Many managers receive company stock as compensation and then pledge that stock as collateral for personal loans. The practice is increasingly common, and its potential economic impact is anything but negligible. For example, Larcker and Tayan (2010) document that pledged shares by 982 directors in 2006-2009 averaged 44 percent of the total shares received as compensation. In addition, the damage to firm value from managers’ failure to meet margin calls can be significant, as shown by lenders’ liquidation of pledged shares of Valeant Pharmaceuticals. In November 2015, Goldman Sachs sold more than $100 million of shares pledged by Valeant CEO Michael Pearson to secure a $100 million dollar loan made in April 2015. The liquidation of the shares prompted the company’s market value to drop by almost 20 percent (Financial Times, Nov. 6, 2015).

In 2013, proxy adviser Institutional Shareholder Services (ISS) designated share pledging as a “problematic pay practice.” Proxy advisers typically provide research and voting recommendations to institutional investors, especially passive investors, on how to vote on director nominations and corporate governance questions. ISS encourages companies to adopt an anti-pledging policy by stipulating that “if the company indicates that they have a policy that prohibits future new pledging and/or that they are encouraging executives/directors to unwind current pledging transactions, these would be viewed as positive factors that could mitigate a negative recommendation on director elections.”

We examine the contractual and managerial consequences of adopting an anti-pledging policy that strictly prohibits managers from pledging the equity shares of their respective firms and therefore limits the flexibility of their equity compensation. In addition to obtaining liquidity without selling their shares, pledges allow managers to pursue potential personal benefits, such as diversifying their wealth portfolios, deferring tax liability, and mitigating litigation concerns. However, despite the clear benefits for managers, share pledging has come to be seen as a governance problem among regulators, proxy advisers, and institutional investors. These parties have expressed concerns over the disconnect between the interests of managers and the interests of shareholders and the potential failure to meet the margin call, which may trigger a sharp stock price drop (Dou, Masulis, and Zein, 2019).

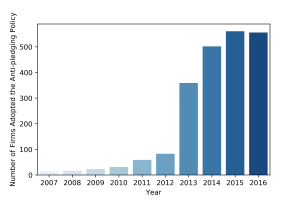

To test the consequences of the adoption of an anti-pledging policy, we compile a dataset of the presence and features of anti-pledging policies and pledged shares of CEOs from the proxy statements (DEF 14A) of S&P 1500 firms from 2007 to 2016. As shown in the figure above, the frequency of firms adopting anti-pledging policies has risen substantially over the last decade. Among S&P 1500 firms, their incidence grew from less than 1 percent in 2007 to over 30 percent in 2016. Using a comprehensive sample of 11,096 firm-year observations with 1,354 unique firms, we examine the economic consequences associated with the adoption of an anti-pledging policy.

We firstly explore the effect of anti-pledging policies on CEO compensation. Given that an anti-pledging policy limits the opportunity to diversify the risk of equity-based compensation, managers may request changes to their compensation; in particular, they may seek changes to pay-for-performance sensitivity to reduce their exposure to firm-specific risk. The estimated results suggest that an anti-pledging policy is associated with increases in salary and decreases in delta (i.e., a proxy for pay-for-performance sensitivity) and vega (a proxy for risk-taking incentives). Specifically, having an anti-pledging policy is associated with a 5.7 percent increase in salary, whereas it is associated with a 14.7 percent decline in delta and a 17.9 percent decline in vega.

We also examine whether anti-pledging policies affect managerial investment decisions. We argue that firms can have difficulty re-writing their compensation contracts to fully offset changes in personal risk exposure caused by an anti-pledging policy. Therefore managers may change investment decisions to compensate for their unadjusted risk exposure. We find that an anti-pledging policy is associated with significant declines in investment growth. Specifically, firms adopting anti-pledging policies experience a $10.35 million decline in capital expenditure growth and a $17.25 million decline in net investment growth, evaluated at the median book value of the sample. The results suggest that a corporate governance policy that reduces compensation flexibility, by limiting CEOs’ ability to manage their risk exposure, has a real impact on firm investment decisions. An additional test on investment-Q sensitivity shows that firm-level investments become less sensitive to growth opportunities after the adoption of an anti-pledging policy, indicating decreases in investment efficiency. Further, decreases in stock price volatility after the adoption of an anti-pledging policy support these findings.

Finally, we investigate whether the adoption of an anti-pledging policy mitigates the likelihood of receiving negative recommendations from ISS and mutes shareholders’ concerns during proxy voting. Proxy advisers’ recommendations meaningfully affect shareholder votes. However, it is controversial whether proxy advisers always enhance shareholder value. We conjecture that boards of directors might have adopted the ISS recommendation to avoid costs likely imposed in proxy votes. Consistent with our conjecture, we find that, after the anti-pledging policy adoption, the probability of receiving an ISS voting recommendation different from the management recommendation becomes about 31 percent lower. Moreover, the probability that the ISS opposes a director candidate is about 45 percent lower, and the chance of passing a governance-related shareholder proposal is about 45 percent lower. These results are consistent with ISS’ announcement that it will issue more favorable recommendations for firms that adopt an anti-pledging policy. More important, the results, together with our main findings, suggest that governance policies catering to the views of proxy advisers may help reduce recommendations against management proposals but may also produce unexpected consequences.

We offer new insights into proxy advisers and corporate governance policy. While proxy advisers are often criticized for perceived conflicts of interest (Belinfanti, 2010), evidence on the costs of following their recommendations is limited. By empirically showing the influence of ISS’ recommendation on the adoption of anti-pledging policies and the downsides of adoption, our study suggests that catering to proxy advisers may result in unintended outcomes for the firm and calls into question the benefit of a one-size-fits-all approach to corporate governance.

REFERENCES

Dou, Y., Masulis, R. W., Zein, J., 2019. Shareholder wealth consequences of insider pledging of company stock as collateral for personal loans. Forthcoming, Review of Financial Studies

Larcker, D. F., Tayan, B., 2010. Pledge (and hedge) allegiance to the company. Rock Center for Corporate Governance at Stanford University Closer Look Series: Topics, Issues and Controversies in Corporate Governance and Leadership No. CGRP-31.

Belinfanti, T. C., 2010. The proxy advisery and corporate governance industry: the case for increased oversight and control. Stanford Journal of Law, Business, and Finance. 14, 384-439.

This post comes to us from professor Jihun Bae at Erasmus University Rotterdam and Ruishen Zhang, a PhD candidate at Frankfurt School of Finance & Management. It is based on their recent article “Anti-Pledging Policy, CEO Compensation, and Investment” available here.

Sky Blog

Sky Blog