The OCC has reversed recent changes to its bank merger policies through an interim final rule. Our client update is a refresher on the new state of play for Bank Merger Act applications to the OCC, which is a return to the old state of play.

OCC interim final rule on bank mergers

The Office of the Comptroller of the Currency is reversing recent changes to its bank merger policies through an interim final rule, citing “confusion and uncertainty” caused by its 2024 final rule.

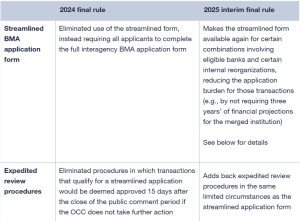

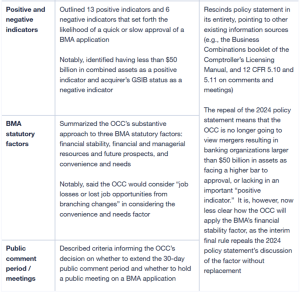

- The table below provides a refresher on the new state of play for BMA applications to the OCC, which is actually a return to the old state of play.

- The interim final rule will be effective immediately upon publication in the Federal Register.

- The OCC will consider issuing a new bank merger policy statement after reviewing any comments on the interim final rule, which will be due 30 days after publication in the Federal Register.

- Please refer to our previous client updates for more details on the OCC’s now-reversed 2024 final rule and the related proposed rule.

Refresher on OCC bank merger policy changes

Refresher on streamlined application and expedited processing

The OCC’s streamlined BMA application and expedited processing will now be available again in four limited situations:

- Transactions between (1) an eligible bank or eligible savings association and (2) one or more eligible banks, eligible savings associations, or eligible depository institutions, where the target’s assets are no more than 50% of the acquirer’s total assets;

- Transactions where (1) the acquirer is an eligible bank or eligible savings association, (2) the target bank or savings association is not an eligible bank, eligible savings association, or an eligible depository institution, and (3) the filers obtain prior OCC approval to use the streamlined form;

- Transactions where (1) the acquirer is an eligible bank or eligible savings association, (2) the target bank or savings association is not an eligible bank, eligible savings association, or an eligible depository institution, and (3) the total assets to be acquired are no more than 10% of the acquirer’s total assets; and

- Certain mergers of a national bank with one or more of its nonbank affiliates, where the filers obtain prior OCC approval to use the streamlined form and the total assets acquired are no more than 10% of the acquirer’s total assets.

In each case, the resulting bank or savings association must be well capitalized.

“Eligible bank or eligible savings association” means a national bank or federal savings association that:

- is well capitalized;

- has a composite CAMELS rating of 1 or 2;

- has a Community Reinvestment Act rating of Outstanding or Satisfactory;

- has a consumer compliance rating of 1 or 2 under the Uniform Interagency Consumer Compliance Rating System; and

- does not have a cease and desist order, consent order, formal written agreement, or prompt corrective action directive or, if subject to any such order, agreement, or directive, is informed in writing by the OCC that the bank or savings association may be treated as an eligible bank or eligible savings association.

“Eligible depository institution” means the above, plus FDIC-insured state banks and savings associations meeting the above criteria.

This post comes to us from Davis, Polk & Wardwell LLP. It is based on the firm’s memorandum, “OCC bank merger policy: What’s old is new again,” dated May 12, 2025, and available here.

Sky Blog

Sky Blog