g)(1) had been crossed.

Question: Would a conversation, email, phone contact, or meetings between a shareholder and an activist investor thatis seeking support for its proposals to an issuer’s board or management, without more, such as consenting or committing to a course of action,[4] constitute such coordination as would result in the shareholder and activist being deemed to form a group?

Response: No. Communications such as the types described, alone and without more, would not be sufficient to satisfythe “act as a . . . group” standard in sections 13(d)(3) and 13(g)(3) as they are merely the exchange of views among shareholders about the issuer. This view is consistent with the Commission’s previous statement that a shareholder whois a passive recipient of proxy soliciting activities, without more, would not be deemed a member of a group with persons conducting the solicitation.[5] Activities that extend beyond these types of communications, which include joint or coordinated publication of soliciting materials with an activist investor might, however, be indicative of groupformation, depending upon the facts and circumstances.

Question: Would an announcement or a communication by a shareholder of the shareholder’s intention to vote in favorof an unaffiliated activist investor’s director nominees, without more, constitute coordination sufficient to find that the shareholder and the activist investor formed a group?

Response: No. We do not view a shareholder’s independently-determined act of exercising its voting rights, and any announcements or communications regarding its voting decision, without more, as indicia of group formation. This view is consistent with our general approach towards the exercise of the right of suffrage by a shareholder in other areas of the Federal securities laws.[6] Shareholders, whether institutional or otherwise, are thus not engaging inconduct at risk of being deemed to give rise to group formation as a result of simply independently announcing or advising others—including the issuer—how they intend to vote and the reasons why.

Question: If a beneficial owner of a substantial block of a covered class that is or will be required to file a Schedule 13D intentionally communicates to other market participants (including investors) that such a filing will be made (to the extent this information is not yet public) with the purpose of causing such persons to make purchases in the same covered class, and one or more of the other market participants make purchases in the same covered class as a directresult of that communication, would the blockholder and any of those market participants that made purchases potentially become subject to regulation as a group?

Response: Yes. To the extent the information was shared by the blockholder with the purpose of causing others to make purchases in the same covered class and the purchases were made as a direct result of the blockholder’s information,these activities raise the possibility that all of these beneficial owners are “act[ing] as” a “group for the purpose of acquiring” securities of the covered class within the meaning of section 13(d)(3). Such purchases may implicate theneed for public disclosure underlying section 13(d)(3) and these purchases could potentially be deemed as having beenundertaken by a “group” for the purpose of “acquiring” securities as specified under section 13(d)(3).[7] Given that a Schedule 13D filing may affect the market for and the price of an issuer’s securities, non-public information that a person will make a Schedule 13D filing in the near future can be material.[8] By privately sharing this material information in advance of the public filing deadline, the blockholder may incentivize the market participants who received the information to acquire shares before the filing is made.[9] Such arrangements also raise investor protection concerns regarding perceived unfairness and trust in markets.[10] The final determination as to whether a group is formed between the blockholder and the other market participants will ultimately depend upon the facts and circumstances, including (1) whether the purpose of the blockholder’s communication with the other market participants was to cause them to purchase the securities and (2) whether the market participants’ purchases were madeas a direct result of the information shared by the blockholder.

ENDNOTES

[1] Augenbaum v. Anson Invs. Master Fund LP, No. 22-CV-249 (AS), 2025 WL 2780854 (S.D.N.Y. Sept. 30, 2025).

[2] Source: TradingView: The stock price indicated in this chart reflects a 1/10 reverse stock split on February 13, 2023.

[3] The conclusion reflected in this example assumes the Rule 14a-8 or other non-binding shareholder proposal is submitted jointly and without “springing conditions” such as an arrangement, understanding, or agreement among the shareholders to vote against director candidates nominated by the issuer’s management or other management proposals if the non-binding proposal is not included in the issuer’s proxy statement or, if passed, not acted upon favorably by the issuer’s board.

[4] Examples of the type of consents or commitments given in furtherance of a common purpose to acquire, hold (inclusive of voting), or dispose of securities of an issuer could include the granting of irrevocable proxies or the execution of written consents or voting agreements that demonstrate that the parties had an arrangement to act in concert.

[5] Amendments to Beneficial Ownership Reporting Requirements, Release No. 34-39538 (Jan. 12, 1998) [63 FR 2854, 2858 (Jan. 16, 1998)].

[6] For example, public announcement of a voting intention qualifies for the exclusion from the definition of solicitation under 17 CFR 240.14a-1(l)(2)(iv).

[7] While each group member individually bears a reporting obligation arising under Rule 13d-1(k)(2), a tippee would not become a member of a group, and thus would not incur a reporting obligation, until it makes a purchase of securities of the same covered class in response to having been tipped even if the tippee already is a beneficial owner of that class.

[8] See Alon Brav, Wei Jiang, Frank Partnoy, and Randall S. Thomas, Hedge Fund Activism, Corporate Governance and Firm Performance, 61 J. FIN. 1729 (2008) (finding on average an abnormal short-term return of 7% over the window before and after a Schedule 13D filing); Marco Brecht, Julian Franks, Jeremy Grant, and Hammes F. Wagner, The Returns to Hedge Fund Activism: An International Study, Center for Economic Policy Research, Discussion Paper No. 10507 (Mar. 15, 2015).

[9] See, e.g., Susan Pulliam, Juliet Chung, David Benoit, and Rob Barry, Activist Investors Often Leak Their Plans to a Favored Few, Wall St. J.(Mar. 26, 2014), available at https://www.wsj.com/articles/SB10001424052702304888404579381250791474792 (“Activists, who push for broad changes at companies or try to move prices with their arguments, sometimes provide word of their campaigns to a favored few fellow investors days or weeks before they announce a big trade, which typically jolts the stock higher or lower.”).

[10] For example, any near-term gains made by these other investors attributable to information about the impending filing may cause uninformed shareholders who sell at prices reflective of the status quo to question the efficacy of existing regulatory framework. Even though the demand to acquire shares in the covered class may increase as a direct result of the blockholder’s communications, and in turn increase the prices at which selling shareholders exit, such prices may be discounted in comparison to the price such shareholders would have realized had the information about the impending Schedule 13D filing been public. See, e.g. John C. Coffee, Jr. & Darius Palia, The Wolf at the Door: The Impact of Hedge Fund Activism on Corporate Governance, 41 J. Corp. L. 545, 596 (2016) (explaining that “the gains that activists make in trading on asymmetric information—before the Schedule 13D’s filing—come at the expense of selling shareholders [and] represent[ ] another wealth transfer”). Consequently, this informational imbalance could, to the extent some perceive it to be unfair, diminish trust in markets. See, e.g., Georgy Chabakauri et al., Trading Ahead of Barbarians’ Arrival at the Gate: Insider Trading on Non-Inside Information (Colum. Bus. Sch. Rsch. Paper, Jan. 2022), available at https://ssrn.com/abstract=4018057 (finding a significant concurrence between purchases of stock by insiders of the issuer and purchases by an activist in the 60 days, and particularly in the last 10 days, preceding a Schedule 13D filing).

This post is based on a Cleary Gottlieb Steen & Hamilton LLP memorandum, “Sections 13/16: Group Formation & Short-Swing Profit Disgorgement,” dated December 19, 2025, and available here. Michael Cronin and Long Dang contributed to the memorandum.

Sky Blog

Sky Blog