With less than six months to conform to the Volcker Rule’s proprietary trading restrictions, large banks are working quickly to build out their compliance programs. Last summer, they scrambled to build systems to report monthly seven metrics by September 2, 2014, as required by the rule.[1] Now banks’ focus has moved to proving their trading desks’ exemptions from the proprietary trading restriction as part of their compliance programs that must be in place by July 21, 2015.[2]

Among these exemptions, market making is becoming the most predominantly used. However, the desks taking this exemption (“market making desks”) face significant challenges as they struggle to set, justify, and monitor new risk and position limits based on the reasonably expected near term demand of customers (“RENTD”). The nine largest trading banks must report these limits as part of their metrics reporting this July, while smaller banks have more time until their metrics reporting deadlines of April 2016 or December 2016, depending on their size (but limits must be in place as part of these smaller banks’ standard compliance programs by July 2015).

RENTD is fundamental to the Volcker Rule, as it is the essential evidence needed to show that a market making desk’s positions are tied to customer activity, rather than being proprietary trading.[3] It has caused banks much confusion around whether RENTD itself is a limit (which it is not) and frustration due to data challenges. Put simply, RENTD is an estimate of future customer demand (based predominantly on past activity) that market making desks must take into account, along with other factors (e.g., risk appetite), when setting risk and position limits on their market making inventory, hedges, overall financial exposure, and inventory holding periods.

RENTD has been a challenge because most banks are not currently capable of capturing and evaluating data in the variety of subsets that the rule requires. For example, while banks are familiar with monitoring and limiting a trading desk’s overall financial exposure, they rarely have data on market making inventory separated from data on products used exclusively for non-market making hedges. Furthermore, banks typically do not separate risk data on trades with customers versus non-customers, as is necessary to calculate RENTD. Thus, capturing and analyzing the data required to calculate RENTD is an enterprise-wide conundrum that most banks are solving tactically on an interim basis to meet the July 2015 deadline.

This Regulatory brief provides (a) our analysis of RENTD and its components, and (b) our view of where banks are currently with their RENTD implementation and where they should be.

What is RENTD?

RENTD is an estimate of future customer demand that market making desks must consider when setting risk and position limits in the following four areas:

- Market making inventory (i.e., the financial instruments held by the desk for customers);

- Products used to manage risks associated with market making inventory (i.e., hedges using non-market making instruments);

- Risk factors relating to the overall exposure of the desk’s entire portfolio; and

- Inventory holding periods.

To prevent proprietary trading, the rule requires that market making desks conduct demonstrable analysis of customer demand in setting these four limits. RENTD is calculated based on this analysis, using both the desk’s customers’ historical and expected future demand for the products in which the desk makes a market. Historical customer demand is calculated using past trade-level data from trading market making instruments with customers. This historical data should then be adjusted to account for the expected future demand of customers (based on expected market conditions or growth strategies), arriving at a RENTD amount, which in turn will be used to set and justify risk and position limits.

Besides providing proof that market making desks are not engaged in proprietary trading, this analysis is also essential to other aspects of Volcker compliance such as the CEO’s attestation that a bank has a sufficient compliance program to prevent proprietary trading.

Step #1: Define market making inventory

The first step in calculating RENTD is defining a desk’s market making inventory by separating products in which the desk makes markets from products used for other purposes (e.g., pure hedging), using the following definitions:

- Market making inventory: Comprises positions in financial instruments (including hedges) in which a trading desk stands ready to make a market. Inventory may be measured by notional/market value (usually for cash desks), or from risk factors arising from market making positions (usually for derivatives desks).[4]

- Non-market making inventory: Includes instruments used exclusively for hedging the market making inventory that the trading desk does not stand ready to buy and sell. Non-market making inventory may also include products used under other Volcker exemptions a trading desk is utilizing (i.e., risk mitigating hedging or underwriting).

As an example applying the above two definitions, where a desk makes markets in both interest rate swaps and interest rate futures, the desk may consider all of its positions in interest rate futures as part of its market making inventory even if the future is used as a hedge in a particular transaction. In contrast, where a desk makes markets in single stock equities but uses equity futures exclusively to hedge single stock equities, the equity future would not be included in market making inventory.

