Shareholders can generally affect the decisions of companies in two ways: through voice (voting) and through exit (selling their shares). In a new paper, “Management (of) proposals,” we use shareholder voting records on management proposals from 2003 to 2015 to evaluate the effectiveness of voice as a governance mechanism. We analyze whether management opportunistically brings up more proposals in good times and whether it systematically games the voting process to achieve a favorable outcome.

We find first that managers opportunistically choose to hold shareholder votes following good firm performance. We examine this further in the context of the Regulation SHO experiment conducted by the SEC. In this experiment, short sales constraints were eased from May 2, 2005 to July 6, 2007 for a group of randomly selected pilot firms in the Russell 3,000. We find that, during the experiment, management at these firms launched significantly fewer proposals, particularly proposals related to compensation policies. Because pilot firms were chosen randomly, this evidence cannot be attributed to changes in firm investment opportunities. Instead, it suggests that, when negative information can more easily be reflected in a company’s stock price by short-sellers, management tends not to risk a shareholder vote.

Next we analyze whether management manipulates voting outcomes. Consistent with prior economics literature, we define manipulation as any strategic attempt to influence the outcome of a vote. Because voting on most management proposals is binding, management has a clear incentive to ensure its proposals pass. Further, in the United States, management has an exclusive right to see real-time voting, giving it an advantage over investors.

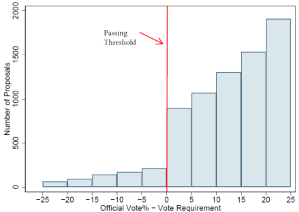

To analyze whether there is any manipulation of voting outcomes, we focus on closely contested management proposals. If management does not influence the voting process, we would expect the density of proposals to be smooth around the passing threshold. This is because the outcome is unknown when proposals are put on the agenda, so management cannot choose to make only those proposals that will win by a small margin. Graphical evidence in Figure 1, however, indicates that there is a sharp increase in the density of proposals around the passing threshold, with 896 proposals passing by less than 5 percent and 213 failing by less than 5 percent.

The evidence of manipulation is stronger for firms with less independent boards and lower institutional ownership and analyst coverage, which suggests that external and internal firm governance affects the ability of management to influence the voting outcome in its favor. Finally, by comparing proposals across different agendas, we observe that the discontinuity is greater for proposals related to share issuance, executive compensation, and strategic initiatives, such as M&A.

Figure 1. Histogram of Management Proposals Around the Passing Threshold

We next examine the mechanisms by which management achieves its desired voting outcomes. We focus only on the legal mechanisms, because they are more readily observable to researchers. If there were any illegal manipulation taking place, it is unlikely that the involved parties would want to leave incriminating evidence. One way in which management can influence voting is to adjourn the meeting to a later date. This procedure is legal if shareholders approve a proposal that gives management the choice of adjourning the meeting. For example, when Jarden Corporation held its annual meeting on May 28, 2009, shareholders were asked to vote on director elections, ratification of auditors, approval of a new stock compensation plan, and meeting adjournment or postponement. While the first two proposals and the meeting adjournment were passed on that date, voting on the new compensation plan was adjourned until June 4, which gave management more time to lobby shareholders. Notably, the compensation plan eventually passed on June 4 by a less than 0.3 percent margin. We find that this case is not isolated. In the full sample of proposals, the discontinuity in proposal density is approximately two times larger if there is meeting adjournment.

Another way in which executives can gain an edge in corporate voting is by selective campaigning and sending the solicitation material to shareholders shortly before the vote. For example, when NetApp, Inc. struggled to secure shareholder support for repricing its employee stock options in 2009, company management sent correspondence to all shareholders arguing in favor of repricing and was able to get the plan to pass narrowly. Indeed, many firms admit that they send the additional solicitation materials to shareholders after reviewing the preliminary voting information. We find that such solicitation is effective for an average firm in our sample. Specifically, the discontinuity in proposal density is significantly sharper for firms that filed an additional definite proxy document DEFA14A after the proxy filing date.

Given the high pass rate of management proposals and the ability of management to manipulate voting outcomes, a logical question is whether these proposals are beneficial for shareholders. For example, it could be that management is better informed about the true costs and benefits of the proposals and influences the voting outcome to satisfy regulatory requirements and advance shareholder interests. An alternative view is that management pushes through mostly unpopular initiatives that involve self-dealing, expropriate the rights of certain groups of shareholders, or increase board entrenchment.

Turning to the value implications of management proposals, we examine the market reaction to narrow wins and losses. Of course, given evidence of significant manipulation in our sample, we cannot interpret narrow wins and losses as if the outcomes are determined at random. Nevertheless, when a proposal narrowly passes, this can lead to the updating of the probability of passing in only one direction – upwards. Therefore, the direction of the price reaction to narrow wins and losses is informative about the value of a proposal. Our results show that a narrow loss is associated with a positive abnormal return of approximately 1.5 percent, while passing is associated with a small negative return. Thus, our results suggest that, at least on the margin, management proposals do not create value for shareholders.

In summary, our evidence indicates that the high observed pass rate of management proposals is misleading and does not necessarily imply that most management proposals are beneficial for shareholders. Management opportunistically pushes through many bad proposals when firm performance is good and then influences the voting outcome in its favor by taking advantage of the privately observed vote information.

This post comes to us from Professor Ilona Babenko at Arizona State University, Goeun Choi, a PhD student at the university, and Professor Rik Sen at the University of New South Wales. It is based on their recent paper, “Management (of) Proposals,” available here.

Sky Blog

Sky Blog