Nearly a year ago, we analyzed the outperformance of ESG strategies during the initial stage of the COVID-19 Pandemic. As of May 2020, we found that ESG indexes based on ISS ESG data had outperformed by 1.3% to 2.8%, with lower volatility than their benchmark over the first five months of 2020. In this article we revisit those findings to examine whether the ESG outperformance has held up as global stock markets have strongly recovered.

We focus here on the Solactive ISS ESG Screened Series, an index family which integrates ISS ESG’s most frequently requested ESG filters including:

- a verified failure to respect established global business norms;

- verified involvement in controversial weapons; and

- involvement at specified revenue thresholds in controversial activities such as:

- fossil fuels;

- military production;

- Tobacco;

- Gambling; and

- other industries as noted in the Index Guideline.

Furthermore, we examine indexes covering four different regions: the U.S., Europe, Developed Markets, and Emerging Markets.

Table 1 below illustrates how the Screened Series differs from its parent universe with regards to some of the ESG criteria. For example, ISS ESG Norm-Based Research identifies companies with verified violations of established norms such as the UN Global Compact. As shown below, 2.4 percent of the market value of the parent index (GBS Global) has exposure to such companies, while all companies with verified violations are removed from the Screened ESG index. The table also illustrates exposure to three additional areas: controversial weapons, tobacco production, and fossil fuel production. Controversial weapons include biological, chemical, and nuclear weapons, anti-personnel mines, and cluster munitions. For norms and controversial weapons, companies with any involvement are excluded. For tobacco and fossil fuel production, Table 1 shows the index weight multiplied by the revenue that the company derives from production in each of the activities. As shown, tobacco and fossil fuel exposures which amount to 0.6 percent and 3.5 percent of the GBS have been removed from the Screened Series.

Table 1:

| ESG Area | GBS Global | Screened Global |

| Verified norms violation (UNGC/OECD) | 2.4% | 0.0% |

| Controversial Weapons | 1.1% | 0.0% |

| Tobacco Production | 0.6% | 0.0% |

| Fossil Fuel Production | 3.5% | 0.0% |

Source: ISS ESG. As of April 30, 2021.

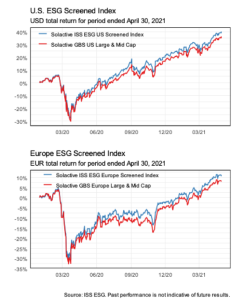

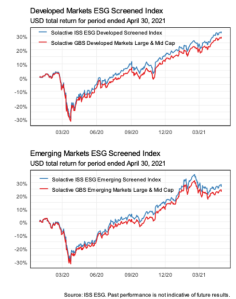

Next we review the performance of the ESG indexes compared with their parent universe for the period December 31, 2019 through April 30, 2021.

Table 2:

| Total Return | ESG Screened | Benchmark | Difference |

| United States (USD) | 38.8% | 35.0% | 3.8% |

| Europe (EUR) | 10.7% | 7.9% | 2.8% |

| Developed Markets (USD) | 31.8% | 28.0% | 3.8% |

| Emerging Markets (USD) | 26.8% | 22.9% | 3.9% |

Source: ISS ESG. Past performance is not indicative of future results.

As shown, the outperformance we noted last year has been maintained and grown further. Furthermore, it is consistent across each of the four regions, with the greatest outperformance visible in the emerging markets (3.8%) and the lowest in Europe (2.8%).

We also take a look at the ‘max drawdown’, the largest peak-to-trough decline that the indexes experienced during this sixteen-month period. Similarly, all of the ESG indexes had smaller max drawdowns than their parent index, a desirable trait during volatile periods.

Table 3:

| Max Drawdown | ESG Screened | Benchmark | Difference |

| United States (USD) | -32.5% | -33.9% | 1.4% |

| Europe (EUR) | -33.6% | -33.8% | 0.2% |

| Developed Markets (USD) | -32.4% | -33.9% | 1.5% |

| Emerging Markets (USD) | -31.5% | -33.8% | 2.3% |

Source: ISS ESG. Past performance is not indicative of future results.

These results are best illustrated by looking at the time series of returns:

Figures 1 & 2:

Figures 3 & 4:

Bottom Line: A lot has changed over the past year, but the tragic consequences of the Pandemic have continued for far longer than was generally anticipated. At this time, while there is improvement in some regions, others have taken a terrible turn for the worse. Despite this evolving and mixed picture, the initial outperformance of the ESG Screened indexes has been sustained over the past year. This is visible in all four regions we examined here, with the most beneficial impact of ESG screening appearing in the emerging markets.

This post comes to us from Institutional Shareholder Services. It is based on the firm’s article, “Performance Update: ESG Screened Indexes During the Pandemic,” dated May 7, 2021, and available here.

Sky Blog

Sky Blog