Step #2: Define customers

The second step in calculating RENTD is defining “clients, customers, or counterparties” (collectively, “customers”) versus non-customers for each trading desk:

- Customers: Include any institution with less than $50 billion in trading assets and liabilities, as well as any institution that conducts trades on exchanges, but only if the trades are executed anonymously and the exchange has broad customer participation.

- Non-customers: The rule generally excludes trading desks and other units of the largest trading banks (known as the “Big 9”)[5] from the definition of customers for the purposes of calculating RENTD.

When defining customers, we have observed that the anonymity and broad participation requirements have created uncertainty around whether trades on inter-dealer broker networks, swap execution facilities, and dark pools qualify as customers. Therefore, questions continue to arise as to how activity on these three types of venues should be treated, until specific regulatory guidance is provided.

For non-customers, the exclusion of the Big 9 trading desks and other units is intended to prevent trading desks from setting artificially high limits based on dealer-to-dealer activity to cloud potential proprietary trading. To the relief of market making desks, the industry consensus is that units of the Big 9 that function as buy-side clients, such as asset management, private banking, or treasury may be considered customers as they behave like buy-side investors rather than dealers. Given that these buy-side entities are the biggest customers of some market making desks, this exception prevents the rule from overly restricting the inventory that a desk may hold.[6]

Finally, the definition of customers for RENTD purposes should be aligned with the Customer Facing Trade Ratio (“CFTR”), one of the seven monthly metrics currently reported to regulators which measures trades with customers versus all trades made on the desk. To align the definition of customers under RENTD and CFTR, market making desks need to determine whether other Volcker trading desks within the organization (i.e., internal desks) may be treated as customers for RENTD purposes. Since internal trades are excluded from CFTR altogether, as a general rule internal desks can be treated as customers for RENTD classification purposes only if their transactions are done on an “arms-length” basis, just as they would transact a market making product with an external customer. Whether a market making desk may consider other internal desks as customers must be determined individually for each desk, which exacerbates implementation challenges.

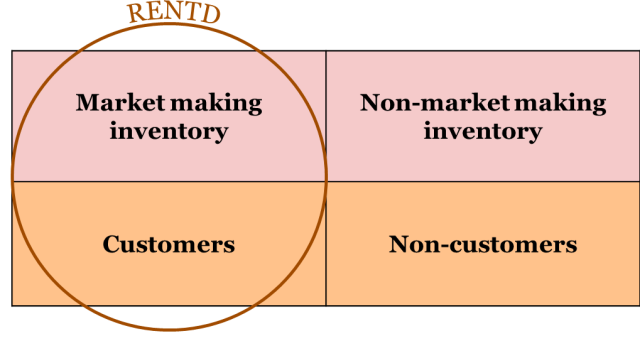

The following graphic depicts the portion of a market making desk’s activities that, as described, is to be used for calculating RENTD:

Where are banks now, and where should they be?

Nearly all banks are facing challenges implementing RENTD, given the unique data sets required for each market making desk. Banks with fewer trading desks and more centralized trade-capture systems are slightly ahead of their peers in implementing the strategic enhancements needed to generate RENTD data.

By contrast, banks with many market making trading desks and disparate trading systems (or banks that have desks taking multiple exemptions) face more daunting strategic implementation challenges, as they need to produce more data, slice it into even more subsets, and enhance more systems. As these strategic measures are still far from being operationalized, faced with a compliance date that is less than six months away, most banks are considering a phased tactical build that involves integrating the rule’s exceptions as system enhancements to support RENTD.

Measuring market making inventory and implementing the definition of customers

Most banks have already defined each trading desk’s market making products in the desk’s trader mandate (that documents which products a desk and/or individual trader is authorized to trade, and for what purpose). As a next step, banks will need to link these trader mandates to trade-capture systems to start generating automated trade data on market making products. This is a necessary change from current systems at most banks, which only generate risk data on end-of-day positions on an aggregated basis, without discerning the risk attributable to market making products only.

Using RENTD as a driver to set limits on market making inventory, hedges, financial exposures, and holding periods also requires that an appropriate measure of this market making inventory be selected for each desk, based on its trading portfolio. For instance, desks that make markets in cash products might measure their market making inventory at notional or market value.

