A wide body of literature emphasizes that venture capitalists focus on young private companies, generally in high-tech industries. However, contrary to this notion, we find that 29% of the firms that were backed by VCs prior to the IPO received additional VC funding within the first five years after the IPO, in a sample of IPOs between 1988 and 2010.

We find that this post-IPO VC financing is focused on companies with high information asymmetry and substantial growth opportunities. These companies might otherwise find it difficult to raise capital at a viable price (see, e.g., Myers and Majluf, 1984). In stark contrast to broader samples of PIPEs (private investments in public equity), VCs tend to invest prior to the company entering a state of distress. While abnormal returns are significantly negative leading up to PIPEs (Chaplinksky and Haushalter, 2010), we find no similar underperformance in advance of post-IPO VC financings. Moreover, compared to broader samples of PIPEs, we find stronger evidence that the post-IPO VC financings are beneficial for companies. Abnormal returns are significantly positive both around the announcement of these financings and over the subsequent several years. These patterns in returns are consistent with a lessening of financial constraints among these companies.

To provide stronger evidence on the value of the ‘option’ to raise financing from a VC, we take advantage of two strong patterns in the data. First, some VCs are substantially more likely to fund companies after the IPO than others. Second, the identity of the pre-IPO VC is one of the strongest predictors of whether a VC funds the company after the IPO. Thus, we compare the post-IPO performance of firms, conditional on the identity of their pre-IPO VC: VCs with a high tendency to fund companies after the IPO, versus those with a low tendency. We conjecture that if the option to raise financing from a VC after the IPO has positive value, then the former group will outperform the latter. Empirical results provide strong support. In addition, we also find that IPOs backed (prior to the IPO) by a VC with a high tendency to provide post-IPO funding are significantly less likely to delist for poor performance.

Finally, our results also indicate that post-IPO financing by a VC provides a signal to other providers of capital: newly public companies receiving funding from a VC also tend to receive funding from other sources, for example, syndicated loans, in the same calendar month.

Overall, we document a new financing channel. Venture capitalists have a unique ability to identify firm value. We find that they use their informational advantages to serve as an intermediary to fund young firms.

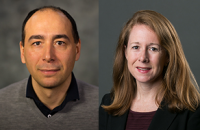

The preceding post comes to us from Peter Iliev, Assistant Professor of Finance at the Pennsylvania State University – Department of Finance, and Michelle Lowry, TD Bank Endowed Professor at Drexel University. The post is based on their paper, which is entitled “Venturing Beyond the IPO: Venture Capitalists’ Investments in Newly Public Firms” and available here.

Sky Blog

Sky Blog