Regulators seem to think so. In the Dodd-Frank Act, policymakers made an unprecedented move towards using securities regulation to address issues unrelated to the Securities and Exchange Commission’s (“SEC”) core mission of protecting investors and maintaining the fair and efficient functioning of financial markets. The Dodd-Frank Act requires financial statement dissemination of information regarding purchases of war minerals from Congo and mine health and safety performance. The objectives of these policies are noble—more than ten million people have died in Africa’s Great War and every year hundreds of workers are injured or killed in U.S. mines. Yet, can such regulation affect wars or improve mine safety? Research by Hans B. Christensen, Mark Maffett, and Lisa Liu from the University of Chicago and Eric Floyd from Rice University suggests it can.

In a recent working paper, the authors examine the effects of the mandatory dissemination of mine-safety disclosures (“MSD”) through the financial reports of the 151 SEC-registered firms whose ownership of a U.S. mine make them subject to the Dodd-Frank legislation. Mine safety information is already publicly available on the Mine Safety and Health Administration’s website, which is a key feature of their setting that allows the authors to isolate and provide insights into the dissemination role of financial reporting.

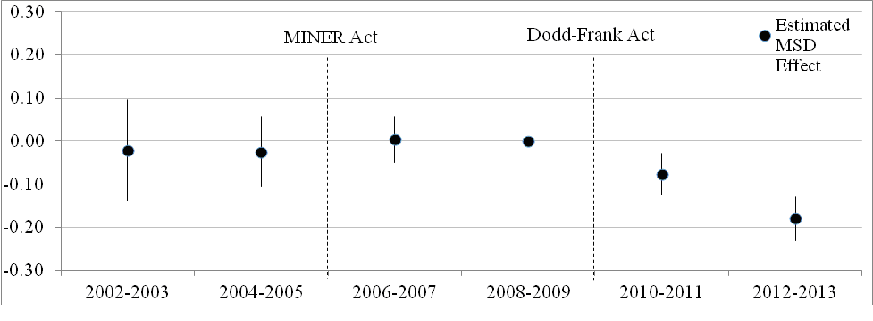

Using a research design that compares companies subject to the reporting requirements of the Dodd-Frank Act to those that are not (private firms are not subject to the reporting requirements), the authors find that mandatory dissemination of mine safety information leads to a reduction in citations per inspection hour of approximately 11 percent and a reduction in injuries per mine hour worked of approximately 13 percent.

The authors suggest a number of channels through which the dissemination of mine safety information can cause an increase in safety performance. These channels include shaming managers and owners of mining companies and some shareholders’ distaste for socially irresponsible companies.

The authors empirically assess the shareholder channel. Consistent with investors revising their beliefs about the value of mining firms due to MSD, the authors find that mining stocks experience negative cumulative abnormal returns around the disclosure of mine-safety related incidents. Furthermore, the authors provide evidence that mutual funds that identify as socially responsible reduce their holdings of mining firms around the disclosures of safety problems, which suggests that taste-based preferences for avoiding the stocks of firms with unsafe working conditions are at play as well.

Given the improvement in safety, one could argue that MSD has accomplished its objective. However, the authors also document a decline in productivity, so it is important to note that the improvement in safety is not without costs. Ultimately, the desirability of non-financial disclosure policies depends on the tradeoff between safety improvements and their associated costs.

Figure 1: This graph shows the effect of MSD by comparing public and private firms’ citation rates around the Dodd-Frank disclosure requirements. As the estimate decreases, public firms experience less citations per inspection hour relative to private firms.

The preceding post comes to us from Hans Christensen, Associate Professor of Accounting at the Chicago Booth School of Business, Eric Floyd, Assistant Professor of Accounting at the Jones Graduate School of Business, Lisa Liu, PhD student at the Chicago Booth School of Business, and Mark Maffett, Assistant Professor of Accounting and Centel Foundation/Robert P. Reuss Faculty Scholar. The post is based on their working paper, which is entitled “The Real Effects of Mandatory Non-Financial Disclosures in Financial Statements” and available here. Professor Eric Floyd is not pictured above.

Sky Blog

Sky Blog