Notional or market value, however, is not suitable for measuring inventory for desks that trade derivatives. Acknowledging this fact, the rule allows a desk to select a relevant risk factor arising from its market making products as a measure of inventory. For instance, a derivatives desk might calculate Vega (a risk measure of implied volatility), CS01 (a risk measure of credit risk sensitivity), or PV01 (a risk measure of interest rate sensitivity), and use one or more of these measures to more accurately evaluate the inventory it holds. Regardless of which risk measure is selected, it should be consistently used to set RENTD-based position limits.

Implementing the definition of customers for RENTD is more challenging and will likely require a phased build. Rather than defining customers at the desk-level based for each desk’s unique set of trades, firms should start with a standardized, enterprise-wide definition, using a risk-based approach (i.e., by starting with excluding all banking entities with greater than $50 billion in trading assets and liabilities as customers). This basic approach is the most effective in understanding what systems and models can be leveraged, and what enhancements are needed, for subsequent phases which will include customization for each desk.

RENTD calculation and limit setting

Once a firm has started generating appropriately measured trade data on market making products and implemented a standardized definition of customers, these two elements can be combined to provide trade-level data on market making products that are traded with customers. Most banks have only recently started, or are yet to start, generating this trade-level data, in some instances using manual processes as a tactical stop gap measure.

This data provides the basis for a justifiable estimation of RENTD. Determining the appropriate methodology to calculate RENTD (i.e., average, maximum, or range of risk factors) is particularly challenging as client demand is rarely steady or completely predictable. As such, developing even a single desk’s methodology may take several rounds of data analysis. Other factors that must be considered in calculating RENTD based on trade data include market liquidity, maturity, and depth. Products’ holding periods, micro and macroeconomic outlooks, firm’s plans for strategic growth, and the desk’s client base should also factor into the desk’s estimation of future client demand.

Eventually, each trading desk must have its own, fully customized RENTD methodology and amount. Absent additional regulatory guidance, the process to calculate RENTD as accurately as possible for each desk is likely to continue to evolve for some time. However, the key for now is to generate RENTD data (even using manual processes), calculate a justifiable measure of RENTD, and set RENTD-based limits for each trading desk in a reviewable manner before the compliance deadline.

Our observations suggest that of the four RENTD-based limits for market making desks, banks should prioritize implementing limits on financial exposure (if not already in place), as this measure of risk is the least foreign to trading desks and existing data can be leveraged in its implementation, resulting in fewer data challenges. Banks should next prioritize implementing limits on market making inventory and hedges. Implementing holding period limits is substantially more challenging, as it may require further analysis of the consequences of such limits, especially for derivatives desks that hold a hedged product with a customer to maturity (e.g., a

30-year interest rate swap).

The rule allows a desk to exceed a limit so long as the desk can justify that it is doing so to facilitate customer demand. Therefore, once the limits are set banks also need to document an appropriate breach monitoring, escalation, and approval process to resolve any potential breaches of a trading desk’s RENTD-based limits.

RENTD flexibility

Implementing RENTD will be an iterative process as methodologies evolve across the industry and regulators provide more specific guidance of what “good” results look like. Therefore, it is necessary to create functional flexibility beyond generating the data that is deemed sufficient today. This flexibility would enable banks to go to an even deeper subset of data within a trading desk if needed, as banks may not have defined all of their trading desks at a discrete enough level.

Flexibility could also allow generated data to be leveraged for other purposes with some change. For example, the ability to show time series analysis for a given product of a desk may also be used to demonstrate liquidity patterns.

Conclusion

Regulators have acknowledged that banks currently do not have the infrastructure to view notional and risk factor sensitivity data on trades identified as both market making and client facing, which is an essential element of RENTD calculation. The technology to view this data is therefore a requirement, and likely a pricey one. However, there is a silver lining: Once this capability is built, firms can derive other benefits from the resulting data, e.g., using it to understand how to better facilitate and enhance the services and products that customers demand.

With less than six months to spare, firms need to start implementing tactical and strategic solutions while increasing enterprise-wide awareness and education of RENTD requirements. At a minimum, banks need to collect the trade-level risk data needed to support RENTD requirements now to have a shot at becoming RENTD compliant by July. The pressure is especially high for the nine largest trading banks, as they must report RENTD-based limits in less than six months. RENTD methodologies must then be developed and integrated into existing risk management and limit-setting processes.

Finally, banking entities should institute a change in culture to ensure businesses understand and effectively use this new approach to risk management. RENTD is likely here to stay and the sooner firms embrace it, the sooner it will become an effective risk management tool that will demonstrate a bank’s commitment toward restricting proprietary trading.

ENDNOTES

[1] See PwC’s A closer look, Volcker Rule clarity: Waiting for Godot (May 2014). The seven monthly reportable metrics are: (1) risk and position limits and usage, (2) risk factor sensitivities, (3) VaR and stress VaR, (4) comprehensive

profit and loss, (5) inventory turnover, (6) inventory aging,

and (7) customer facing trade ratio.

[2] The Federal Reserve last December extended the conformance deadline one year to July 21, 2016 for the portion of the rule pertaining to “legacy covered funds.” See PwC’s First take, Ten key points from the Fed’s Volcker Rule covered funds extension (December 2014). However, conformance relief for the trading provisions of the rule was not granted and remains July 21, 2015.

[3] Setting RENTD-based limits is also a requirement for trading desks taking the Volcker Rule’s underwriting exemption, which is outside the scope of this brief.

[4] Market making products traded with non-customers are also a part of a trading desk’s market making inventory, although these products are excluded from the RENTD calculation.

[5] The rule excludes banks that have greater than $50 billion in trading assets and liabilities from being considered customers for RENTD purposes without documentation and justification. These “Big 9” banks include Bank of America, Barclays, Citi, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan, Morgan Stanley, and Wells Fargo.

[6] Showing that the asset management arms of the Big 9 are treated in the same way as other customers of the market making desk (e.g., through sales coverage) could be a justification for treating them as customers for RENTD purposes. In contrast, it would be more difficult, but not impossible, for a market making desk to justify why a trading desk of the Big 9 that is also taking the market making exemption should be considered a customer, as the rule seeks to restrict unnecessary dealer-to-dealer trading. In the event that inventory was sourced from a Big 9 market making trading desk to satisfy a customer trade, this activity could be captured in the RENTD data, thereby justifying higher limits. Interestingly, the rule is less clear on how smaller banks are to be treated for RENTD purposes. In line with the spirit of the rule, it would make sense for the buy-side units of smaller banks to be considered customers whereas the sell-side units of the same would be excluded. However, the rule does not specifically require a market making desk to justify and document why another market making desk of a smaller banking entity should be treated as a customer.

The full and original memorandum was published by PwC on February 24, 2015, and is available here.

Sky Blog

Sky Blog

Thank you for this summary of RENTD calculation. My comment is specifically about the inventory (step#1 of the article).

PWC’s “instrument-based” approach to inventory does not work for derivatives businesses.

The example that illustrate PWC’s position is unpersuasive: “[…] where a desk makes markets in both interest rate swaps and interest rate futures, the desk may consider all of its positions in interest rate futures as part of its market making inventory […]” (emphasis added).

The logical follow up question is: what happens if the desk only makes a market in swaps? The short answer is: the desk cannot do more than one trade if it uses an instrument-based approach to inventory. Indeed the desk’s inventory will be equal to its RENTD after the first trade. It will be twice RENTD after the second trade etc…

Of course the PWC’s approach has some appeal:

• It seems to perfectly fit the rule definition of inventory (79 Fed. Reg. 5784)

• It is easy to communicate to clients or trader

• It is easy to justify: right or wrong, that’s what the regulators want

• Without interpretive guidance from the regulators, it may be a safe regulatory bet

However, an “instrument-based” approach is not the only one supported by the rule. A derivatives business can use a “risk-based” approach to inventory. This approach consists in identifying the type of risk marketed and sold by the desk – such as interest rate, credit, vega – and include ALL instruments sensitive to this particular risk.

The legal argument in support of this appraoch may be summarized this way:

i. The rule cannot be the only place to look for the definition of inventory because the plain meaning of the rule produces absurd results for derivatives businesses.

ii. The rule definition is explained in the supplemental information provided with the rule (at 79 Fed. Reg. 5592). This supplemental information becomes therefore the best source for the definition of inventory.

iii. The supplemental information clearly distinguishes derivatives businesses from securities businesses. Furthermore the supplemental information explains that derivatives businesses involve “the retention of […] exposures rather than the detention of actual financial instruments”. 79 Fed. Reg. 5592, footnote 716 (emphasis added)

iv. Therefore using a risk-based approach rather than an instrument-based approach is justified for derivatives businesses.

Hopefully, derivatives professional and their legal support are becoming aware of this issue. PWC’s approach is not as inexorable.